Insurance appeals letter template

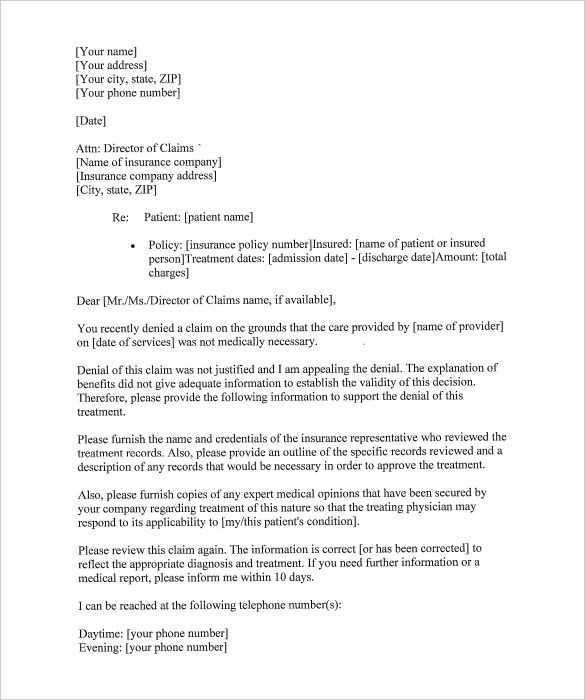

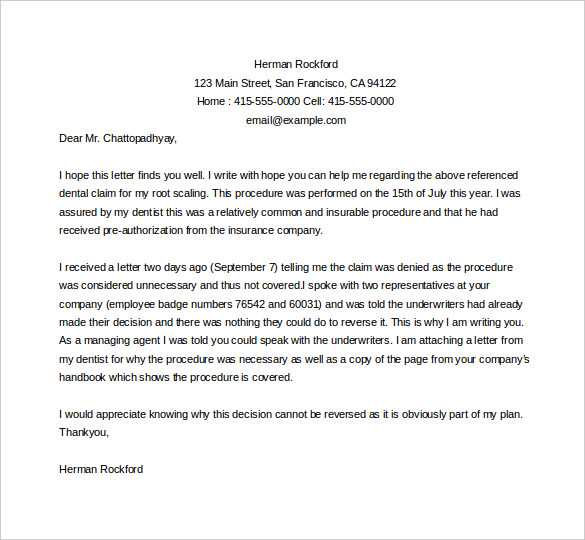

Begin your insurance appeal letter with a clear statement of the situation. Mention the claim number and the date of the denial, ensuring the recipient knows exactly which case you’re referring to. Be concise, but make sure to provide enough details for the insurance company to quickly identify your claim and the reasons for the appeal.

Next, explain why you believe the denial was incorrect. Reference specific policies or provisions that support your argument. If you have additional documentation or evidence, mention it here. This can include medical reports, invoices, or statements from professionals that provide further context or clarification.

Finish the letter with a respectful request for a review of the decision. Clearly state what you are hoping for, whether it’s reconsideration of the claim or a request for a more thorough investigation. Keep your tone polite but firm, emphasizing your willingness to provide any further information needed for a fair reassessment.

Here’s the revised version without repetition:

Clearly state the reason for your appeal at the beginning of the letter. Focus on the key issue you are addressing, such as the denial of your claim or any misunderstanding in your case. Provide concise, factual details of the situation, ensuring accuracy and clarity. Avoid unnecessary background information.

Key Points to Include:

Explain why the decision made by the insurance company is incorrect, referring to specific policy clauses or terms that support your case. Use evidence such as medical reports, invoices, or other documentation to back up your claims. Each supporting document should be referenced clearly and attached as required.

Clear Call to Action:

End with a direct request for reconsideration of your claim or a specific action you wish the company to take. This helps the recipient understand exactly what you are asking for and speeds up the resolution process.

- Insurance Appeals Letter Template

Begin with a clear and concise opening statement. Specify the reason for the appeal and reference the claim number and any relevant policy details. Make sure to directly address the issue with the claim decision and provide supporting evidence or documentation that justifies your request for reconsideration.

Next, explain why the denial was incorrect, referencing any policy terms or conditions that support your argument. Be specific about how your situation fits the criteria for coverage or how the interpretation of the decision is flawed.

It’s helpful to offer any additional information that may not have been considered initially, such as new medical records, repair estimates, or other documents that substantiate your case. Stay factual and avoid emotional language.

Conclude with a polite request for a review of the decision and ask for a written response. Provide your contact information for any follow-up. Ensure your tone remains professional and courteous throughout the letter.

Begin your appeal letter with a clear and formal statement of purpose. Directly address the decision being appealed, referencing the claim number, policy number, or any relevant identifiers that will help the reader quickly locate the case in their system. This helps establish the context right away and sets the tone for the rest of the letter.

Be Specific and Direct

Start by stating exactly what decision you are contesting. If the insurance claim was denied, specify the date of the denial and any reason provided. If additional documentation is requested, outline what’s missing or why the request was not met. Avoid vague or ambiguous language; be direct and concise.

Include Your Contact Information

Ensure that your full name, address, and phone number are clearly visible at the top of the letter, preferably in a header. This allows the recipient to easily contact you for any clarifications or updates. If you’re submitting the letter via email, include your contact details in your signature.

| Key Information | Why It’s Important |

|---|---|

| Claim or policy number | Helps the recipient quickly identify the relevant case |

| Reason for appeal | Clarifies the specific decision being contested |

| Contact details | Ensures easy communication for follow-ups |

Focus on these key elements to structure your appeal letter clearly and effectively:

- Claim Reference Number: Always include your claim number at the top of the letter. This helps the insurance company quickly locate your case.

- Policy Number: Add your policy number to ensure that the letter is matched with your records, making the process smoother.

- Specific Denial Reason: Clearly address the reason your claim was denied. If the reason is unclear, request further clarification. Be precise in explaining why you believe the denial was incorrect.

- Supporting Documents: Attach any relevant documents that support your case. This can include medical reports, photos, repair estimates, or expert opinions.

- Corrective Action: Explain what action you want the insurance company to take, such as reevaluating the claim or providing additional information for review.

- Concise and Clear Language: Be direct and avoid long-winded explanations. Make sure your argument is easy to follow.

- Respectful Tone: Maintain a polite and professional tone throughout. Even when disputing the decision, professionalism will help your case.

By including these elements, your appeal letter will present a well-organized case that increases the chances of a successful outcome.

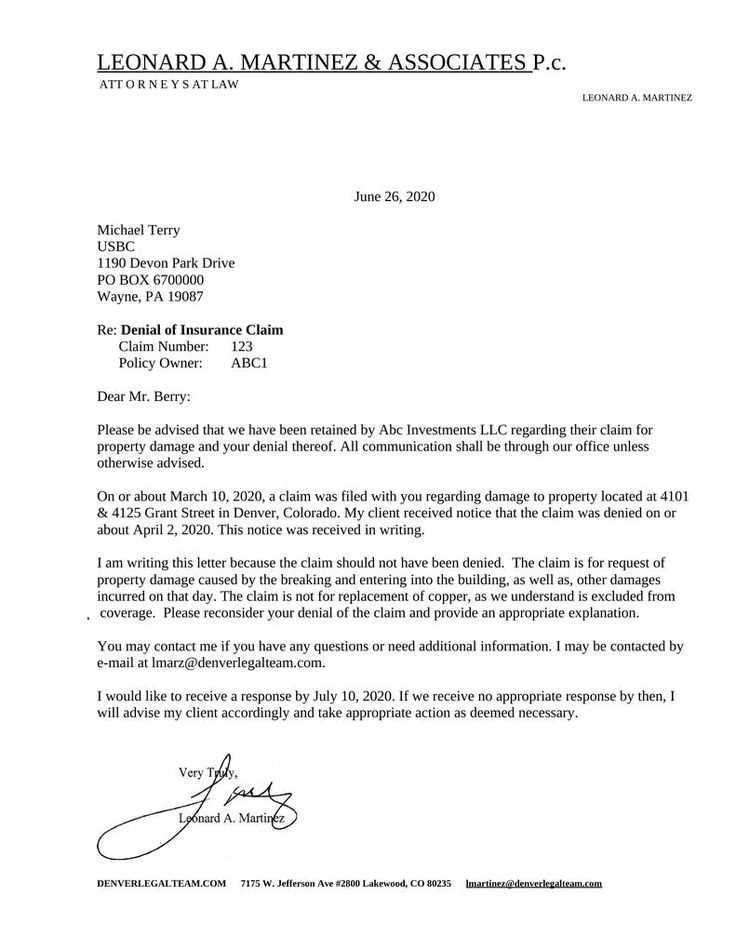

Address the insurance provider with clarity and professionalism. Begin by directing your letter to the claims department or the specific person handling your case, if possible. Use their formal title or name, such as “Dear Claims Manager” or “Dear [Insurance Company] Representative.” If you don’t know the recipient’s name, “Dear Sir/Madam” is a suitable option.

Using the Correct Company Information

Make sure to include the full name of the insurance company and its proper address. Use the address provided in your policy documents or on the official company website. Correct details help ensure that your letter reaches the appropriate department without delay.

Keep it Formal and Direct

Maintain a formal tone throughout your letter. Avoid casual language or informal phrasing. Directly state the purpose of your letter and provide any relevant case or policy numbers for easy reference. This makes it easier for the insurer to locate your file and process your request efficiently.

Be precise when referencing policy terms. Identify the exact sections of the insurance policy that are relevant to your appeal. Quote the specific clauses, using the policy number or title, if possible. This shows you have a clear understanding of the terms and strengthens your argument.

Clarify the Reason for Denial

Clearly state the reason your claim was denied, as outlined by the insurer. Address this directly by referencing the language used in the denial letter. If the insurer cites a particular clause, include that clause number and explain how it does not apply to your situation or how your claim meets the required criteria.

Present Your Case with Clear Examples

Use examples from the policy to demonstrate how your situation aligns with the terms. This might include showing that specific exclusions don’t apply or that the evidence provided supports your claim. Point out any areas where the insurer may have misinterpreted or overlooked details in the policy.

Maintain clarity and focus on the facts. Avoid overly emotional language and stick to the details of the case. Use polite, direct phrasing when addressing the issue and avoid sounding accusatory.

Be Concise and Specific

Explain your reasons for appeal clearly, focusing on the most relevant details. Keep the letter short, addressing key points without unnecessary elaboration.

Stay Objective and Respectful

Use a respectful tone throughout the appeal. Acknowledge the other party’s position while presenting your case logically. Being respectful helps maintain a constructive tone and increases the chances of a positive outcome.

After submitting your appeal letter, track the timeline for a response. Keep a record of when the letter was sent and the method used. Some insurance companies may take several weeks to review your appeal. Check your mail and email regularly for updates on the status of your claim.

If you don’t receive a response within the expected time, follow up with a polite inquiry. Ensure you mention your claim number and appeal letter details to streamline the process. Make a note of any communication or responses you receive for future reference.

If your appeal is denied, review the reasons provided by the insurer. Understand the specific issues they raised and consider addressing them in a second appeal, if necessary. You may also want to consult with a professional, such as a lawyer or an insurance expert, for further assistance.

In some cases, you can request a formal review or seek mediation through a third party. Know your rights and available options in your jurisdiction. If the appeal process isn’t yielding favorable results, consider escalating the matter by filing a complaint with the relevant regulatory body.

| Action | Description | Timeframe |

|---|---|---|

| Track Response | Monitor for updates on your appeal | Within 2-3 weeks |

| Follow Up | Reach out to insurer if no response is received | After 3-4 weeks |

| Review Denial | Analyze reasons for denial and address issues | Immediately after denial |

| Seek Legal Advice | Consult with professionals for further assistance | When necessary |

In order to enhance the clarity and effectiveness of your insurance appeal letter, follow these key steps:

Organize Your Appeal Letter

- Start with a clear subject line: Mention the specific claim number or issue to make it easily identifiable.

- State the purpose early: Begin by briefly explaining that you are submitting an appeal for a denied claim, specifying the reasons if known.

Provide Supporting Documentation

- Attach all relevant documents: Include medical records, receipts, or any evidence that supports your case. Highlight key details that back up your appeal.

- Clearly reference documents: In the body of your letter, mention the documents you’re attaching and explain how they relate to your claim.

By following this structure, your appeal letter will be straightforward, and the insurance company will have all the information needed to review your case properly.