Dispute charges letter template

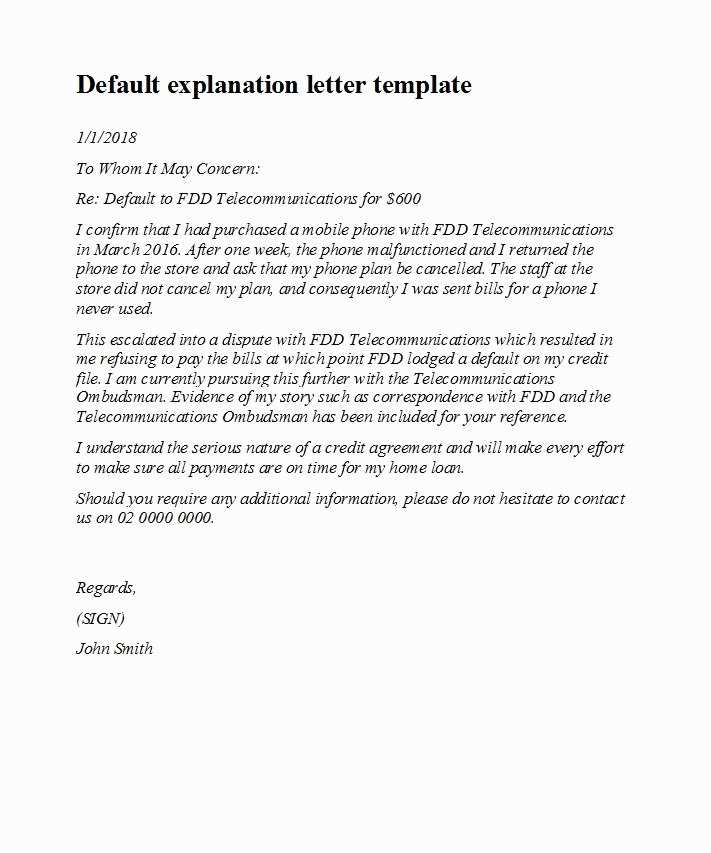

When disputing charges on your account, it’s crucial to present clear and concise information. Start by identifying the specific charge in question and explaining why you believe it is incorrect. Avoid ambiguity by providing exact details, such as the date, amount, and merchant involved.

Next, request a resolution. Whether you seek a refund, adjustment, or clarification, state your expectations clearly. Be polite but firm in your approach to encourage a prompt and positive response. Include any supporting evidence, like receipts or communication records, to back up your claims.

Keep your letter brief but thorough. The goal is to make your case easy to understand, so the recipient can act swiftly. After drafting your letter, proofread it for any mistakes before sending it off. A well-structured letter can make all the difference in getting your dispute resolved smoothly.

Here’s the revised version:

Begin by stating the specific charge you’re disputing and providing clear evidence that supports your claim. For example, mention the exact amount, the date of the transaction, and the name of the merchant. Include any receipts or transaction records that can help clarify the mistake.

Clearly explain the issue:

Explain why you believe the charge is incorrect. Focus on the specific error, whether it’s a double charge, an unauthorized purchase, or an overcharge. Be straightforward and avoid unnecessary details that could detract from the main point.

Request for action:

End with a polite but firm request for the charge to be reviewed and corrected. Include your contact information for follow-up, and express your willingness to provide further documentation if needed. Ensure the tone remains respectful while clearly stating your expectation for resolution.

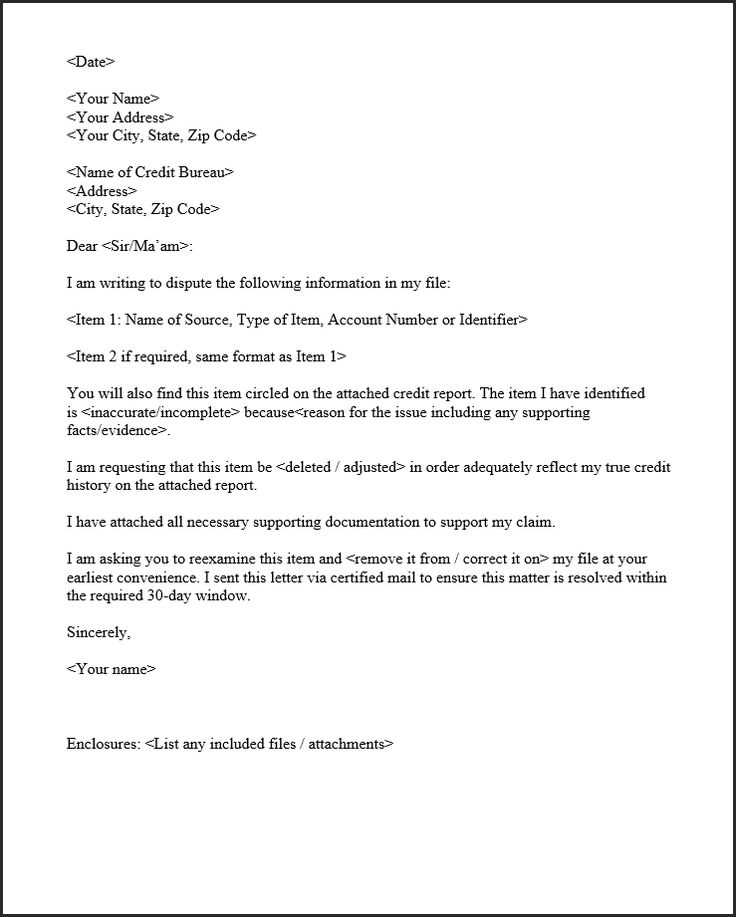

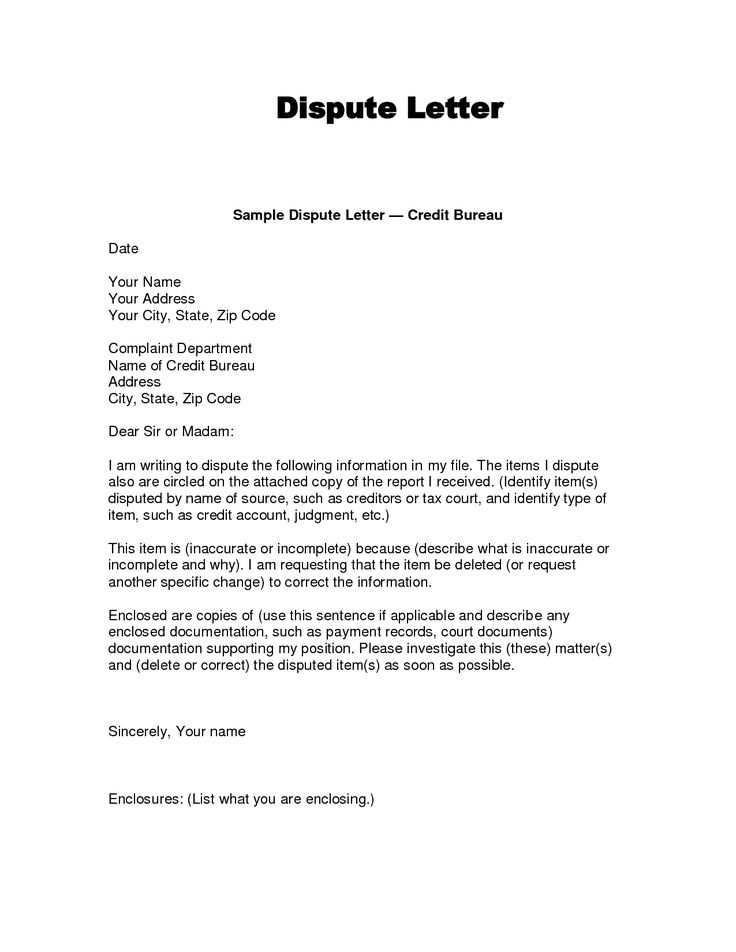

Dispute Charges Letter Template

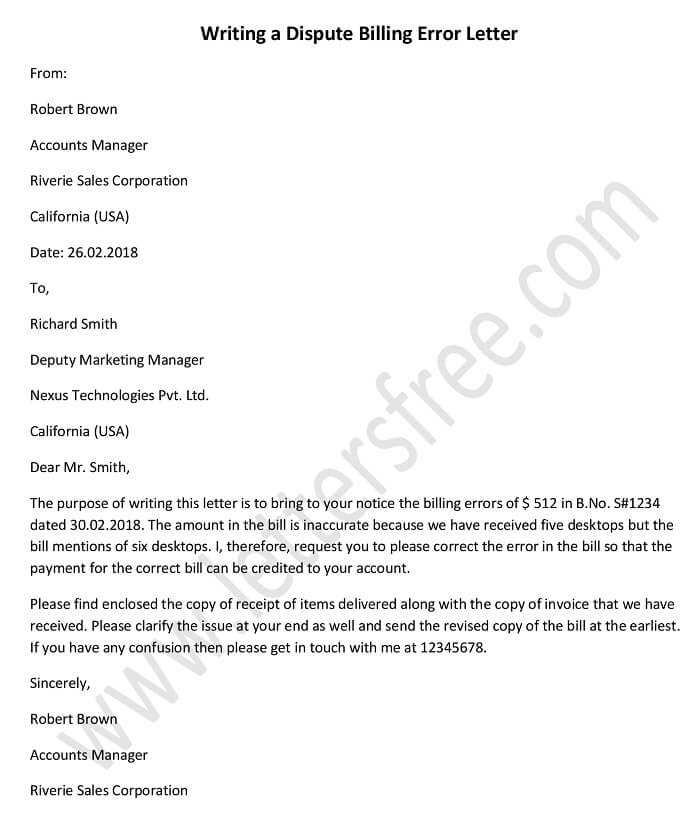

To begin a dispute letter, clearly state the specific charges in question. Identify the invoice or transaction number and include any relevant dates. Mention why the charge is incorrect, referencing supporting documentation if necessary. Be concise and factual, avoiding emotional language.

Key details to include are the exact amount you are disputing, a brief explanation of the issue, and the resolution you seek. Keep the tone polite and professional. Make sure to request written confirmation of the dispute and a timeline for resolution.

If the creditor responds, carefully review their reply. If they agree with your dispute, ask for confirmation of the charge removal or adjustment. If they deny the dispute, ask for more details or clarification of their findings and provide additional evidence if needed.

Examples of formats to use:

– “I am writing to dispute a charge on my account dated [Date], in the amount of [Amount]. After reviewing my account, I believe this charge is incorrect due to [Reason].”

– “I would like to formally challenge the charge on [Date], with reference to [Invoice/Transaction Number], as it does not align with the agreed terms.”

These examples maintain a clear structure and provide all necessary information in an easily understandable manner.

Common errors to avoid include vague language, missing details like transaction references, or a lack of supporting evidence. Be sure to address the issue clearly without making unsupported claims. Avoid making threats or using overly aggressive language, as it may hinder resolution.

If your dispute is rejected, double-check the creditor’s explanation and consider providing more documentation. If the matter remains unresolved, contact the relevant consumer protection agency for further assistance or explore legal options depending on the situation.