Vehicle Lien Release Letter Template Guide

When a financial obligation tied to an asset is settled, it is essential to document the conclusion of this arrangement in a clear, official format. This ensures that both parties acknowledge the cancellation of any outstanding claims and that all legal aspects are properly addressed. Understanding how to draft such a document can help facilitate the process and protect all involved parties.

Purpose of Documenting Debt Settlement

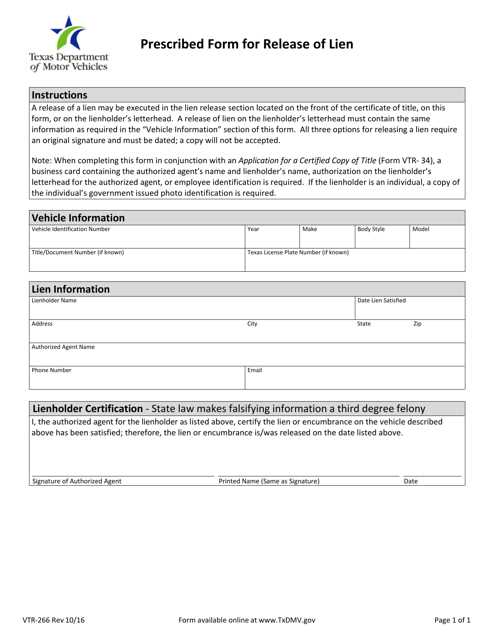

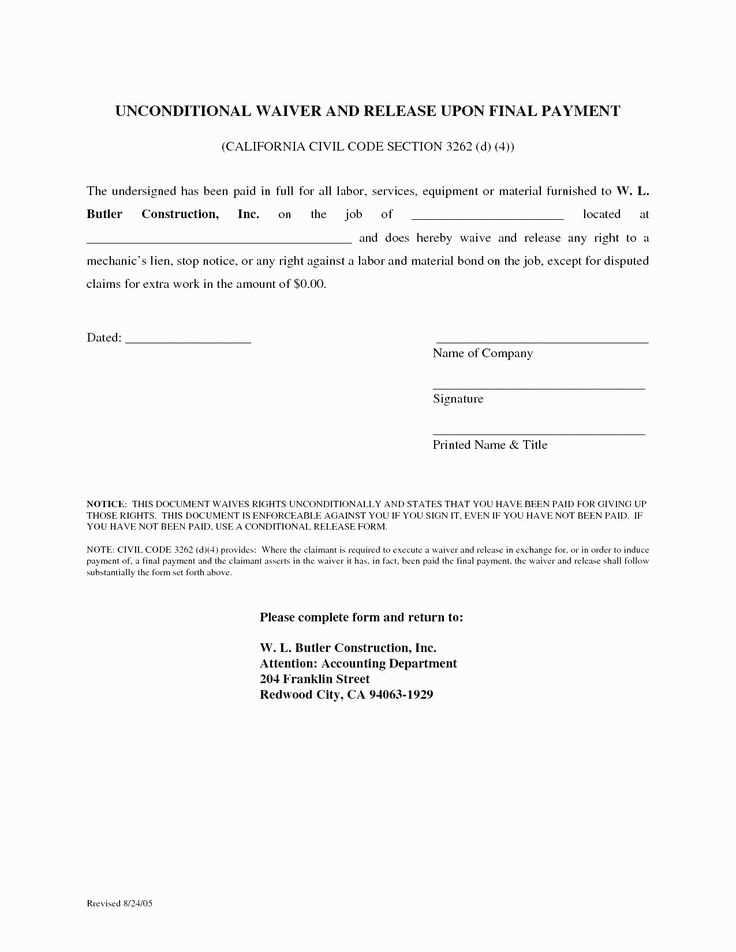

Creating a formal written statement when a debt tied to an asset is paid off provides a legally binding acknowledgment that the obligation has been fulfilled. This document serves to notify relevant parties, such as authorities or financial institutions, that the claim has been satisfied. Without it, complications may arise if questions about ownership or liability emerge later.

Key Elements of the Document

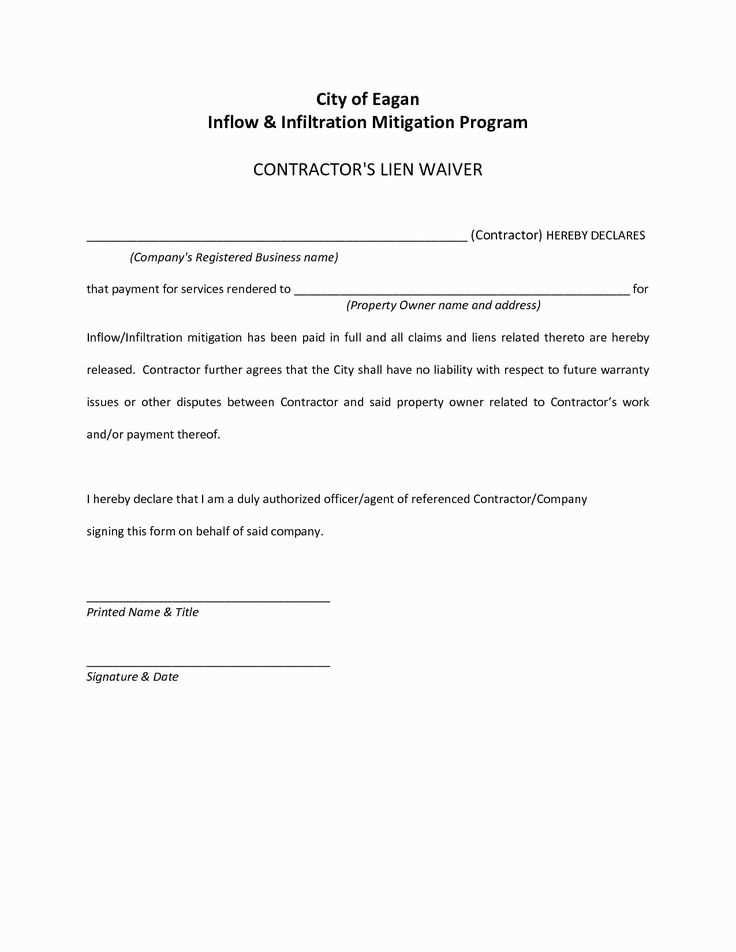

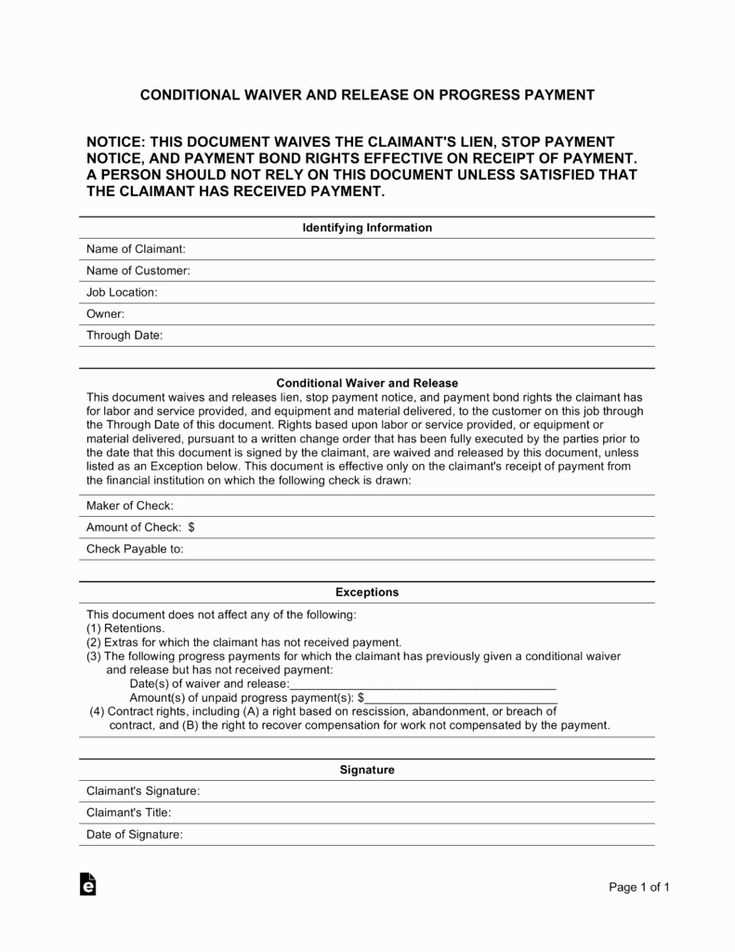

- Identifying Information: Include full names and addresses of both parties.

- Asset Description: Provide detailed information about the item in question, including identification numbers or unique characteristics.

- Settlement Confirmation: Clearly state that the obligation has been met, with relevant dates and amounts.

- Signatures: Ensure both parties sign to validate the document.

Why Using a Pre-made Format is Beneficial

Using a structured format for drafting such documents simplifies the process. It ensures that no critical details are overlooked and saves time. Additionally, templates often comply with legal standards, reducing the risk of errors that could lead to future disputes.

Final Steps in Submission

Once completed, the document should be submitted to the appropriate institutions or registered authorities. Retaining copies for both parties is crucial in case of future verification needs. Following these steps ensures a smooth conclusion to any outstanding financial obligations.

What is a Debt Settlement Confirmation

Understanding the Process of Removal

Steps to Create a Settlement Document

Guidelines for Writing the Document

Essential Components of a Settlement

Information Needed for Valid Documentation

Legal Considerations When Using a Pre-made Format

Ensuring Compliance with Regulations

Finalizing an outstanding obligation on an asset requires proper documentation to confirm the completion of the financial arrangement. This type of formal statement serves as an official declaration that the owed amount has been satisfied, ensuring clarity for all parties involved.

Understanding how to properly cancel a claim on a financed item is key to ensuring all parties have legally binding confirmation that the debt has been cleared. This process involves submitting the necessary paperwork to remove any associated encumbrances.

To create a valid document, it is important to follow specific steps to ensure all the required details are included. These steps help maintain transparency and avoid potential legal issues in the future. The document should clearly outline the agreement’s conclusion and the asset’s unencumbered status.

Writing a clear and effective document involves including accurate, relevant information, and following a consistent structure. The document should be easy to understand and contain no ambiguities to ensure its legal enforceability.

Key elements of such a document include identifying both parties, describing the asset in question, and confirming the full satisfaction of the financial obligation. These components guarantee that the document will serve its intended purpose without confusion.

For the document to be legally valid, certain information must be provided. This includes full names, contact details, the amount paid, and any pertinent dates. Without this, the document could be deemed incomplete or ineffective in the event of disputes.

When using a pre-made structure, it is important to be aware of specific legal requirements and jurisdictional differences that may impact the document’s validity. Legal consultation can ensure that the document complies with local laws and minimizes the risk of future issues.

Ensuring that all necessary regulations are followed during the creation of the document helps avoid complications and potential delays. Compliance with both state and federal requirements is crucial to ensure that the settlement is officially recognized and recorded.