Letter of Intent to Sell Business Template

When planning a significant transfer of assets, it’s essential to establish clear communication between the parties involved. A formal agreement, outlining the fundamental terms of the deal, helps set expectations and ensures both sides are aligned before moving forward. This preliminary document plays a crucial role in defining the scope, terms, and obligations of each party.

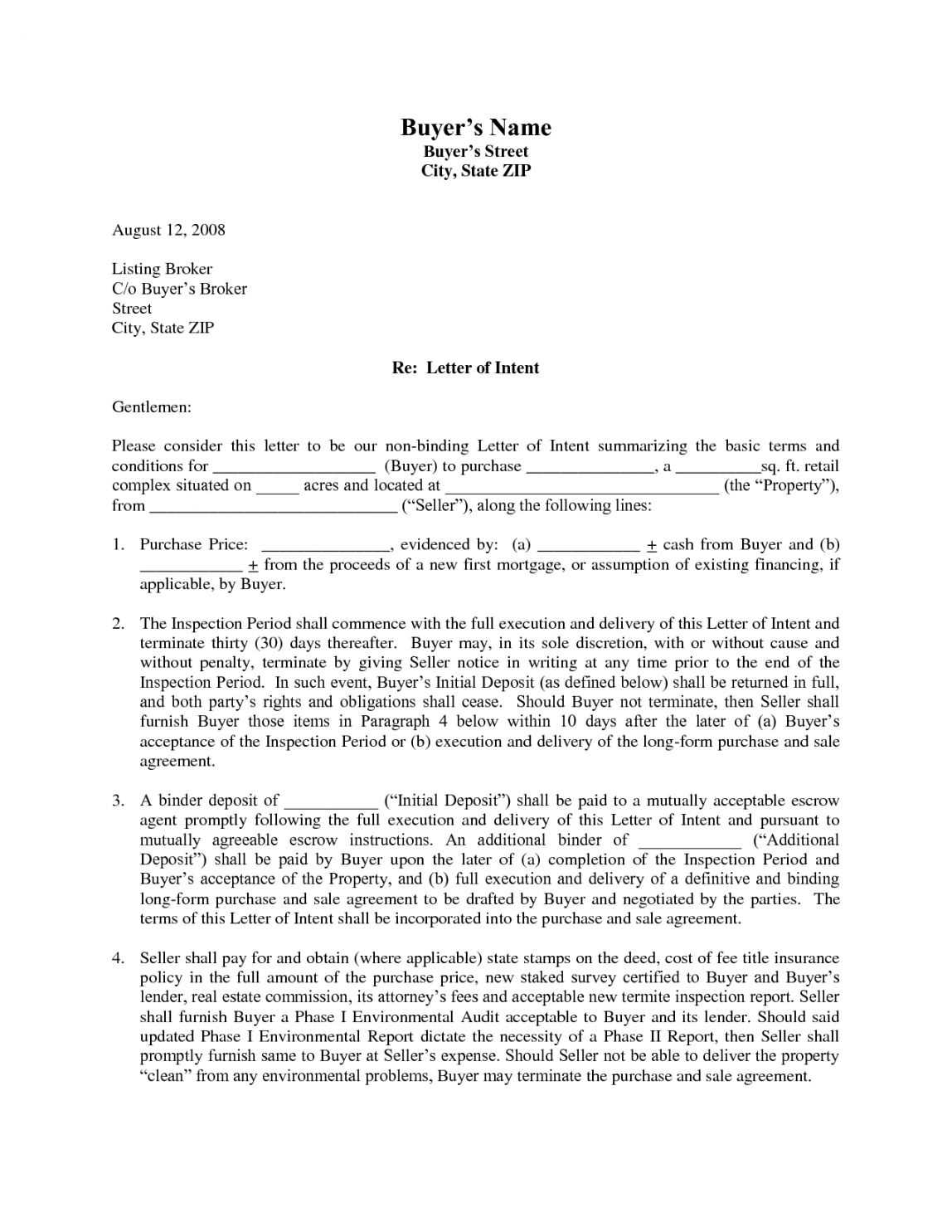

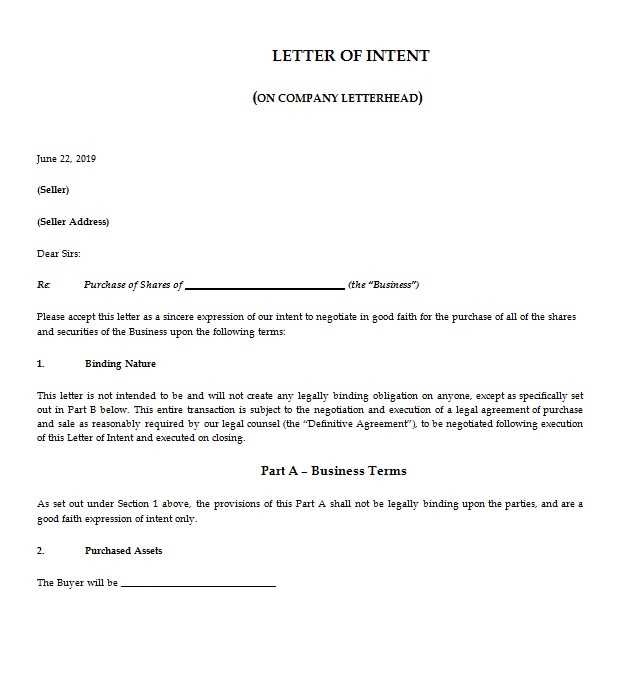

Creating a structured proposal provides a professional framework for discussions and sets the stage for negotiations. By laying out the key points of the transaction early on, you can avoid misunderstandings and clarify the intentions of both parties. This type of document is not legally binding, but it serves as a vital step in the process of reaching a final agreement.

Understanding the components of this document is crucial. It should address the main conditions of the deal, including pricing, deadlines, and any special considerations. Crafting such an agreement with care ensures that both the buyer and seller have a clear understanding of their roles and responsibilities throughout the negotiation process.

Letter of Intent Overview

In the context of significant transactions, having a preliminary agreement is essential for defining the initial terms and conditions between the parties involved. This document serves as a formal expression of the parties’ willingness to proceed with negotiations and establishes a foundation for further discussions. While it is not legally binding, it provides a clear structure and helps avoid potential misunderstandings during the process.

Key elements typically included in this type of document are:

- Overview of the deal and involved parties

- Basic terms and conditions to be negotiated

- Timeline for completing the agreement

- Outline of financial arrangements

- Confidentiality provisions if needed

This document serves as a roadmap, laying the groundwork for more detailed contracts and helping all parties understand the scope of the agreement. It is an important tool that can aid in building trust and establishing transparency, which are vital for successful negotiations.

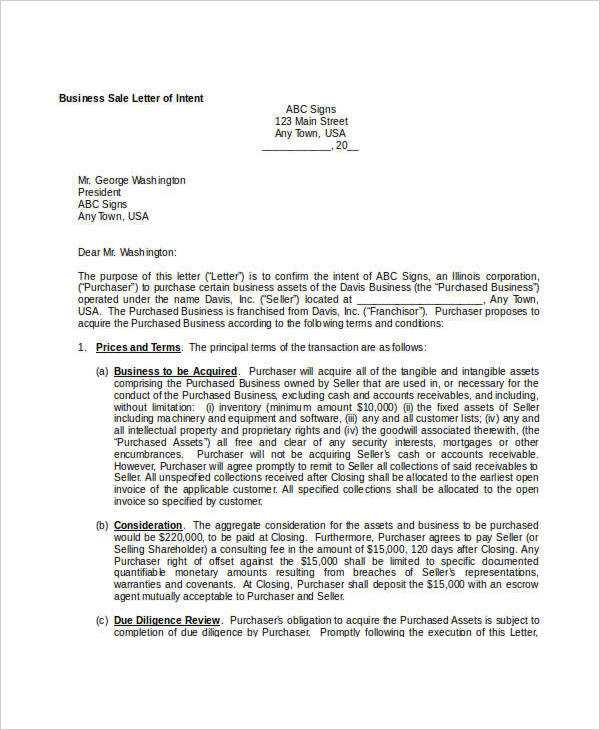

Key Elements of a Business Sale Agreement

When preparing a formal agreement for transferring ownership, it’s essential to clearly outline the terms that will govern the transaction. These elements define the rights and obligations of each party involved, ensuring that the deal is transparent and that expectations are aligned. By including specific details, you help prevent future disputes and set a solid foundation for finalizing the transfer.

Important Aspects to Consider

| Element | Description |

|---|---|

| Transaction Overview | A summary of the parties involved and the general scope of the deal. |

| Purchase Price | The agreed-upon amount to be paid, along with payment terms and schedule. |

| Assets Included | Detailed list of assets being transferred, including intellectual property, physical property, and any liabilities. |

| Timeline | The anticipated deadlines for completing each phase of the transaction. |

| Confidentiality | Provisions for protecting sensitive information throughout the process. |

| Dispute Resolution | The methods to resolve any conflicts that may arise between the parties. |

Additional Considerations

In some cases, it is also important to include clauses related to post-transaction involvement, such as transitional support or non-compete agreements. These provisions help maintain smooth operations during the ownership change and safeguard both parties’ interests.

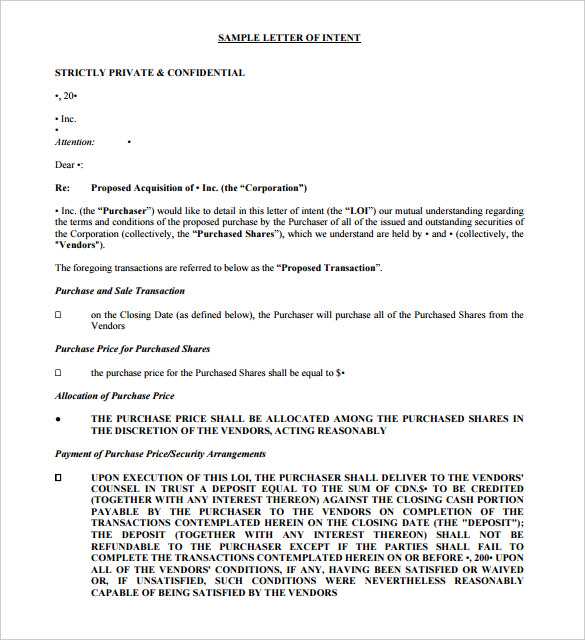

Why You Need an LOI for Selling

In any significant asset transfer, having a clear, formal statement outlining the terms of the arrangement is crucial. This document helps set the stage for negotiations and ensures that both parties are on the same page before proceeding further. By establishing the key elements of the deal early on, you can minimize risks and create a foundation for a smoother, more efficient transaction.

Establishing clarity from the outset prevents misunderstandings that could complicate the process later. This type of agreement clarifies each party’s responsibilities and sets expectations regarding timelines, payments, and conditions. Having these details in writing fosters trust and allows for more productive discussions.

Protecting both parties is another important reason for using such a document. By clearly defining the scope and nature of the transaction, you avoid potential legal disputes and ensure that both sides have a clear understanding of their roles and commitments. This initial framework can help in addressing any concerns before entering into binding contracts.

Steps to Draft a Letter of Intent

Creating a formal document outlining the key terms of a transaction is a critical step in any major transfer. It serves as a foundation for negotiations, ensuring that both parties are aligned before proceeding to a final agreement. While the document itself is non-binding, it provides a clear understanding of the deal’s parameters and establishes a framework for further discussions.

To draft this document effectively, follow these essential steps:

- Identify the Parties Involved: Clearly list all the individuals or entities participating in the transaction.

- Outline the Transaction Details: Describe the assets or rights being transferred, including any financial terms or conditions.

- Specify the Timeline: Provide an estimated timeline for completing the deal, including key deadlines.

- Include Confidentiality Clauses: If necessary, include terms for protecting sensitive information during negotiations.

- Address Potential Contingencies: Identify any conditions that must be met for the deal to proceed, such as financing or approvals.

- Clarify Next Steps: Outline the process following the agreement of the terms, including follow-up meetings or document reviews.

By following these steps, you can create a clear and professional document that sets the stage for successful negotiations and ensures all parties have a mutual understanding of the terms involved.

Common Mistakes to Avoid in LOIs

While drafting a preliminary agreement for any major transaction, there are several pitfalls to be aware of. Small errors or unclear language can lead to confusion, delays, or even disputes later in the process. Being mindful of these common mistakes can help ensure the document serves its intended purpose effectively and reduces the risk of complications down the road.

Vague Language is one of the most common issues. Without clear and precise terms, the document may create ambiguity, making it harder to negotiate and finalize the deal. Ensure every key element is well defined to avoid misunderstandings.

Skipping Legal Review is another critical mistake. Even if the document is non-binding, it is important to have it reviewed by legal professionals. They can ensure that all the necessary clauses are included and that the language adheres to legal standards, preventing potential issues in the future.

Ignoring Contingencies can lead to major problems if unexpected events arise. It’s essential to account for potential contingencies, such as financing or approval requirements, that could affect the success of the transaction.

Overcomplicating the Terms is another error to avoid. A letter should be clear and to the point, outlining the major aspects of the deal without unnecessary complexity. A document that is too detailed can confuse rather than clarify the terms.

Avoiding these common mistakes ensures that the document remains useful, clear, and sets a solid foundation for the negotiations that follow.

Legal Considerations When Selling a Business

When transferring ownership of a company, it’s essential to be aware of the legal implications that can arise throughout the process. Understanding and addressing these legal factors ensures a smooth transition and protects both parties involved from potential risks. Proper legal planning can prevent disputes and ensure compliance with relevant laws and regulations.

Due Diligence is a critical component of the transaction. Both parties must conduct thorough investigations to verify the value and condition of the assets, liabilities, and any outstanding legal issues. This step ensures that all information is accurate and that both sides are making informed decisions.

Contractual Obligations should also be considered carefully. Existing agreements with clients, suppliers, employees, and other stakeholders must be reviewed to determine if they are transferable or if new agreements need to be created. These obligations can affect the future of the company and need to be addressed in the final agreement.

Tax Implications play a significant role in the decision-making process. The structure of the transaction, whether it involves the transfer of assets or shares, can have different tax consequences for both the buyer and the seller. It’s essential to seek expert advice on tax planning to minimize liabilities.

Intellectual Property Rights must also be carefully addressed. If intellectual property, such as trademarks, patents, or copyrights, is part of the deal, proper transfer procedures must be followed to ensure the buyer acquires all necessary rights.

By considering these key legal factors, both parties can proceed with confidence, knowing they have addressed potential legal concerns that could affect the success of the transaction.

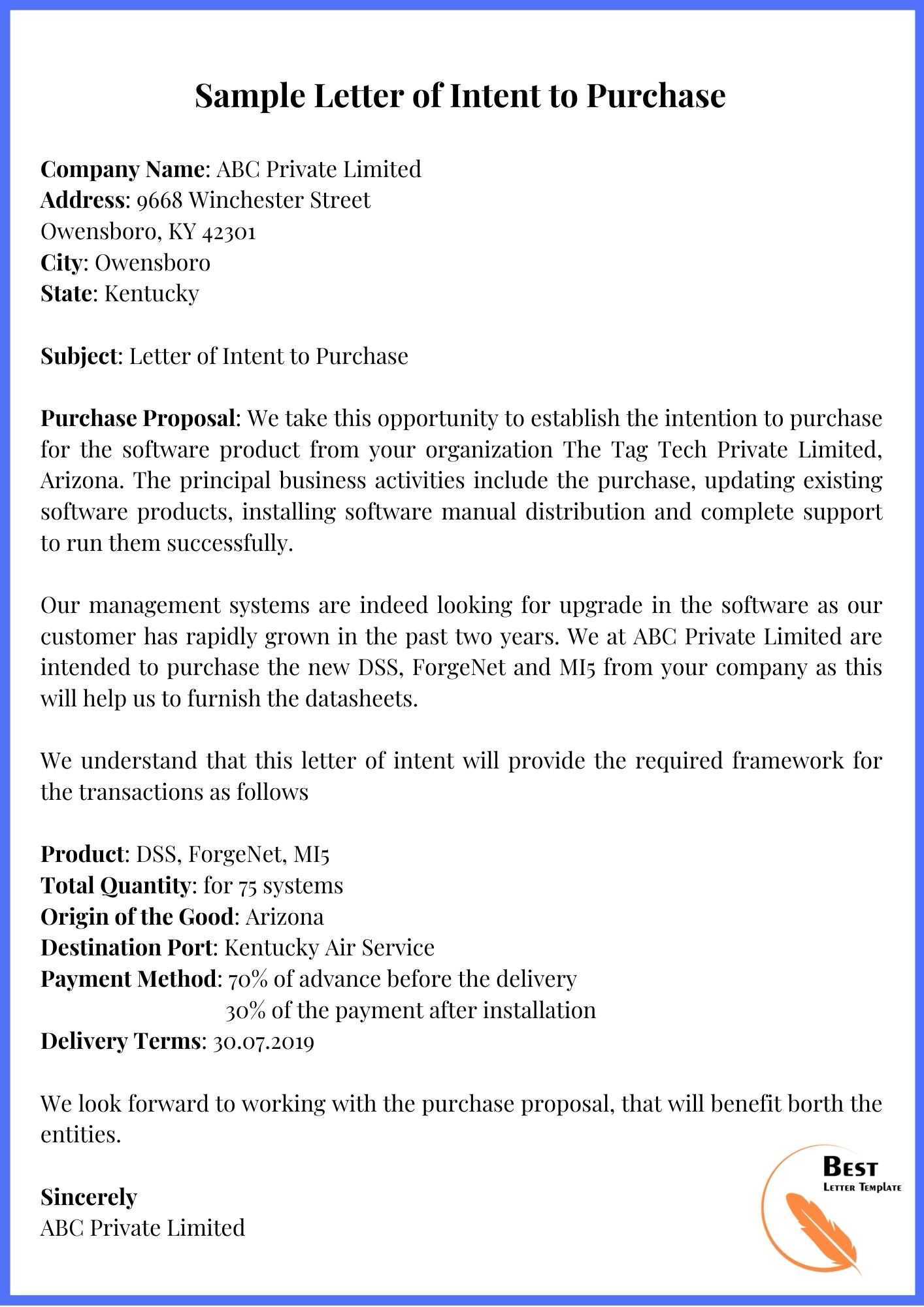

How to Use an LOI Template Effectively

Using a standardized document for outlining the terms of a potential deal can be a useful tool, but it’s important to understand how to customize it properly. A well-crafted document provides structure and clarity, but it must be tailored to fit the specific details of the transaction to ensure accuracy and relevance. Following the proper steps ensures that the document reflects the intentions of both parties and serves its intended purpose.

Steps for Effective Use

- Review the Structure: Understand the key sections of the document, such as the parties involved, transaction terms, and timelines. These should be aligned with the specifics of your deal.

- Customize the Content: Modify the generic clauses to suit your unique circumstances, ensuring that they reflect the specifics of the transaction you are pursuing.

- Clarify Terms and Conditions: Be sure that all critical terms are clearly defined. This includes the pricing, payment terms, and any conditions that need to be met before the deal can proceed.

- Seek Legal Review: Before finalizing, have a legal expert review the document to ensure compliance with local laws and that all necessary provisions are included.

- Negotiate Flexibility: The document should allow for some flexibility in case unforeseen changes arise during the negotiation process. Ensure there are provisions for amending the agreement if needed.

Benefits of Using a Template

- Consistency: A template ensures that essential elements are not overlooked, offering consistency across different agreements.

- Time-Saving: Templates streamline the process by providing a ready-made structure, reducing the time spent drafting from scratch.

- Professionalism: Using a formalized structure enhances the professional appearance of the document, which can help build trust with the other party.

By following these steps and customizing the document appropriately, you can effectively use the template to facilitate clear and efficient negotiations, ensuring that both parties are on the same page before proceeding further.