Letter of intent to purchase business template

Structure and Key Elements

A letter of intent (LOI) for purchasing a business outlines the preliminary terms between the buyer and the seller. It sets the foundation for the future purchase agreement and is crucial in ensuring that both parties are aligned before proceeding with formal negotiations. Below is a template for crafting an LOI that covers the necessary elements for a business purchase.

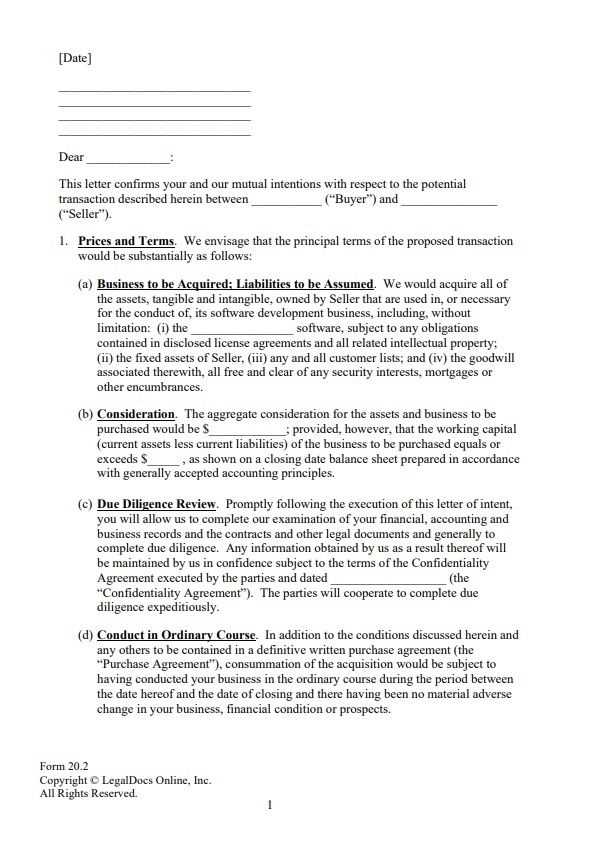

Basic Template for LOI

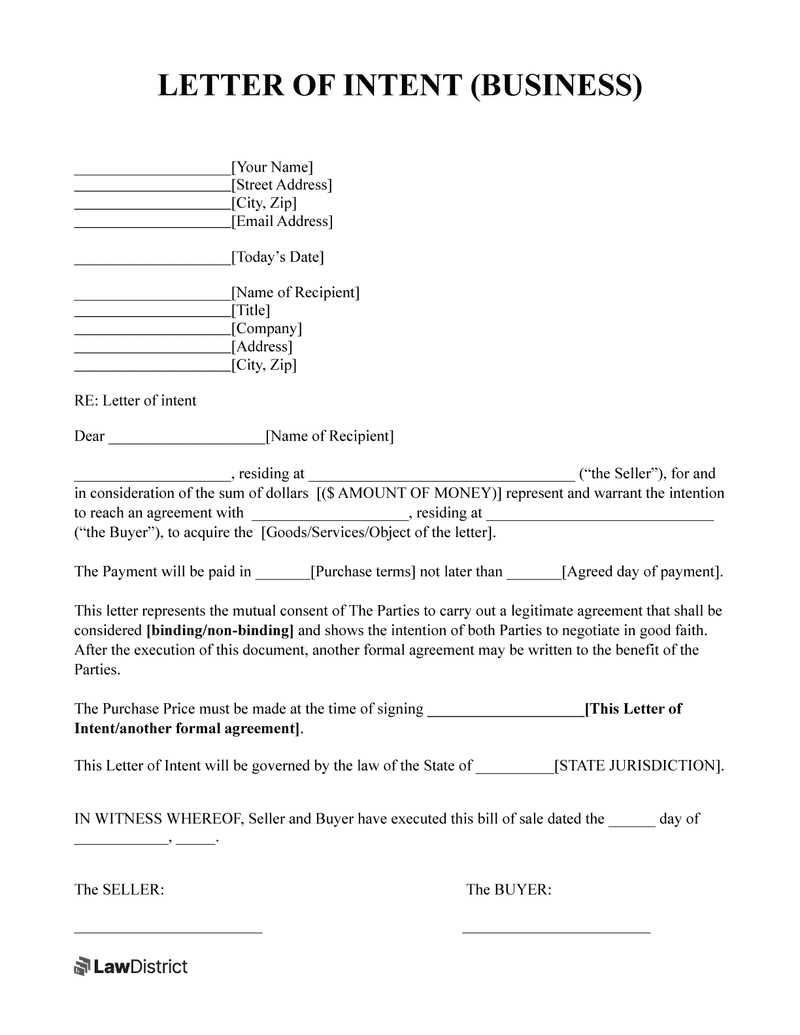

The structure of an LOI typically includes the following sections:

- Introduction: State the intent to purchase the business and introduce the parties involved (buyer and seller).

- Business Description: Provide a brief overview of the business being acquired, including its legal name, type of business, and location.

- Purchase Price: Specify the total purchase price and outline any payment terms, such as installments or lump sums.

- Due Diligence: Indicate a timeline for due diligence, allowing the buyer to assess the business’s financial health, liabilities, and operations.

- Contingencies: Include any conditions or contingencies that must be met before the deal can be finalized, such as financing approval or regulatory compliance.

- Confidentiality: Ensure both parties agree to maintain confidentiality regarding the terms of the deal and sensitive business information.

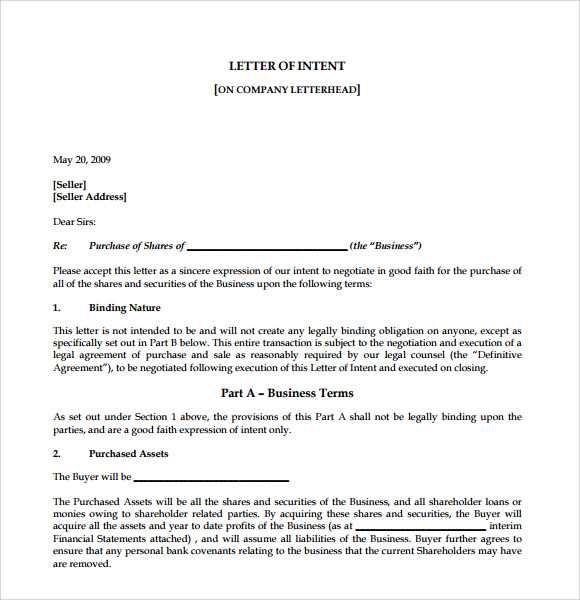

- Non-binding Nature: Clarify that the letter of intent is non-binding, meaning it is not a final commitment but a basis for future negotiations.

- Closing Timeline: Outline a timeline for completing the transaction, including key dates for signing agreements and finalizing payment.

- Legal Considerations: Include a statement about legal counsel and the intent to formalize the deal with a purchase agreement.

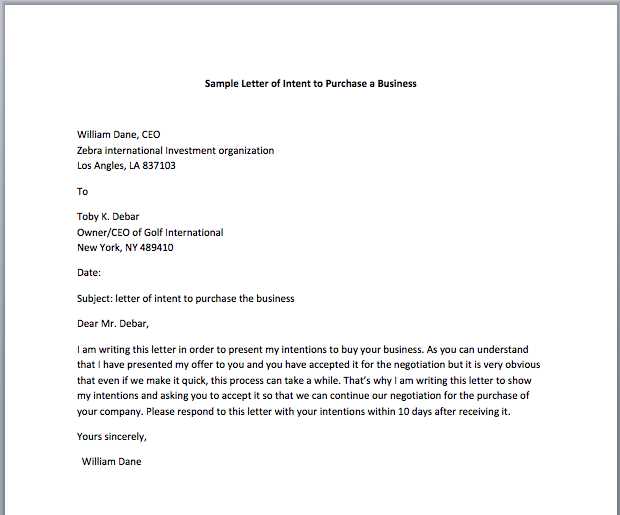

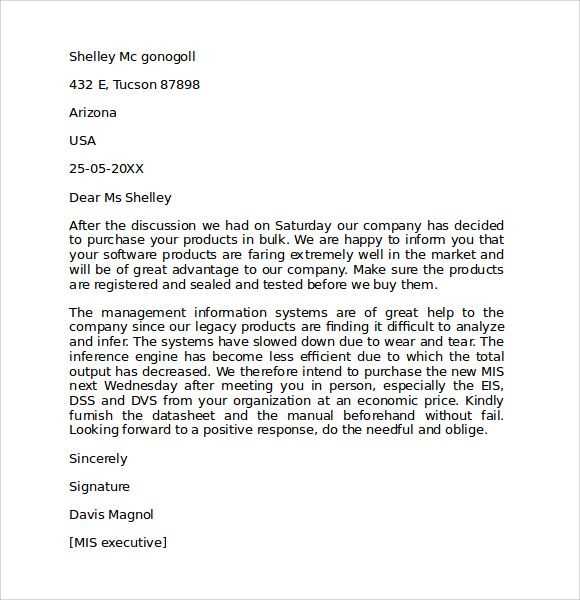

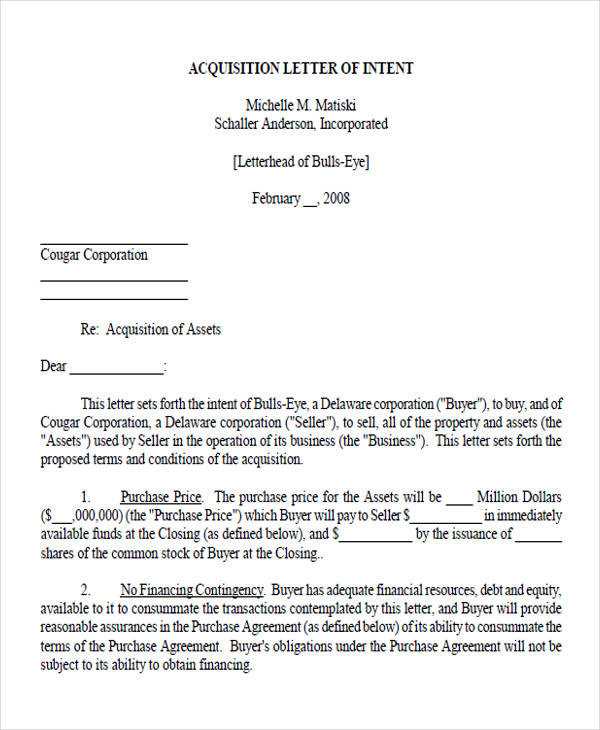

Sample Letter of Intent

Below is an example LOI template for reference:

LETTER OF INTENT

[Date]

[Buyer’s Full Name]

[Buyer’s Address]

[Seller’s Full Name]

[Seller’s Address]

Subject: Letter of Intent to Purchase [Business Name]

Dear [Seller’s Name],

This letter serves as an expression of intent by [Buyer’s Full Name] (“Buyer”) to purchase the business known as [Business Name] (“Seller”), located at [Business Location], on the terms set forth herein.

1. Purchase Price: The total purchase price for the business shall be [Amount], payable [terms of payment].

2. Due Diligence: Buyer will have [X] days from the date of this letter to conduct a due diligence review of the business. During this period, Seller agrees to provide access to financial records, operational data, and any other relevant documents.

3. Contingencies: This transaction is contingent upon Buyer securing financing and completion of due diligence. Additionally, the transaction must be approved by [relevant regulatory authority or board].

4. Confidentiality: Both parties agree to keep the details of this transaction confidential and will not disclose any information to third parties without prior written consent.

5. Closing: The parties anticipate that the closing of this transaction will occur on or before [closing date].

6. Non-binding Agreement: This letter of intent is non-binding and is intended only to outline the basic terms and conditions for further negotiation. A formal agreement will follow upon completion of the due diligence process and resolution of all contingencies.

We look forward to moving forward with this transaction and are confident that this purchase will be mutually beneficial for both parties.

Sincerely,

[Buyer’s Full Name]

[Buyer’s Contact Information]

[Seller’s Full Name]

[Seller’s Contact Information]

Conclusion

An LOI serves as a guidepost for the acquisition process, ensuring both parties are clear on the essential terms and conditions before finalizing the deal. Using this template helps avoid confusion and sets the stage for successful negotiations and closing.

Letter of Intent for Business Purchase Template

Key Elements of a Letter of Intent for Purchasing a Business

How to Structure Agreement Terms in a Letter of Intent

Negotiating Price and Payment Conditions in a Letter of Intent

Legal Considerations in a Letter of Intent for Purchase

Ensuring Confidentiality in a Business Acquisition Letter

Common Mistakes to Avoid When Writing a Letter of Intent

Clearly outline the intent to purchase a business, highlighting the terms and conditions that will guide the transaction. A well-structured letter of intent (LOI) acts as a preliminary agreement, signaling the buyer’s commitment while allowing for due diligence and negotiation. In your LOI, make sure to include specific details about the purchase price, payment terms, timelines, and responsibilities of each party. It should also address contingencies and conditions for finalizing the purchase.

The key elements in an LOI typically include: a description of the business being acquired, the agreed purchase price, and any conditions such as financing or regulatory approvals. Structure these details in clear sections for easy reference. Start by summarizing the deal’s objectives, followed by sections on the transaction timeline, deposit terms, and non-compete clauses. Be precise and direct in outlining any milestones or conditions that must be met for the deal to proceed.

When negotiating the price and payment terms, focus on flexibility and clarity. Specify whether the price is fixed or subject to adjustments based on performance or asset evaluations. The LOI should also detail the payment structure–whether it’s an upfront payment, installment plan, or a combination of both. Clarify any escrow arrangements or third-party involvement in the transaction process to avoid misunderstandings later.

Legal considerations are crucial in the LOI. Address potential liabilities, warranties, and indemnifications that could arise during the transaction. Specify which party will be responsible for certain legal costs, including due diligence, legal fees, and any potential regulatory compliance requirements. Be clear about any exclusivity clauses, which prevent either party from negotiating with others during the LOI period.

Confidentiality is another essential component in a business acquisition letter. Include clauses that protect sensitive business information from being disclosed to third parties. Ensure that the LOI explicitly states the duration of confidentiality and the consequences of any breaches, safeguarding both buyer and seller interests throughout the transaction.

Avoid common mistakes by staying concise and clear. Don’t overcomplicate terms or leave room for ambiguity in areas such as payment schedules or deliverables. Don’t neglect to include a provision for dispute resolution, as conflicts may arise even in the most well-structured agreements. Finally, ensure the document is reviewed by legal experts to confirm its enforceability and avoid future complications.