How to Use a 609 Credit Repair Letter Template

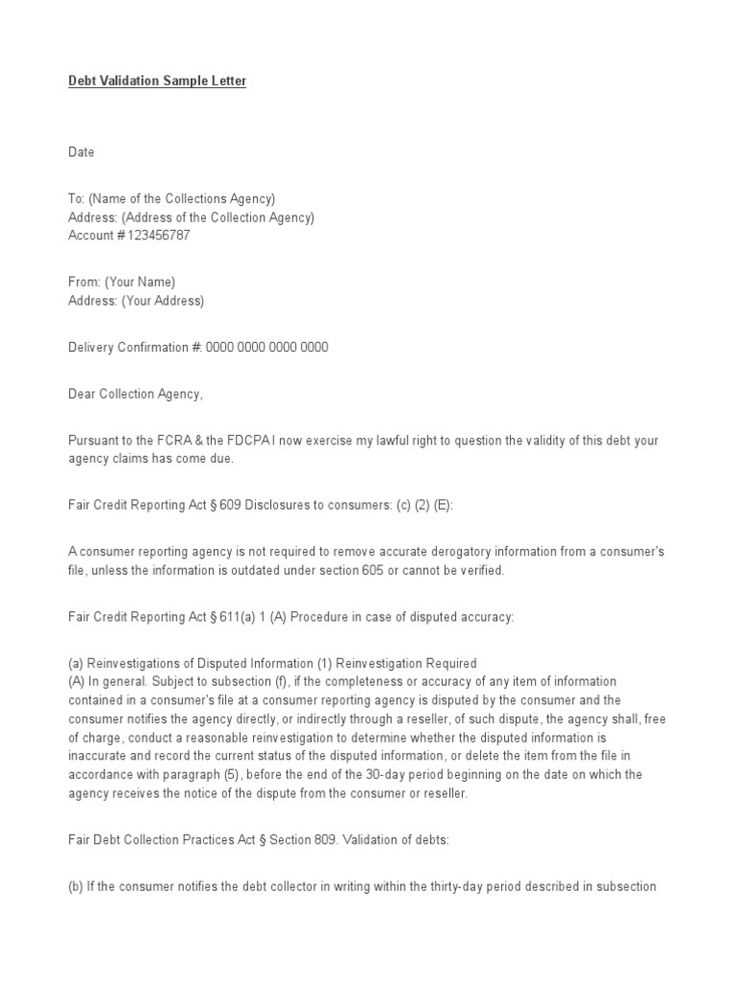

When inaccuracies appear in your personal financial records, it’s crucial to address them effectively. This process involves communicating with relevant institutions to resolve discrepancies. One common approach is to send a formal request for corrections, providing supporting documentation to strengthen your claim.

Why You Should Address Errors Promptly

Failure to contest mistakes may lead to long-term financial consequences. By addressing inaccuracies quickly, you can improve the overall quality of your records and ensure fair treatment in future financial dealings.

Common Issues Found in Records

- Incorrect account details

- Accounts marked as overdue that are paid

- Duplicated entries for the same debt

- Accounts that don’t belong to you

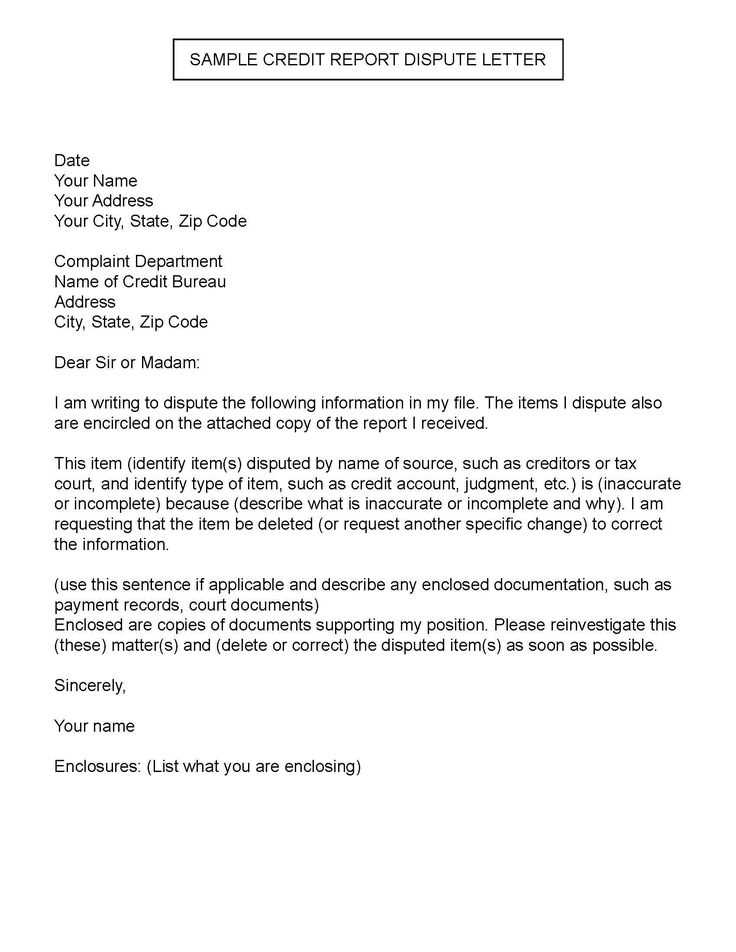

How to Compose Your Request

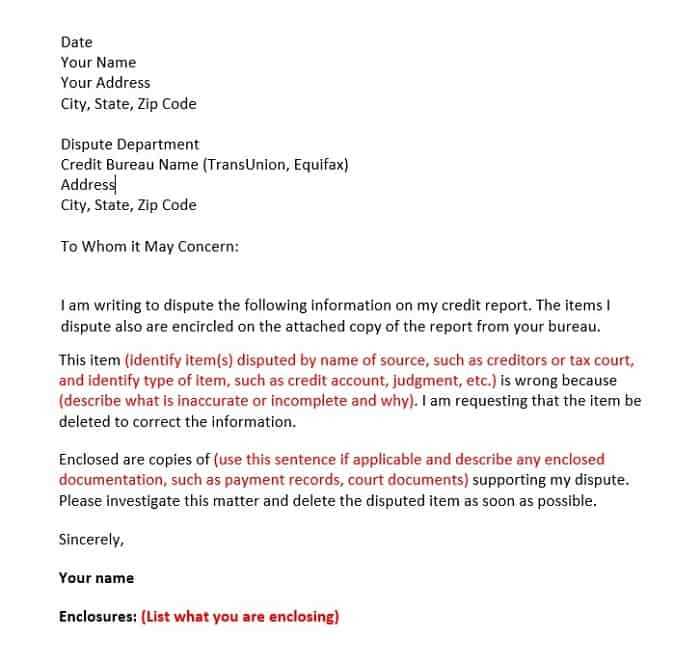

The process of drafting your request should be clear and concise. Include your full name, contact information, and detailed descriptions of the errors you’re disputing. Attach any evidence that supports your case, such as receipts, statements, or other relevant documents.

Next Steps After Sending Your Dispute

After submitting your formal request, it’s essential to follow up regularly to check on the status. Depending on the institution’s response, you may need to send additional information or escalate the matter if no action is taken.

Disputing Errors on Your Report and Improving Your Record

When errors appear on your financial record, it’s essential to take action to correct them. One effective approach is through submitting a formal request for changes, which can lead to the removal of inaccurate information. This method helps individuals take control of their financial history and ensure it reflects the truth.

By using a well-structured formal request, you can challenge incorrect entries and provide supporting evidence to back your claims. The goal is to get institutions to review and amend any misleading or incorrect details that might negatively impact your standing.

Benefits of Using This Formal Request

Submitting a well-crafted request can help speed up the process of correcting inaccuracies. This approach is straightforward and often leads to a quicker resolution, improving your overall financial standing without the need for prolonged efforts.

How to Write Your Dispute Request

To begin, clearly state the information in question, including specific details about what is wrong. Provide a clear explanation of why the details are incorrect, and back it up with relevant supporting documents. Make sure to keep the tone professional and concise to increase the chances of a successful outcome.

Key Elements to Include in Your Request

- Your full name and contact details

- A description of the dispute with accurate reference numbers

- Any supporting evidence like bank statements or receipts

- A request for the removal or correction of the error

When to Submit the Dispute

It’s important to submit the formal dispute promptly after identifying the error. The sooner you address discrepancies, the sooner they can be corrected, and the better your chances of seeing a positive outcome.

What You Can Expect After Submission

After submitting your formal request, you might receive a response from the relevant institution acknowledging the dispute. They will review the evidence and, depending on their findings, either make the necessary corrections or request further documentation. This process may take time, but the end result should be the accurate representation of your financial history.

Other Options for Disputing Errors

If this approach doesn’t yield the desired results, there are other methods available to address errors. You can explore services that specialize in assisting with the dispute process or consider escalating the matter to higher authorities for further review.