Personal Information Update Letter Template for Credit Bureau

When discrepancies arise in your financial history, it’s essential to address them promptly. Whether you’ve changed your address, name, or any other relevant details, ensuring that your records are accurate is crucial for maintaining a reliable financial profile. Institutions rely on precise data, and even minor errors can lead to issues like delays or miscalculations.

To facilitate the process, you’ll need a formal means of communicating the necessary adjustments. Crafting a well-structured request ensures clarity and minimizes the chances of confusion. Knowing the proper format and including all relevant details can help speed up the correction process and make sure your account is up-to-date without unnecessary setbacks.

In this guide, we will explore the most effective way to handle such requests, providing you with the tools to address your situation confidently. By following a few simple guidelines, you can ensure that your details are revised accurately and efficiently.

Why Update Your Records

Maintaining accurate details with financial entities is crucial for smooth transactions and effective management of your profile. When you move, change your name, or experience other life events, those updates must be reflected in the systems that store your financial history. Failing to keep this information current can result in delays, mistakes, and even complications when applying for loans or other financial services.

Potential Consequences of Inaccurate Data

- Difficulty in obtaining loans or mortgages

- Errors in credit assessments and risk evaluations

- Problems with identity verification during financial transactions

- Missed opportunities for benefits or rewards linked to accurate details

Benefits of Keeping Records Updated

- Ensures correct assessment of financial standing

- Streamlines communication with financial institutions

- Reduces the risk of fraud and identity theft

- Improves your eligibility for favorable terms and offers

Understanding Financial Institution Procedures

Each organization that manages your financial records follows specific protocols when processing updates or corrections. These processes are designed to ensure that the data they store is accurate and reflective of your current situation. Any modifications to your details are typically evaluated through a set of standardized steps, ensuring transparency and fairness in the decision-making process. It’s important to be familiar with these steps to ensure that your request is handled efficiently.

Key Steps in the Process

| Step | Description |

|---|---|

| Step 1: Initial Submission | Your request is received and logged into the system for processing. |

| Step 2: Verification | The details provided are checked against the existing records for accuracy. |

| Step 3: Assessment | Any discrepancies are reviewed, and additional information may be requested. |

| Step 4: Confirmation | If the changes are valid, they are incorporated into your profile, and you are notified. |

Factors Affecting the Processing Time

- Complexity of the changes being made

- Volume of requests being processed at the time

- Accuracy and completeness of the documentation provided

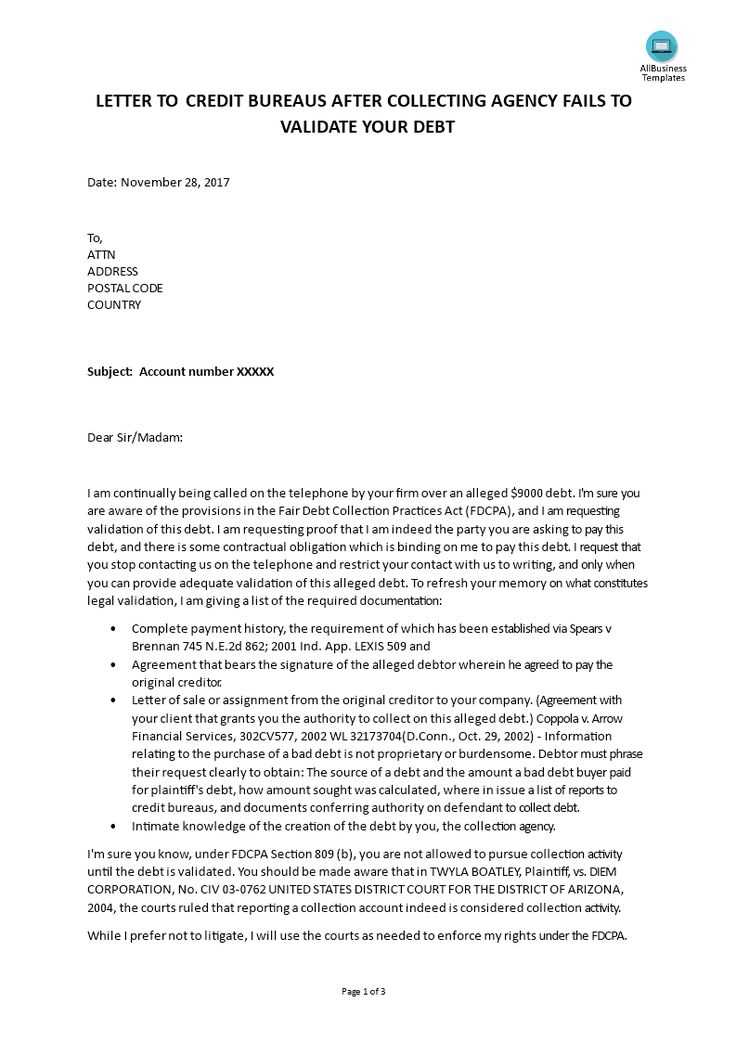

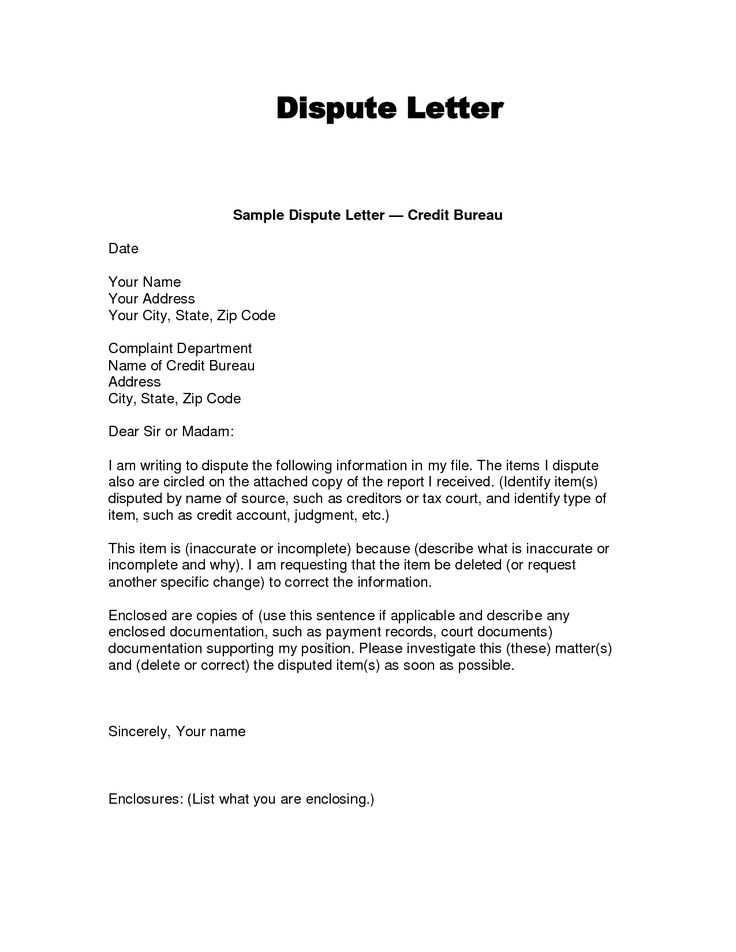

How to Write an Effective Request

When you need to request changes to your financial records, it’s essential to present a clear, concise, and professional communication. A well-structured message not only conveys your intent but also increases the likelihood of a swift response. The way you express your request can significantly impact how quickly and accurately it’s processed.

To create a compelling request, focus on clarity and include all relevant details without being overly verbose. Be polite and formal, as this helps ensure your request is taken seriously. It’s also crucial to include any supporting documents or information that might be required to validate your claim.

Essential Elements of a Strong Request:

- Clear Introduction: Start by briefly stating the purpose of your message.

- Details of the Change: Specify the exact modifications you wish to make.

- Supporting Evidence: Attach any necessary documents to back up your request.

- Professional Tone: Keep the tone respectful and formal throughout.

- Request for Confirmation: Politely ask for confirmation once the changes are made.

Common Mistakes in Record Modifications

When submitting requests to correct or change details held by financial institutions, many individuals make errors that can delay or hinder the process. These mistakes often stem from insufficient clarity, incomplete information, or failure to follow proper procedures. Being aware of these common pitfalls can help you avoid unnecessary setbacks and ensure your request is processed smoothly.

One frequent mistake is submitting incorrect or outdated documentation. Failing to provide the necessary proof or submitting invalid supporting materials can lead to a rejection or delay of your request. Another common issue is not clearly specifying the exact change you want to make, leaving room for misunderstandings or misinterpretations.

To avoid these issues, always double-check the accuracy of the details you provide and ensure that all required documents are included. Clear, direct communication is key to preventing mistakes and ensuring a quick resolution.

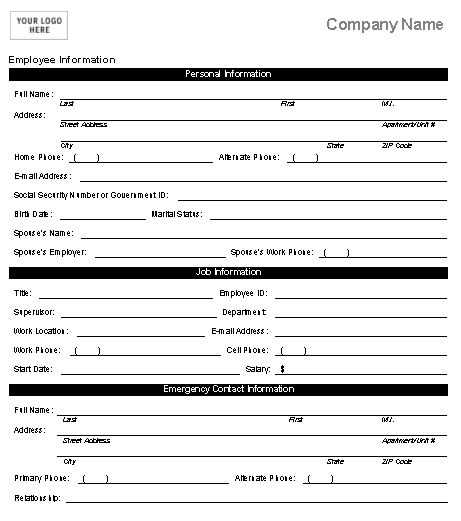

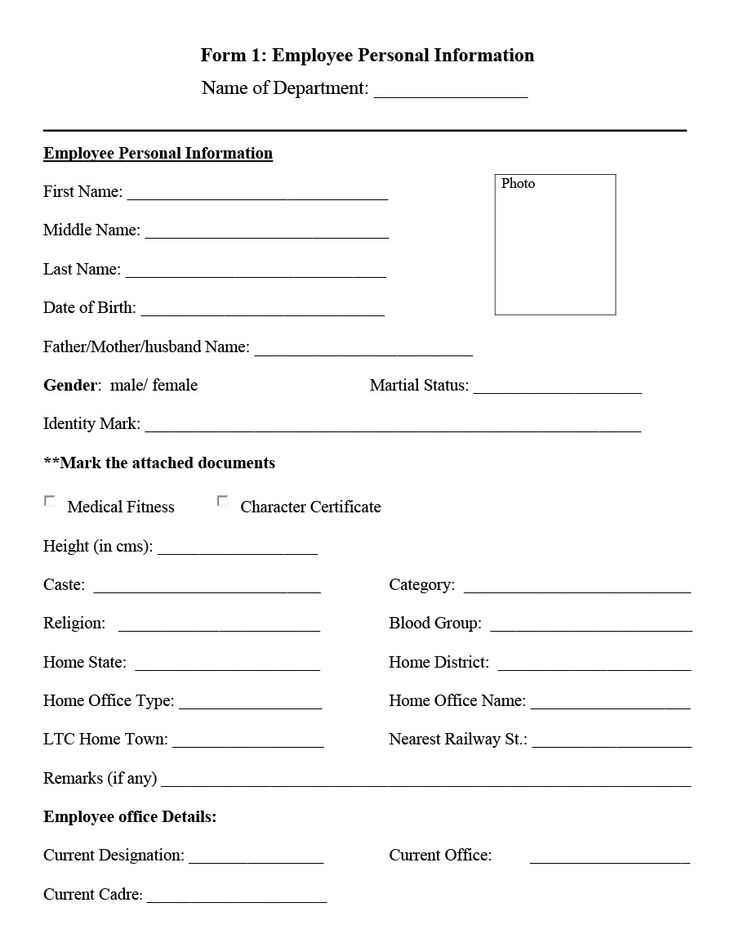

Essential Details to Include in the Request

To ensure that your communication is effective and results in the desired changes, it’s important to provide all relevant details in a clear and organized manner. Missing or vague information can delay the process, so each element of your request should be carefully considered. The more precise and complete your submission is, the faster the organization can assess and act upon it.

Key Components of a Complete Request

- Your Full Name: Ensure that your name is spelled correctly and matches the one on file.

- Account or Reference Number: Provide the relevant identifiers that help locate your record quickly.

- Description of the Change: Clearly state what information needs to be corrected, added, or removed.

- Supporting Documents: Attach any documentation that proves your claim, such as utility bills, identification, or legal forms.

- Contact Information: Include your phone number and email address in case the organization needs to reach you for further clarification.

How to Structure the Content

Start with a polite introduction and brief explanation of why you are writing. Follow this by a clear description of the specific changes you are requesting. Attach all necessary documentation and conclude with a respectful request for confirmation. Keeping the tone professional and to the point is essential for a successful resolution.

Processing Time and Next Steps

Once your request has been submitted, it enters a processing stage where the necessary actions are taken to make the required changes. The length of time it takes to complete this process can vary depending on several factors, including the complexity of the change and the volume of requests being handled by the institution. It’s important to be aware of the typical processing time so that you know when to expect a response or follow-up communication.

Factors Influencing Processing Time

- Complexity of the Requested Change: Simple changes may be processed quickly, while more detailed requests may take longer.

- Volume of Pending Requests: If the organization is handling a high number of submissions, processing times may be delayed.

- Accuracy of the Provided Documentation: Complete and accurate paperwork speeds up the review process, while missing or incorrect documents can cause delays.

What to Do After Submission

After sending your request, be sure to keep track of any confirmation receipts or reference numbers you receive. These will help you follow up on your submission if needed. If you don’t hear back within the estimated timeframe, you can contact the organization to inquire about the status of your request. Be prepared to provide any additional information if requested.