How to Write a Formal Letter to the IRS

htmlEdit

Writing a Professional Message to the Tax Authority

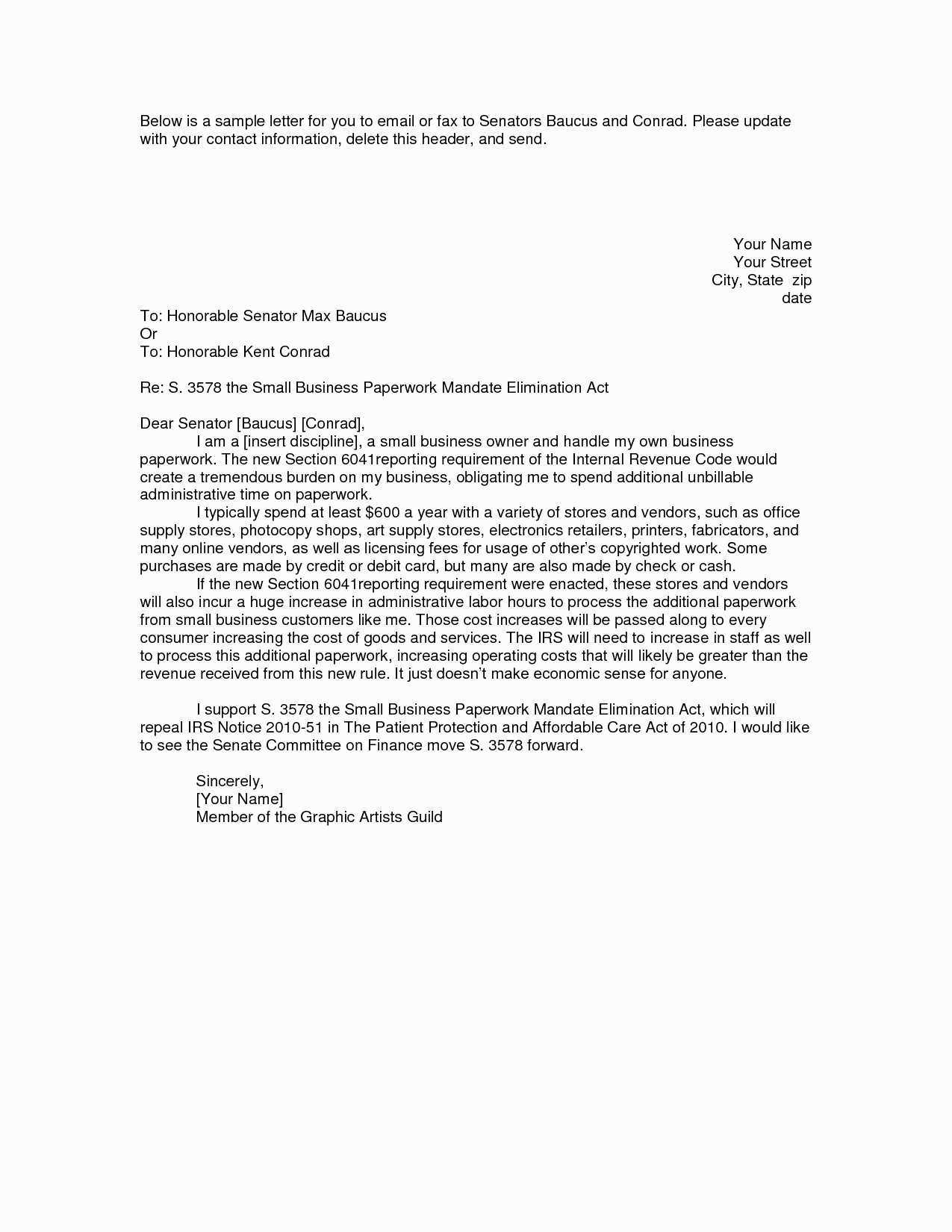

When addressing a government agency regarding tax matters, it is important to ensure your communication is clear, respectful, and precise. A well-crafted message can help facilitate resolution of any issues while maintaining a professional tone throughout. Here are key points to consider when drafting your communication.

- Be Clear and Concise: Avoid unnecessary details. Focus on the purpose of your message and present the facts directly.

- Stay Polite and Respectful: Use courteous language, even if addressing an issue or concern. Maintain professionalism in tone.

- Include Relevant Information: Provide any necessary identifiers such as account numbers, case references, or specific dates to help the recipient quickly understand your inquiry.

- Provide a Solution or Request: State clearly what you are asking for or what action you expect the agency to take.

- Double-Check Details: Review the message to ensure there are no errors. Inaccurate information can delay processing or cause confusion.

By following these guidelines, you can ensure that your correspondence is professional, effective, and conducive to a timely resolution.

htmlEdit

Understanding the Purpose of Tax Agency Communications

Government communications regarding tax matters serve a critical function in ensuring compliance and resolving any discrepancies between taxpayers and authorities. These messages often contain important updates, requests for additional information, or notifications about potential issues with filings. Understanding their purpose is essential for responding appropriately and avoiding delays or complications.

Types of Communications

There are various types of notifications, each addressing specific concerns or updates. Common types include requests for documentation, notices of due balances, or reminders of deadlines. Recognizing the type of communication helps in determining the necessary steps to take next.

Importance of Timely Response

Responding promptly to official correspondence is crucial. Delays can result in penalties, interest, or further complications with your account. Ensuring that you understand the content and act accordingly can help maintain good standing with the authorities.

htmlEdit

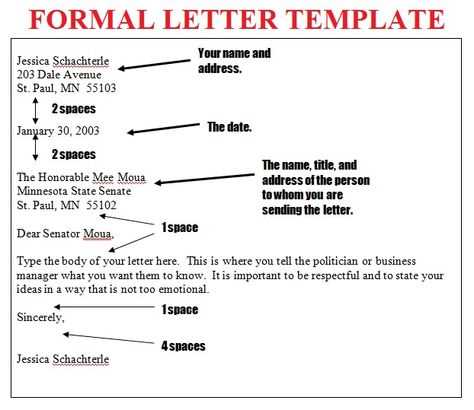

Key Elements to Include in Your Message

When preparing a message to a government agency, it is essential to include specific details to ensure clarity and facilitate a smooth process. Providing the right information upfront can help avoid delays and ensure that your request or concern is addressed promptly. Below are the critical components to consider when composing your communication.

- Identification Information: Always include your full name, address, and any relevant account or reference numbers to help the agency identify your case quickly.

- Clear Purpose: State the reason for your communication clearly. Whether you’re asking for assistance or providing requested information, your goal should be immediately understood.

- Supporting Documents: Attach any necessary documents, such as forms or receipts, that back up your request or concern. Make sure they are legible and well-organized.

- Action Requested: Be specific about the action you are requesting or the resolution you are seeking. Providing clear instructions can help expedite the process.

- Contact Information: Provide your phone number or email in case further clarification is needed. This ensures the agency can reach you easily.

htmlEdit

Common Mistakes to Avoid When Writing

When crafting a message to a government agency, it’s crucial to avoid certain errors that could lead to delays or misunderstandings. Recognizing common mistakes can help ensure that your communication is effective and properly received. Below are some of the key pitfalls to watch out for.

Incomplete or Incorrect Information

- Missing Identification Details: Omitting crucial information such as your name, reference numbers, or account details can make it difficult for the agency to process your request.

- Unclear Purpose: Failing to clearly state the purpose of your communication can lead to confusion and delays in addressing your issue.

Poor Presentation and Tone

- Overly Casual Language: While it’s important to be polite, using overly informal language can undermine the seriousness of your message.

- Excessive Length: Including irrelevant details or unnecessary information can make the communication difficult to follow. Stick to the key points.

htmlEdit

How to Address Requests Correctly

When responding to requests from a government agency regarding tax matters, it’s essential to ensure that your response is accurate, timely, and well-organized. Addressing the request properly helps to expedite the process and avoid any unnecessary complications. Below are the key steps to follow when addressing these types of requests.

| Step | Action |

|---|---|

| 1 | Read the Request Carefully: Ensure you understand exactly what is being asked of you. Review the document thoroughly to avoid misinterpretation. |

| 2 | Provide Required Information: Include all the requested documents, details, and explanations. Missing or incomplete information can cause delays. |

| 3 | Respond Promptly: Ensure your response is sent within the specified time frame. Delayed replies may result in penalties or further complications. |

| 4 | Maintain Professionalism: Keep your tone polite and clear. Avoid casual language and focus on being concise and respectful. |

| 5 | Double-Check Your Submission: Review your response for accuracy before sending it to ensure all details are correct and complete. |

htmlEdit

Tips for a Polite and Effective Tone

When communicating with authorities regarding tax matters, maintaining a respectful and clear tone is essential for a positive outcome. A well-balanced tone ensures your message is received constructively and helps in resolving any issues efficiently. Below are some practical tips to help you achieve a polite and effective tone in your communication.

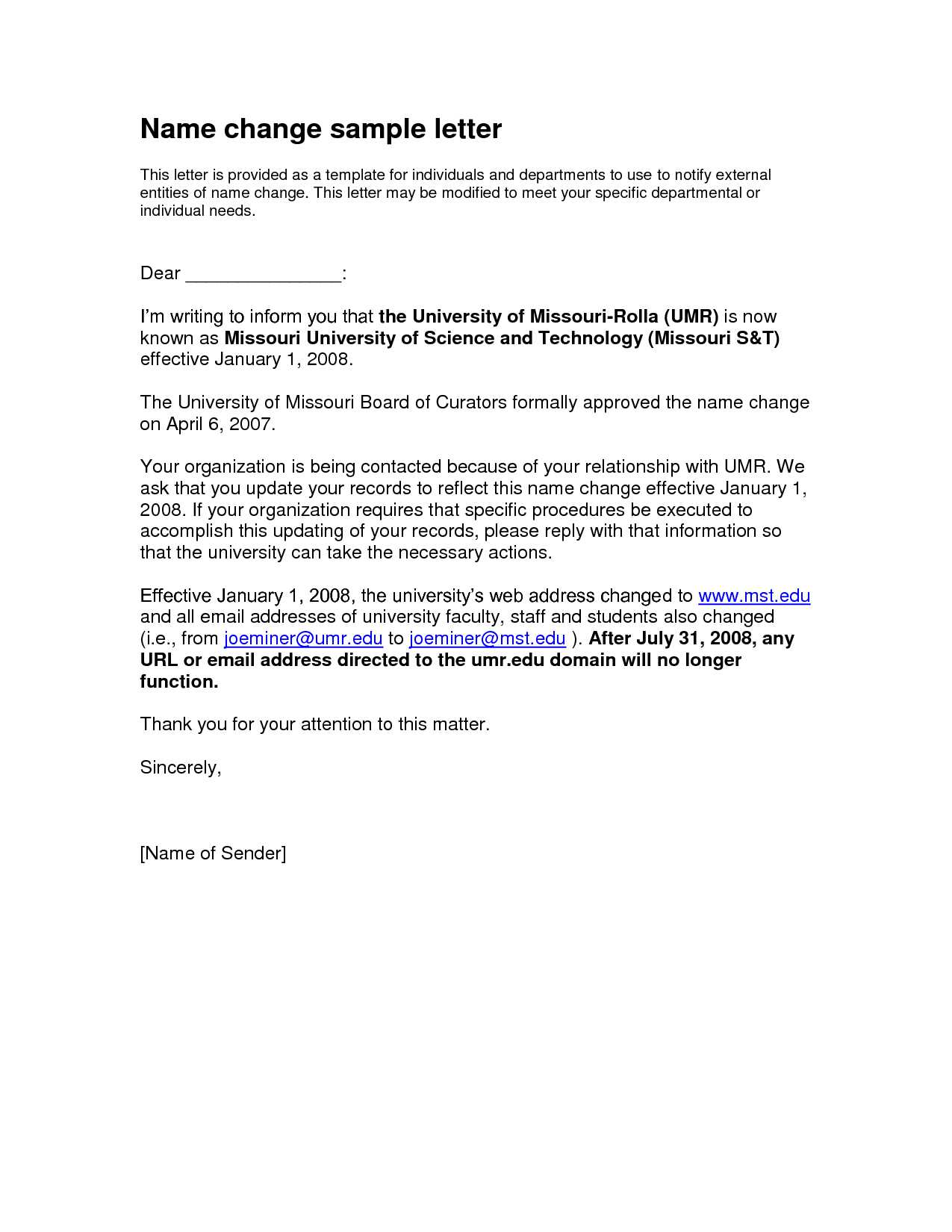

- Use Respectful Language: Always address the recipient with courtesy, using appropriate titles such as “Dear [Title]” or “To Whom It May Concern.” This sets the right tone from the start.

- Stay Clear and Direct: Be straightforward in your message while avoiding overly complex language. Clarity helps ensure your points are understood without ambiguity.

- Be Professional: Avoid emotional language, even if the matter is frustrating. Focus on the facts and remain objective to maintain a constructive tone.

- Express Gratitude: Acknowledge the recipient’s time and effort. A simple “Thank you for your attention to this matter” can go a long way in maintaining goodwill.

- Be Concise: While it’s important to be thorough, avoid unnecessary verbosity. Keeping your message to the point demonstrates respect for the recipient’s time.

htmlEdit

Follow-Up Actions After Sending Your Message

Once you have submitted your communication, it’s important to take certain steps to ensure that your request is processed and to track any responses. By following up appropriately, you can avoid unnecessary delays and stay on top of the situation. Below are some key actions to consider after sending your message.

Confirm Receipt

If you haven’t already received an acknowledgment, consider following up to confirm that your message has been received. This ensures your communication has reached the correct department and is being reviewed.

Monitor for Updates

Stay proactive by checking your account or contacting the relevant office to monitor for any updates regarding your request. If you don’t receive a response within the expected timeframe, you may need to inquire about the status.