Income Verification Letter Template for Easy Customization

When you need to prove your earnings or financial standing to an organization, it’s important to provide a clear and professional document. This type of document serves as an official statement of your financial situation, often required for renting an apartment, securing a loan, or applying for a government program. The format of such a document is simple yet needs to contain specific details to be valid.

Creating this kind of document may seem challenging, but having a structured format can simplify the process. Whether you’re an employee or self-employed, understanding the core elements to include will help ensure your document is accepted by any requesting party. A well-organized and accurate statement will not only reflect your professionalism but also speed up the review process.

In this guide, we’ll explore how to draft this essential document efficiently. From the basic components to the necessary adjustments based on your specific situation, we’ll cover everything you need to know to create a comprehensive and effective statement of your financial status.

Understanding the Purpose of Income Verification

Documents that confirm a person’s financial resources are essential in many situations, especially when dealing with loans, housing applications, or government assistance. These documents offer a clear representation of an individual’s financial capacity, allowing entities to make informed decisions regarding creditworthiness or eligibility for services.

Providing proof of your financial situation is often required to ensure that you are able to meet obligations, whether it’s paying rent, repaying a loan, or managing monthly expenses. The purpose of such a statement is to reassure the requesting party that you can fulfill the financial responsibilities associated with a contract or agreement.

Moreover, such documents help to standardize the process of assessing an applicant’s ability to manage their finances. They create transparency and set clear expectations for both parties involved, ensuring trust and reducing the likelihood of misunderstandings in the future.

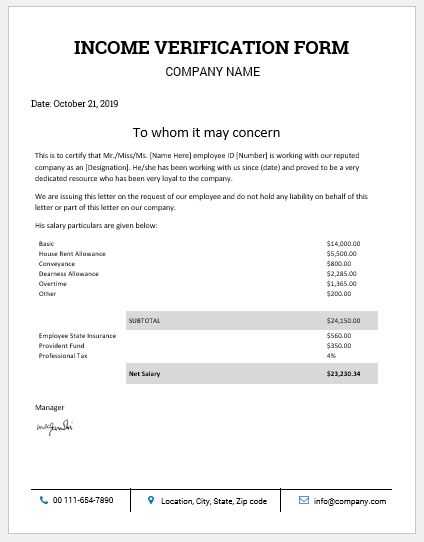

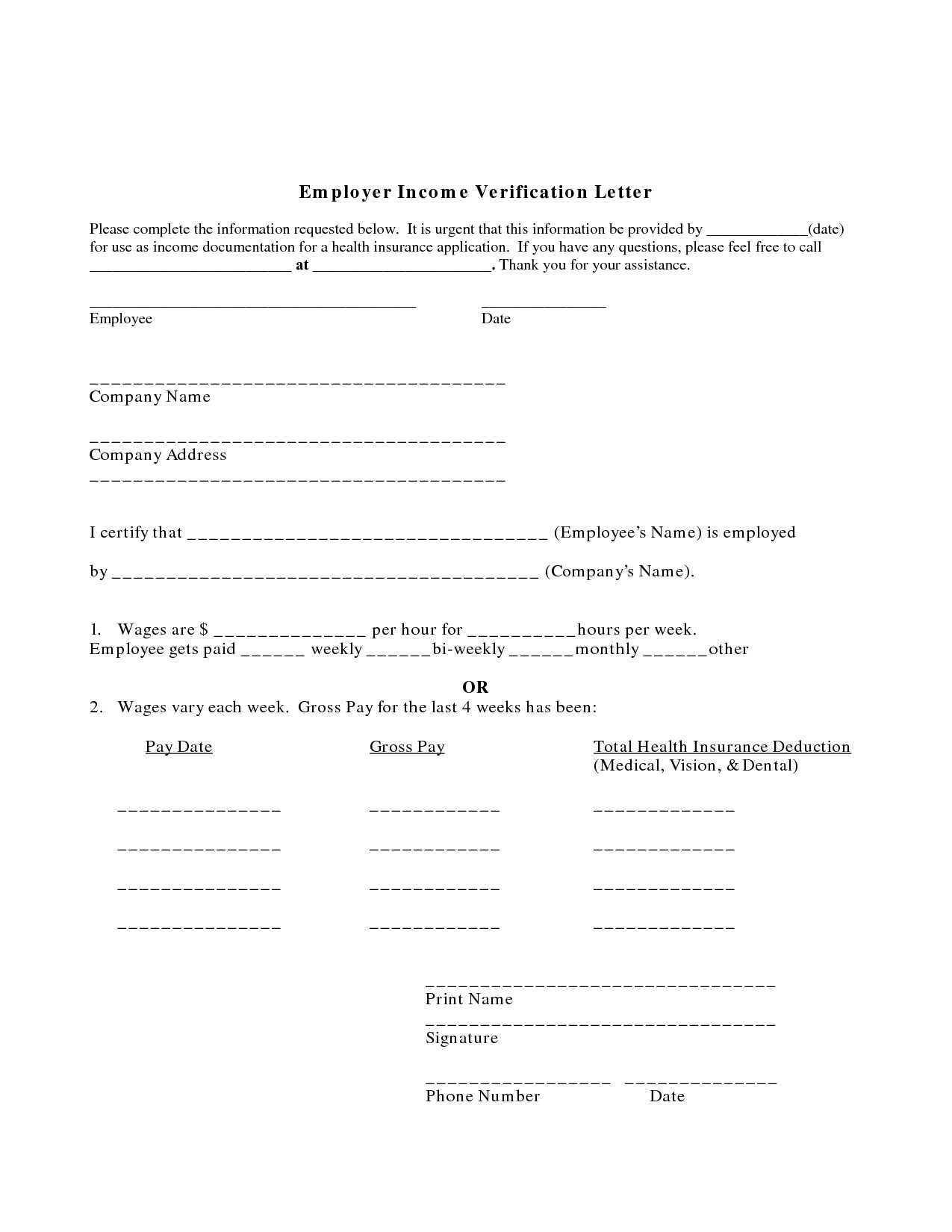

Key Elements to Include in the Document

When preparing a statement to confirm your financial standing, it’s important to include the right details to make sure the recipient can easily understand your situation. This ensures that the document serves its purpose and meets the requirements of the requesting party.

Below are the essential components that should be included:

- Full Name and Contact Information: Clearly state your full name, address, phone number, and email to establish your identity.

- Employer Details (if applicable): Provide your employer’s name, contact information, and your job title to confirm your place of employment.

- Financial Amount: Specify the exact amount you earn, whether it’s monthly or annually, along with any additional income sources if relevant.

- Employment Duration: Indicate the length of time you have been employed or self-employed to show your stability.

- Signature and Date: Include a signature to verify the authenticity of the information, along with the date of creation.

Including these key details ensures that your statement will be comprehensive, clear, and valid for any purposes that require confirmation of financial capacity.

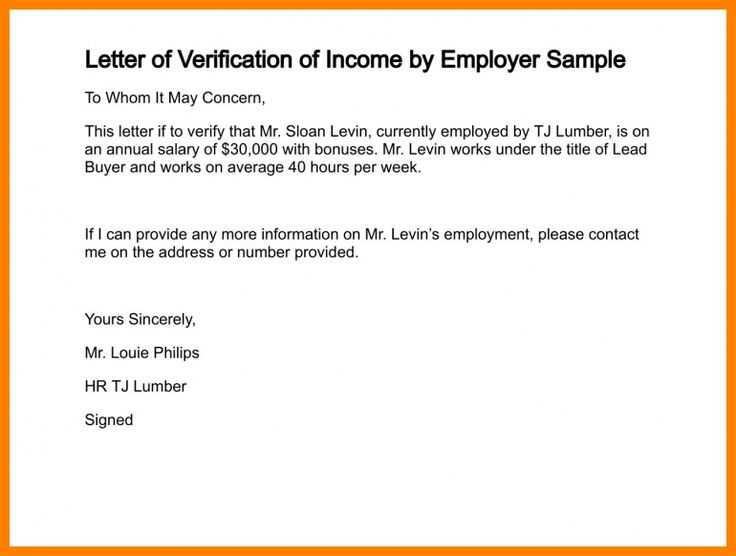

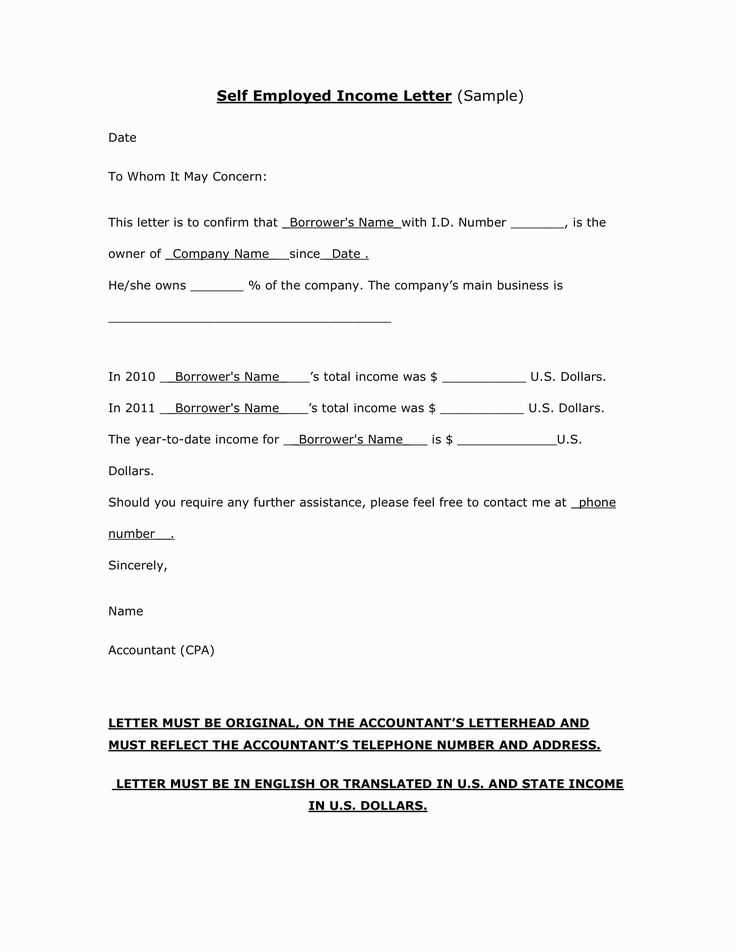

How to Adapt the Template for Your Needs

Once you have a basic structure for your financial confirmation document, it’s important to adjust it to fit your specific situation. Personalizing the content ensures that the statement is relevant and provides all necessary details to the recipient, whether it’s a lender, landlord, or government agency.

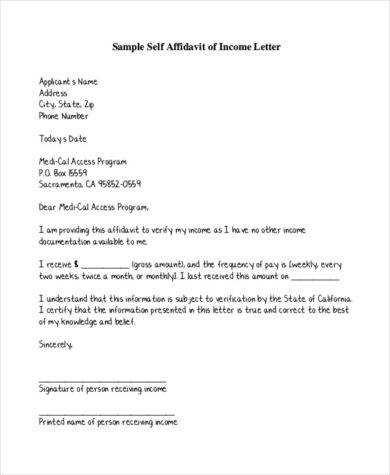

Adjusting for Employment Status

If you are employed, you’ll need to include information about your employer and the specifics of your role. For those who are self-employed, the document should reflect your business details and income sources, providing a clear picture of your financial capacity.

Modifying for Different Purposes

The purpose of the document can influence what details need to be included. For example, a bank may ask for additional verification of earnings, such as recent pay stubs or bank statements, while a rental agency might only require basic employment information.

| Purpose | Details to Include |

|---|---|

| Loan Application | Loan amount, employment history, income breakdown |

| Renting Property | Employer’s contact info, rental history, monthly earnings |

| Government Assistance | Self-employment details, dependents, total earnings |

By tailoring the document to meet the specific demands of the request, you ensure that your submission is accurate, complete, and more likely to be accepted without delay.

When Do You Need an Income Verification Letter?

There are several situations where confirming your financial status is necessary. Whether you are applying for a loan, signing a lease agreement, or seeking financial assistance, proving your ability to meet financial obligations is essential for a smooth process.

For example, when applying for a mortgage or personal loan, lenders need reassurance that you have a stable source of funds to repay the amount borrowed. Similarly, landlords often request such a document to ensure you can afford the rent and fulfill lease terms. Additionally, government programs or aid packages might require financial confirmation to determine eligibility for assistance.

In some cases, the request might come from a third party, such as a government agency or a financial institution, where the document helps in verifying your eligibility for certain programs or benefits. This could include unemployment benefits, tax purposes, or student loan applications.

Best Practices for Writing a Clear Document

When drafting a statement to confirm your financial situation, clarity is crucial. A well-structured and straightforward document ensures that all relevant parties can easily understand the information provided. Following certain guidelines will help you create a professional and effective document.

Ensure Accuracy and Completeness

- Provide correct details: Double-check the names, addresses, and other personal details to avoid errors that could cause delays or misunderstandings.

- Include all relevant information: Make sure that the document covers all necessary financial data, such as the amount earned and employment status.

- Be honest: Provide truthful information. Falsifying details can lead to consequences and damage your credibility.

Maintain a Professional Tone

- Use formal language: Ensure the document maintains a respectful and professional tone. Avoid casual language or slang.

- Organize the content: Present the details logically, starting with personal information, followed by financial details, and ending with verification and signatures.

- Keep it concise: Only include relevant facts. A lengthy document may cause confusion and make it harder for the recipient to focus on the key points.

By following these best practices, you can create a clear and effective document that will fulfill its intended purpose and be accepted by any requesting party.

Legal Requirements for Income Verification Letters

When submitting a document to confirm your financial status, it is important to be aware of the legal standards that apply to such documents. Depending on the purpose of the request, certain regulations may dictate what information needs to be included and how it should be presented to ensure validity and compliance with legal norms.

For example, when submitting a financial statement to a lender, there may be specific rules regarding how earnings should be reported, particularly in relation to taxes or deductions. Similarly, for government assistance programs, the document may need to include proof of employment duration or details of other income sources to be considered legally binding.

In some jurisdictions, signatures and dates may be required to authenticate the information, while others may require additional supporting documents, such as tax returns or bank statements. These legal requirements vary based on the type of request and the authority requesting the document.

Understanding these requirements ensures that the document will be accepted and fulfill its intended purpose without delays or complications.

Free Resources to Download Templates

Creating a professional document to confirm your financial standing doesn’t have to be a time-consuming task. Many online resources offer free, ready-made structures that can be easily customized to suit your needs. These resources save you time and ensure that the document meets all necessary requirements.

Popular Websites Offering Free Downloads

- Template.net: Provides various ready-to-use documents for different purposes, including financial confirmation statements.

- Docsity: Offers a range of downloadable templates for individuals and businesses to create accurate and clear financial records.

- LegalZoom: Features customizable legal documents that can be used to verify financial status for different formal processes.

How to Customize the Templates

Once downloaded, you can personalize the documents to include specific details such as your earnings, employment information, or other relevant data. Most websites provide clear instructions on how to modify the content, ensuring the document fits your exact situation.

Utilizing these free resources will help streamline the process and ensure that your document is both professional and legally sound, without the need for hiring expensive services.