Complete Down Payment Letter Template Guide

When engaging in a financial transaction, especially for large purchases or services, it is often required to confirm an initial commitment. This formal acknowledgment serves to ensure that both parties are clear about their intentions and obligations. Such documents play a crucial role in protecting the interests of both the buyer and the seller by outlining the terms of the preliminary commitment.

Creating a document to confirm a financial commitment may seem straightforward, but there are several important elements that need to be considered. The content must be clear, concise, and legally sound, ensuring that it is valid and enforceable. It is essential to include the right details to avoid future misunderstandings.

Crafting an effective agreement requires more than just filling in blanks. It should reflect the specific conditions of the deal, including amounts, deadlines, and any relevant conditions that could affect the agreement’s terms. The goal is to ensure both parties are fully informed and agree on the outlined points before proceeding with the full arrangement.

Understanding Commitment Confirmation Documents

In many business transactions, an initial deposit serves as a sign of intent to move forward with the deal. This form of acknowledgment ensures both parties are clear about their responsibilities and the terms of the agreement. The written record not only protects the interests of those involved but also provides a reference point for resolving any potential conflicts.

It is essential that this document includes specific details, as its purpose is to formalize the preliminary arrangement. The agreement should clearly outline the agreed amount, conditions, and deadlines for the financial contribution, as well as any penalties for non-compliance. By doing so, both sides are guaranteed protection and a mutual understanding of the deal.

Key Considerations in Drafting the Document

While drafting such a formal statement, there are several elements that need to be included for it to be effective:

| Element | Description |

|---|---|

| Amount | The total sum agreed upon for the initial installment |

| Conditions | Any special terms or circumstances that affect the deposit |

| Due Date | The agreed deadline by which the installment must be made |

| Refund Policy | Conditions under which the deposit may be refunded or retained |

Why Clear Terms Matter

Clarity is key in any financial agreement. Both parties must understand the specifics of the commitment, including how and when the amount should be paid, what happens in case of non-fulfillment, and any additional clauses that may apply. This document serves not only as a record of intent but also as a safeguard against potential disagreements.

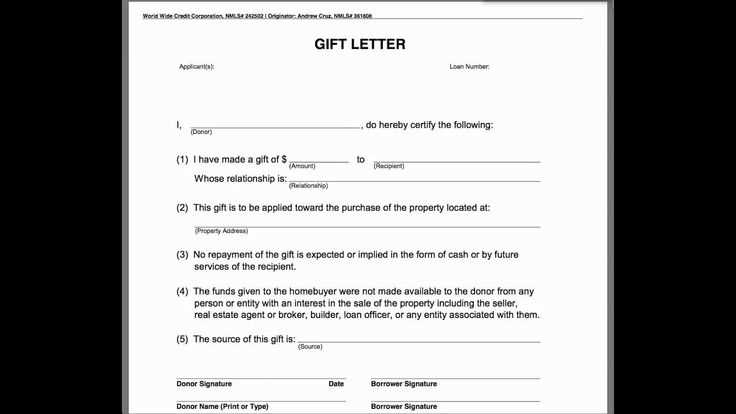

What Is a Commitment Agreement?

A commitment agreement is a formal document used to confirm a buyer’s initial financial commitment to a transaction. It acts as a binding confirmation that a party is willing to proceed with a deal, often securing a product or service for later delivery or completion. This document lays out the terms of the commitment and clarifies the expectations of both parties involved in the agreement.

Key Features of a Commitment Agreement

The essential components of such a document often include:

- Amount: The agreed-upon sum or percentage to be paid upfront.

- Terms: Any conditions that affect the commitment, such as deadlines, product details, or service requirements.

- Refund/Forfeiture Clause: Outlines the circumstances under which the deposit may be refunded or forfeited.

- Due Date: Specifies when the initial installment must be paid.

- Signatures: Both parties sign the document to confirm their understanding and agreement of the terms.

When Is a Commitment Agreement Needed?

This type of document is particularly useful in situations where the buyer wants to secure a product or service in advance, but full payment will only be made later. Common examples include:

- Real estate transactions where an initial deposit is required to hold the property.

- Special orders in retail, ensuring the seller prepares the requested items.

- Service agreements for projects requiring advance assurance before work begins.

Why You Need This Type of Document

Having a formal written acknowledgment of an initial financial contribution is crucial in many business transactions. It provides clarity and security for both parties involved, ensuring that the terms of the arrangement are clearly understood and agreed upon. This written confirmation helps prevent misunderstandings and offers protection in case disputes arise later in the process.

Benefits of a Formal Commitment Agreement

- Security: Both parties have a clear record of the agreed terms, ensuring that the deal is legally binding.

- Transparency: The details regarding the amount, conditions, and expectations are clearly outlined, leaving no room for confusion.

- Legal Protection: In case of non-fulfillment or disagreements, the document serves as a legal reference to resolve conflicts.

- Commitment Confirmation: It demonstrates the buyer’s intent to proceed with the deal, securing the seller’s interests as well.

When Is This Document Essential?

This type of written confirmation is particularly important in the following situations:

- When purchasing large items or services that require an advance to hold or secure the transaction.

- In agreements where one party needs to guarantee their intent before moving forward with more significant steps.

- For transactions involving specialized products or custom services that cannot be readily returned or resold.

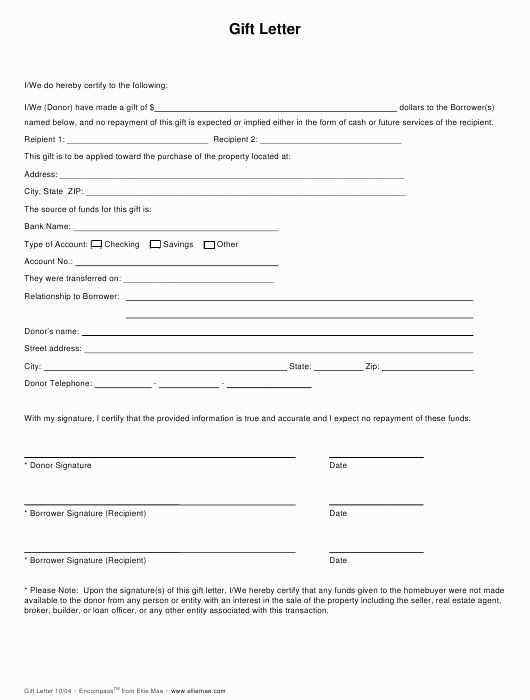

Key Components of the Document

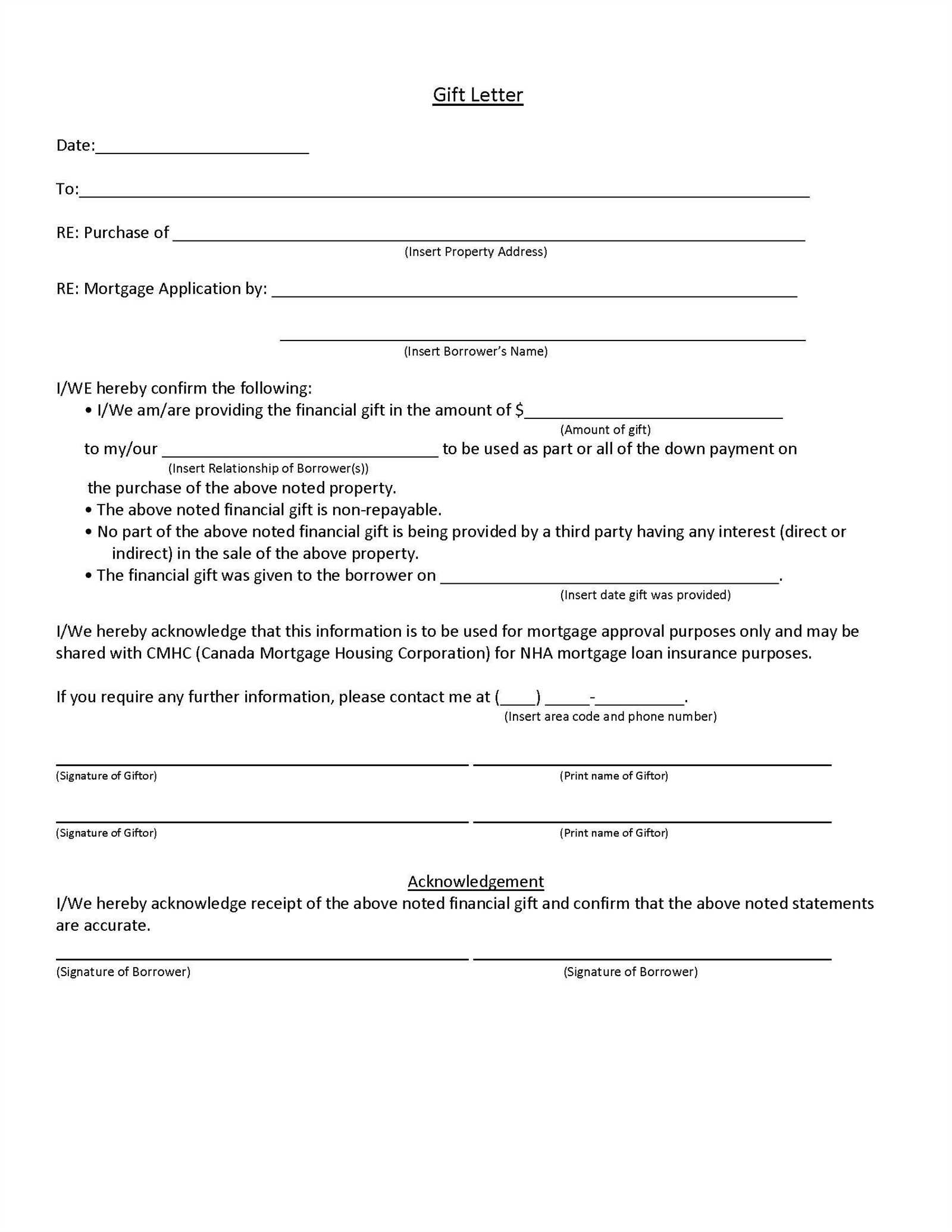

To ensure that a financial commitment is properly documented, the agreement must include several important details. These elements clarify the terms of the arrangement and make the agreement legally binding. A well-structured document covers all necessary aspects to prevent confusion and secure both parties’ interests.

The most essential components of such a document include:

- Amount: The sum of money agreed upon for the initial installment, specifying whether it is a fixed or variable amount.

- Due Date: The exact date by which the initial contribution should be made, establishing a clear timeline for both parties.

- Terms and Conditions: Detailed clauses describing the responsibilities of each party, payment expectations, and any other relevant stipulations.

- Refund Policy: A clear statement outlining circumstances under which the contribution may be refunded or retained, protecting both parties in case of changes.

- Signatures: Signatures of both parties affirming their understanding and agreement to the outlined terms.

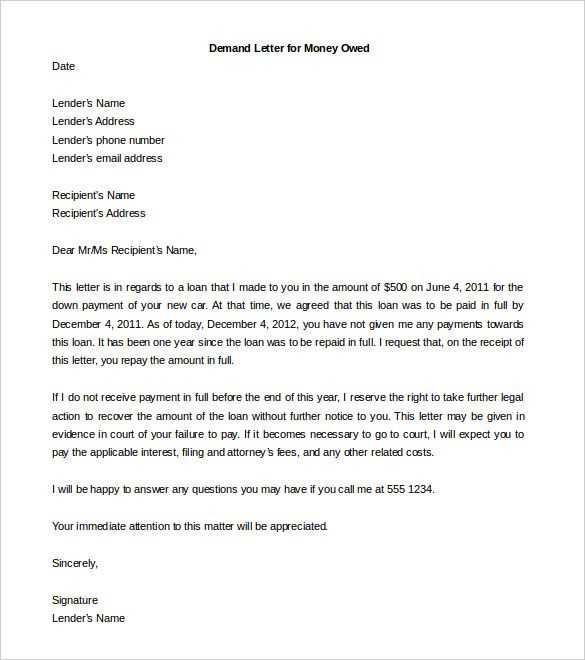

How to Draft a Commitment Document

Creating a formal agreement to confirm an initial financial contribution requires careful attention to detail. The document should be clear, concise, and legally sound to ensure both parties understand their obligations. A well-drafted document not only protects the interests of both sides but also establishes a transparent record of the transaction.

Follow these steps to draft an effective commitment document:

- Start with the Basics: Include the full names and contact details of both parties involved. Specify the nature of the transaction and the reason for the financial commitment.

- Clearly State the Amount: Specify the exact amount being offered as the initial installment. This section should be unambiguous to avoid confusion later.

- Include the Payment Terms: Outline the payment due date, method of payment, and any conditions that apply to the transfer.

- Define Refund or Retention Policies: State whether the contribution is refundable or forfeited under certain conditions. Make sure this is clearly explained to avoid future disputes.

- Conclude with Signatures: Both parties should sign the document to confirm their agreement to the terms. It’s also important to include the date of signing.

Common Errors in Commitment Documents

When drafting a formal document to confirm a financial commitment, it’s important to avoid common mistakes that could lead to confusion or legal complications. These errors can cause misunderstandings between the parties involved and create challenges if any disputes arise later. Ensuring that the document is accurate and clear is crucial for its effectiveness.

Here are some frequent mistakes to avoid when creating such a document:

- Ambiguous Terms: Failing to define key terms or leaving them open to interpretation can lead to confusion. All details, such as the exact amount and due date, should be clearly specified.

- Lack of Signatures: Not having both parties sign the document invalidates the agreement. Ensure that each party’s signature is included as a form of acknowledgment.

- Omitting Refund Terms: Not clearly outlining refund policies or conditions under which funds may be retained can lead to disputes if one party needs to back out of the agreement.

- Inconsistent Dates: Having conflicting or incorrect dates for the financial commitment or due date can create confusion and complicate the enforcement of the agreement.

- Missing Contact Information: Failing to include complete contact information for both parties can create difficulties in reaching each other should issues arise.

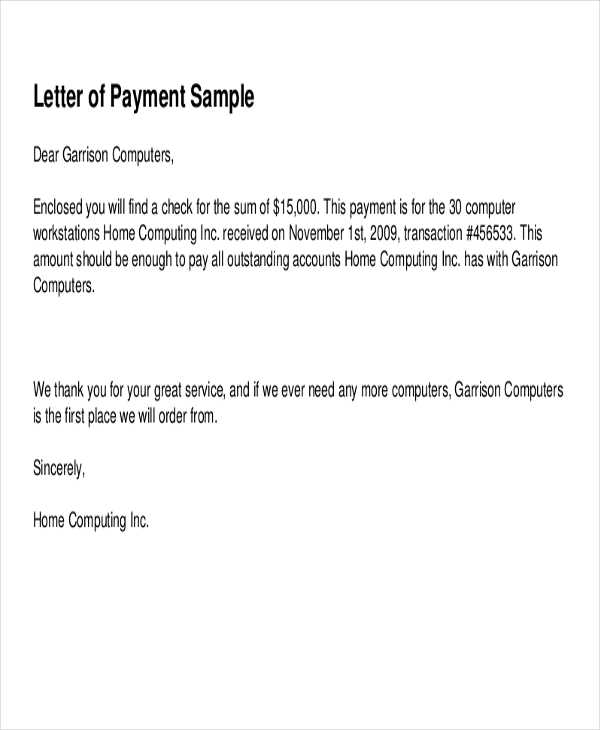

How to Apply a Commitment Document

Once a formal agreement has been drafted and signed, it’s essential to understand the proper steps for applying it in the context of the transaction. The correct application ensures both parties honor the terms outlined in the agreement and allows for a smooth execution of the financial arrangement. Proper application also helps in maintaining transparency and avoiding potential issues in the future.

Step 1: Review and Confirm Details

Before applying the agreement, thoroughly review the terms to ensure everything is accurate. Double-check the financial amounts, dates, and the conditions for the transaction. If anything seems unclear or incorrect, address it before proceeding further.

Step 2: Submit the Document

Once the document is reviewed and finalized, submit it to the relevant party (e.g., the recipient of the financial contribution). Ensure it’s delivered in the manner agreed upon, whether through physical mail or electronic means, and confirm receipt to avoid any confusion.

By following these steps, you can ensure that the commitment document serves its purpose in a clear and legally sound manner, protecting both parties involved.