Letter of Explanation for Derogatory Credit Template

When faced with past financial challenges, it’s important to provide a clear and honest account of the situation. Writing a concise and compelling statement can help you explain why certain negative events appeared in your financial history and how you’ve addressed or resolved them. This written explanation can play a significant role in influencing future decisions made by lenders, landlords, or employers.

Essential Elements to Include

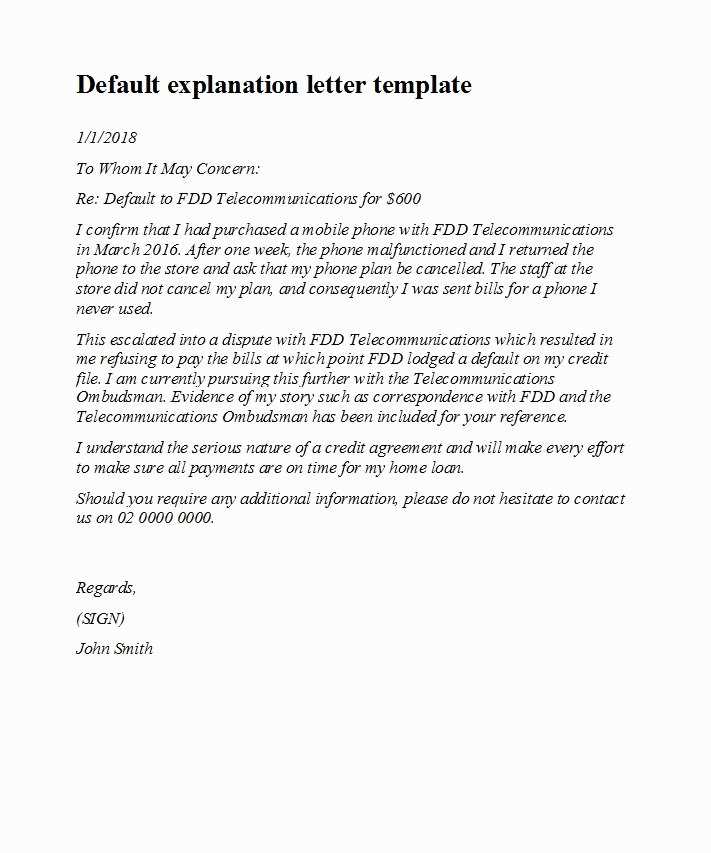

To create a persuasive and professional statement, certain elements should be included:

- Context – Briefly explain what led to the financial difficulties.

- Resolution – Describe the steps taken to resolve the issue, such as paying off debts or working with creditors.

- Future Actions – Highlight any measures you’ve implemented to prevent future problems.

Be Clear and Honest

When drafting your statement, it’s essential to be transparent and straightforward. Avoid over-explaining or making excuses. Focus on the facts, acknowledge your mistakes, and emphasize the efforts you’ve made to improve your situation.

Common Mistakes to Avoid

While writing your response, keep these tips in mind to avoid errors:

- Too much detail – Keep it concise. Avoid unnecessary details that may complicate the situation.

- Negative tone – Keep the tone positive and forward-focused.

- Lack of structure – Ensure the statement is well-organized and easy to read.

How to Make a Strong Impact

For your written response to have the desired effect, make sure it presents a clear narrative, demonstrating responsibility, growth, and the steps you’ve taken to avoid similar problems. By presenting yourself as someone who takes ownership of past mistakes and proactively works to resolve issues, you can increase the likelihood of a favorable outcome.

Understanding Financial Challenges and Their Impact

Financial difficulties, such as missed payments or outstanding balances, can significantly affect your financial reputation. When applying for loans, housing, or even a job, these past issues might raise concerns for decision-makers. Addressing these situations in writing can help clarify the circumstances, show responsibility, and demonstrate your commitment to improving your financial situation.

A well-crafted statement explaining past financial difficulties can enhance your chances of receiving a favorable response from lenders, landlords, or potential employers. This approach gives you an opportunity to provide context for any negative marks on your record and to showcase the steps you’ve taken to resolve them.

Key Elements of a Persuasive Statement

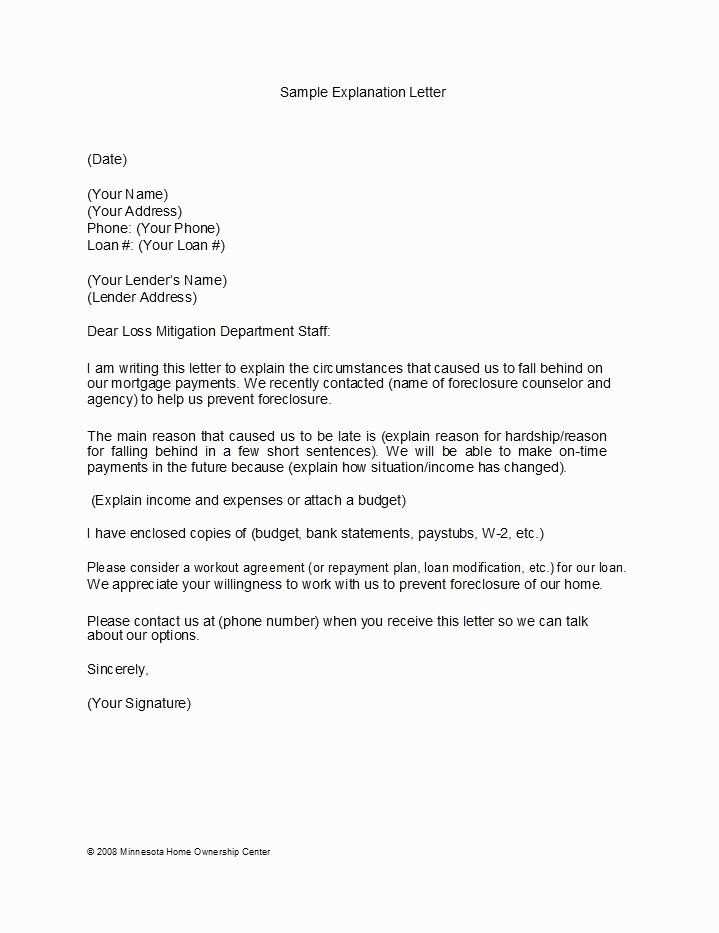

To ensure your message is impactful and convincing, focus on the following components:

- Clear Context – Briefly describe the events that led to financial setbacks.

- Steps Taken – Highlight any corrective measures, such as paying down debt or negotiating with creditors.

- Future Assurance – Explain any changes or actions you’ve implemented to prevent similar issues in the future.

How to Address Financial Setbacks

When addressing past financial problems, it’s essential to keep the tone constructive and solution-oriented. Acknowledge the issue honestly, but focus on what you’ve done to resolve it and how you’re managing your finances now. Being proactive in outlining your recovery process demonstrates accountability.

Avoid Common Mistakes

While drafting your statement, steer clear of these common errors:

- Excessive Detail – Avoid including too much information or unrelated background. Keep it focused.

- Excuses – While providing context is necessary, don’t shift blame or make excuses for your actions.

- Unclear Structure – Ensure your statement is well-organized, clear, and easy to read.

Enhancing Your Financial Standing with a Strong Message

Submitting a well-written, thoughtful message can help improve your chances of a positive decision. By presenting a clear narrative of responsibility, corrective actions, and steps taken to ensure future stability, you can show that you are a reliable and committed individual, despite past challenges.