Equity Commitment Letter Template for Your Business Agreement

When seeking financial backing, it’s important to establish clear agreements with investors or lenders. A formal document that outlines the terms of support ensures that both parties understand their roles, responsibilities, and expectations. This type of agreement serves as a key element in any funding arrangement, helping to solidify trust and commitment from both sides.

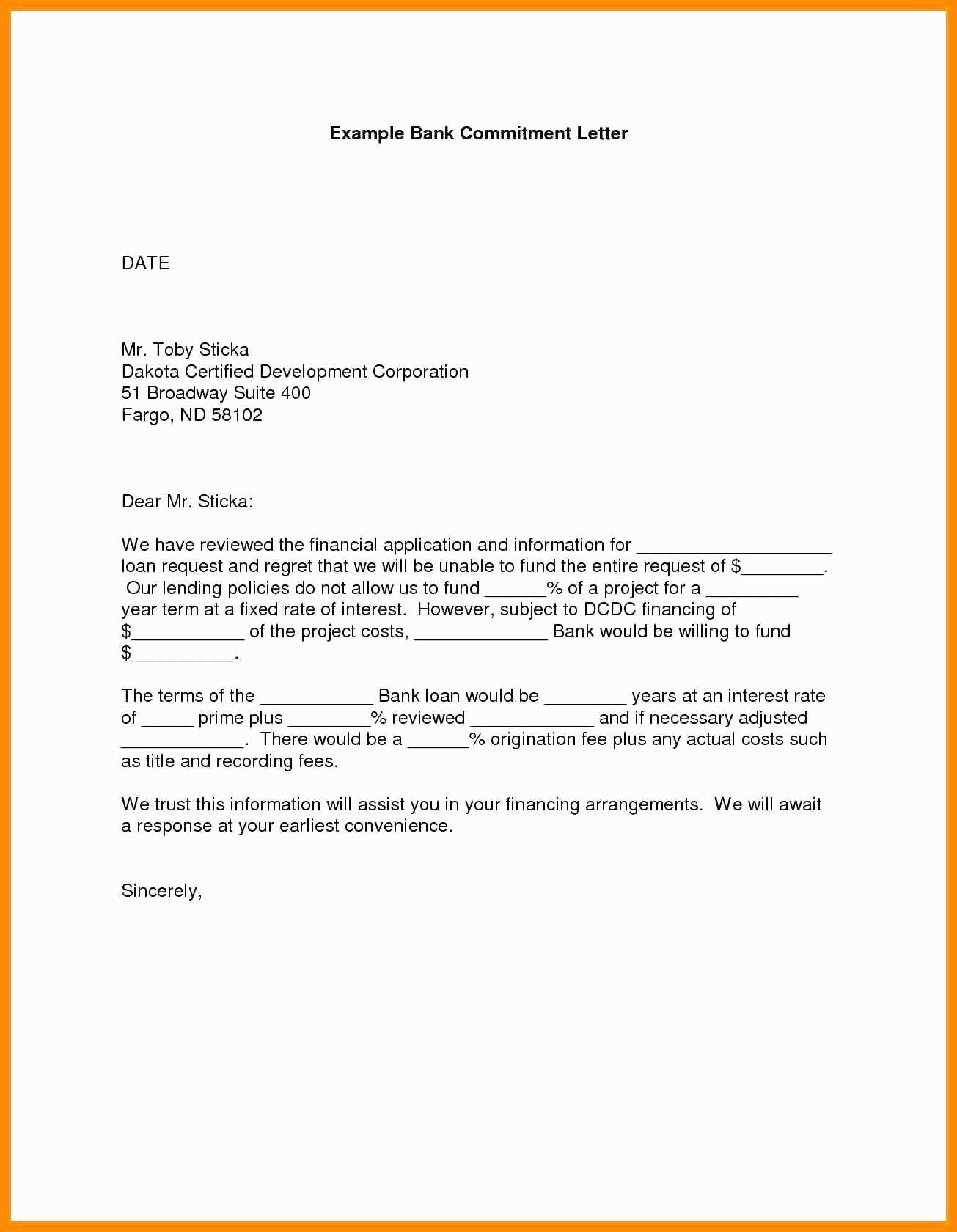

What Should Be Included in the Document

The core purpose of such an agreement is to lay out the specifics of the deal. Important details should include the amount of funding being provided, the timeline for disbursement, and any conditions that need to be met. Both the investor’s contribution and any potential returns or risks should also be addressed clearly.

Key Points to Highlight

- Amount of Support: Clearly define the financial contribution.

- Terms and Conditions: Outline the necessary prerequisites for both parties.

- Timeline: Specify when funds are expected to be provided or returned.

- Responsibility Breakdown: Clarify each party’s obligations and rights.

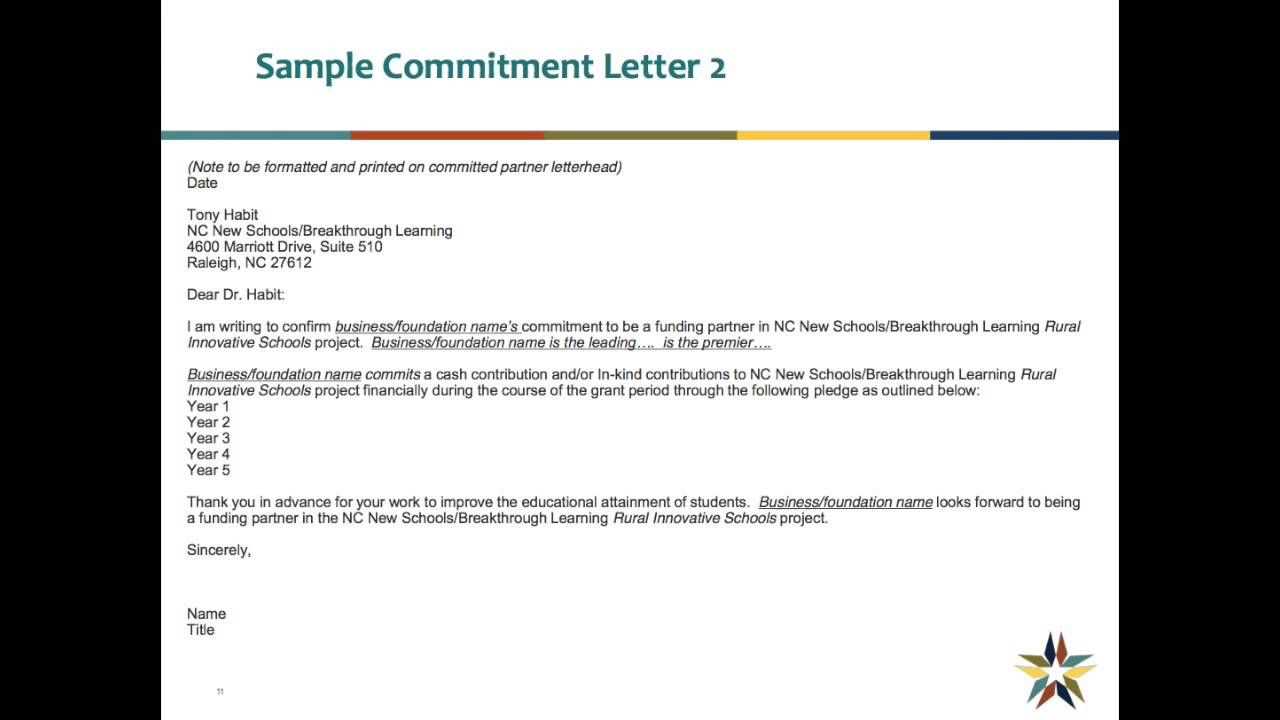

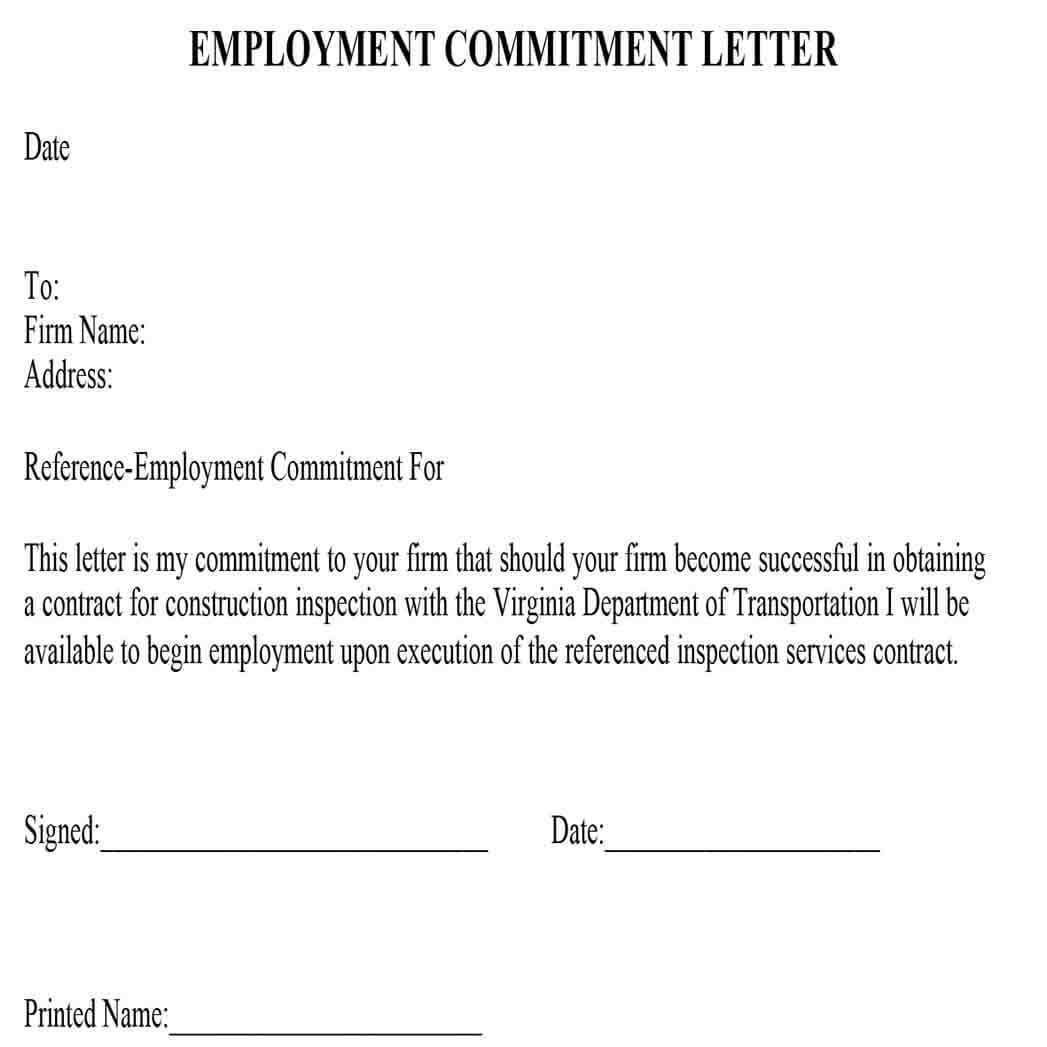

How to Tailor the Document for Your Needs

Every business is unique, and agreements should reflect the specific needs of your company. Whether it’s adjusting the terms for a small startup or a large corporation, it’s crucial that the document mirrors the nature of the arrangement. Make sure to consult legal advisors or financial experts to ensure that all necessary aspects are covered and aligned with your goals.

Customizing for Your Situation

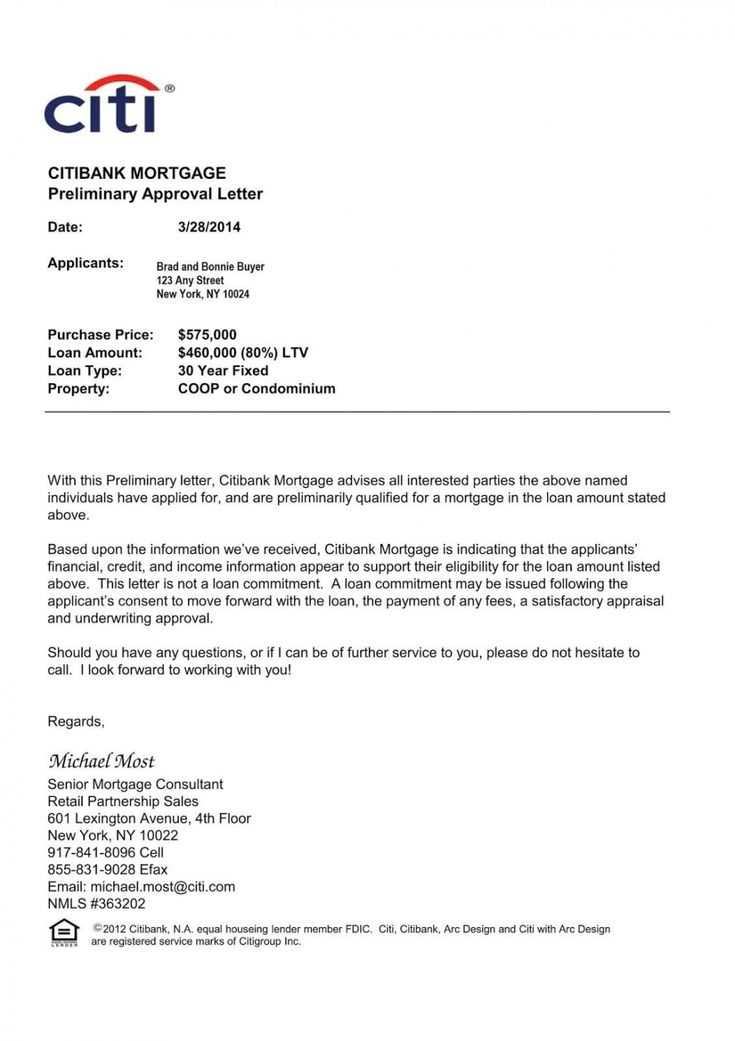

Different industries and financial structures may require distinct clauses or considerations. If your business is seeking venture capital, certain risk-related clauses might be necessary, whereas a loan agreement would focus more on repayment terms. Adjust the document accordingly to meet your precise funding needs.

Legal Considerations

While customizing your agreement, it’s essential to consider the legal implications. Consulting with legal professionals ensures that the terms are enforceable and compliant with applicable laws. This step helps avoid any future disputes that could arise from unclear or improper agreements.

Final Thoughts

Creating a clear and detailed agreement is a crucial step in securing funding for your business. By focusing on transparency, customization, and legal considerations, you can build a strong foundation for a successful financial partnership. The document you create serves as an essential safeguard for both your company and your investors, ensuring a smooth and beneficial collaboration for all involved.

Understanding the Agreement for Financial Backing

Securing financial support for your business requires clear and well-structured agreements that define the expectations and obligations of both parties. These documents play a key role in ensuring that all aspects of the deal are understood, protecting both the investor and the business owner. This section explores the essential components of such agreements, how to create them, and the common pitfalls to avoid.

Why Financial Support Matters in Business

Financial backing is crucial for business growth and stability. Whether seeking funds for expansion, product development, or day-to-day operations, clear agreements help ensure that the financial resources are properly allocated and that both parties involved are aligned on goals. Such arrangements foster trust and provide a formal framework that prevents misunderstandings or disputes.

Essential Elements of a Financial Agreement

The foundation of any financial arrangement includes several key elements. These should address the amount of funding, the conditions attached to the investment, and any expectations related to returns or repayment. It’s also essential to specify the timeline and how any issues or changes will be handled to avoid confusion in the future.

Crafting a clear and precise agreement will help both parties feel confident and secure in their roles. Customizing the terms according to the needs of your business and the nature of the financial support ensures a tailored and effective document.

Common Errors to Avoid

One of the most common mistakes is not clearly defining the terms and conditions, which can lead to confusion and disputes later on. It is also important not to overlook the legal aspects of the agreement, as failing to comply with applicable laws could invalidate the deal or create unnecessary risks. Always seek professional legal guidance to ensure that the agreement is robust and legally binding.