Letter Template for Communicating with Credit Bureaus

When you notice discrepancies or inaccuracies in your financial history, it’s important to take proactive steps to resolve them. A well-crafted communication can help ensure that your concerns are addressed efficiently. By reaching out to the relevant institutions, you can initiate a process that leads to the correction of errors or clarification of any misunderstandings that might affect your standing.

In this guide, you will learn the best practices for drafting a professional and effective message aimed at resolving such issues. Whether you’re addressing mistaken entries or seeking clarification, knowing how to communicate clearly and persuasively is crucial for a favorable outcome. Keep in mind that these institutions are required to investigate and respond to your requests, so understanding how to present your case can make all the difference.

Understanding Financial Institution Communication

When dealing with institutions that track your financial records, it’s essential to understand how to engage with them effectively. These organizations manage vast amounts of sensitive information, and any correspondence needs to be clear, professional, and well-structured. Knowing how to communicate with them can help ensure that your concerns are handled promptly and accurately.

The Importance of Clear Communication

Effective communication is key to resolving any issues or addressing questions. It’s important to be precise in explaining what you believe needs to be corrected or clarified. A well-articulated message helps avoid delays and misunderstandings, ensuring the recipient understands your concerns fully.

How Institutions Handle Your Requests

Institutions are legally obligated to address your inquiries within a specific timeframe. They are responsible for investigating your claims and providing a response based on the findings. By following the right steps and ensuring your communication is clear, you increase the likelihood of a favorable resolution to any discrepancies or issues.

Why Write to Financial Reporting Agencies

When you notice discrepancies in your financial history or believe certain information may not be accurate, it’s important to take formal action. Communicating directly with the institutions responsible for maintaining your records allows you to request corrections, clarifications, or further investigation. This can help ensure that your financial standing is accurately reflected and prevent any negative consequences from errors in your file.

There are several common reasons why reaching out to these organizations is necessary. Below is a table that outlines some of the most frequent scenarios when communication might be required:

| Reason | Explanation |

|---|---|

| Disputed Entries | If you find incorrect or outdated information in your report, contacting the relevant parties can help get it corrected. |

| Fraudulent Activity | In case of identity theft or fraudulent actions, notifying the institution can trigger a review and help prevent further issues. |

| Clarification Requests | If certain details in your records are unclear or need further explanation, reaching out can provide the necessary answers. |

| Correcting Personal Information | Any errors in your personal details, such as name or address, should be updated to ensure your records are accurate. |

How to Address Discrepancies in Reports

When discrepancies appear in your financial records, it’s essential to take swift and clear action to resolve the issue. Addressing inaccuracies not only helps maintain an accurate reflection of your financial standing but also protects your reputation and ensures that any mistakes are corrected promptly. Here’s how to approach the process of identifying and addressing these inconsistencies effectively.

Follow these steps to resolve discrepancies:

- Review your records carefully to identify any errors or outdated information.

- Gather supporting documentation to back up your claim. This may include bank statements, receipts, or previous communications.

- Reach out to the responsible institution with a detailed explanation of the issue, highlighting specific discrepancies.

- Request a formal investigation or correction, and provide clear instructions on how the issue can be resolved.

Additionally, consider these tips when addressing any inconsistencies:

- Be concise and professional in your communication to ensure your concerns are taken seriously.

- Provide accurate and relevant information to avoid confusion during the review process.

- Follow up regularly if there is no response within the expected timeframe.

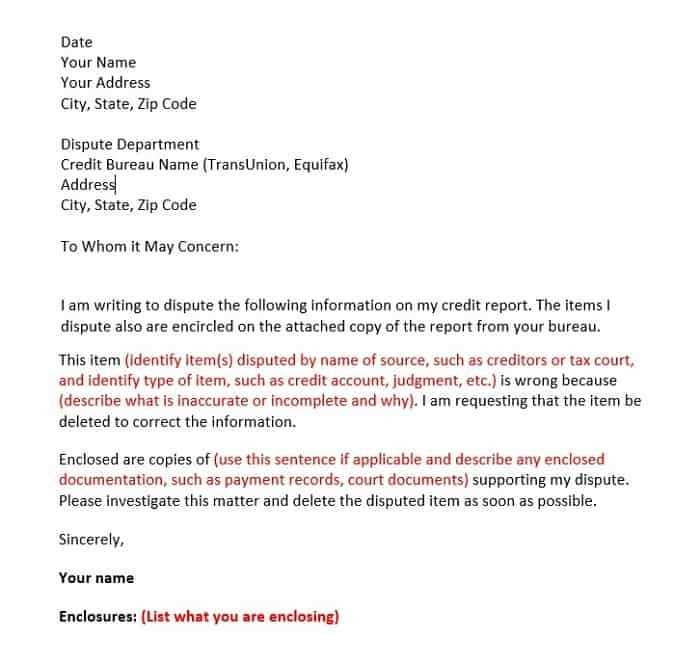

Steps to Create an Effective Communication

To address issues or clarify discrepancies in your financial records, crafting a clear and effective message is essential. A well-organized communication ensures that your concerns are conveyed properly and that the recipient can understand and respond efficiently. Following a few key steps will help you compose a message that is both professional and persuasive.

1. Gather All Relevant Information

Before writing, ensure that you have all the necessary details to support your case. This includes any relevant documents, such as account statements, previous correspondence, or identification information. Having everything prepared will make your communication more credible and provide the necessary context for the recipient to understand your request.

2. Be Clear and Concise

When drafting your message, focus on clarity. State the issue clearly and outline what actions you wish to be taken. Avoid unnecessary details that could distract from the main point. A concise message helps ensure that your concerns are understood without confusion or delay.

Common Mistakes to Avoid in Communications

When addressing issues related to your financial records, it’s important to communicate effectively to ensure your message is taken seriously. Small mistakes can lead to delays or misunderstandings that hinder the resolution process. Avoiding common errors can help make your communication more effective and improve the chances of a positive outcome.

Here are some common mistakes to avoid:

- Being Vague or Ambiguous: Clearly state the issue and provide relevant details to avoid confusion.

- Failing to Provide Evidence: Always include supporting documents or references that back up your claims.

- Being Too Emotional: While it’s understandable to be frustrated, maintaining a professional tone increases the likelihood of your concerns being addressed.

- Ignoring Deadlines: If the institution has a response time requirement, ensure you follow up within the specified timeframe.

- Not Following Up: After sending your message, follow up if you don’t receive a response within a reasonable period.

Tracking Your Message’s Progress

Once you’ve sent your communication to the appropriate organization, it’s important to monitor its progress. This ensures that your concerns are being addressed and allows you to take any necessary follow-up actions. By tracking the status of your request, you can stay informed and avoid unnecessary delays in the resolution process.

1. Use Tracking Services

If you’ve sent your message via mail, make sure to use a service that provides tracking. This will allow you to confirm when the recipient has received your correspondence. Tracking services can also provide delivery confirmation, which can be useful in case you need to prove that your message was received.

2. Set Reminders for Follow-Ups

Keep track of when you expect a response and set reminders to follow up if necessary. Many organizations are required to respond within a certain time frame, so be proactive in checking the status. If you haven’t received a reply within the expected period, reaching out again can help ensure that your concerns are being addressed.

What to Do After Sending the Communication

After you’ve sent your message, it’s essential to stay proactive and ensure that the issue is being addressed. This period is crucial for monitoring the progress of your request and making sure no further steps are overlooked. Knowing what actions to take next can help ensure a timely resolution to the matter.

First, keep track of the delivery confirmation, especially if you used a service that provides proof of receipt. This helps verify that the recipient received your correspondence. Once confirmed, allow for the expected response time to pass before following up if you haven’t heard back. Be patient, but also remain vigilant in checking the status and taking necessary actions to keep things moving forward.

If you don’t receive a response in the time frame you were expecting, it’s important to follow up. Contact the relevant institution to check on the status of your request, and politely remind them of the issue at hand. Regular follow-ups can help prevent unnecessary delays and keep the process on track.