Collection Letter Template for Effective Communication

In business, maintaining timely payments is crucial for smooth operations. A well-structured formal request can help recover outstanding amounts efficiently, ensuring a professional and respectful tone. The following section outlines how to craft a persuasive and clear message to encourage prompt settlement.

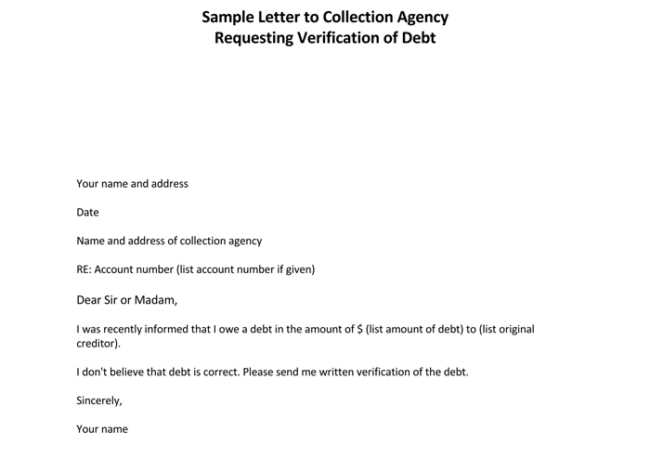

Key Components of a Formal Request

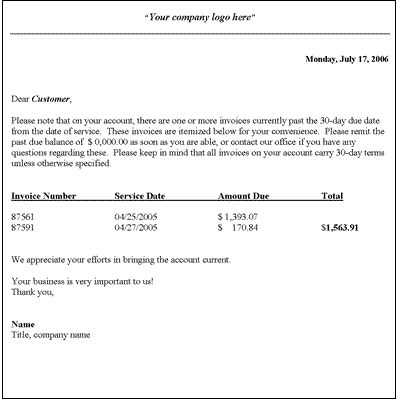

A successful request includes essential details that are both clear and concise. It should have the following elements:

- Introduction: Briefly explain the reason for reaching out.

- Details of the Debt: Clearly state the owed amount and any relevant dates.

- Call to Action: Specify the expected outcome and desired timeline.

Creating a Professional and Respectful Tone

The tone used in your message should maintain professionalism while expressing urgency. Avoid sounding too harsh or aggressive, as this could harm the relationship with the recipient. Focus on clarity and politeness, as a well-mannered approach increases the likelihood of a positive response.

Avoiding Common Pitfalls

Some common mistakes can undermine the effectiveness of your request. These include:

- Being too vague about the amount owed.

- Using unclear language or excessive jargon.

- Failing to mention any potential consequences for non-payment.

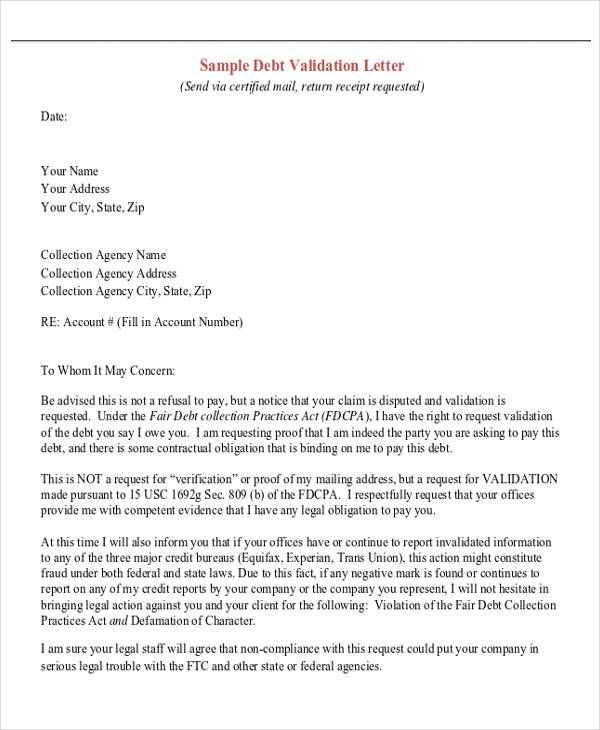

Legal Considerations When Making a Formal Request

Before sending out any formal requests, it’s important to be aware of the relevant laws and regulations regarding debt recovery. Ensure that your message complies with legal requirements to avoid misunderstandings or legal issues in the future.

Customizing the Message

Each situation is different, and a one-size-fits-all approach won’t always be effective. Tailoring your message to fit the specific context and relationship with the recipient can lead to better outcomes. Consider adjusting the tone, urgency, and details based on your prior communication and the person you are addressing.

Maximizing Response Rates

To increase the chances of a prompt reply, it’s essential to make your request as clear and actionable as possible. Be sure to provide all necessary details and make it easy for the recipient to take the next steps toward settlement. Follow-up if needed, but remain courteous and professional throughout the process.

How to Create an Effective Payment Request

When seeking payment for an outstanding balance, crafting a well-organized and polite message is essential. Clear communication not only encourages prompt payment but also helps maintain positive business relationships. Below, we outline the crucial components of an effective payment reminder and tips to optimize the process.

Key Components of an Effective Request

To ensure your message is clear and actionable, focus on these core elements:

- Introduction: State the purpose of your message and remind the recipient of their unpaid balance.

- Details of the Debt: Include the exact amount owed, the due date, and any relevant account or invoice numbers.

- Call to Action: Clearly request the desired outcome, such as making a payment by a specific date or contacting you for further arrangements.

Best Practices for Tone in Communications

The tone of your message is crucial in encouraging the recipient to respond positively. While it’s important to be firm about the need for payment, it’s equally important to remain courteous and professional. Avoid harsh or threatening language, as this could damage your relationship with the recipient. A balanced tone increases the likelihood of a favorable reply.

Common Mistakes to Avoid in Communication

While drafting a payment request, be mindful of these frequent errors:

- Being too vague about the owed amount or the due date.

- Using overly complex language or jargon that could confuse the recipient.

- Failing to include clear instructions on how to make the payment or reach out for further questions.

Legal Considerations for Debt Recovery

It’s important to ensure your message complies with legal requirements for debt recovery. Understand the applicable laws in your region regarding language, debt collection practices, and required documentation. Taking the time to ensure your message is legally sound can prevent complications in the future.

How to Personalize Your Message

Personalizing your message can improve the chances of receiving a response. Tailor your approach based on your relationship with the recipient, past interactions, and the specific situation. A personalized tone shows respect and consideration, which can help in resolving the matter amicably.

Improving Response Rates from Requests

To increase the likelihood of a timely response, ensure your message is clear, polite, and easy to act upon. Include all necessary details, provide a straightforward payment method, and set a reasonable deadline for the recipient to take action. Following up professionally, if necessary, can further improve your chances of resolving the outstanding balance.