How to Write an Effective Debt Collector Letter

When individuals or businesses fail to fulfill their financial obligations, it often becomes necessary to reach out with formal requests for payment. These communications are essential in encouraging timely settlements and ensuring that the owed funds are recovered in a professional manner. Crafting the right approach is critical in maintaining both legal compliance and a respectful tone throughout the process.

Clear and direct communication is key when addressing unsettled financial matters. The message should be straightforward and convey the urgency of the situation, while still being polite and respectful. Properly structured requests can enhance the chances of receiving a positive response and can help avoid unnecessary disputes.

By following certain best practices, you can create a compelling request that encourages prompt action. These guidelines will help you address overdue accounts efficiently, providing the necessary details without overwhelming the recipient. This ensures that both parties are clear about expectations and next steps, fostering a smoother resolution process.

Overview of Debt Collection Communication

When payments are overdue, it’s essential to reach out in a professional and structured way. Clear communication serves as the foundation for resolving financial disagreements and ensuring that the owed amount is settled efficiently. The goal is to encourage the recipient to take action while preserving a positive relationship and avoiding legal complications.

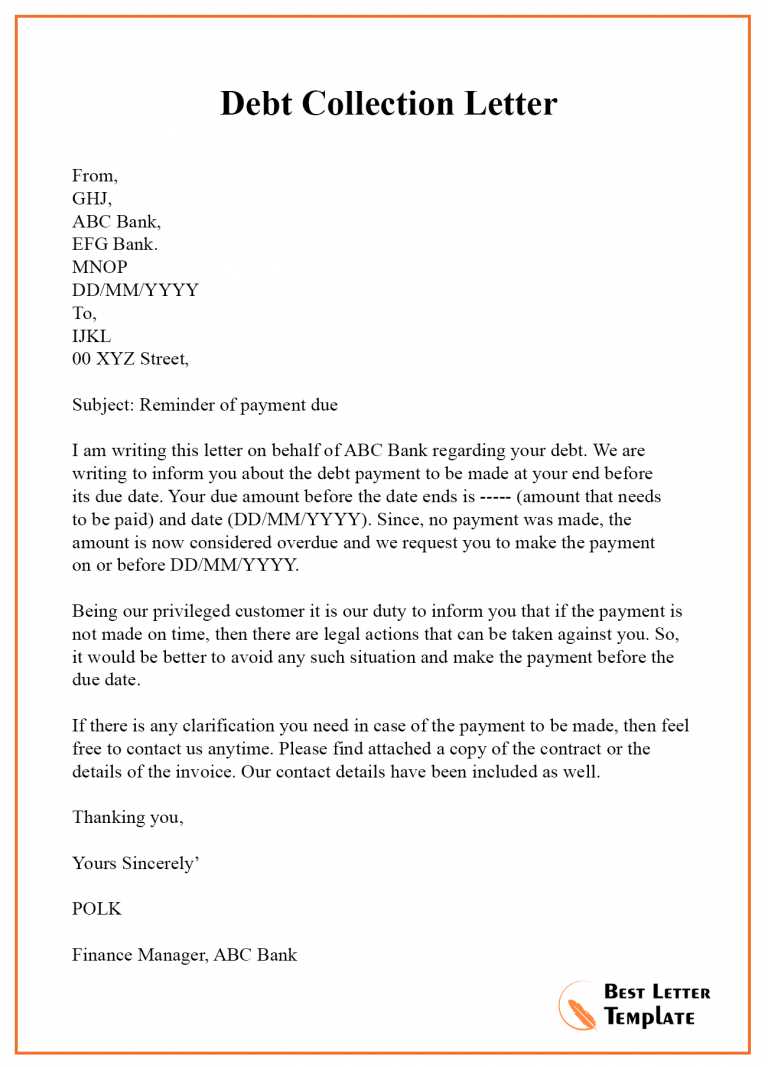

Such communications should outline the outstanding balance, the terms of repayment, and any relevant deadlines. It’s important to approach the situation with clarity and respect, ensuring that all necessary information is conveyed without confusion. A well-crafted message increases the likelihood of a favorable outcome and maintains the integrity of both parties involved.

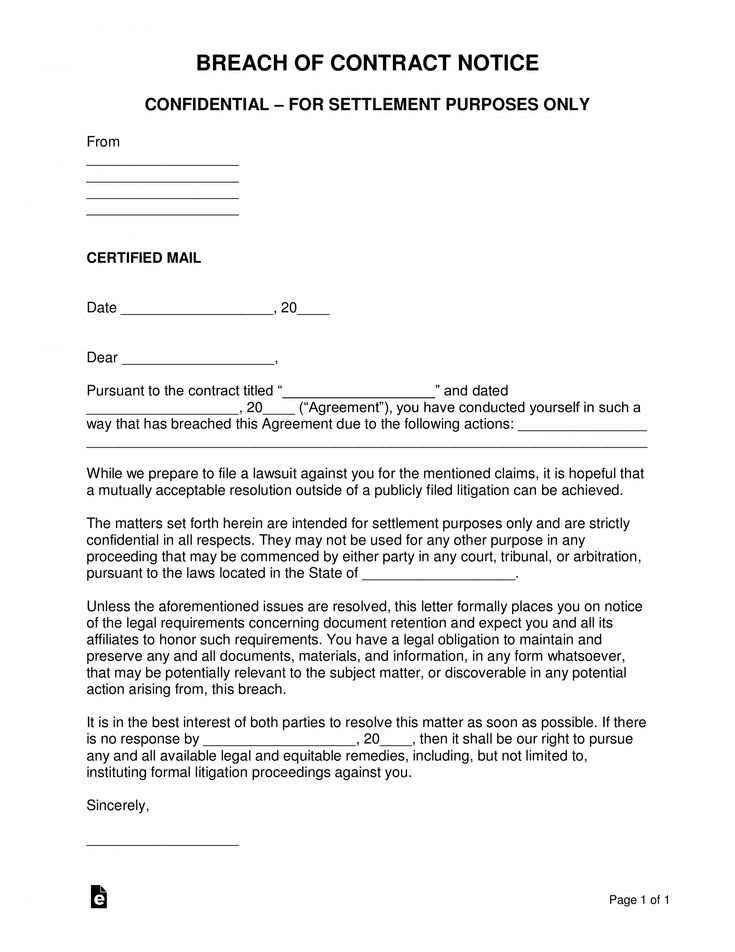

Effective communication also involves understanding the legal framework surrounding these exchanges. While being assertive is important, it’s equally crucial to avoid language that could be interpreted as aggressive or threatening. A balanced tone can lead to more successful resolutions and potentially prevent future conflicts.

Understanding the Purpose of a Letter

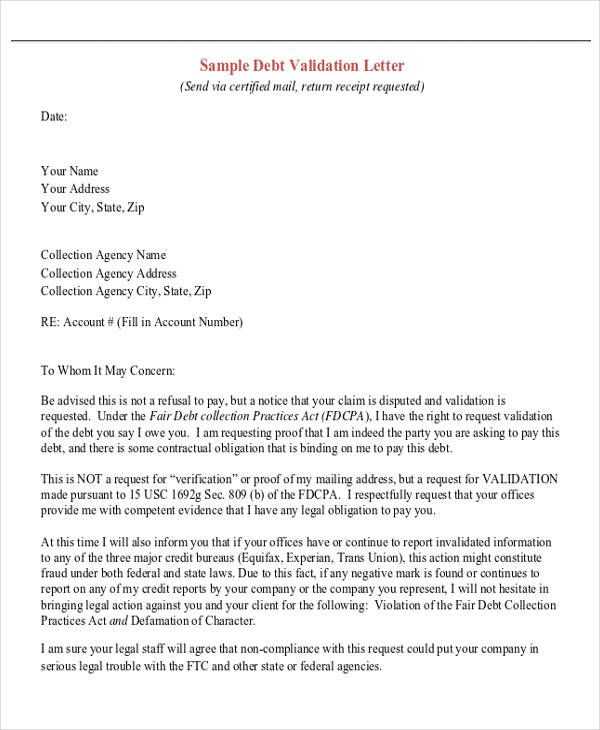

When financial obligations are not met, it’s necessary to send a formal communication to address the issue. This message serves as a reminder of the outstanding amount and clearly explains the steps needed to resolve the situation. Its primary purpose is to prompt the recipient to take action, while also providing a written record of the request for both parties.

Clarifying the Intent

The main goal is to encourage prompt payment without creating unnecessary tension. By outlining the amount owed and the terms of settlement, the communication ensures that both sides are on the same page. It also gives the recipient an opportunity to respond or dispute the claim, if needed.

Ensuring Legal Compliance

Additionally, these communications play an important role in protecting both the sender and recipient by ensuring that the process adheres to relevant laws and regulations. A properly constructed message can serve as evidence in case further action is required to resolve the issue.

Key Information to Include in a Letter

For an effective communication regarding outstanding payments, it’s crucial to include all the necessary details that will help the recipient understand the situation clearly. A comprehensive message not only provides clarity but also sets clear expectations for the next steps, reducing the chance of confusion or dispute.

Payment Details

The primary information to include is the exact amount owed. Specify the original sum, any accrued interest, or fees, and ensure that the total balance is easy to identify. It’s important to break down the payment history and show any partial payments that have already been made, if applicable.

Deadlines and Instructions

Clearly communicate the timeline for payment. Indicate any due dates and specify the acceptable methods of payment. Providing easy-to-follow instructions on how to make the payment can help streamline the process, avoiding any unnecessary delays.

Common Mistakes to Avoid in Debt Letters

When drafting a formal communication to address unpaid amounts, certain mistakes can undermine the effectiveness of the message. Avoiding these errors is essential for maintaining professionalism and improving the likelihood of a positive outcome. Below are some of the most common pitfalls that should be carefully avoided.

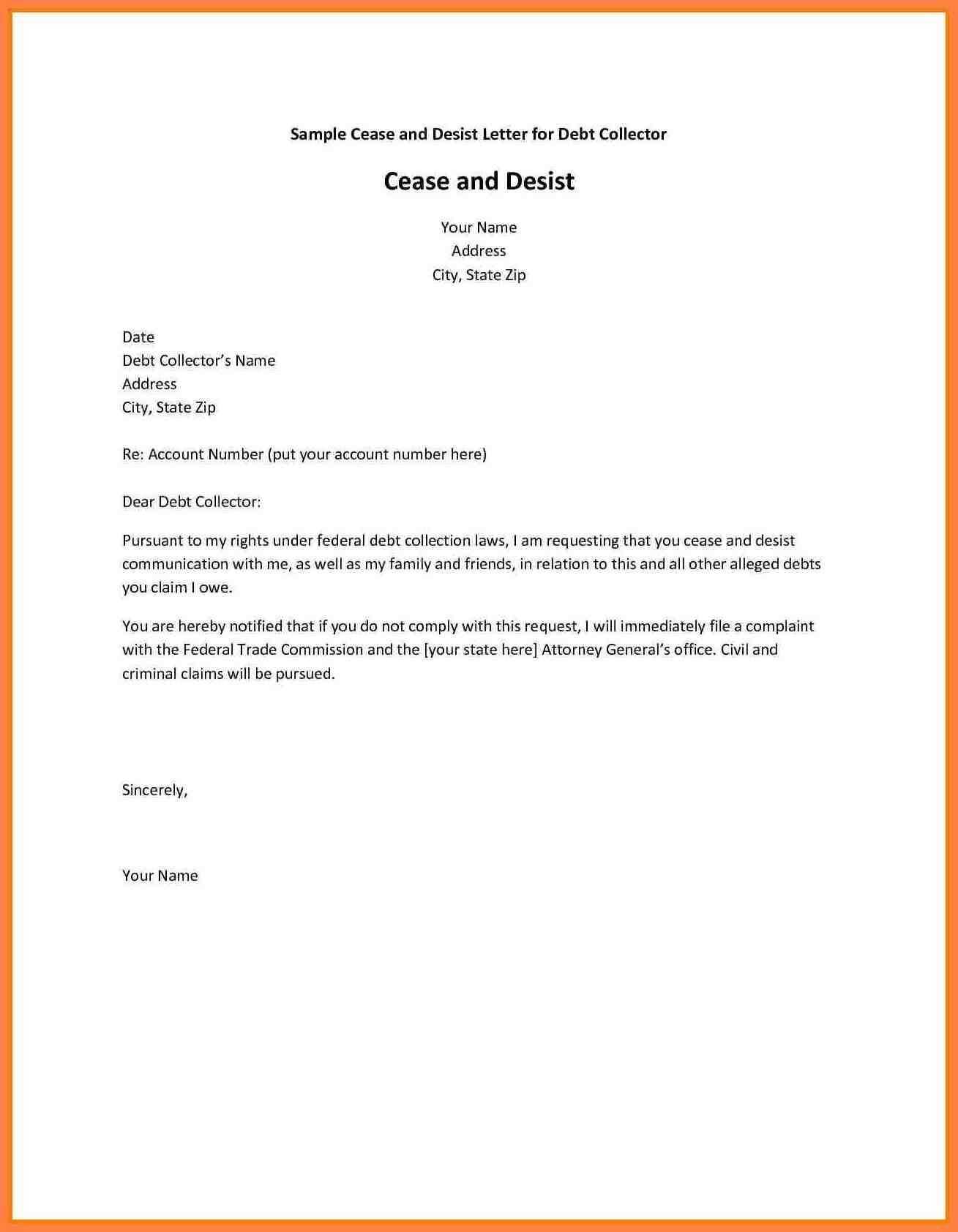

Overly Aggressive Tone

One of the biggest mistakes is using a harsh or demanding tone, which can lead to unnecessary conflict and may cause the recipient to ignore the request altogether. Instead, aim for a polite yet firm approach that encourages cooperation without sounding threatening.

- Avoid using ultimatums or strong language that could escalate tensions.

- Be respectful and professional throughout the message, even when the matter is urgent.

Lack of Clear Details

Another common error is not providing enough information about the owed amount or the payment terms. Failing to clearly outline the balance and the due date can confuse the recipient, making it harder for them to take the necessary actions.

- Ensure that all relevant amounts are listed, including interest, fees, and the total balance.

- Specify the payment methods and deadline to avoid any ambiguity.

Best Practices for Writing a Collection Notice

Writing a formal request for payment requires a balance of clarity, professionalism, and urgency. Following best practices ensures that the message is effective and encourages timely resolution while maintaining a respectful tone. By keeping a few key strategies in mind, you can craft a communication that is both clear and compelling.

First and foremost, be direct yet polite. The recipient should fully understand the purpose of the message, but without feeling cornered or harassed. It’s important to convey that the matter is serious, but also that there is an opportunity to resolve the issue amicably.

Another essential aspect is to ensure that all the necessary details are present. Include the amount owed, the payment due date, and any applicable terms. This provides the recipient with everything they need to know to make a payment or respond appropriately.

How to Handle Late Payment Requests

When payments are delayed, it’s essential to approach the situation with both professionalism and tact. Managing overdue amounts effectively involves clear communication and a structured approach that encourages timely payment while maintaining positive relations. By addressing late payment requests thoughtfully, you can facilitate smoother resolution processes and preserve goodwill.

The first step is to acknowledge the issue promptly. It’s important to communicate with the recipient as soon as possible to avoid the situation escalating further. At the same time, provide them with clear instructions on how to proceed with the payment, offering flexibility when possible.

Here’s an example of how the process might unfold:

| Action | Details |

|---|---|

| Initial Reminder | Send a polite reminder of the overdue payment with clear instructions on how to make the payment. |

| Second Request | If no response is received, follow up with a more urgent reminder, reiterating the consequences of non-payment. |

| Final Notice | Before taking further action, send a final notice that clearly states the due amount and outlines any additional steps. |

Legal Requirements in Debt Collection Letters

When addressing outstanding financial obligations, it’s important to follow the legal guidelines that govern how such communications should be handled. These rules are in place to ensure that both parties are treated fairly, and to prevent any actions that could be deemed unlawful or unethical. Understanding and adhering to these requirements helps protect both the sender and the recipient of the notice.

There are several key aspects to consider when drafting a formal request for payment:

- Clear Identification of the Creditor: The communication should clearly state who is requesting payment and include relevant contact details.

- Accurate Amount Owed: Always ensure the amount requested is correct, including any accrued interest or fees, and provide a clear breakdown if necessary.

- Notification of Rights: It’s essential to inform the recipient of their legal rights in response to the request, including the option to dispute the amount.

- Timely Response Information: Include a specific deadline for the recipient to act and the consequences of non-payment, all within the boundaries of the law.

Ensuring that your communication complies with these rules helps maintain transparency and avoids potential legal issues down the line. Following these steps helps keep the process professional and within legal boundaries.

Final Steps After Sending a Collection Letter

After sending a formal request for payment, it’s essential to know the next steps to take depending on the recipient’s response. Whether the payment is made or further action is needed, having a clear plan in place will ensure that you maintain control of the situation while staying within legal and ethical boundaries.

Once the notice is sent, monitor the recipient’s response. If they make a payment or respond positively, promptly acknowledge the payment and close the matter. If there is no response, follow up with a reminder or consider other measures, keeping in mind any applicable legal regulations.

Follow-Up Actions

If no response is received after the initial notice, it may be necessary to send a follow-up message. This communication should reiterate the importance of resolving the matter and the consequences of continued non-payment. Keep the tone firm but respectful to avoid escalating the situation unnecessarily.

Exploring Further Legal Options

If the recipient continues to ignore the request and no payment is made, consider legal options. This could include engaging a third party or pursuing formal legal action, depending on the amount and the circumstances. Always ensure that any further steps align with the laws governing financial disputes in your area.