Credit Reference Letter Template for Businesses

In any commercial interaction, having a written confirmation of someone’s financial reliability can be a crucial asset. These endorsements play a key role in establishing trust between parties, whether it’s for a loan, partnership, or other financial dealings. A well-crafted document can provide significant insight into a person or company’s history of managing obligations.

Such documents typically follow a set structure, ensuring clarity and highlighting essential information. By using a clear format, one can efficiently convey a positive financial track record. Whether you’re preparing one yourself or receiving it, understanding the components of a strong endorsement is vital for both parties involved.

Understanding Professional Endorsements

In the context of financial interactions, a formal document that vouches for an individual’s or company’s credibility is often required. Such documents are essential tools for confirming a party’s ability to meet financial commitments, whether it be for lending, partnerships, or other transactions. These records carry weight in establishing trust and credibility between involved parties.

Key Elements of a Formal Endorsement

A well-crafted endorsement typically includes specific details that help verify the subject’s financial reliability. Here are the crucial components:

- Identity Confirmation: Basic information about the individual or company being endorsed, including their name, address, and business details.

- Financial Behavior: A history of payments, creditworthiness, or reliability in handling obligations.

- Endorser’s Relationship: A brief mention of how the endorser knows the subject, including the nature and duration of the relationship.

- Final Recommendation: A clear statement indicating the endorser’s confidence in the subject’s ability to meet financial responsibilities.

Why These Documents Matter

Such endorsements are vital for establishing a trusted financial reputation. When presented with such a document, the recipient can quickly assess whether the subject is a suitable candidate for a financial agreement. They help avoid risks and provide a framework for making informed decisions.

Why Companies Need Financial Endorsements

In today’s competitive environment, having a solid reputation for managing financial responsibilities is critical. When seeking funding or entering partnerships, it’s essential to prove that your company can reliably meet its financial obligations. A well-documented endorsement can significantly enhance trust and facilitate smoother business operations.

Building Trust with Potential Partners

When engaging in transactions, whether securing loans or forming partnerships, a written endorsement from a trusted third party can help foster confidence. Here’s why such documents matter:

- Establishing Credibility: Demonstrates your company’s history of responsible financial practices.

- Risk Mitigation: Reduces the perceived risk for potential investors or lenders by providing an objective assessment.

- Enhancing Opportunities: Opens doors to new partnerships or favorable terms on financial agreements.

Gaining Access to Better Financial Terms

Having a formal recommendation from a reliable source can lead to more favorable financial arrangements. Institutions or other companies may offer better loan terms, lower interest rates, or more flexible payment options when they trust the financial stability of the entity they’re dealing with.

Essential Components of a Financial Endorsement

A well-structured endorsement document serves as a comprehensive statement of reliability and trustworthiness. It provides the necessary details that allow third parties to evaluate the financial stability of a company or individual. Including the right information in this document is crucial to ensure it serves its purpose effectively.

Each endorsement should include the following key elements:

- Introduction of the Endorser: Identify the person or entity providing the endorsement and their relationship to the subject. This establishes credibility and context.

- Subject’s Financial History: Provide relevant details about the subject’s financial behavior, including any history of paying obligations on time and managing debts responsibly.

- Duration of Relationship: Specify how long the endorser has known the subject and the nature of their business relationship. This helps establish trustworthiness and reliability.

- Positive Confirmation: A clear and concise statement confirming the subject’s financial responsibility and suitability for whatever purpose the document is being used for.

Including these elements ensures that the document is both professional and useful in validating a company’s or individual’s financial trustworthiness.

How to Craft an Effective Endorsement

Creating a well-crafted endorsement requires careful attention to detail, ensuring that all necessary information is presented clearly and professionally. The goal is to highlight the strengths and reliability of the subject while providing enough context for the recipient to make an informed decision.

Steps to Writing an Effective Endorsement

Follow these steps to create an impactful document:

- Start with Clear Identification: Clearly state the names of the subject and endorser, and describe their professional relationship.

- Provide Specific Examples: Offer concrete examples of the subject’s ability to manage finances and meet obligations. This adds credibility to the claims being made.

- Be Concise and Direct: Keep the document focused on key points, avoiding unnecessary information that may dilute the message.

- End with a Strong Recommendation: Conclude the document with a firm, positive endorsement, affirming the subject’s financial responsibility and trustworthiness.

Tips for Clarity and Impact

To ensure your endorsement stands out, use clear and precise language. Avoid jargon, and make sure to structure the content logically. A well-organized document will leave a stronger impression and be more effective in conveying the reliability of the subject.

Key Considerations When Writing Endorsements

Crafting a well-structured and effective endorsement requires careful thought and precision. Each element should be carefully considered to ensure that the message is clear, professional, and supportive. The goal is to provide an accurate portrayal of the subject’s abilities and financial reliability while maintaining a formal and neutral tone.

Maintain Objectivity and Accuracy

One of the most important factors in writing an endorsement is presenting accurate and objective information. Avoid exaggeration or vague statements. Instead, focus on clear, measurable facts that demonstrate the subject’s financial history and reliability. This enhances credibility and ensures the document serves its intended purpose.

Keep the Tone Professional and Positive

While it’s essential to remain factual, the tone of the document should be supportive. Use a formal language style that conveys professionalism. A positive but realistic tone helps strengthen the subject’s standing without over-promising or making unsupported claims.

Practical Tips for Using Endorsements

Effectively utilizing an endorsement can provide significant advantages in establishing credibility and trust. Whether you are presenting it to a potential client or using it to secure a partnership, understanding how to apply such documents correctly is crucial for achieving positive outcomes. Below are some practical tips for ensuring the best results when leveraging these documents.

Best Practices for Using Endorsements

Follow these essential guidelines to maximize the impact of your endorsement:

| Tip | Description |

|---|---|

| Present the Endorsement Early | Offer the document at the beginning of your interactions to build trust immediately, setting a strong foundation for your professional relationship. |

| Be Selective with Recipients | Only share the endorsement with parties who will genuinely benefit from it. Target individuals or companies that value financial reliability. |

| Ensure Clarity and Relevance | Tailor the endorsement to address the specific needs of the recipient. Highlight relevant strengths that align with their objectives. |

| Follow Up Regularly | After providing the endorsement, follow up with recipients to gauge their response and reinforce the relationship. |

By following these tips, you can effectively use the endorsement to build stronger, more trusted relationships in your professional network.

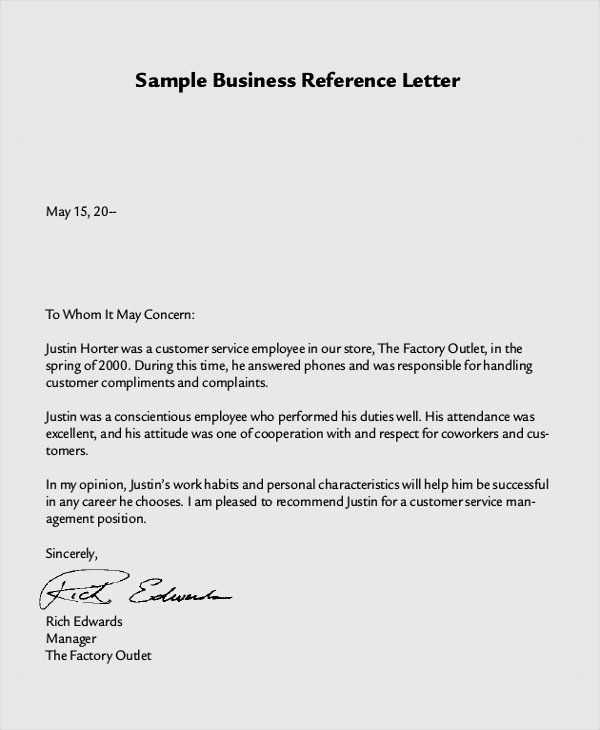

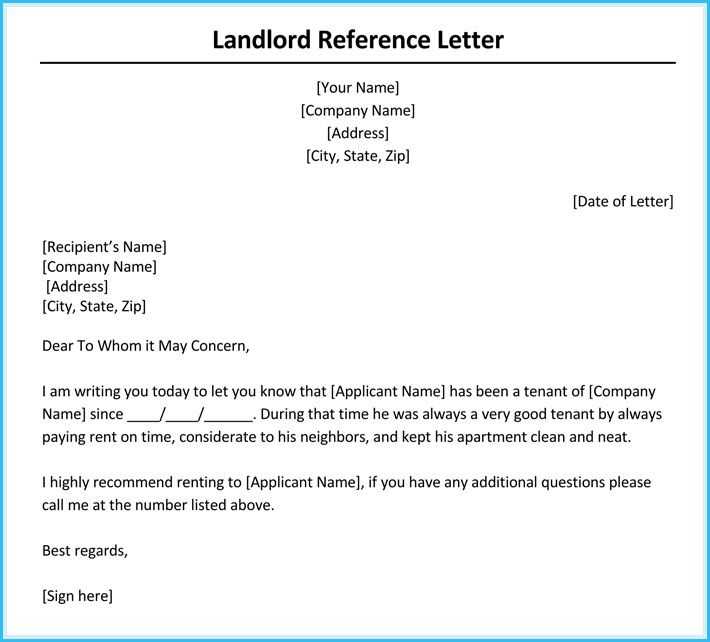

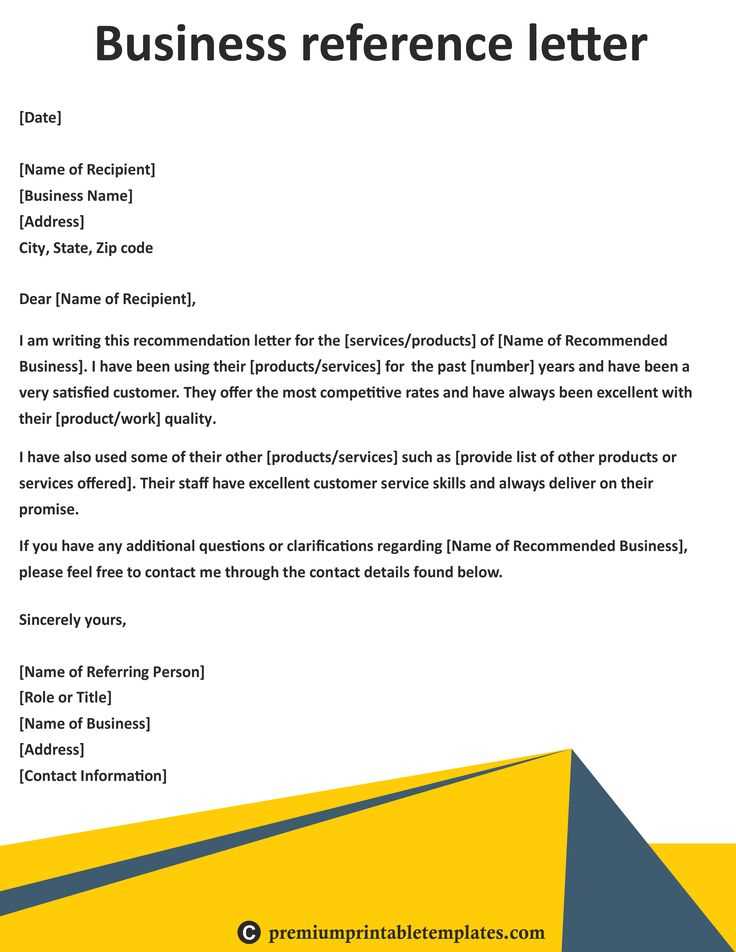

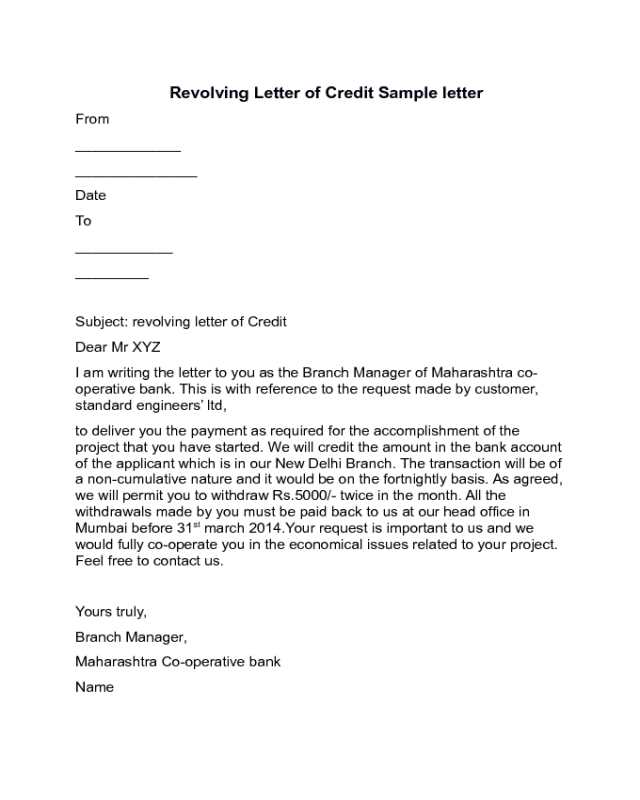

Example Template for Professional Endorsement

Creating a comprehensive and effective endorsement involves using a clear structure that highlights the key details. The following example offers a well-organized format that can be tailored for various professional needs. This structure ensures that the information is communicated effectively, making it easier for recipients to understand the strengths and reliability of the subject.

Sample Structure

Below is an example layout you can use when drafting an endorsement for a client or partner. This format covers the essential elements that make an endorsement clear and professional.

Introduction: Briefly introduce yourself and your relationship with the individual or company. Include details on how long you have known them and in what capacity.

Professional Overview: Highlight the subject’s key qualities, including their expertise, reliability, and work ethic. Provide specific examples that demonstrate their strengths.

Financial Responsibility: If applicable, mention the subject’s ability to meet financial obligations, showcasing their track record in managing payments or responsibilities.

Conclusion: Offer a strong recommendation based on the qualities and traits you’ve discussed. State your confidence in their ability to succeed and suggest further contact if needed.

Customized Example

Here’s a simplified version of what a completed endorsement might look like:

Dear [Recipient Name],

I am pleased to write in support of [Name/Company]. I have known [them] for [X] years, during which we have worked closely on several projects. Throughout our time together, I have found [Name/Company] to be highly professional, reliable, and dedicated. Their ability to manage tasks efficiently and uphold commitments has been a key factor in their continued success. I am confident that [they] will continue to perform with excellence in any future ventures. Please do not hesitate to contact me if you require any further information.

Sincerely,

[Your Name]