How to Write a Credit Bureau Dispute Letter Template

Maintaining accuracy in personal financial records is essential for ensuring a solid foundation for future opportunities. Mistakes in these documents can lead to unnecessary complications, making it important to address them promptly and effectively.

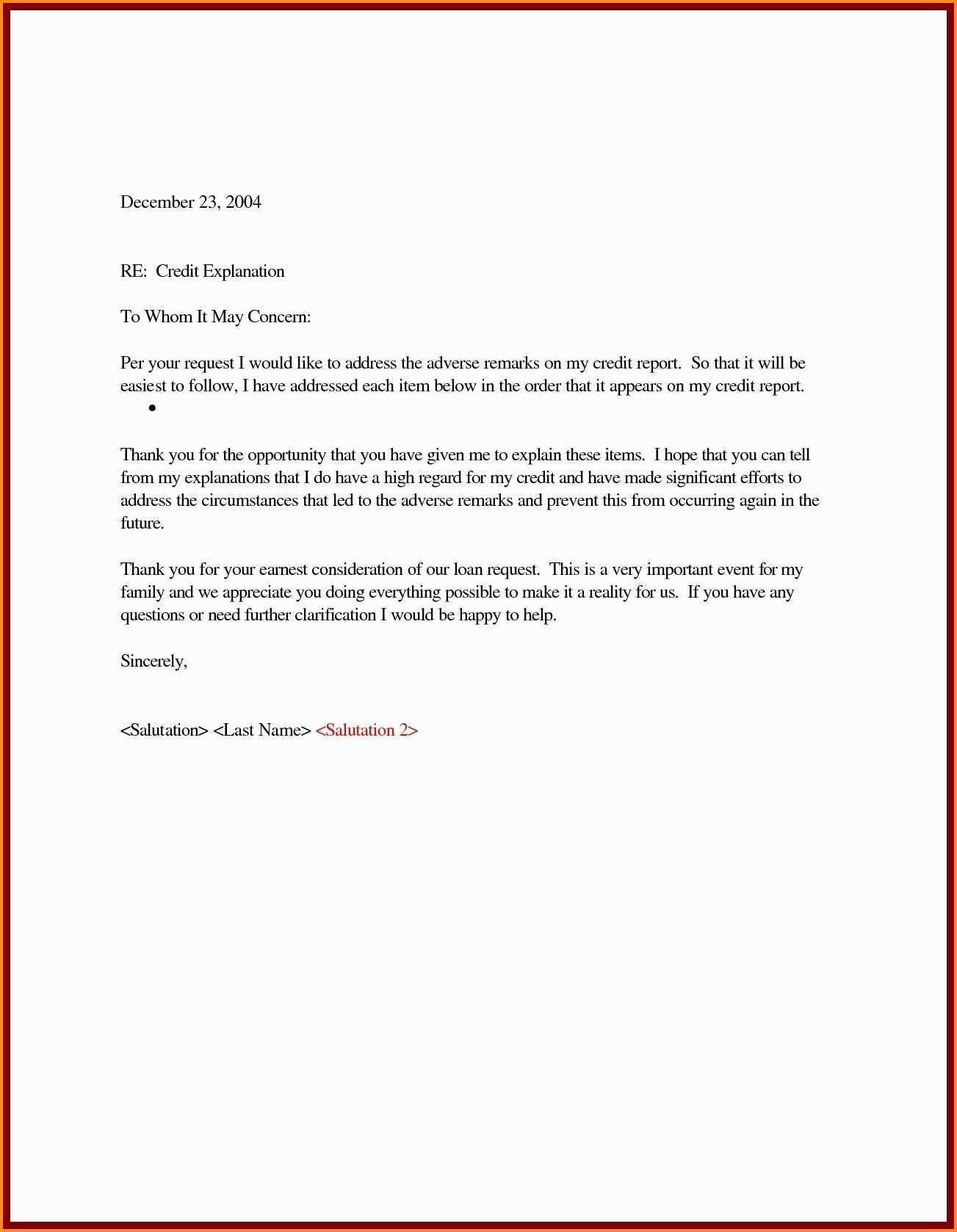

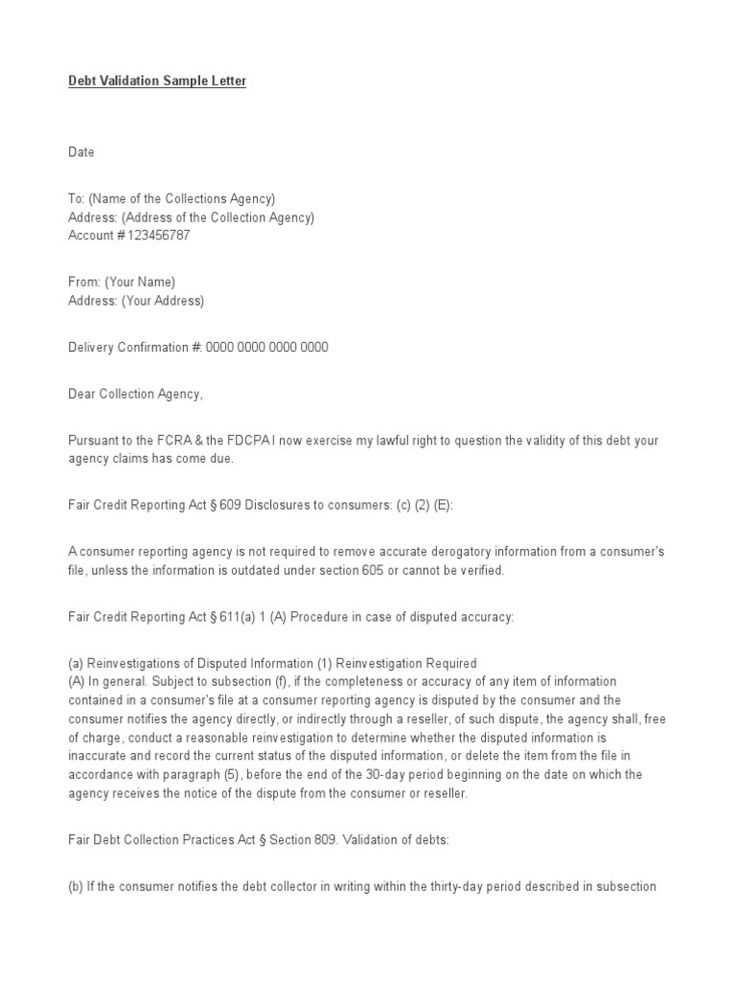

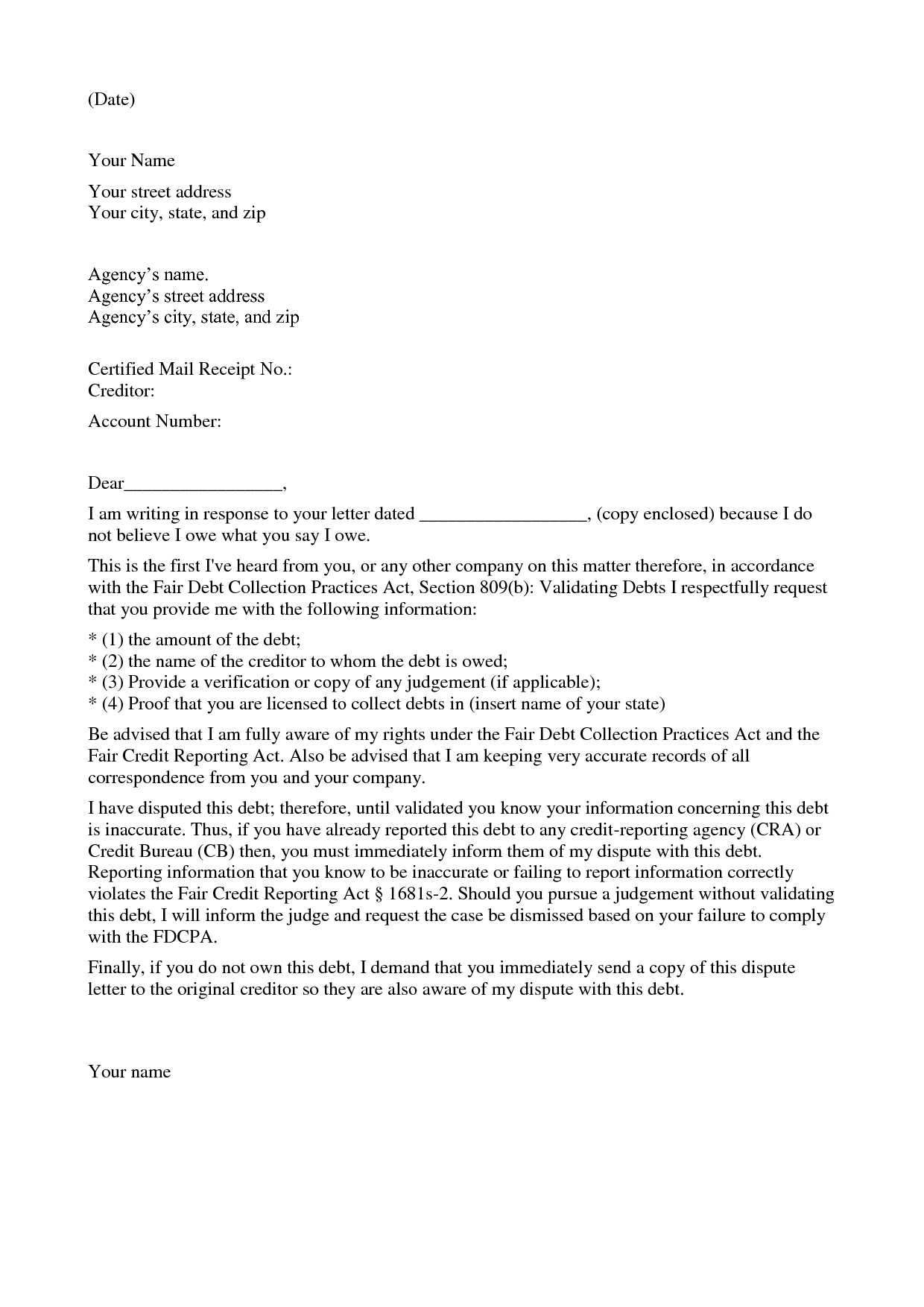

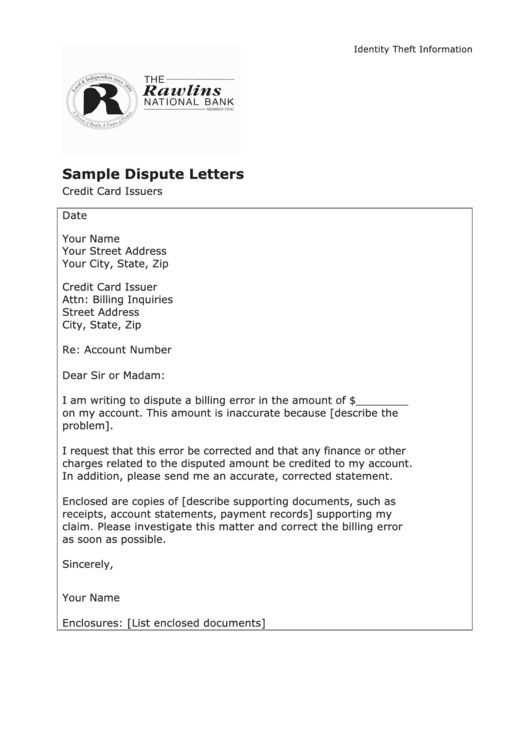

Whether it’s an incorrect transaction, outdated information, or a misunderstanding, having a structured approach to resolve such issues is crucial. A well-prepared document can help convey your concerns clearly and support the necessary revisions.

This guide provides useful insights and a structured format to help you create a formal request for correcting inaccuracies. With the right approach, you can ensure that your records accurately reflect your financial history and reliability.

Understanding the Purpose of a Challenge Note

Addressing inaccuracies in official financial documentation is a critical step toward maintaining transparency and trust. A thoughtfully crafted communication can effectively highlight concerns and pave the way for necessary adjustments.

Why Addressing Errors Matters

Errors in financial records can have far-reaching consequences. They may affect opportunities, financial health, and overall reliability. Identifying and correcting these issues ensures that your information accurately reflects your history and intentions.

Key Objectives of a Formal Request

When preparing a formal communication to address inaccuracies, there are several important goals to keep in mind:

- Clarity: Clearly outline the issue and provide supporting information.

- Professionalism: Maintain a respectful and formal tone to encourage positive outcomes.

- Actionable Solutions: Request specific steps or corrections to resolve the problem.

Understanding the purpose and objectives of this process allows you to approach the task with confidence and achieve accurate and fair results in your financial records.

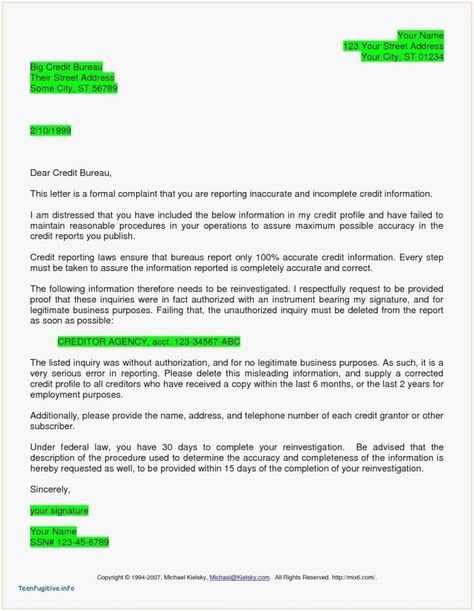

Key Components of an Effective Request

When aiming to correct inaccuracies in financial documentation, the structure and content of your communication play a vital role. A well-organized approach ensures your concerns are understood and addressed promptly.

An effective request should include all necessary details to provide a clear picture of the issue. Including relevant evidence and maintaining a respectful tone can greatly increase the likelihood of a positive response.

Ensure the following elements are part of your document:

- Identification: Clearly state your personal information, such as your name and account reference, to help identify the specific record in question.

- Description: Provide a detailed explanation of the issue, specifying any errors or inconsistencies you have identified.

- Evidence: Attach supporting documents, such as statements or receipts, that validate your claims and help illustrate the problem.

- Request for Action: Clearly outline what resolution you are seeking, such as corrections or updates to the records.

- Contact Information: Include your current contact details so the recipient can easily reach out for clarification or updates.

By incorporating these essential components, your request can be both professional and effective, ensuring a smoother resolution process for addressing inaccuracies in your records.

Frequent Errors to Avoid in Your Appeal

Submitting a formal request to address inaccuracies in financial records requires careful attention to detail. Certain common mistakes can weaken your case or delay the resolution process, making it important to avoid them.

The table below highlights typical errors and offers tips for preventing them:

| Common Mistake | How to Avoid It |

|---|---|

| Omitting key information | Ensure you provide all relevant details, including personal identifiers and document references. |

| Failing to include supporting evidence | Attach documents that back up your claims, such as statements or receipts. |

| Using an overly informal tone | Maintain a professional and respectful tone throughout your communication. |

| Not specifying the desired outcome | Clearly state what resolution you are seeking, such as correcting errors or updating records. |

| Sending an incomplete request | Double-check all sections of your appeal to ensure no critical information is missing. |

Avoiding these pitfalls can greatly enhance the effectiveness of your appeal, increasing the likelihood of a swift and accurate resolution.

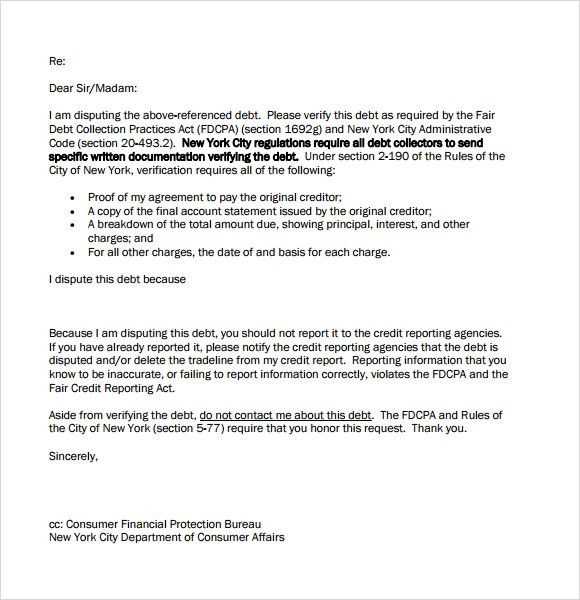

Ways to Resolve Issues on Your Credit File

Addressing inaccuracies in financial records requires a systematic approach to ensure that all concerns are properly evaluated and corrected. Taking the right steps can lead to a smoother resolution process and improved outcomes.

Here are some effective methods to resolve such concerns:

- Review Your Documentation: Begin by carefully examining your financial records to identify discrepancies and gather evidence to support your case.

- Reach Out to Relevant Organizations: Contact the institution responsible for the incorrect information to clarify the issue and request updates.

- Provide Accurate Information: Submit any necessary corrections or clarifications to ensure the organization has the correct details.

- Request Confirmation of Changes: After submitting your concerns, ask for a confirmation once the adjustments have been made to the records.

- Follow Up Regularly: If the issue takes time to resolve, maintain communication with the relevant parties to track progress.

By following these steps, you can effectively address discrepancies and work toward ensuring your financial records accurately reflect your situation.

Advice for Interacting with Reporting Agencies

When addressing concerns with organizations that manage your financial information, clear and respectful communication is key to achieving a positive outcome. Your approach can determine the speed and effectiveness of the resolution process.

Here are some essential tips for communicating with these agencies:

- Be Clear and Concise: Clearly explain your issue, providing only the necessary details. Avoid unnecessary information that could confuse the matter.

- Stay Professional: Maintain a courteous and professional tone in all your interactions. This helps foster a cooperative relationship.

- Document Everything: Keep a record of all your communications, including emails and letters. This provides a reference in case you need to follow up.

- Request Confirmation: Always ask for written confirmation when your issue has been addressed or resolved, ensuring that there is no ambiguity.

- Be Patient: Understand that these organizations may take time to process your request. Follow up if necessary, but give them adequate time to respond.

By following these guidelines, you can enhance your chances of a quick and efficient resolution when dealing with entities that handle your financial records.

Securing Positive Outcomes from Your Appeal

Achieving a favorable resolution requires more than simply submitting a request. By taking a strategic approach and ensuring all necessary steps are followed, you can improve your chances of a successful outcome.

Here are some essential actions to increase your likelihood of a positive response:

Provide Accurate and Complete Information

Make sure all details provided are correct and thorough. Incomplete or incorrect information can delay the process or result in the rejection of your request. Double-check your documents and be clear about the changes you are seeking.

Follow Up and Stay Persistent

Sometimes, the process can take time. Don’t hesitate to follow up if you haven’t received a response. Staying proactive ensures your request is being reviewed and keeps the matter on their radar.

By ensuring your appeal is accurate and consistent and maintaining open lines of communication, you can secure the outcome you desire.