Business Debt Collection Letter Template for Professional Recovery

When clients fail to settle their financial obligations on time, it becomes crucial to approach the situation with professionalism and clarity. Crafting a formal document is a necessary step in ensuring the recovery of funds owed. A well-structured approach not only communicates urgency but also sets the stage for potential resolution without escalating the issue.

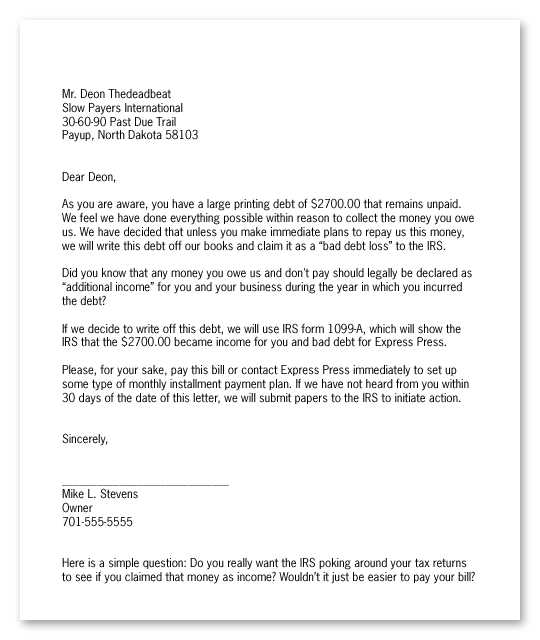

Clear communication plays a pivotal role in these situations. It’s important to outline the amount owed, the timeline for payment, and the consequences of continued non-payment. At the same time, the tone should remain respectful and constructive, aiming to maintain the business relationship while securing payment.

Knowing how to craft an effective message ensures you present all necessary details in a straightforward manner, reducing confusion and the likelihood of disputes. By following a proven structure, you can increase the chances of prompt repayment, while minimizing misunderstandings and delays.

Why Use a Payment Recovery Document

In many situations, outstanding balances require a formal approach to ensure resolution. Relying on clear, written communication is essential when attempting to recover funds. Such documents serve as a reminder to clients of their responsibilities, while also laying out the consequences of non-payment. They not only provide a tangible record of the request but also convey the seriousness of the matter.

Clarity and Transparency

One of the main reasons for using a formal communication is to avoid any confusion regarding the amount owed and the expectations for repayment. By outlining the details of the payment request, both parties have a clear understanding of the situation. This transparency helps reduce the likelihood of disputes, ensuring that both sides are on the same page.

Professionalism and Efficiency

Having a standardized approach for handling late payments demonstrates professionalism and shows that the business values its operations. It also encourages clients to act quickly and fulfill their obligations. A well-written document creates a sense of urgency and maintains the business relationship by approaching the situation in a respectful yet firm manner.

Key Elements of an Effective Communication

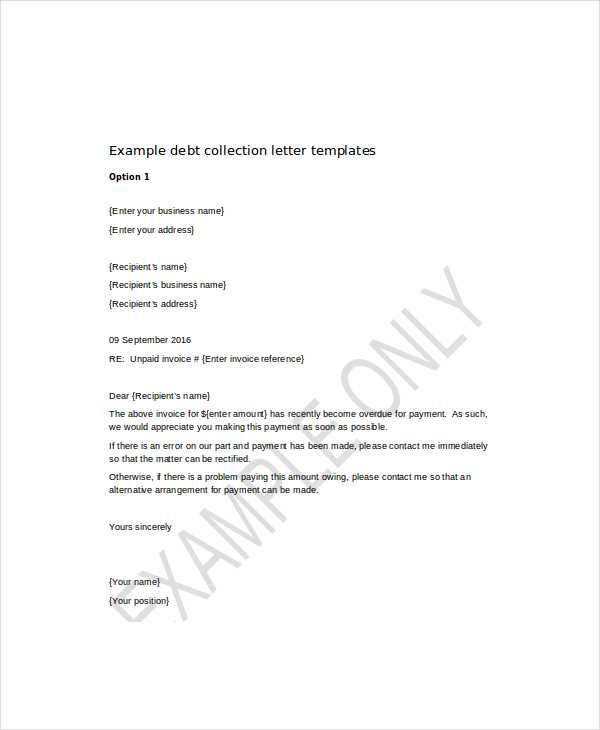

An impactful request for payment should be structured in a way that clearly conveys all necessary details while maintaining a professional tone. Including specific elements ensures that the message is not only understood but also prompts action. The following components are essential for crafting a message that serves its purpose and encourages timely repayment.

Clear and Concise Information

- Amount Owed: Clearly state the exact sum that is being requested for payment.

- Due Date: Specify the date by which the payment must be made to avoid further actions.

- Invoice Reference: Include any relevant invoice numbers or account details to avoid confusion.

Professional and Respectful Tone

- Polite Language: Maintain a tone that is firm but courteous, showing respect for the recipient.

- Neutral Tone: Avoid using overly harsh or emotional language that could alienate the recipient.

- Solution-Oriented Approach: Emphasize cooperation and offer assistance in case the recipient has any questions or concerns.

How to Address Unpaid Invoices Professionally

When payments remain outstanding, it’s essential to approach the situation with a professional attitude to maintain positive client relationships and secure the funds owed. A carefully crafted communication can encourage clients to take action without creating unnecessary tension. Focusing on clarity, respect, and a solution-oriented approach helps to keep the matter productive.

Start with a Polite Reminder

Begin by acknowledging that the payment may have been overlooked or delayed. This sets a positive tone and assumes no ill intent, which can help avoid defensive reactions. A simple, respectful reminder can encourage swift resolution without antagonizing the client.

Be Specific About Payment Terms

Provide clear details about the outstanding balance, including the due date, the amount, and any previous communications or agreements. Make sure to specify the method of payment and the expected timeline for settling the amount. This removes any ambiguity and makes it easier for the client to take action promptly.

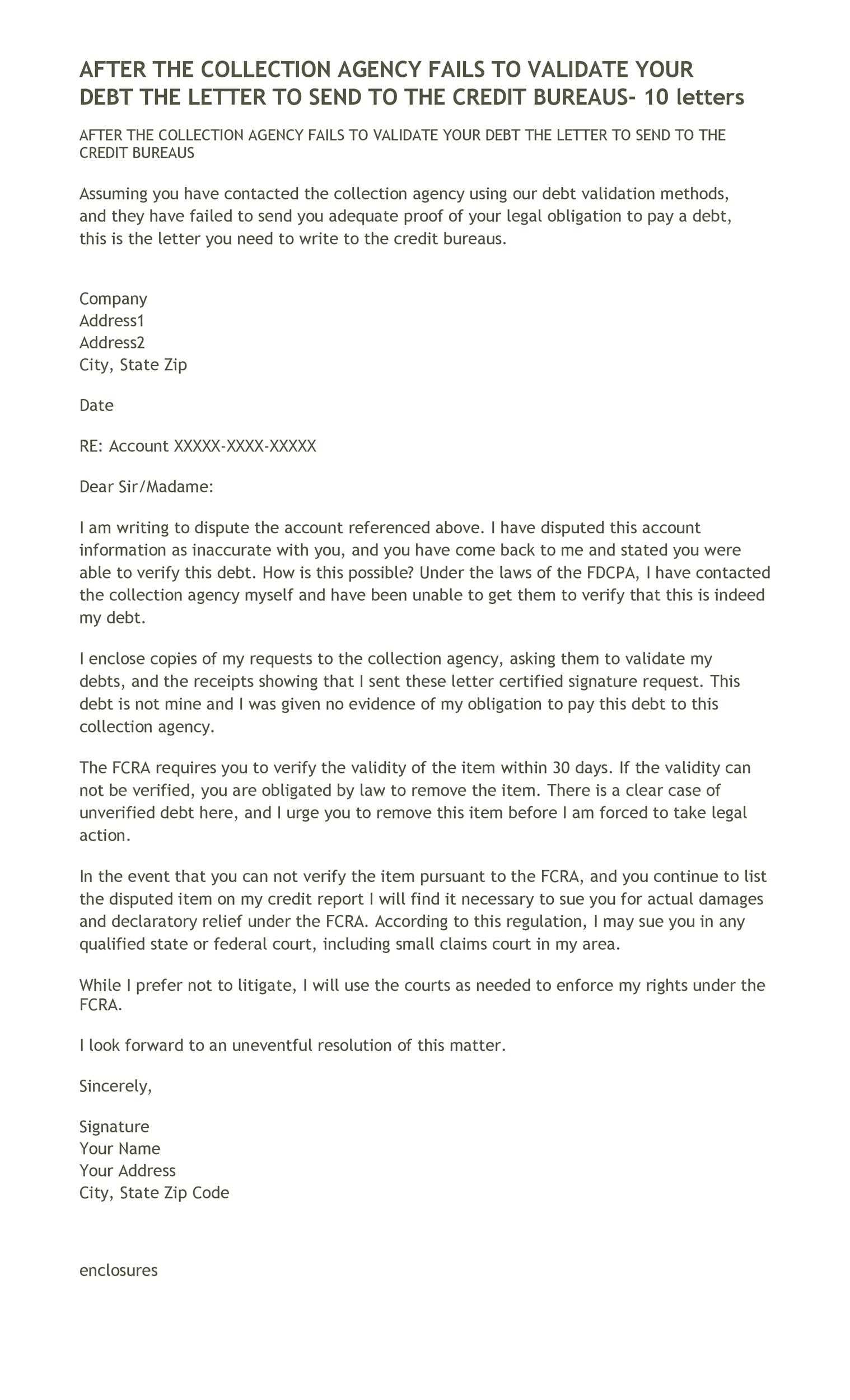

Legal Considerations in Payment Recovery

When pursuing unpaid amounts, it’s crucial to understand the legal framework that governs such actions. Failing to comply with regulations can lead to unintended consequences, including disputes, penalties, or damage to business relationships. By being aware of legal requirements, businesses can handle payment requests effectively and within the law.

Key Legal Requirements

- Compliance with Laws: Ensure that all communication and actions align with local, state, and federal regulations regarding payment disputes.

- Respect for Privacy: Avoid disclosing payment details to unauthorized parties and maintain confidentiality throughout the process.

- Fair Practices: Follow ethical standards by avoiding harassment, threats, or undue pressure on the client to pay.

Actions to Avoid

- Threatening Legal Action Unnecessarily: Do not threaten court proceedings unless it is the next logical step based on the situation.

- Excessive Interest Charges: Ensure any late fees are clearly stated in the agreement and are in compliance with the law.

- Misleading Statements: Avoid any misleading or false statements about the consequences of non-payment that may be considered deceptive.

Best Practices for Writing a Clear Message

Effective communication is key when requesting overdue payments. A well-crafted message ensures that the recipient fully understands the request and the urgency of the matter. By following best practices, you can present your case in a straightforward manner while maintaining a professional tone, which can increase the chances of prompt repayment.

First, keep the message concise and to the point. Avoid unnecessary details and focus on the essential information such as the amount owed, the due date, and any relevant reference numbers. This helps the recipient quickly grasp the situation without confusion.

Next, maintain a respectful and neutral tone. Even though the matter is serious, it’s important to avoid sounding overly harsh or aggressive. A polite yet firm approach fosters a positive response and encourages cooperation from the recipient.

Finally, ensure clarity by organizing the information in a logical order. Use bullet points or numbered lists to highlight key details, making it easy for the reader to find the information they need. This simple approach increases the likelihood of a timely resolution.

How to Follow Up After Sending the Request

Once you have sent a formal request for payment, it’s important to monitor the situation and take appropriate follow-up steps. A timely and respectful reminder can often prompt the recipient to settle their obligations. By following a structured approach, you can maintain professionalism while ensuring that the matter progresses toward resolution.

When to Follow Up

Determining the right time to follow up is crucial. You don’t want to act too quickly, but waiting too long can lead to delays. Below is a general guideline to help you decide when to make contact:

| Timeframe | Action |

|---|---|

| 1-2 days after due date | Send a polite reminder, checking if there were any issues with processing the payment. |

| 1 week after due date | Follow up with a firmer tone, reiterating the payment terms and highlighting the importance of resolving the matter. |

| 2 weeks after due date | Make a final request, stating possible consequences and suggesting a specific date for payment. |

Maintaining Professionalism

Throughout the follow-up process, it’s important to remain courteous and professional, regardless of the recipient’s response. Each communication should be clear, assertive, and respectful, showing that you’re serious about resolving the matter but are still open to discussion. Avoid sounding confrontational, as this could damage the relationship and prolong the process.