Final Debt Collection Letter Template for Efficient Recovery

htmlEdit

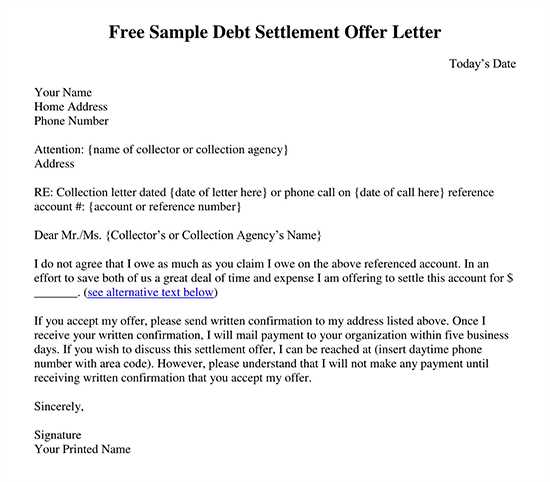

When a financial obligation remains unpaid for an extended period, it becomes crucial to address the issue with a formal communication. This document serves as a crucial tool in urging the recipient to settle the outstanding amount before further actions are taken. Understanding how to craft such a message ensures clarity and a higher chance of resolving the matter without escalating it further.

Effective communication in these situations can make all the difference. A well-structured message should clearly state the amount owed, the time frame for payment, and the potential consequences of non-payment. It is essential to maintain a professional tone, while still making it clear that the matter requires immediate attention.

Knowing the right format and tone for this communication is vital to achieving the desired outcome. The goal is to encourage prompt payment while avoiding unnecessary legal steps, and a carefully composed message plays a significant role in reaching this objective.

htmlEdit

Understanding the Payment Reminder Notice

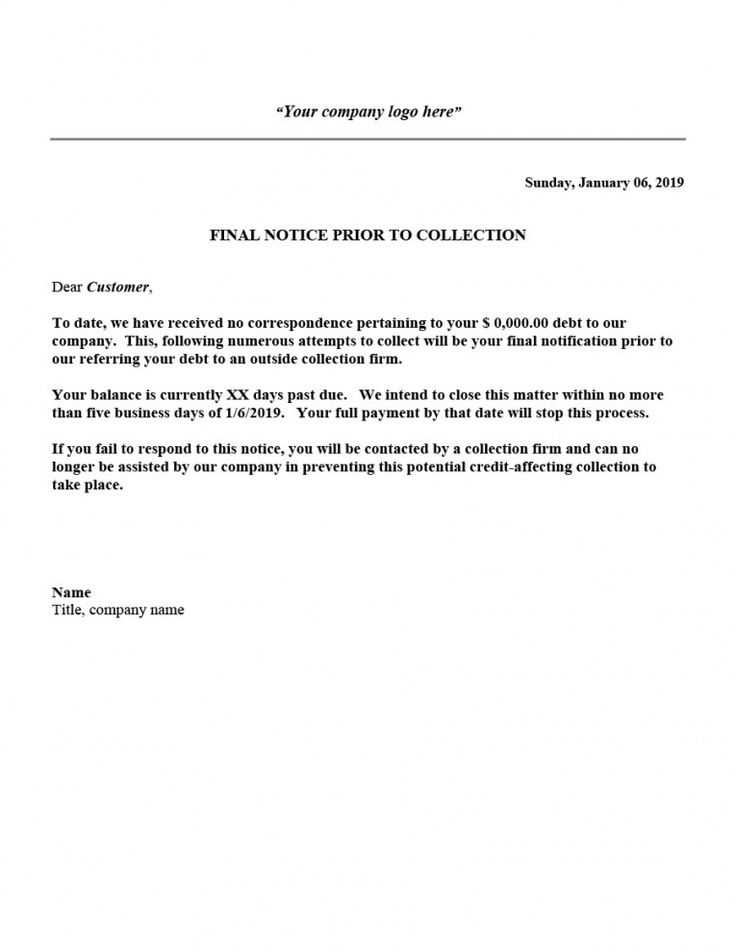

When payments remain overdue, it is essential to take steps to notify the individual of their responsibility. A well-crafted notice ensures the recipient understands the urgency and the consequences of failing to settle their outstanding balance. This communication is crucial for both parties, helping to clarify expectations and avoid future misunderstandings.

Key Points to Include in the Notice

- Clear Account Information: Ensure the recipient knows exactly what is owed and which account the payment applies to.

- Urgency of Payment: Emphasize the importance of addressing the issue promptly to avoid further complications.

- Possible Consequences: Outline the potential actions that may be taken if the payment is not made within the specified time frame.

Why Tone and Clarity Matter

The tone of the message should be firm but respectful. A clear, direct approach helps the recipient understand the seriousness of the matter without causing unnecessary conflict. A well-organized document provides all necessary details in an easy-to-read format, ensuring no confusion about the expectations and deadlines.

htmlEdit

Key Components of the Document

For an effective payment reminder, certain details must be included to ensure clarity and urgency. These elements help convey the necessary information in a straightforward manner, increasing the likelihood of a timely response. A well-structured message not only informs the recipient but also sets expectations for resolution.

Clear Identification of the Amount: It is essential to specify the exact sum that is owed. This helps the recipient understand precisely what needs to be paid.

Due Date and Payment Instructions: Clearly state the deadline for payment and provide straightforward instructions on how to remit the amount. This removes any confusion about the payment process.

Consequences of Non-Payment: The notice should outline the potential actions that may follow if payment is not made by the stated deadline. This could include legal actions or account restrictions, depending on the situation.

Firm but Professional Tone: The tone should be respectful, yet firm enough to convey the seriousness of the issue. This ensures the recipient understands the importance of acting promptly without feeling antagonized.

htmlEdit

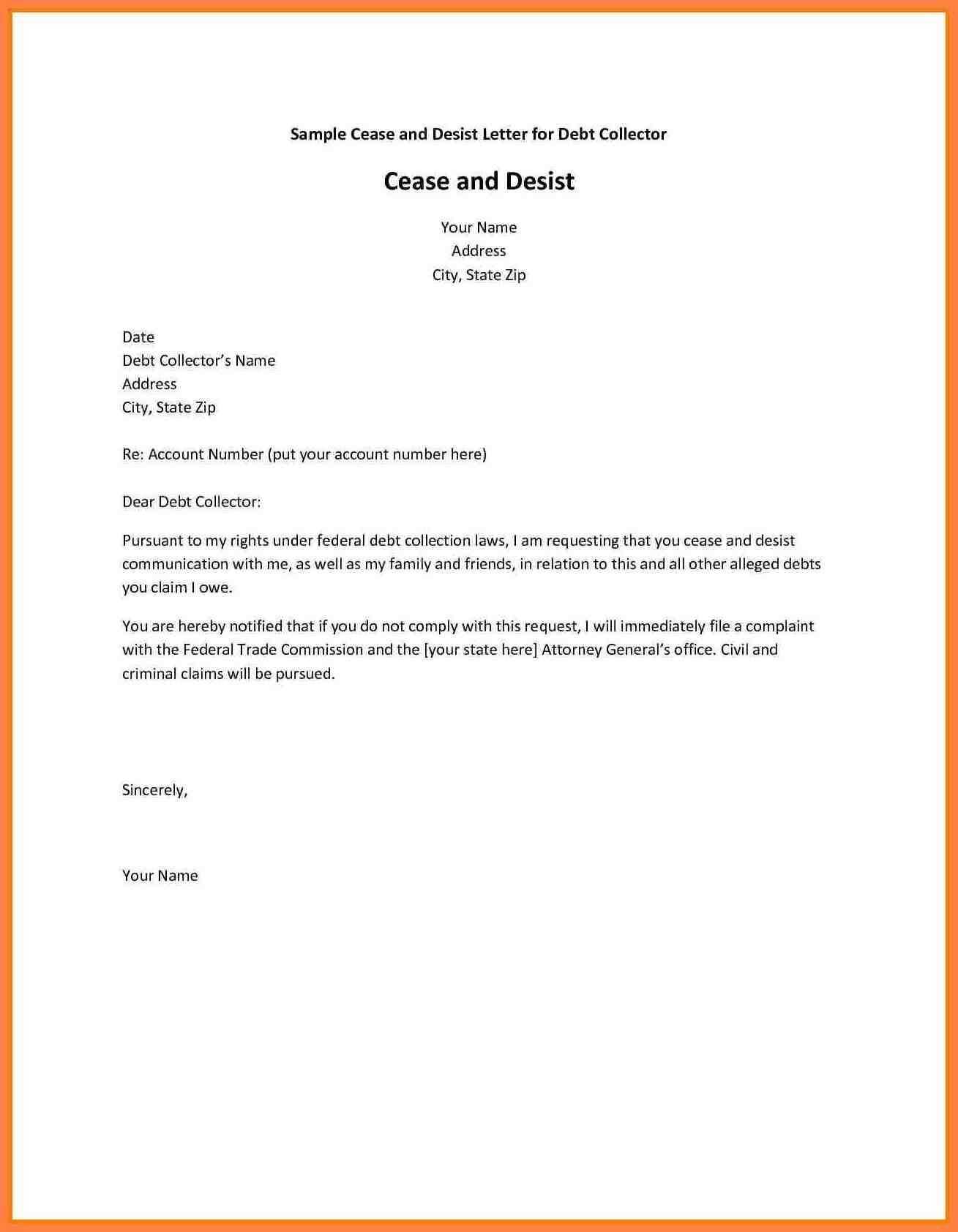

How to Write a Strong Message

Crafting an effective reminder is crucial for ensuring timely payment. A strong message is clear, direct, and contains all necessary information in a professional tone. It should motivate the recipient to take action while maintaining a respectful approach. The following elements are essential for creating a compelling notice.

Structure of an Effective Message

- Opening Statement: Begin with a polite yet firm reminder that the payment is due.

- Details of the Obligation: Clearly mention the amount owed and any relevant account or invoice numbers.

- Deadline for Payment: Specify a clear due date and emphasize the importance of meeting it.

Important Considerations for Tone

- Professional Language: Use formal language to maintain a respectful tone, even when addressing overdue payments.

- Firmness Without Aggression: While it’s important to be assertive, avoid language that could be seen as hostile.

- Call to Action: Clearly state the next steps, such as how the recipient can make the payment or what will happen if the obligation is not met.

htmlEdit

Legal Implications of Payment Reminder Notices

When addressing overdue payments through formal communication, it’s essential to be aware of the legal consequences that can arise. Such messages not only serve to remind the recipient of their obligation but may also set the stage for further legal action if the matter remains unresolved. Understanding these implications is key to ensuring compliance with applicable laws and maintaining a professional approach.

Potential Legal Actions

Failure to settle an outstanding balance after receiving a formal notice can lead to several legal actions, including:

- Court Proceedings: If the recipient does not respond, legal action may be taken to recover the owed amount through the court system.

- Credit Damage: Non-payment can negatively impact the recipient’s credit score, leading to long-term financial consequences.

- Seizure of Assets: In extreme cases, assets may be seized or wages garnished to settle the outstanding amount.

Complying with Legal Standards

It’s important to ensure that all notices comply with relevant consumer protection laws. These laws are designed to protect individuals from unfair or aggressive tactics during the payment recovery process. Any communication should be clear, accurate, and free from misleading statements or threats that could violate the law.

htmlEdit

Common Mistakes to Avoid in the Notice

When drafting a formal communication to address an outstanding balance, it is essential to avoid certain mistakes that can hinder the effectiveness of the message. These errors can lead to confusion, misunderstandings, or even legal complications. Ensuring that your notice is clear, professional, and legally compliant is crucial for achieving a positive outcome.

Overly Aggressive Language

Using threatening or harsh language can create unnecessary tension and may even violate consumer protection laws. A professional tone is key. Focus on being firm, yet respectful, to ensure the recipient understands the seriousness of the matter without feeling antagonized.

Lack of Clear Payment Instructions

Failing to provide clear and specific payment instructions can delay resolution. Always include precise details on how the recipient can make the payment, including methods and account information. This eliminates any confusion and ensures the process is straightforward for both parties.

htmlEdit

Steps After Sending the Final Notice

Once a formal communication has been sent to the recipient regarding an overdue balance, it’s important to know what actions to take next if the payment is not made. Following up in a systematic manner ensures that you are prepared to escalate the situation appropriately, should the need arise. There are several steps that can be taken depending on how the situation progresses.

Monitor the Response Time

It’s important to track the time after sending the communication and assess if any payment has been made or response has been received. This will help you determine whether further steps are necessary or if the issue is resolved.

Escalation Process

If no payment has been received, you may need to escalate the situation. Below is a summary of the options available at each stage.

| Action | Timing | Next Step |

|---|---|---|

| Wait for Payment or Response | 7-14 Days | Monitor for incoming payment or contact. |

| Legal Action Consideration | After 14 Days | Evaluate the possibility of small claims court or other legal actions. |

| Debt Recovery Agency | After 30 Days | Consider hiring an external service to pursue the outstanding balance. |

htmlEdit

When to Seek Legal Assistance

Knowing when to involve a legal professional in the recovery of an outstanding obligation is crucial. While most situations can be resolved without the need for legal action, certain circumstances may require expert guidance. Understanding these situations can help you take timely and appropriate steps to protect your interests.

If the recipient continuously ignores reminders and refuses to settle the balance, or if there are disputes regarding the amount owed, it might be time to consult with a legal expert. Legal assistance can help you navigate the complexities of the situation and determine the best course of action, including pursuing formal legal proceedings if necessary.

Additionally, if you are unsure about how to comply with local regulations or if you believe the recipient’s actions are violating any agreements or laws, seeking legal counsel can help clarify your options and prevent potential complications down the line.