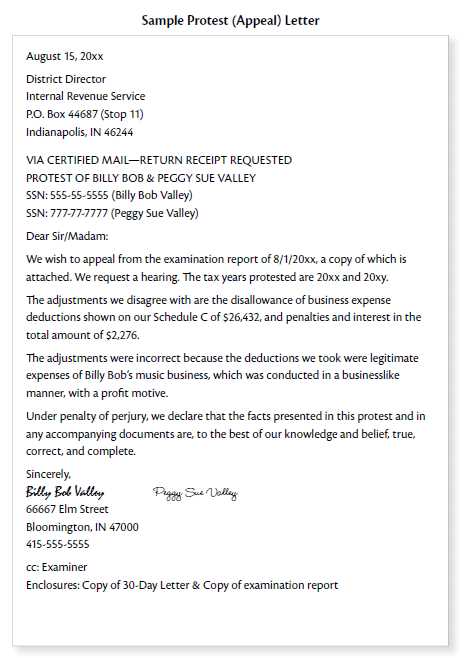

Tax appeal letter template

If you believe that your tax assessment is incorrect, writing an appeal letter can be an effective way to address the issue. Start by clearly stating the reason for your appeal, highlighting any discrepancies you have found. It’s essential to present your case in a clear, organized manner to ensure the reviewer can quickly understand the issue at hand.

Focus on providing all necessary supporting documents. This could include receipts, valuations, or any other evidence that backs up your claims. The more concrete your evidence, the stronger your appeal will be. Be sure to reference specific sections of your tax notice that you are challenging to help pinpoint the errors you’re addressing.

Use a respectful tone throughout the letter. Avoid overly emotional language or aggressive statements. Instead, maintain a professional approach while making sure your points are direct and well-substantiated. A well-written letter increases the likelihood of a successful appeal and helps to expedite the process.

Here’s an edited version of the sentences with reduced repetition:

Keep your tax appeal letter clear and concise by removing redundant phrases. Avoid unnecessary repetition of the same points across different sentences. For instance, instead of repeatedly stating your case’s urgency, express it once with strong, specific language. Focus on presenting relevant facts directly, without restating them multiple times throughout the letter.

Rather than using multiple phrases to describe the same idea, choose the strongest, most precise wording. This makes your argument more persuasive and easier to follow. Use varied sentence structures to convey your points and avoid sounding repetitive. If you have supporting evidence, mention it succinctly in one section instead of revisiting it throughout the document.

Consistency in tone and clarity in your request will make your letter more effective. Ensure every sentence adds value and reinforces your main points, without unnecessary reiteration of ideas. This way, your appeal will be direct and impactful.

- Essential Information to Include in Your Tax Appeal Letter

Begin with your full name, address, and contact details at the top of the letter. This ensures the tax authority can easily reach you for further communication.

Next, clearly state the reason for your appeal. Specify which tax assessment you are challenging, including relevant reference numbers or tax years. This helps the recipient identify your case promptly.

Provide a Detailed Explanation of Your Disagreement

Outline your concerns with the tax assessment in a clear and concise manner. Provide factual evidence or specific errors in the calculation, documentation, or any aspect that supports your claim. Be direct and precise, avoiding vague statements.

Include Any Supporting Documentation

Attach relevant documents that validate your case. This can include receipts, invoices, bank statements, or any official correspondence that strengthens your argument. Make sure all documents are clearly labeled and organized.

Lastly, specify the resolution you seek. Whether you are requesting a reduction, reconsideration, or a complete adjustment of your tax assessment, state it clearly to ensure the tax authority understands your expectation.

Begin with a clear and concise subject line. The recipient should immediately understand the purpose of the letter. Specify your case number or tax identification number to avoid confusion.

1. Address the Appropriate Authority

Directly address the letter to the person or department handling your appeal. Use their official title, and if you’re unsure, look up the specific contact details from the tax authority’s website or a previous letter you received.

2. Present the Facts in an Organized Manner

List the facts of your case in chronological order. Avoid long paragraphs, and use bullet points to break down each key point. This allows the reader to follow your argument step by step.

3. Include Supporting Documents

Clearly reference the attached documents that support your case. These may include receipts, tax forms, or previous correspondence. Mention each document specifically in the letter and ensure they are easy to find.

4. Keep Your Argument Simple and Focused

Stick to the key points that support your appeal. Avoid unnecessary details or unrelated information. This will make it easier for the recipient to understand your reasoning.

5. Be Polite and Professional

Even if you’re frustrated, maintain a respectful tone. This increases your chances of getting a positive response. Avoid aggressive or accusatory language.

6. Conclude with a Clear Request

End your letter with a specific request. Do you want a reassessment of your tax status or a meeting to discuss the issue? Make your intentions clear to ensure a prompt resolution.

| Key Point | Recommendation |

|---|---|

| Subject Line | Be direct and clear about the purpose |

| Recipient | Address the letter to the right authority |

| Facts | Present them in chronological order |

| Supporting Documents | Clearly reference attached documents |

| Tone | Be polite and professional throughout |

| Request | End with a clear, actionable request |

Provide clear and relevant evidence to back up your appeal. This can include documentation, records, or statements that demonstrate why your tax assessment is incorrect.

- Official Documents: Include tax returns, receipts, or contracts that support your case. This may include income statements, deductions, or credits you are entitled to.

- Professional Valuations: If the assessment is based on property or asset values, include independent appraisals or expert opinions to challenge the valuation.

- Supporting Correspondence: If you’ve had prior communication with tax authorities or other agencies, include letters, emails, or any official responses that clarify your situation.

- Witness Statements: If relevant, submit statements from professionals, such as accountants or legal advisors, who can confirm the inaccuracies in the assessment.

- Relevant Financial Statements: Provide bank statements, loan documents, or other financial records that can verify the claims made in your appeal.

Ensure that all evidence is organized and clearly labeled to make it easier for the review body to understand your case. Avoid overwhelming them with irrelevant or excessive documentation.

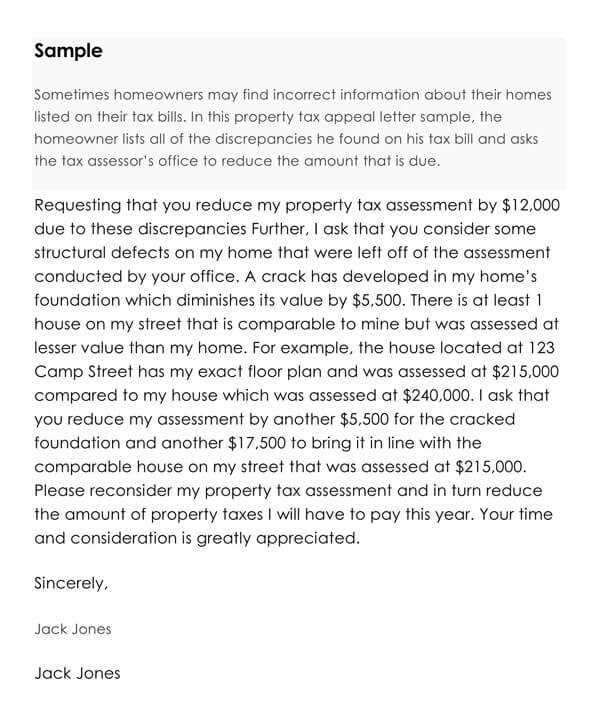

If you find discrepancies in your tax assessment, addressing them promptly will increase your chances of a successful appeal. Here are a few practical steps you can follow to resolve common issues:

1. Incorrect Property Valuation

Ensure the property valuation is accurate. If your property was assessed higher than its actual market value, gather evidence like recent sales of similar properties in your area or an independent appraisal. This data can demonstrate that the assessment is overstated.

2. Misclassification of Property Type

Sometimes, a property may be misclassified (e.g., residential instead of commercial). Verify the classification in the assessment and, if incorrect, provide supporting documents, such as zoning regulations or usage history, to prove the error.

3. Missing Deductions or Exemptions

Double-check your eligibility for any tax deductions or exemptions you might have missed. Gather all required documentation, such as proof of a disability or senior citizen status, and submit it to the taxing authority for a correction.

4. Errors in the Tax Calculation

If the tax rate or any other calculation appears wrong, cross-check it with the official rates for the year in question. If discrepancies are found, request a correction with the appropriate evidence.

5. Incorrect Property Size or Features

Ensure the tax assessor has accurate information about the square footage or unique features of your property. If these details are wrong, provide photos or construction records to support your claim.

- Gather supporting documents before filing an appeal.

- Clearly explain the nature of the discrepancy in your appeal letter.

- Submit your appeal before the deadline.

Addressing these common issues with clarity and evidence will help strengthen your case and increase the likelihood of a successful appeal.

Once you submit your tax appeal letter, the tax authority will acknowledge receipt of your appeal. Depending on their procedures, you may receive a confirmation notice with an assigned case number. Expect the authority to review the details of your case, including any supporting documents you submitted.

If your appeal involves a correction of errors or an adjustment to your assessed taxes, the authority may request additional information to clarify certain points. Be prepared to respond quickly if asked for more documentation or explanations to avoid delays in processing your appeal.

The tax authority will then make a decision based on your appeal. You will either receive a favorable decision, a partial adjustment, or a denial. If your appeal is successful, your tax bill will be amended accordingly. If it’s denied, the authority will provide an explanation, and you may have the option to appeal to a higher authority or seek alternative dispute resolution.

After receiving the final decision, you may need to take action based on the outcome, such as paying a reduced tax amount, appealing further, or making adjustments to your finances. Be sure to review the decision carefully and note any deadlines for further actions.

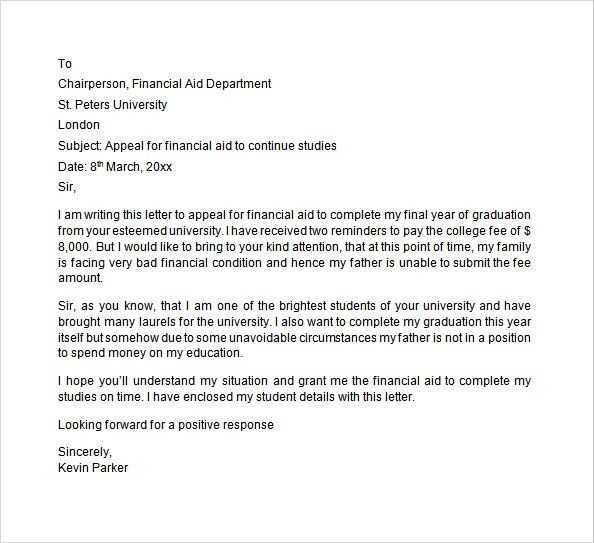

To begin your tax appeal letter, focus on presenting your case clearly and concisely. State the purpose of your appeal right at the start, including your assessment number and the specific issue you’re contesting. This sets the stage for a direct and focused conversation with the tax authority.

Include a brief explanation of why you believe the tax decision is incorrect. Reference any documents, figures, or facts that support your claim, making sure to organize them logically for easy reading. Avoid overloading the letter with irrelevant details–keep it concise and to the point.

Address the letter to the correct department or official handling appeals, and ensure that all contact information is accurate. A personalized approach increases the chances of your appeal being reviewed promptly.

If applicable, offer a proposed solution or adjustment, demonstrating your willingness to work with the authorities in resolving the matter. This not only shows your cooperation but also helps them understand what resolution you’re seeking.

Close with a polite yet firm request for a reconsideration of the decision. Reaffirm your willingness to provide additional information if needed. Conclude the letter with your contact details for follow-up and thank them for their attention to the matter.