Gifted Deposit Letter Template for Financial Transactions

When receiving a financial contribution from a family member or friend, it’s important to formalize the arrangement through a written statement. This ensures both parties are clear on the terms of the transaction, especially when the funds are meant for specific purposes, such as assisting with a property purchase or other large financial commitments. A well-crafted document serves as proof of the transaction and can be essential for both legal and financial purposes.

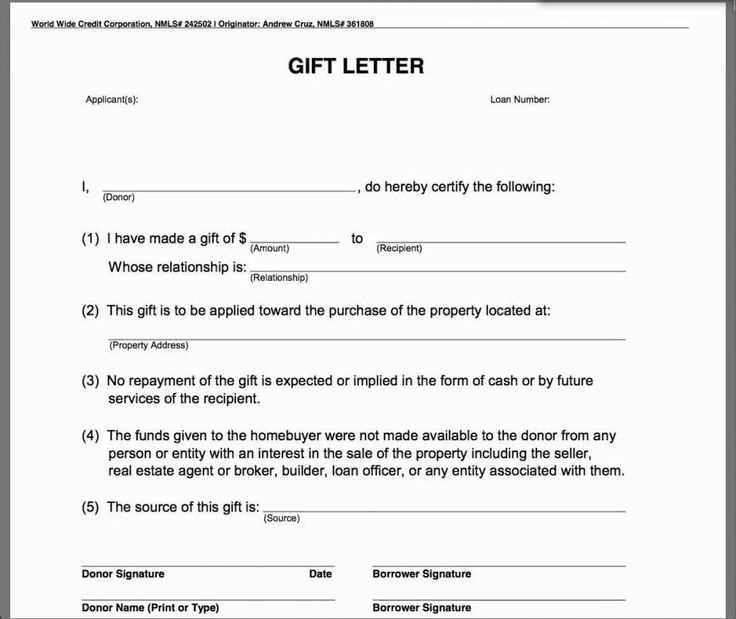

Key Elements to Include in the Document

To create an effective record of the gift, certain details must be clearly outlined. These elements help ensure that the transfer is properly documented and can be referenced in the future if needed.

- Names of both parties – Ensure the full names of both the giver and receiver are included to avoid confusion.

- Amount of the gift – Clearly specify the exact sum being transferred, whether it’s a lump sum or in installments.

- Purpose of the funds – State the intended use of the contribution to avoid misunderstandings later on.

- Date of transfer – Include the specific date or dates when the funds are provided.

Additional Considerations

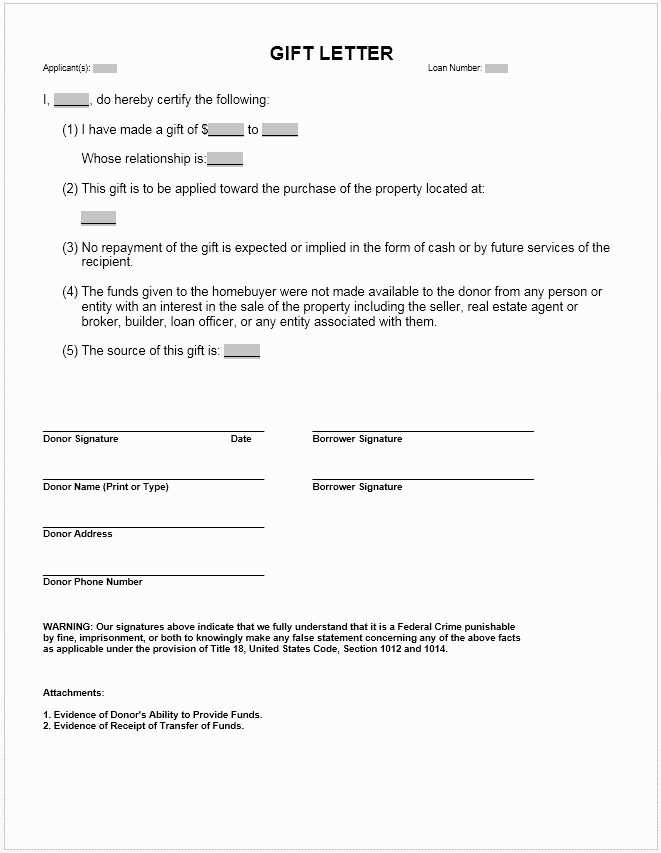

While it’s not always legally required, adding a statement about the non-repayment of the amount can make the nature of the gift clearer. This helps establish that the transaction is a one-time, non-repayable gesture. Also, both parties should sign the document to make it official.

Why This Document is Important

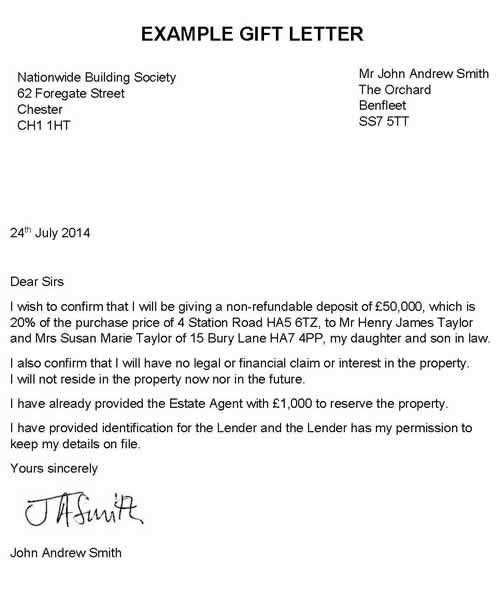

Having this written agreement is particularly beneficial when it comes to financial institutions or tax-related issues. Mortgage lenders, for instance, may ask for such documentation to verify that the funds were indeed a gift and not a loan. Without it, the borrower may face difficulties proving the source of the money. This type of formal agreement provides peace of mind and ensures transparency.

Legal and Financial Implications

In some cases, the individual receiving the funds may need to report the contribution for tax purposes. It’s important to check with a tax professional to understand any obligations that may arise from receiving a large sum. Proper documentation ensures the process is handled smoothly and helps avoid future complications.

Understanding Financial Gift Documentation

When large sums of money are transferred between individuals, particularly in personal situations such as property purchases, it is essential to document the transfer. This formal record helps clarify the nature of the transaction, ensuring that both parties have a clear understanding of the terms. Whether for personal or financial purposes, documenting a monetary gift can prevent misunderstandings and provide legal protection if necessary.

Why You Need a Financial Contribution Record

Proper documentation serves as proof that the funds were given without any expectation of repayment. This can be crucial for various reasons, such as satisfying requirements from financial institutions or meeting tax regulations. By creating a record of the transaction, both the giver and the recipient can avoid potential legal complications and ensure that the terms of the arrangement are clear.

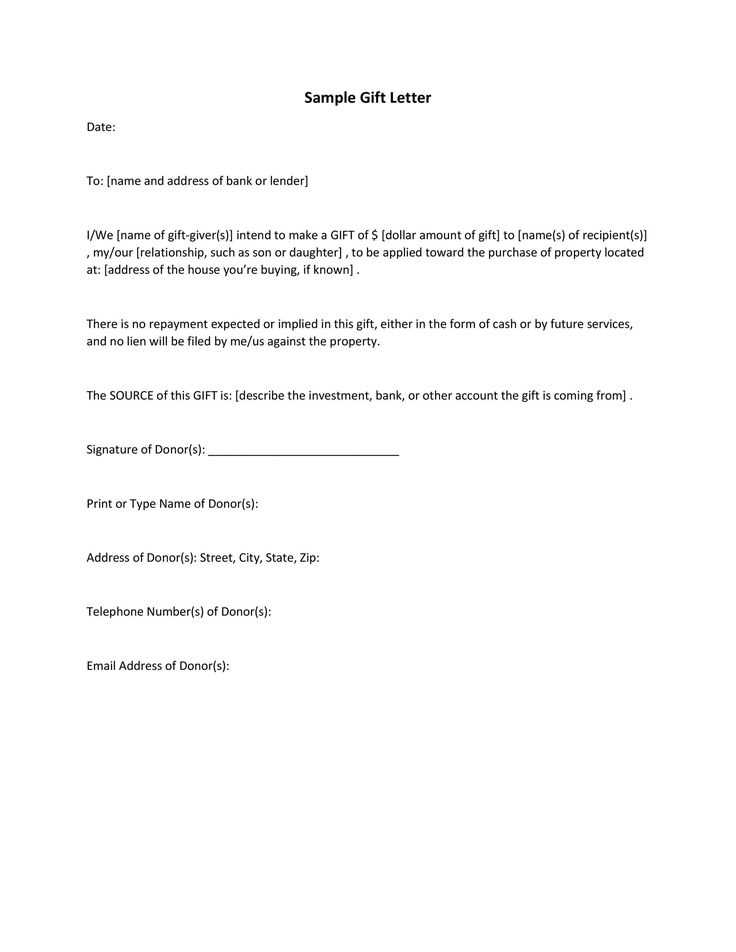

Key Information to Include in Your Document

For a comprehensive and effective record, certain details must be included:

- Parties Involved: Clearly state the full names of both the giver and the recipient.

- Amount Transferred: Specify the exact monetary amount provided.

- Purpose of the Funds: Mention the reason for the gift, such as assisting with a home purchase or other financial need.

- Date of Transfer: Include the date or timeframe when the funds were given.

In some cases, it is also helpful to include a statement that clarifies the funds are a non-repayable gift to avoid any confusion in the future.

How to Write an Effective Financial Gift Document

When drafting a financial gift document, it’s important to be clear and precise. Use straightforward language to avoid ambiguity and ensure that both parties fully understand the terms. Be sure to include all relevant details and have both individuals sign the document to make it official. Additionally, it’s always wise to keep a copy for personal records.

Legal Considerations for Financial Contributions

Depending on the amount and jurisdiction, there may be legal implications associated with receiving a large financial gift. Both the giver and the recipient may need to comply with certain tax regulations or report the gift to authorities. It’s advisable to consult a tax professional or legal advisor to ensure compliance with applicable laws.

By following these guidelines, both parties can create a clear, legally sound record of the financial contribution, ensuring that the transaction proceeds smoothly and without future complications.