Proof of income letter template

A proof of income letter is a straightforward way to confirm your earnings when requested by landlords, lenders, or other entities. It should clearly state your income details, the source of that income, and the duration for which you have received it. Be concise and professional to ensure the letter meets its purpose effectively.

Start by including your full name, the employer’s details, and your job title. Include the amount of income you earn, specifying whether it’s weekly, bi-weekly, or monthly. Don’t forget to mention any bonuses or additional income if applicable. Use a simple, formal tone, as this helps present the information in the most straightforward manner.

Ensure that the document is signed and dated for authenticity. This simple step reinforces the credibility of the information provided and ensures clarity for whoever reads the letter. Always review the document for accuracy before submission to avoid any confusion.

Here is the revised version with reduced word repetition:

When drafting a proof of income letter, focus on clarity and conciseness. Start with a direct statement of employment, including your job title, income, and how long you’ve been employed. Provide exact figures for the income earned, and clarify if it is weekly, monthly, or annual. If the income fluctuates, include average amounts over a specific period.

Details to Include

It’s important to specify the nature of the income: salary, commission, or any additional bonuses. Mention the frequency of payments and any relevant details about deductions, if applicable. Be transparent but concise about your financial situation, ensuring that all information is relevant and accurate.

Verification

End the letter by offering verification of the details, such as a contact person or department that can confirm the information. Keep the tone professional, ensuring that the document serves as a clear representation of your financial situation.

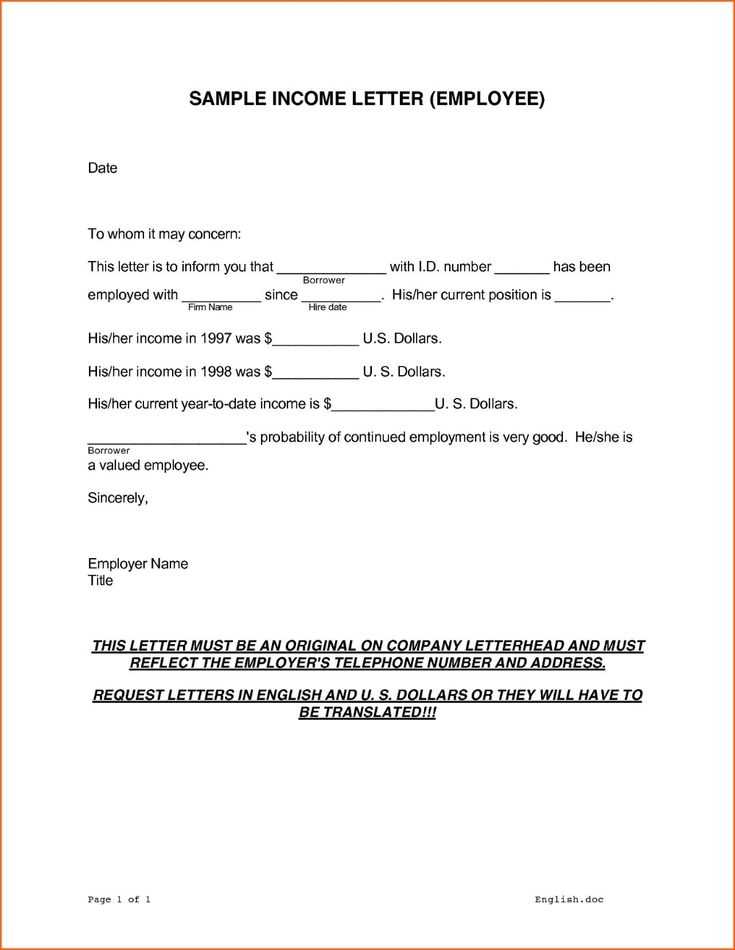

- Proof of Income Letter Template

A proof of income letter is a written statement verifying an individual’s earnings. It is commonly required by landlords, lenders, or government agencies to confirm an applicant’s ability to meet financial obligations. To create an effective proof of income letter, ensure it is clear, concise, and includes all relevant details. Below is a basic template for this purpose.

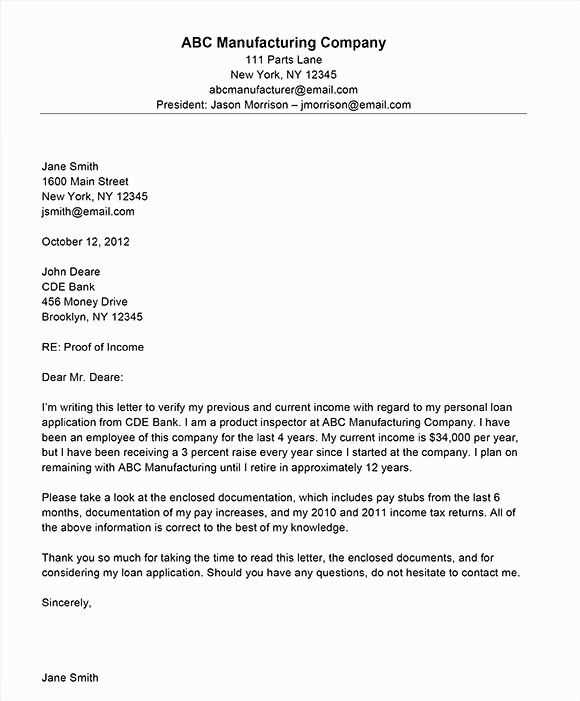

Template for Proof of Income Letter

Here’s a straightforward example of how a proof of income letter can be structured:

- Your Name

- Your Address

- City, State, ZIP Code

- Email Address

- Date

Recipient’s Name

Recipient’s Position

Company Name

Company Address

City, State, ZIP Code

Dear [Recipient’s Name],

This letter serves as verification of my income. I am currently employed at [Company Name] as a [Job Title]. Below are the details of my income:

- Employer Name: [Company Name]

- Job Title: [Your Job Title]

- Annual Salary: [Annual Salary Amount]

- Employment Start Date: [Start Date]

- Additional Income (if applicable): [Additional Income Details]

If you require any further information or documentation to support this verification, please do not hesitate to contact me at [Phone Number] or via email at [Email Address].

Thank you for your attention to this matter.

Sincerely,

[Your Name]

Key Points to Include

- Start with your contact details and the date.

- Provide the recipient’s contact information to make it clear who the letter is addressed to.

- State your employment status, including job title, company name, and your income specifics.

- Be sure to include any additional forms of income, if applicable, such as bonuses or side jobs.

- Close with a polite offer to provide further information if necessary.

Tailor the letter to your needs by adjusting the details such as income amount, employment dates, and company name. This template will provide a clear and professional document for confirming your income.

Begin your letter by stating your full name, address, and contact information at the top. Follow this with the date, then the landlord’s name and title, like “Dear [Landlord’s Name].”

Provide Proof of Employment and Income

List your current job title, employer, and monthly income. If you have multiple income sources, mention them briefly. This gives the landlord assurance that you can cover rent payments reliably.

Include Rental History and References

Share details about your previous rental addresses, how long you lived there, and your rental payment history. If available, include references from previous landlords to show that you were a responsible tenant. This helps establish trust.

End the letter by thanking the landlord for their time and consideration. Offer to provide any further details if necessary and make sure to include your contact information for follow-up.

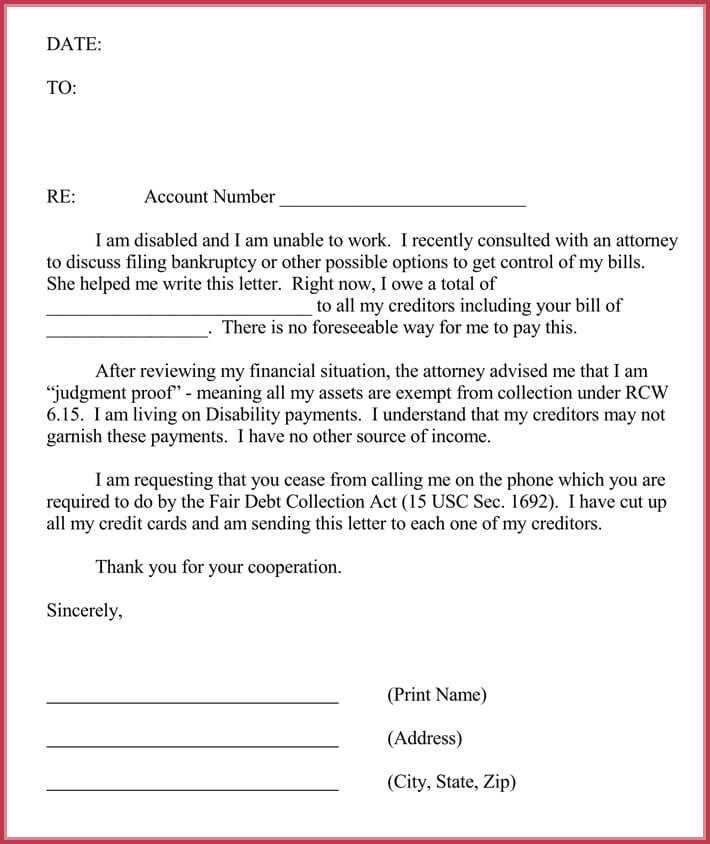

Key Information to Include in Your Income Letter

Clearly state your full name and the purpose of the letter at the beginning. Specify your current employment status, whether you are employed, self-employed, or receiving other types of income, and mention the relevant job title or position if applicable.

Include the exact amount of your monthly or annual income. Break this down into salary, wages, commissions, bonuses, or any other sources of income. If applicable, mention the regularity of these payments, such as weekly, bi-weekly, or monthly.

Provide details of your employer or business, including the company name, address, and contact information. If you are self-employed, include the name of your business, its registration details, and contact information.

Verify the dates of your employment or income receipt, including your start date with your employer or the duration of your self-employment. This helps establish the period for which your income is consistent and reliable.

Clearly state any deductions or withholdings that affect your income, such as taxes, insurance, or retirement contributions. This provides an accurate picture of your actual take-home amount.

Finally, include any supporting documents, such as pay stubs, tax returns, or bank statements, to validate the income figures presented in the letter.

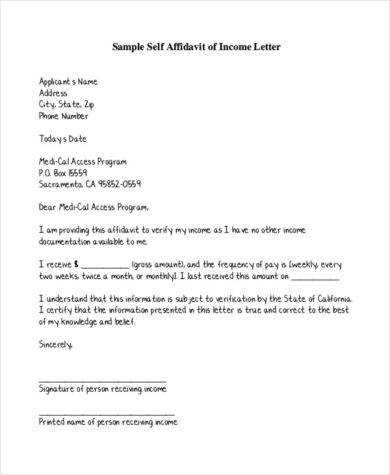

When preparing a proof of income letter as a self-employed individual, clarity and accuracy are key. Unlike salaried workers, you must present evidence of consistent income through a variety of documents.

Key Documents to Include

Your letter should highlight your revenue sources. The most common documents for self-employed individuals include:

- Tax returns (Form 1040 or similar for your region)

- Bank statements showing business deposits

- Invoices and receipts for work completed

- Profit and Loss statements

- Contracts or agreements with clients

Writing the Proof of Income Letter

Keep the letter professional and direct. Include the following details:

- Your full name and business details

- Type of business you run

- Average monthly or yearly income

- Specific periods of income if applicable

- Signature and date

Here’s a simple structure for your letter:

| Section | Details |

|---|---|

| Introduction | Your name, business name, and type of work you do |

| Income Summary | Details of income amounts, referencing specific months or years |

| Verification | Statement that the income details provided are accurate |

| Sign-off | Signature and date |

Be honest and transparent with the data. If your income fluctuates, show this clearly, and provide supporting documents to validate your statements. This will help avoid confusion and ensure your letter is taken seriously.

Start by including clear and accurate information. The most common mistake is misstating income or providing unclear figures. Always provide precise numbers and specify the payment frequency (weekly, monthly, etc.). Avoid rounding off amounts too much as it can raise doubts about the legitimacy of the letter.

1. Lack of Specificity

Be specific about the nature of income. Simply writing “I earn money from my job” doesn’t help the recipient understand the source. Instead, provide details such as your job title, employer’s name, and the specific terms of your contract, including bonuses or commissions, if applicable.

2. Inconsistent Formatting

Inconsistent formatting can confuse the reader. Ensure that the date, employer’s details, and amounts are presented clearly and in a uniform format. Using bullet points or tables can help organize the information effectively.

| Incorrect Format | Correct Format |

|---|---|

| “I work at XYZ Company” | “Job Title: Software Engineer at XYZ Company” |

| “$4000 a month” | “Monthly income: $4000 (before taxes)” |

3. Omitting Supporting Documents

Don’t forget to include supporting documents that verify your income, such as pay stubs, bank statements, or tax returns. Without these, your letter may not be accepted as valid evidence of income.

4. Overly Complex Language

Avoid using complicated language or jargon. Keep the letter clear and straightforward, with simple sentences that provide only the necessary information. The goal is for the reader to quickly understand your financial situation without any confusion.

Focus on accuracy and clarity. Lenders need to quickly verify your income, so provide a concise summary of your earnings with supporting evidence.

- Include Specific Income Details: List all sources of income, such as salary, freelance work, or rental income. For each source, provide the amount and frequency (e.g., weekly, monthly).

- Attach Supporting Documents: Include recent pay stubs, tax returns, or bank statements. These documents validate your income and show lenders you’re reliable.

- State Your Employment Status: Clearly mention if you’re employed full-time, part-time, or self-employed. Self-employed applicants should include additional details like business profit/loss statements.

- Highlight Consistency: If possible, show a pattern of consistent earnings over time. Lenders are more likely to approve applicants with stable income histories.

- Be Transparent: If your income varies (e.g., commission-based work), provide a range or average over several months to reflect your typical earnings.

Tailoring your proof of income helps create a clearer, more convincing case for loan approval. Double-check your figures to avoid mistakes, and ensure all supporting documentation is up to date.

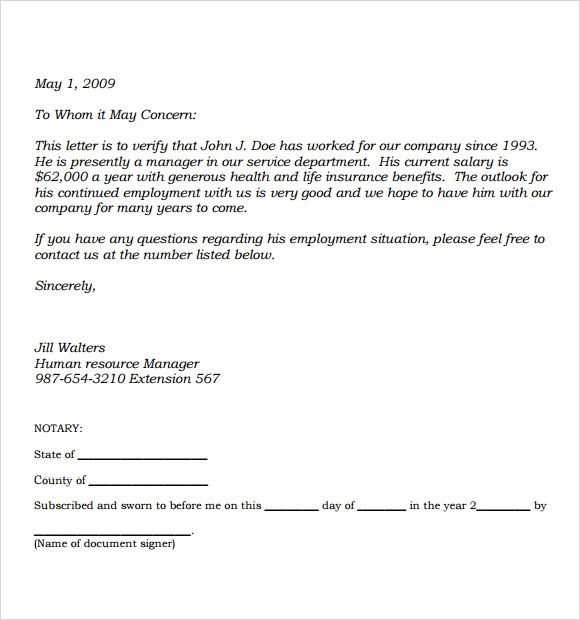

Verifying and Authenticating Your Income Letter

Ensure your income letter is credible and trusted by taking these steps to verify and authenticate the details:

- Include official company letterhead: Make sure the letter is printed on your employer’s official letterhead, which should include the company’s name, address, and contact details.

- Use an authorized signatory: The letter should be signed by someone with the authority to verify income, such as your HR manager or payroll officer.

- Include specific details: Clearly state your job title, employment start date, salary, and payment frequency (e.g., weekly, monthly). This provides a clear picture of your income situation.

- Attach supporting documents: Include recent payslips or bank statements that reflect your income. This will back up the claims in the income letter.

- Confirm details with your employer: Double-check with your employer or HR department to ensure the information is correct and up to date.

By taking these steps, you will present a well-documented and verified income letter that can be trusted by banks, landlords, or any organization requiring proof of income.

Proof of Income Letter Template

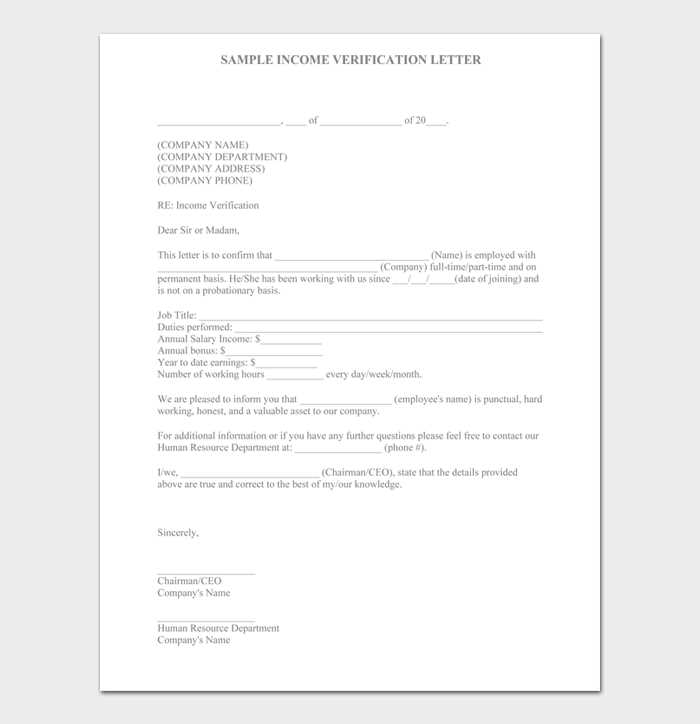

Begin by clearly stating your name and contact details at the top. Include your job title, employer’s name, and contact information. Then, specify the purpose of the letter, such as confirming employment and salary. Mention your position, employment duration, and the frequency of your payments.

Employment Details

Provide specific details about your job. State the start date of your employment and the type of contract you have. If applicable, note whether you are full-time, part-time, or a freelancer. Be precise about your salary amount, whether it is hourly, weekly, monthly, or annual. Specify any bonuses or additional compensation you receive.

Conclusion

Close by stating that the information is accurate to the best of your knowledge and offer to provide additional documentation if necessary. End with a polite thank you and sign the letter.