Overdue Payment Reminder Letter Template for Easy Use

Managing unpaid invoices is a critical aspect of maintaining healthy business operations. When clients fail to settle their bills within the expected time frame, it’s essential to have a structured approach to address the issue and recover outstanding amounts efficiently. One of the best ways to approach this situation is by using a formal written request to encourage prompt payment.

Crafting a well-written communication that conveys professionalism and urgency can make a significant difference in encouraging clients to fulfill their financial obligations. By using clear and respectful language, businesses can maintain strong relationships with their clients while ensuring that payments are made on time.

In this section, we will explore various methods to structure such a document, focusing on key elements that make it both effective and respectful. Whether you’re dealing with a one-time delay or repeated issues, these strategies can help streamline the collection process while protecting your business interests.

Why Use a Payment Reminder Letter

Having a formal approach to requesting unsettled financial obligations helps maintain clear communication between businesses and clients. When funds are not received by the agreed-upon date, it’s essential to take action that encourages timely resolution while preserving professional relations.

By sending a well-structured communication, businesses can achieve several goals:

- Promote timely action: A clear and direct message can help clients understand the importance of paying their debts promptly.

- Protect professional relationships: A polite and professional tone ensures that the message is received without damaging the business relationship.

- Clarify expectations: Clearly outlining the terms of payment ensures that both parties are on the same page regarding deadlines and consequences.

- Document efforts: Having a written communication serves as proof that the business made attempts to resolve the situation before taking further steps.

These benefits make it a necessary tool in business operations, helping ensure that outstanding funds are recovered efficiently and professionally.

Key Elements of a Reminder Letter

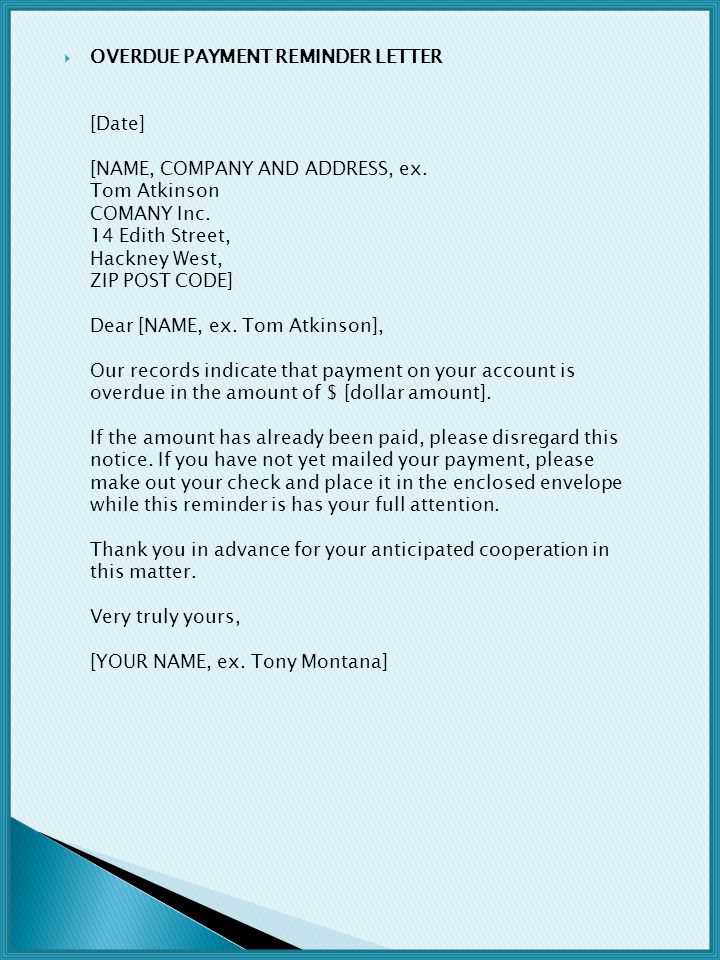

When requesting funds from clients who have not settled their debts within the agreed timeframe, it is important to include specific details in the communication. A well-structured message increases the likelihood of a positive outcome and ensures clarity for both parties.

Clear Identification of the Issue

Start by clearly identifying the reason for the correspondence. Specify the amount due, the original due date, and any previous communications about the matter. This makes it easy for the recipient to understand the situation without ambiguity.

Polite Yet Firm Tone

The tone should be courteous and professional, maintaining respect while also conveying the urgency of the situation. A balanced approach ensures that the client feels valued but also understands the importance of resolving the matter swiftly.

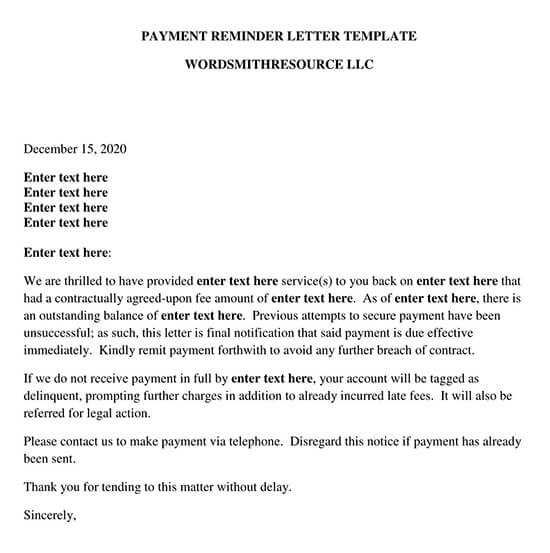

How to Customize Your Template

To effectively address unpaid invoices, it’s important to personalize your communication to fit the specific situation. Customizing the structure allows you to tailor the message in a way that is relevant to each client and case.

Here are key elements you should consider adjusting when preparing your document:

| Section | Customization Tips |

|---|---|

| Introduction | Start with a professional greeting, using the client’s name to establish a personal connection. |

| Details of the Issue | Provide specific information about the amount due, the original due date, and any previous correspondence related to the matter. |

| Call to Action | Clearly state what action you expect from the recipient, such as making the necessary transfer or contacting you for further assistance. |

| Closing | Conclude with a polite yet firm reminder, ensuring that the client understands the importance of settling the amount as soon as possible. |

By adjusting these sections, you can create a customized and professional document that effectively addresses your needs while maintaining a positive business relationship.

Best Practices for Effective Communication

Clear and respectful communication is essential when addressing financial matters with clients. When crafting a request for outstanding funds, using the right tone and structure can make all the difference in achieving a positive resolution.

Maintain a Professional Tone

It is crucial to keep the tone respectful and polite, even when the subject matter may be urgent. Avoid sounding accusatory or aggressive, as this can damage your relationship with the client. A neutral and professional approach is more likely to encourage cooperation.

Be Clear and Concise

Clearly state the purpose of the communication and provide all necessary details in a straightforward manner. Avoid lengthy explanations or unnecessary information, as this could lead to confusion. Directness is key to ensuring the client understands the situation and what is expected of them.

Common Mistakes to Avoid

When requesting unpaid funds, it’s important to avoid certain pitfalls that could hinder the effectiveness of your communication. Failing to pay attention to these details can lead to misunderstandings or even damage to professional relationships.

Using an Aggressive Tone

While it’s important to be firm, using an aggressive or harsh tone can create unnecessary tension. It’s essential to maintain professionalism, showing respect while still conveying the urgency of the matter.

Overloading with Unnecessary Information

Including too many details or irrelevant information can distract from the core message and make the request confusing. Stick to the essentials–mention the due amount, the original due date, and what action you expect from the recipient.

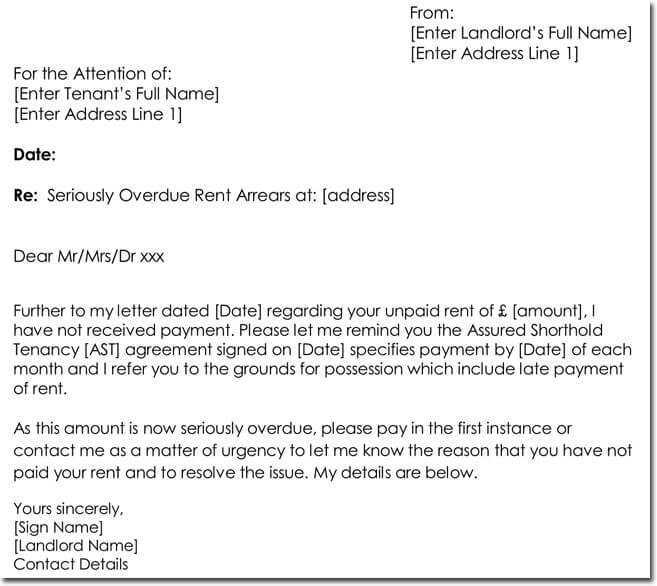

When to Send a Payment Reminder

Timing plays a critical role in addressing delayed financial obligations. Knowing when to reach out is key to ensuring a prompt resolution without overwhelming the client. Sending a message too early might seem unnecessary, while waiting too long could lead to complications in recovering the owed amount.

The best approach is to monitor the due date closely and determine the appropriate moment to send a courteous and firm reminder. Typically, it’s recommended to wait a few days after the agreed-upon date to allow for any potential delays. However, it is essential to balance urgency with professionalism, ensuring the message is clear but not overly aggressive.