Example Debt Collection Letter Templates to Use

When dealing with unpaid balances, it’s crucial to craft a professional and clear communication. Such correspondence is key to encouraging timely settlement and maintaining positive relationships with clients or customers. A well-structured document can often result in a swift resolution, ensuring that outstanding sums are addressed without escalating the situation.

Key Components of a Payment Request

Each communication should contain several core elements to ensure clarity and effectiveness:

- Clear Identification: Begin by identifying both parties involved, including the creditor and the recipient.

- Outstanding Amount: Explicitly mention the sum due, with an itemized breakdown if necessary.

- Payment Terms: Specify the expected payment timeline and available methods for payment.

- Consequences of Non-Payment: Briefly mention the potential actions that may follow if the issue is not resolved.

Crafting a Formal Request

To ensure professionalism, always address the recipient formally, including their full name and title. Be concise yet direct in your request, maintaining a courteous tone throughout. Avoid overly aggressive language, as this may hinder cooperation and lead to unnecessary conflict.

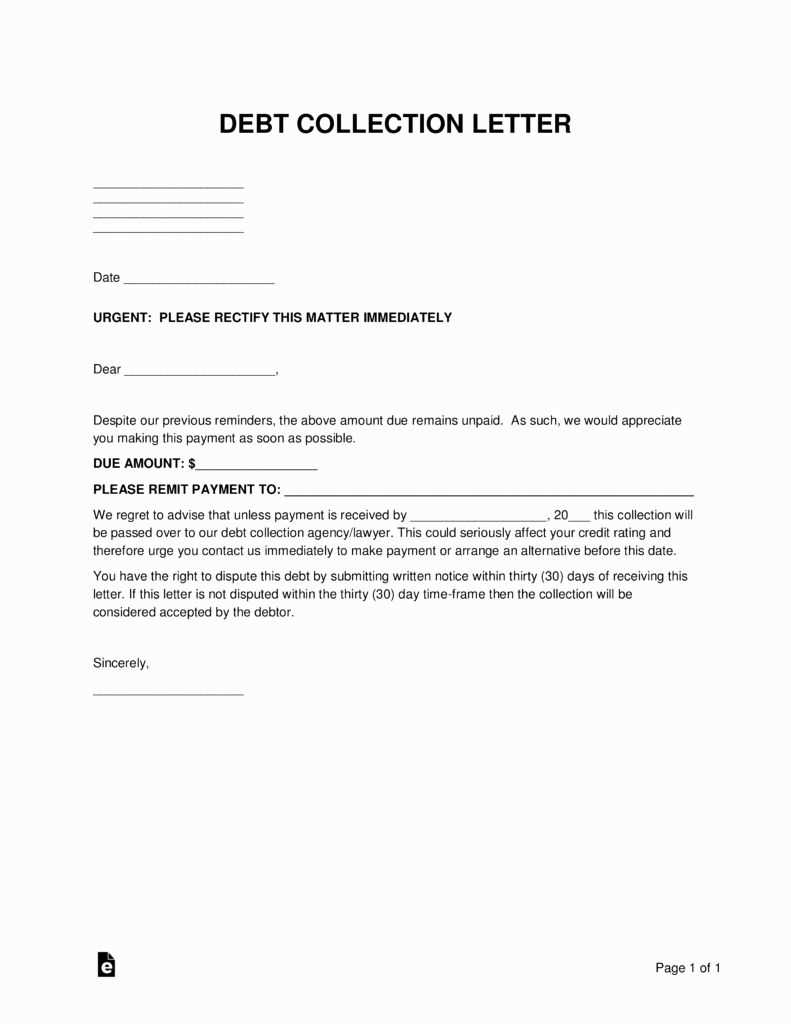

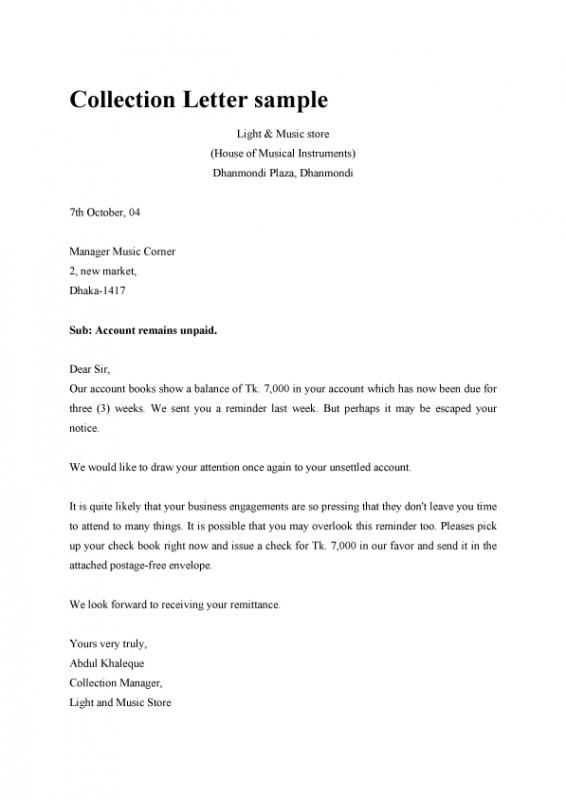

Examples of Effective Communication

Here are some examples that outline the structure of a formal request:

- Initial Reminder: A polite but firm message stating the amount due, the payment date, and a request for prompt settlement.

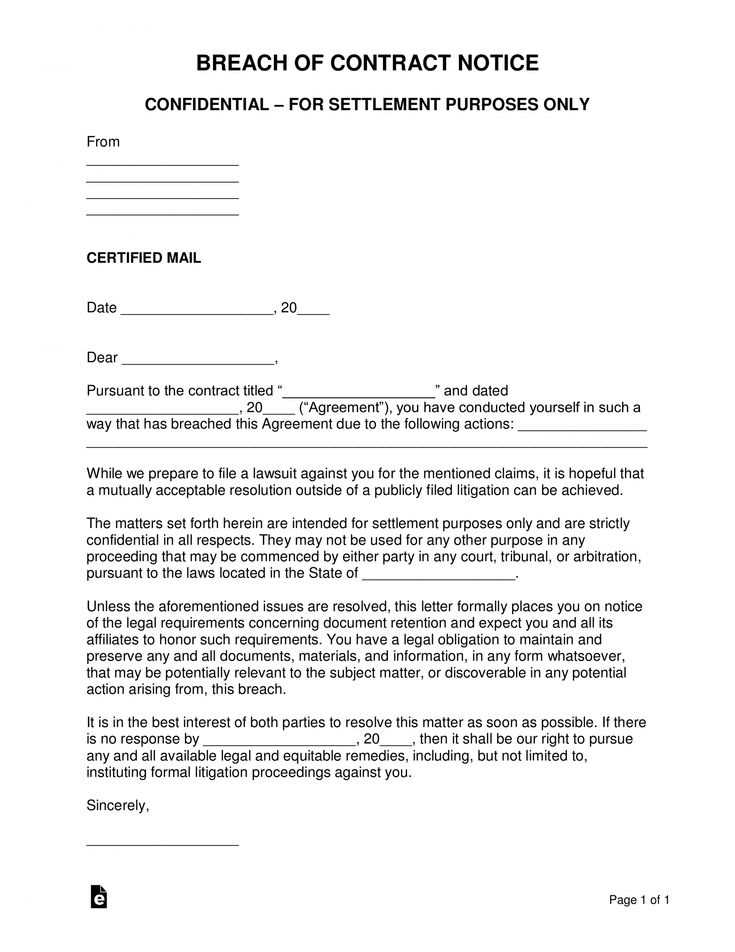

- Final Notice: A more urgent communication, emphasizing the consequences if payment is not received within a specified time.

- Legal Action Warning: A formal notification stating the intention to pursue legal avenues if payment is not made.

Best Practices for Sending Payment Requests

When sending such notices, it’s important to use reliable channels for delivery. You can send them via mail, email, or even hand-deliver them depending on the situation. Always request a confirmation of receipt to ensure your message has been received. Additionally, keeping a record of all correspondence will be crucial should you need to escalate the matter further.

Why Payment Requests Are Essential in Business

In any business, managing unpaid balances is crucial for maintaining financial health. Proper communication regarding overdue sums is not just a formality, but an essential step in protecting the interests of both parties. Clear, professional correspondence can help resolve payment issues promptly, ensuring smoother business operations and reducing the need for further intervention.

Understanding the Legal Considerations of Payment Demands

When sending a request for outstanding payments, it is important to be aware of the legal framework surrounding such communications. The tone, wording, and timing of your correspondence can have legal implications. Following the appropriate legal procedures ensures that your actions are enforceable should the matter need to be taken further, protecting your rights while maintaining a professional approach.

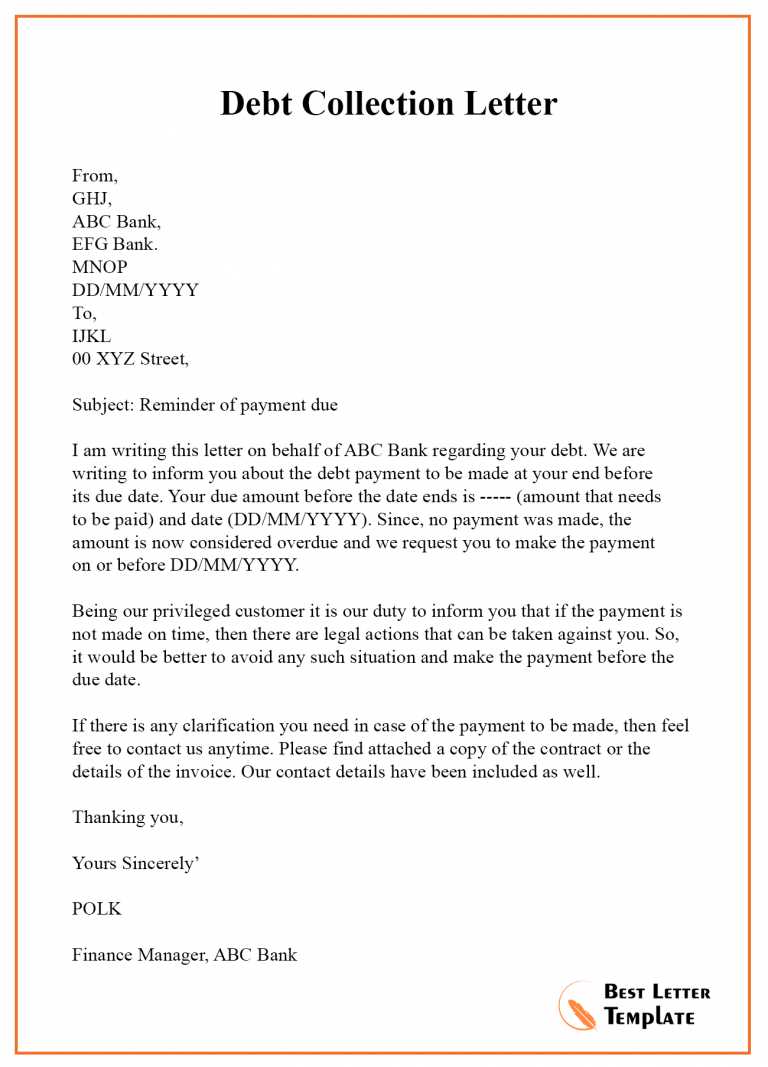

Crafting a Formal Request for Payment

Creating an official request requires clarity and a straightforward approach. Clearly outline the outstanding amount, provide relevant details such as invoice numbers, and set a firm deadline for payment. Avoid using overly aggressive language; instead, focus on professionalism and the mutual goal of resolving the issue amicably.

Incorporating the right elements into your communication is key to success. Be sure to include:

- Identification of both parties

- Specifics of the outstanding amount

- A clear deadline for settlement

- Consequences for non-payment

These elements will help ensure your request is clear, formal, and effective in encouraging prompt payment.