Closing Business Bank Account Letter Template

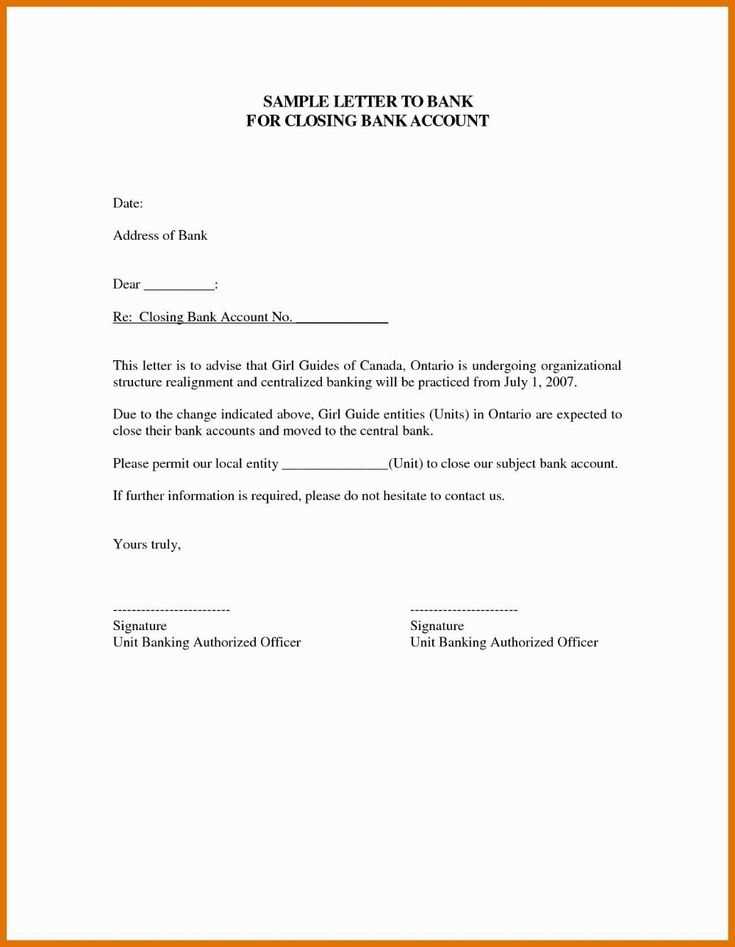

When ending a formal partnership with a financial institution, it’s essential to notify them properly through a written communication. Crafting this message effectively ensures that your intentions are clear and that the process is handled smoothly. Below is a guide on how to structure such a message, ensuring all necessary points are addressed.

Key Elements to Include

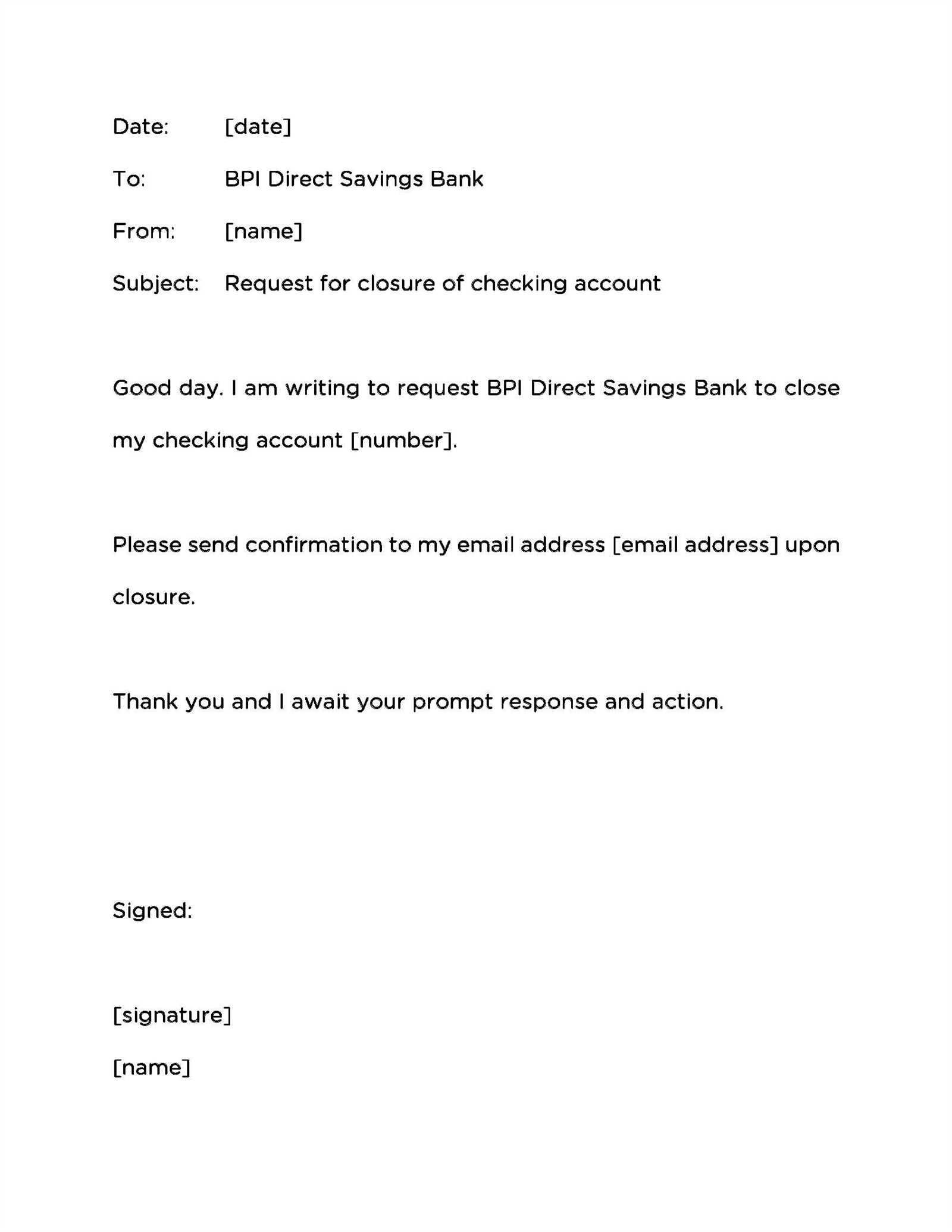

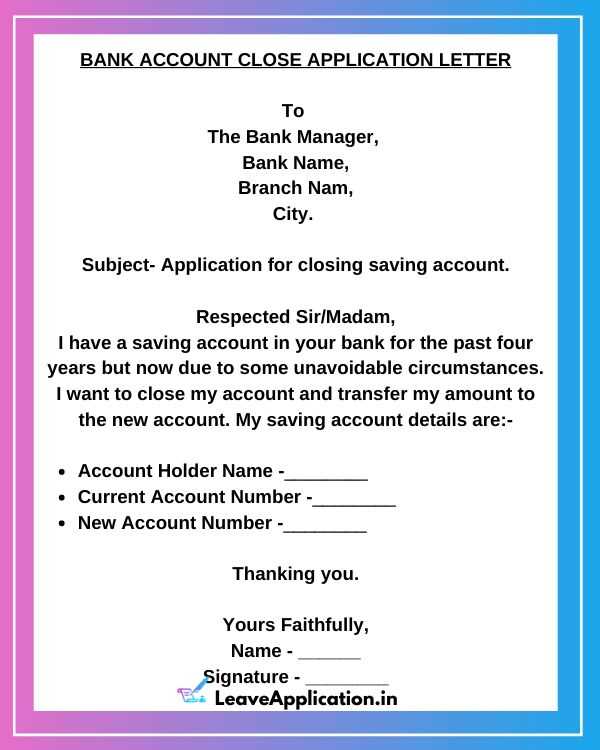

In your correspondence, make sure to mention the following crucial information:

- Your personal details – Include your name, address, and account identification number to ensure the institution can easily locate your file.

- Request for termination – Clearly state your request to end the relationship, specifying any relevant details about the account.

- Reason for ending – Although optional, you may provide a brief explanation for your decision. This helps the institution understand your perspective.

- Request for confirmation – Ask for written confirmation that the process has been completed and that all outstanding balances or obligations have been settled.

Common Mistakes to Avoid

When drafting your message, be mindful of these common errors:

- Providing unclear or insufficient account information.

- Failing to request a confirmation of closure.

- Using vague language that could lead to misunderstandings.

Important Legal Considerations

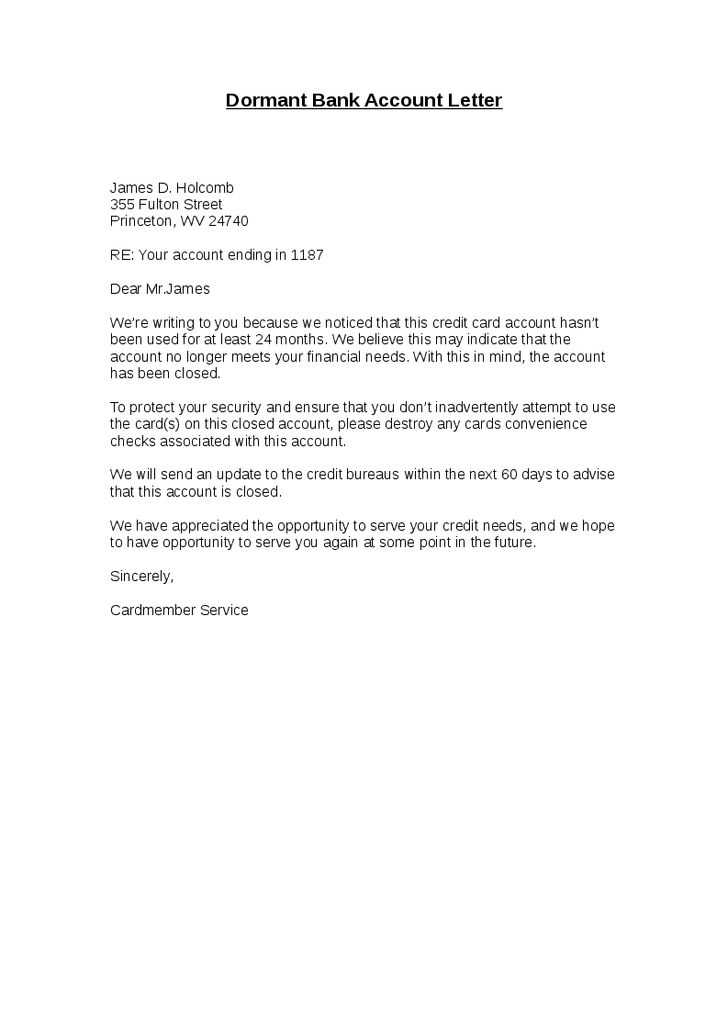

Before sending your notice, ensure that you’ve met all legal and contractual requirements. Some institutions may require you to clear all outstanding balances or settle any pending transactions. Ensure you review all terms associated with ending the relationship to avoid any surprises later on.

Final Steps in the Process

Once your message is sent, monitor the process to ensure that the termination is finalized properly. Keep a copy of all correspondence for your records and follow up if necessary to confirm that everything has been processed as requested.

How to Draft a Financial Relationship Termination Request

When ending your partnership with a financial institution, it’s important to craft a clear and professional message. This ensures the process is smooth and avoids any unnecessary delays or misunderstandings. Below is a guide that will help you structure your communication effectively.

Essential Information to Include

In your communication, make sure to include the following critical details:

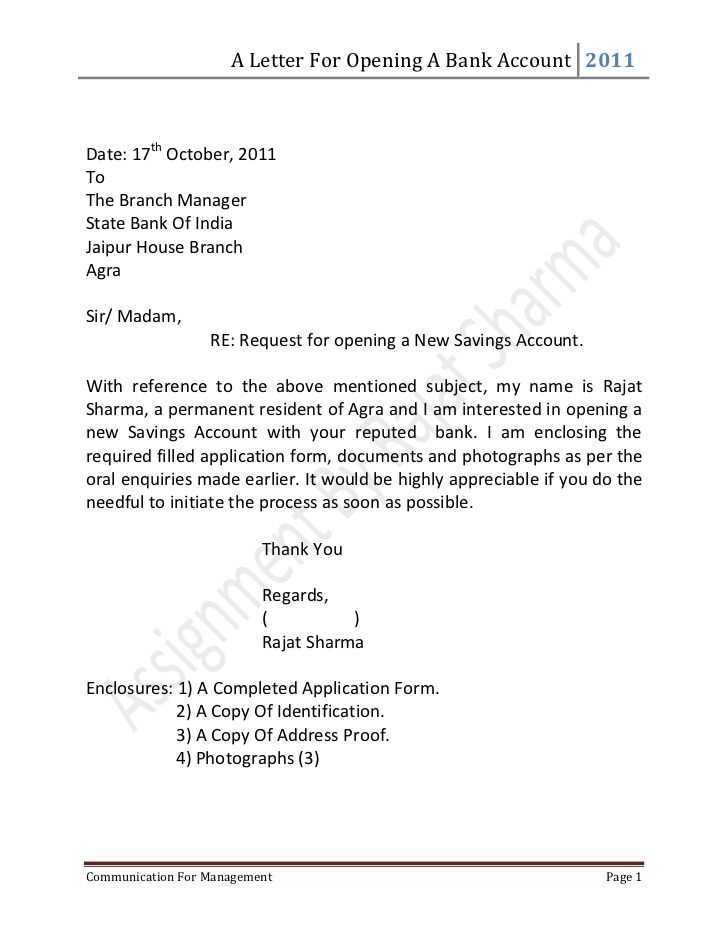

- Personal Identification – Provide full details such as your name, address, and relevant identification numbers to help the institution locate your file.

- Request for Termination – Clearly state your intention to end the partnership, along with any necessary specifics related to the agreement.

- Explanation (Optional) – While not mandatory, you may briefly explain the reason for your decision. This adds context to your request.

- Confirmation Request – Ask the institution to confirm the completion of the process and ensure there are no pending obligations.

Common Errors to Avoid

While writing your message, avoid these typical mistakes:

- Providing insufficient or unclear information about your account or services.

- Failing to request written confirmation of the process being completed.

- Being too vague in your message, which could result in confusion or delays.

By following these tips and ensuring all necessary details are included, you can streamline the termination process, making it as efficient as possible.