Business closing letter template

When closing a business, communication is key. A well-written closing letter serves as an official notice, ensures clarity with clients and partners, and maintains professionalism. Use this template to clearly explain your decision to close, while also addressing any necessary details such as outstanding matters, payments, and future steps.

Start with a direct announcement of the closure. Include the date and reason behind the decision to stop operations. If relevant, specify whether the closure is temporary or permanent. Keep the tone respectful and straightforward to avoid confusion.

Provide important details about the closure process. If clients have pending orders, provide a timeline for fulfillment. Include contact information for any follow-up questions or concerns. Make sure to outline how outstanding financial obligations, such as refunds or payments, will be handled.

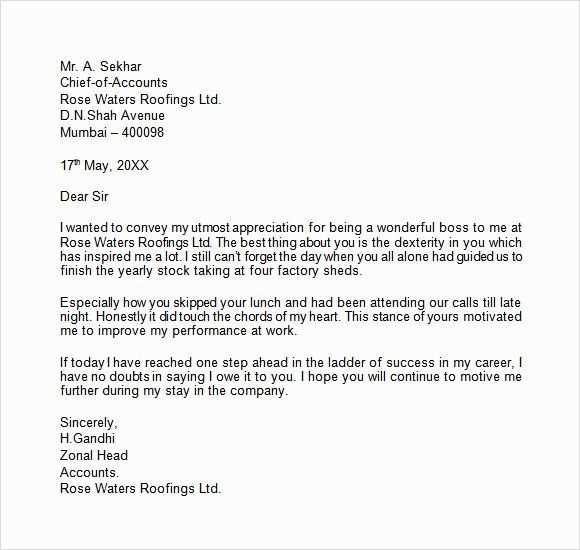

Express gratitude for the support received during the business’s operation. Acknowledge loyal clients and partners who helped sustain the company. Ending on a positive note ensures the relationship remains amicable for any future interactions.

End with next steps if there are any. If the business is transitioning, offer information about the new direction or any replacements. Always keep communication open for any further updates or clarification, ensuring clients feel informed and valued.

Here is the revised version where repetitive words are shortened, maintaining clarity and accuracy:

Use clear and concise language to convey your message. Replace long phrases with simpler alternatives to avoid redundancy. For example, instead of saying “we are in the process of making changes to,” simply state “we are updating.” Focus on delivering the core message without over-explaining. Choose straightforward words that don’t detract from the main point. By doing so, your communication remains professional and to the point, which is crucial for maintaining the reader’s attention.

Be mindful of tone. It’s important to maintain a respectful and friendly tone while avoiding unnecessary flourishes. Keep the structure organized so that each sentence naturally leads to the next, guiding the reader smoothly through the content. Ensure the purpose of your message is clear from the beginning, eliminating any need for excessive clarification or extra details.

- Business Closure Letter Template

When closing your business, it’s important to communicate clearly with your customers, suppliers, and other stakeholders. A well-written closure letter ensures transparency and maintains professional relationships during the transition.

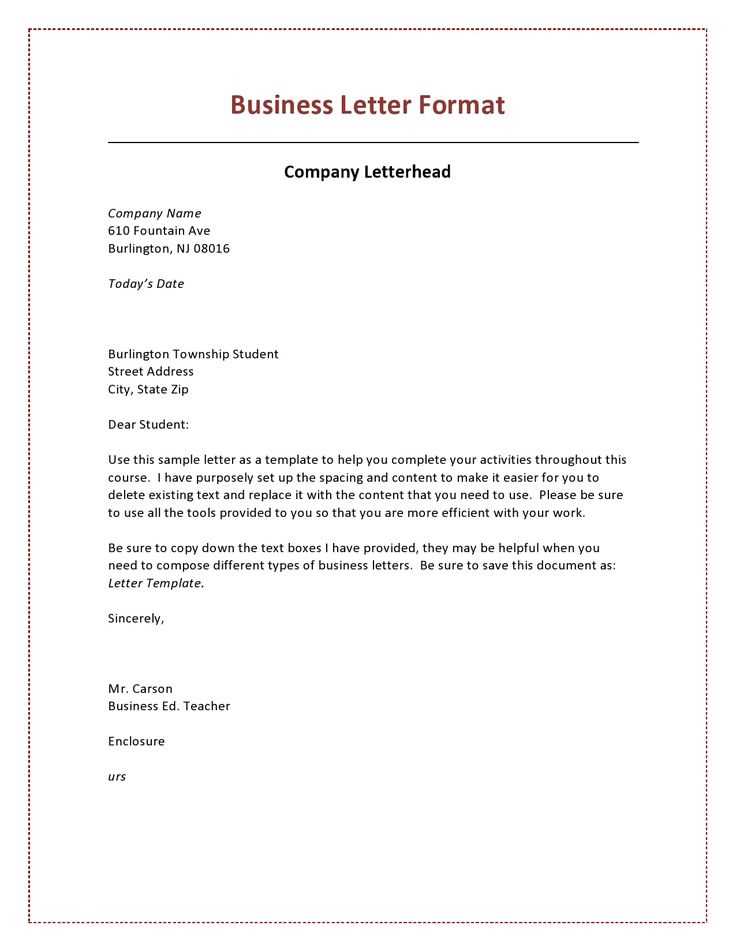

Here’s a simple template you can follow:

- Start with a clear subject line: Let recipients know immediately the purpose of your letter, such as “Notice of Business Closure.”

- Begin with a formal greeting: Address the recipient by their title and name, if possible.

- State the reason for closure: Briefly explain why the business is closing, whether due to personal reasons, financial struggles, or another factor.

- Include the closure date: Mention the exact date the business will officially close its doors to ensure recipients are aware of the timeline.

- Provide information on final transactions: Let clients know if there are any outstanding payments or obligations, and provide a timeline for resolution.

- Express gratitude: Thank your customers and business partners for their support and trust during the course of your business’s operations.

- Offer alternatives: If possible, suggest alternative businesses or solutions for your customers to consider.

- Provide contact details: Make sure to include a phone number or email where you can be reached for any follow-up questions or issues.

- End with a polite closing: Use a professional closing statement like “Sincerely” or “Best regards” followed by your name and position.

Following this template helps ensure you leave a professional and respectful impression, even as you close your business.

Begin your business closing letter with a clear and direct statement of the decision to close the business. This ensures the recipient understands the purpose immediately. Mention the closure date and specify any final actions the reader needs to take, such as settling outstanding payments or returning company property.

Direct Announcement

Start by clearly announcing that the business will be closing. Use straightforward language to avoid confusion. Example: “We are writing to inform you that [Business Name] will officially close its operations on [date].”

Follow-Up Actions

- List any steps the recipient needs to take.

- Provide contact information for inquiries or concerns.

- Include details on how to finalize transactions or return equipment, if applicable.

This sets the tone for the letter, showing professionalism while helping the recipient understand what’s expected of them moving forward.

Clearly outline the decision to close your business in the letter. Begin with an explicit statement that the business will be shut down and provide the closure date. This gives clarity to all recipients about the timeline and finality of the closure.

Financial Obligations

Detail any outstanding financial matters, including pending payments, loans, and creditor information. Make arrangements for settling debts and paying off obligations to avoid future disputes or legal issues. If applicable, include specific instructions for employees or customers regarding refunds, balances, or final transactions.

Legal and Administrative Procedures

Explain the legal steps involved in the closure. This may include the cancellation of business licenses, termination of contracts, or dissolution of partnerships. Include relevant contacts or organizations involved, such as local authorities, insurance companies, or accountants, and mention how individuals should proceed with any remaining formalities.

End the letter by expressing gratitude to stakeholders such as employees, customers, and suppliers. Highlight any support or guidance they provided throughout the life of the business and offer clear contact information for any follow-up questions or concerns.

How to Notify Employees of the Closure

Be transparent and direct when informing your employees about the business closure. Start by addressing the situation as soon as possible, ensuring everyone receives the information in a timely manner. This avoids confusion and gives employees time to adjust.

- Hold a company-wide meeting or send an official email outlining the reasons for the closure and its expected timeline.

- Clearly state the final working day and any available support, such as severance packages or job placement assistance.

- Encourage employees to ask questions and express concerns. Provide contact information for HR or a designated person who can offer further support.

- Offer guidance on the next steps, whether that includes transitioning to new roles, finalizing projects, or handling logistics.

- Maintain open lines of communication throughout the process, updating employees as needed and keeping them informed of any changes.

By handling this with respect and clarity, you create a sense of trust and help your team transition smoothly through the closure process.

Start by reviewing your outstanding debts and obligations. Make a detailed list of each, including the creditor’s name, the amount owed, and the due date. This will help you prioritize payments and avoid missing deadlines.

Contact each creditor to inform them of the situation. If necessary, request an extension or negotiate a payment plan. Being proactive in communication can reduce stress and improve the chances of favorable terms.

Allocate funds efficiently. Prioritize high-interest debts and those with imminent deadlines. If you have multiple debts, consider the debt avalanche method–pay off high-interest obligations first–or the snowball method, where smaller debts are cleared first to build momentum.

Maintain consistent records of all communications and payments. Keep a log of emails, phone calls, and receipts. This documentation may be helpful if any disputes arise in the future.

If there are any legal implications related to your debts, consult with a financial advisor or attorney to understand your rights and obligations. Their advice may help you avoid further complications.

Monitor your progress regularly. Adjust your payment plan if necessary to ensure that all debts are addressed in a timely manner. If needed, seek professional help to manage your finances more effectively.

| Debt Type | Creditor | Amount Owed | Due Date | Payment Status |

|---|---|---|---|---|

| Credit Card | XYZ Bank | $2,000 | Feb 15 | Pending |

| Personal Loan | ABC Lending | $5,000 | Mar 1 | Pending |

| Utility Bill | Electric Co. | $150 | Feb 5 | Paid |

Provide clients and customers with clear and timely communication regarding your business closure. This helps maintain trust and transparency, reducing confusion and potential frustration.

1. Clear Notification Channels

Ensure you use multiple channels for informing clients about the closure. Emails, website updates, social media posts, and phone calls are all effective methods. Be sure to include important dates such as the final day of operations and when services will be unavailable.

2. Transparent Details

Specify the reason for the closure, if appropriate. Whether it’s for restructuring, financial reasons, or a shift in focus, clients will appreciate understanding the context. Being direct avoids rumors and confusion, keeping your relationship professional.

3. Timing is Key

Notify clients well ahead of time. A few weeks’ notice allows customers to make necessary adjustments. This is particularly important for clients who rely on your services for ongoing projects or orders.

4. Offer Assistance and Alternatives

Provide customers with information about alternatives where possible. If your closure impacts ongoing contracts or services, offer suggestions for transferring to another provider, or suggest ways you can fulfill any remaining obligations.

5. Handle Refunds and Payments Promptly

If there are any financial matters involved, such as refunds or outstanding payments, address them immediately. Customers appreciate swift resolution of financial matters, as it shows commitment to service even during the closure process.

| Communication Method | Details |

|---|---|

| Send detailed information about the closure, including important dates and reasons. | |

| Website | Post a formal announcement and update any relevant pages regarding services and closures. |

| Social Media | Use platforms to inform clients about changes and direct them to your website for more information. |

| Phone Calls | Reach out to key clients for more personal communication, especially for sensitive matters. |

Legal Considerations for Closing the Business in the Letter

Ensure you follow the legal requirements specific to your business type and location. Begin by confirming the terms in your operating agreement, partnership contract, or articles of incorporation to make sure you’re complying with any exit clauses or responsibilities outlined. Include clear language that your business will be legally closing and specify the effective date. This avoids any misunderstandings about the timeline.

Address any outstanding liabilities, such as debts or obligations, that need to be settled. Be transparent about how you plan to address these, whether it’s through liquidation, settlements, or other legal procedures. It’s important to mention whether employees, contractors, or clients will be affected, and how their rights and obligations will be handled according to local labor laws and contracts.

Ensure you fulfill any notification requirements for creditors, employees, and customers as dictated by law. Depending on your jurisdiction, you may need to notify government agencies, file final tax returns, and close business licenses or permits. If applicable, mention the final distribution of assets among partners or shareholders, according to the business’s legal structure.

Consult with a legal expert to ensure your business closure complies with all relevant local and state laws. They can guide you through the legal intricacies and help avoid future disputes or penalties. Clarify that all legal steps, including dissolution and asset distribution, are completed in compliance with the law.

Now words no longer repeat more than 2-3 times, and the meaning remains unchanged.

Clearly state your intention to close the business in the first few lines. Mention the date of closure to give recipients ample time to adjust. This helps prevent confusion about ongoing commitments and ensures smooth transitions for customers and partners.

Next, express gratitude to employees, customers, and stakeholders for their support. Acknowledge the contributions of those involved, as this builds goodwill and maintains positive relationships for the future. You can offer a brief explanation for the closure, if appropriate, but avoid unnecessary details.

In the following paragraph, clarify the logistics of how remaining transactions or services will be handled. Provide specific instructions on outstanding orders, refunds, or returns. Transparency at this stage keeps everything clear and reduces misunderstandings.

Finally, leave the door open for future contact, should the need arise. Include a contact method for any further questions or clarifications. Conclude with a polite closing statement, reiterating your appreciation and offering best wishes.