Letter of intent to sell a business template

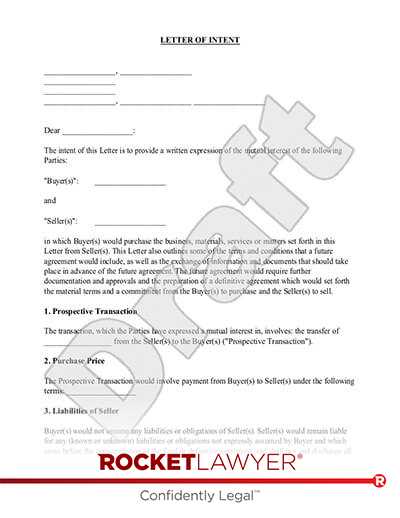

A Letter of Intent (LOI) to sell a business lays out the basic terms of a potential sale before final agreements are made. It serves as a framework for both the buyer and seller, ensuring that both parties understand the fundamental conditions that will guide the transaction. This document is a preliminary step that can help clarify expectations and avoid misunderstandings during the negotiation process.

Use the following template to structure a clear, professional, and concise LOI. The document should include key elements like the purchase price, payment terms, timeline, and any conditions that must be met before the sale proceeds. By setting these terms early, both sides can avoid wasting time on issues that could derail the deal later on.

Remember to consult with a legal professional to ensure the LOI is tailored to your specific transaction and meets all necessary legal requirements. This document is non-binding but serves as a foundation for more formal agreements down the line.

Here are the corrected lines:

Ensure your letter is clear and concise by focusing on the key terms. Replace vague language with specific details that define the terms of the sale, such as the agreed price, timeline, and contingencies. Provide a timeline for expected actions and a firm date for the closing. Highlight any terms that are subject to approval or further negotiation.

Make sure you specify any conditions that could affect the sale, such as regulatory approval or pending legal matters. Keep the tone professional, but avoid overcomplicating the language. Use simple terms to convey the purpose of the letter while including all necessary details without being overly detailed.

Remove unnecessary or redundant clauses that may confuse the reader. Stick to the facts and ensure the purpose of the letter is immediately clear. A well-structured letter should contain the offer details, agreement to negotiate further, and an expression of intent to proceed under defined terms.

Finally, avoid using ambiguous terms like “may” or “might.” Instead, state actions and expectations clearly to prevent misunderstandings. A letter of intent should be a straightforward document that outlines clear intentions for both parties moving forward.

- Letter of Intent to Sell a Business Template

A Letter of Intent (LOI) is a preliminary agreement that outlines the basic terms and conditions of a business sale. The template below provides a structured format to communicate your intent to sell, and helps both parties understand key details before moving into a formal agreement. Use this template as a guide, customizing it for your specific situation.

Template for Letter of Intent

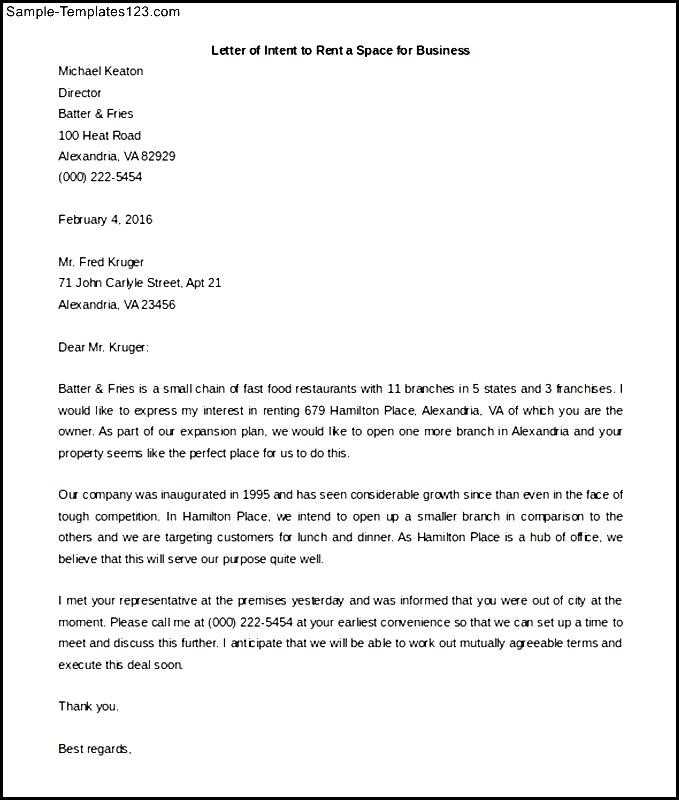

- Seller’s Information: Include the name, address, and contact details of the seller.

- Buyer’s Information: Provide the buyer’s name, address, and contact information.

- Overview of the Business: A brief description of the business being sold, including its name, type of business, and any other relevant details.

- Sale Price: Clearly state the price for the business and any terms of payment (e.g., lump sum or installment payments).

- Assets Included: Specify which assets are being sold, such as property, equipment, intellectual property, etc.

- Conditions of Sale: List any conditions that need to be met before the sale can proceed, such as financing or due diligence requirements.

- Timeline: Outline the expected timeline for the transaction, including key milestones and deadlines.

- Confidentiality Agreement: Mention any confidentiality agreements that both parties are expected to honor during the negotiation and transaction process.

- Legal Review: Note that both parties will have the opportunity to review the LOI with their respective legal counsel.

This template provides a clear starting point for negotiating the sale of your business. Ensure that all details are accurate, and consult with a legal expert to finalize the terms.

A letter of intent (LOI) serves as a formal indication of one party’s interest in entering into a business transaction with another. It outlines the basic terms and framework for negotiations, setting the stage for the final agreement. The purpose is to establish clarity between both parties before they proceed with detailed discussions or enter into legally binding contracts.

Clarifying Expectations

By defining the key elements of the deal–such as price, timeline, and conditions–the LOI helps prevent misunderstandings. It ensures both sides are on the same page regarding the broad outline of the transaction, giving them a shared understanding of what to expect moving forward.

Facilitating Negotiations

The LOI acts as a guide for further negotiations. It helps the parties focus on critical issues and avoid wasting time on matters that have already been agreed upon. It also allows for adjustments to be made if necessary before committing to a final contract.

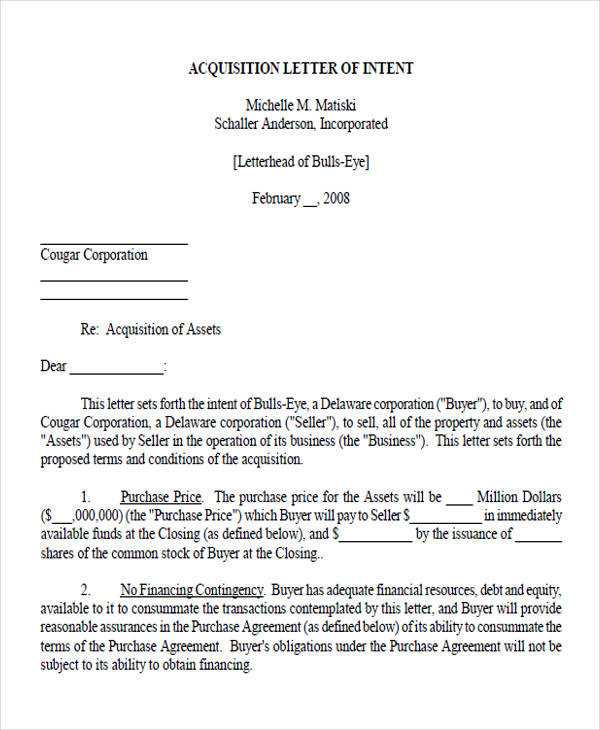

Include the legal names and addresses of both parties, clearly identifying the buyer and the seller. This establishes the foundation of the agreement. Specify the business being sold, detailing its assets and liabilities. Be transparent about any exclusions or specific items not part of the deal.

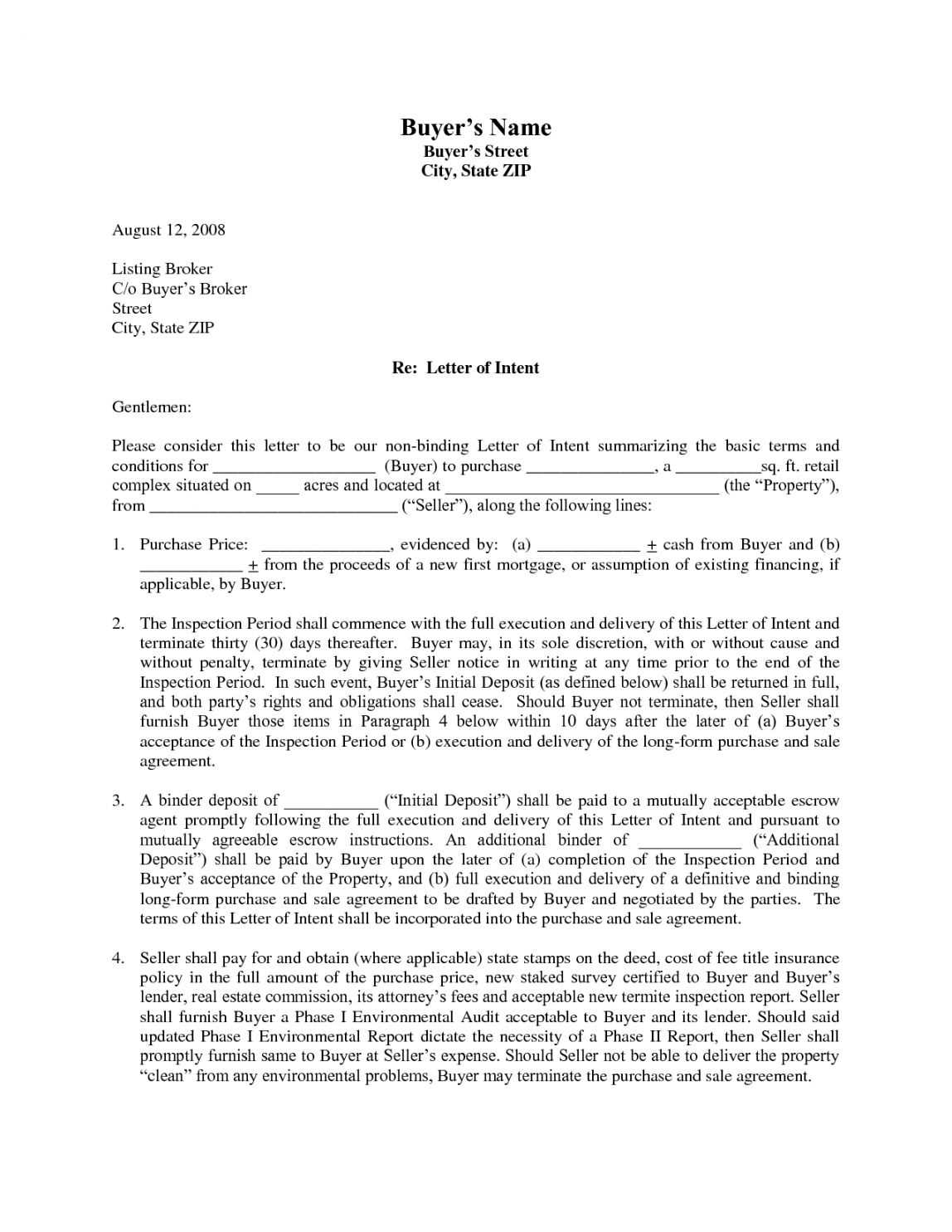

Transaction Terms

Clearly state the agreed-upon price and payment structure. Include how payments will be made, whether in installments, a lump sum, or other arrangements. Specify any adjustments to the price based on future circumstances, such as performance targets or inventory changes.

Timeline and Conditions

Outline the timeline for completing the transaction. Include key milestones, like due diligence and closing dates. If there are any contingencies, such as securing financing or regulatory approvals, make sure they are clearly defined.

Finally, clarify the intentions of both parties post-sale. Outline expectations regarding the seller’s involvement in the business after the transaction or if they will remain involved in any capacity. This helps set clear boundaries for both sides.

Begin with a clear definition of the parties involved. Specify the buyer and seller with full legal names and addresses. This establishes the framework for the agreement.

Key Terms and Conditions

Outline the main terms, such as the purchase price, payment structure, and any contingencies. Be specific about timelines for payment and the completion of due diligence. Detail how any adjustments to the price might occur based on further investigation into the business’s assets or liabilities.

Confidentiality and Non-Compete Clauses

Include provisions for confidentiality. The buyer should agree not to disclose any sensitive information during the process and after the transaction is completed. Consider adding a non-compete clause to prevent the seller from starting a similar business within a defined geographical area and timeframe.

Be sure to specify the legal remedies available if any terms are violated, making clear the process for resolving disputes.

Ensure the letter of intent (LOI) clearly defines the terms and obligations of both parties involved. This includes the price, payment structure, and timeline for the sale. A well-defined LOI sets the groundwork for the final agreement and reduces the risk of misunderstandings later on.

Clarify Confidentiality and Non-Compete Clauses

Include provisions for confidentiality and non-compete agreements. These clauses protect sensitive information shared during negotiations and prevent the seller from competing with the buyer after the sale. Clearly specify the duration and geographic scope of these restrictions to avoid future legal conflicts.

Outline the Conditions for Sale Completion

Detail the conditions that must be met before the sale can be completed, such as regulatory approvals, financing, or other specific requirements. Both parties should agree on what actions will be taken if these conditions are not fulfilled, ensuring a clear path forward if the deal falls through.

Focus on the following critical aspects during business negotiations to ensure clarity and mutual understanding between both parties:

| Negotiation Point | Recommendation |

|---|---|

| Sale Price | Agree on a fair price that reflects the business’s current value and future potential. Consider market conditions, assets, and any liabilities. |

| Payment Terms | Specify the payment structure: lump sum, installment payments, or a combination. Ensure both parties are clear on due dates and payment methods. |

| Transition Period | Determine the length of time for the seller to stay involved in the business after the sale, ensuring a smooth handover of operations. |

| Assets and Liabilities | Define which assets (e.g., property, equipment) and liabilities (e.g., debts, contracts) are included in the sale. |

| Confidentiality Agreements | Ensure that non-disclosure agreements are in place to protect sensitive business information during and after the sale process. |

| Post-Sale Non-Compete Clause | Agree on a non-compete clause, if applicable, to prevent the seller from starting or joining a competing business for a specified period. |

By addressing these points clearly, both parties can proceed with the transaction on solid ground and avoid misunderstandings during the negotiation process.

Clarity is key when drafting an intent letter. Avoid vague language that can lead to confusion. Be precise about the terms, conditions, and expectations.

- Overly Complex Language: Keep sentences simple and straightforward. Legal jargon or overly complex terms can make the letter harder to understand and create ambiguity.

- Vague Details: Ensure that you outline specific details like the sale price, payment terms, timelines, and key conditions. General statements like “reasonable terms” should be avoided.

- Lack of Timelines: Failing to include clear deadlines for each phase of the process can cause delays. Be explicit about key dates and milestones in the transaction process.

- Unclear Confidentiality Terms: It’s important to define the confidentiality agreement clearly. Not doing so might lead to misunderstandings about the sharing of sensitive information.

- Omitting Contingencies: Always mention any contingencies, such as approval from relevant authorities or securing financing, to prevent the letter from becoming legally binding prematurely.

- Failure to Outline Next Steps: Be specific about the actions expected from both parties after the letter is signed. Leaving this out can cause delays and confusion down the road.

By avoiding these mistakes, you can ensure that your intent letter communicates your intentions effectively and sets a solid foundation for the business sale process.

Ensure that all sections in the letter are clearly outlined and easy to read. Each point should be concise, stating the intention to sell, the business’s key details, and the proposed terms. Be direct about the expectations from both parties and the general timeline for the transaction. Leave no room for ambiguity.

Key Points to Include

Start with a formal greeting, followed by a brief introduction of the business being sold. Then, clearly state the selling price, how payments will be made, and any conditions related to the transfer of ownership. Include the business’s financial summary, assets included in the sale, and any liabilities that need to be addressed.

Finalize with Clear Next Steps

Conclude by indicating the expected timeline for both parties to finalize the sale. Set deadlines for the agreement’s next steps, and provide contact details for follow-up. Make sure both parties understand that the letter serves as an initial proposal, subject to negotiation and final agreement.