Template for Writing a Letter to Close Business Bank Account

When it comes time to sever ties with a financial institution, it is important to communicate the decision clearly and professionally. The process often requires formal documentation to ensure all necessary steps are followed and both parties are informed. Crafting a precise and courteous message is key to a smooth transition.

Understanding the proper format for your communication will help in preventing any confusion. Knowing what information to include ensures that your request is processed quickly and efficiently. Whether you are handling it personally or through a representative, keeping your message to the point will facilitate a smoother process.

Commonly overlooked details such as account balances, outstanding transactions, or fees need to be addressed in the message. By doing so, you can avoid delays or misunderstandings. This guide offers insights into how to approach this task with confidence and clarity, ensuring your message meets the necessary standards.

Essential Steps to Close Your Business Account

When you decide to end your relationship with a financial institution, it is important to follow a series of steps to ensure a smooth and complete process. Each step must be executed carefully to avoid any issues that may arise in the future. A clear plan of action will help you manage all necessary tasks effectively.

Review Your Obligations before taking any further steps. Make sure there are no outstanding payments or fees left to settle. This includes checking if any pending transactions need to be finalized or refunded. Failing to do this can lead to complications or unnecessary charges.

Notify the Institution in a formal manner once you have completed all necessary checks. Providing them with adequate notice will allow them to process your request accordingly. Be sure to confirm that all necessary paperwork is filed and that your request is being handled promptly.

Finally, it is important to request confirmation once the process is complete. A written statement from the institution confirming that all steps have been taken will provide peace of mind and protect you from any future discrepancies. Keeping a record of this confirmation is a wise precaution.

How to Write a Professional Closure Letter

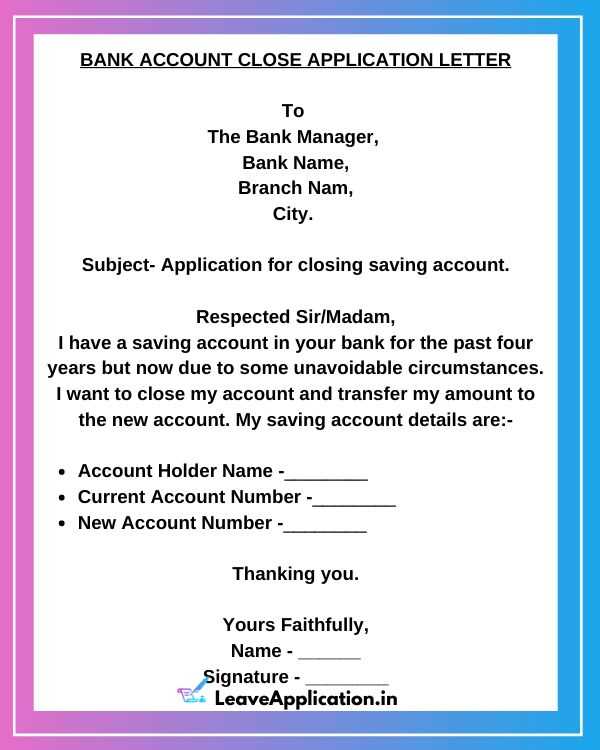

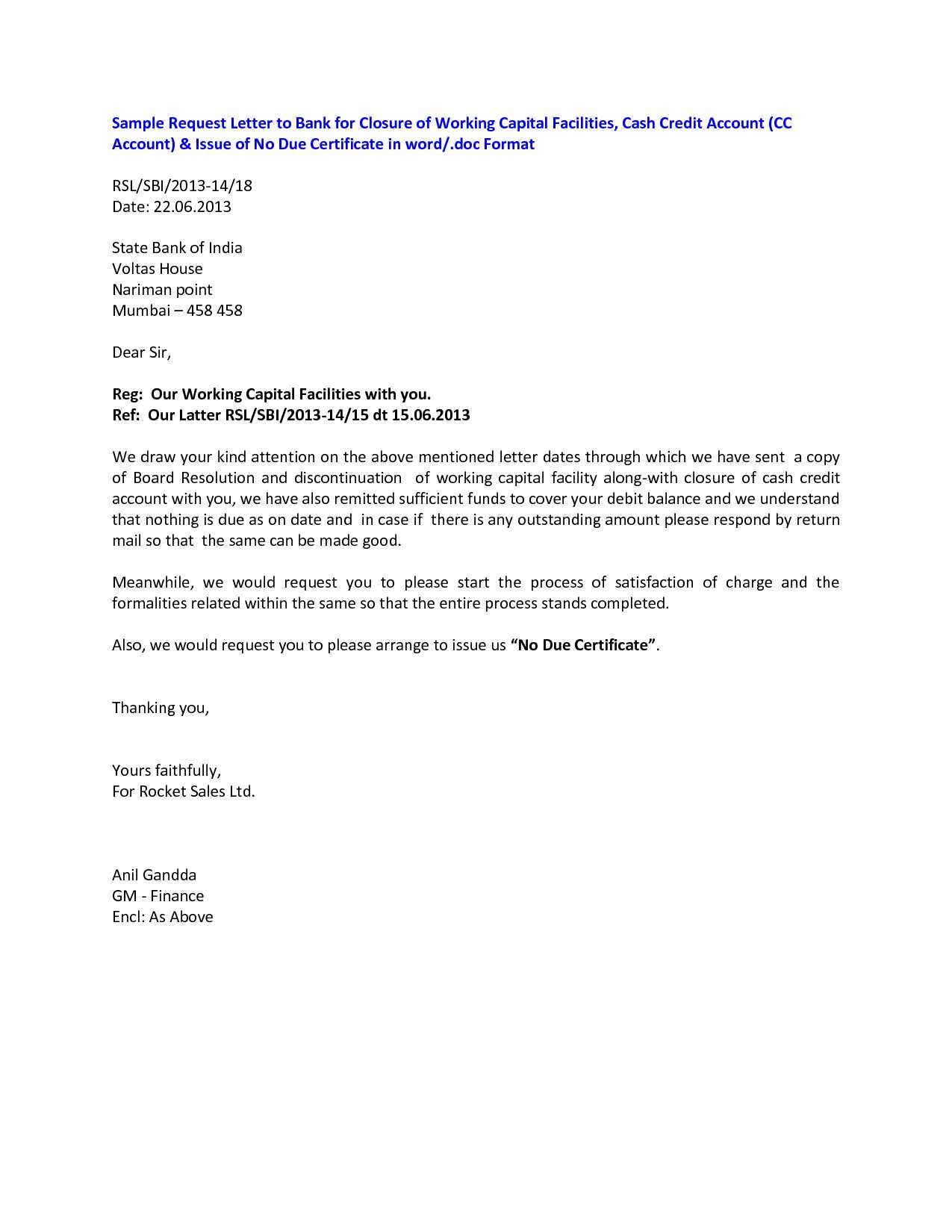

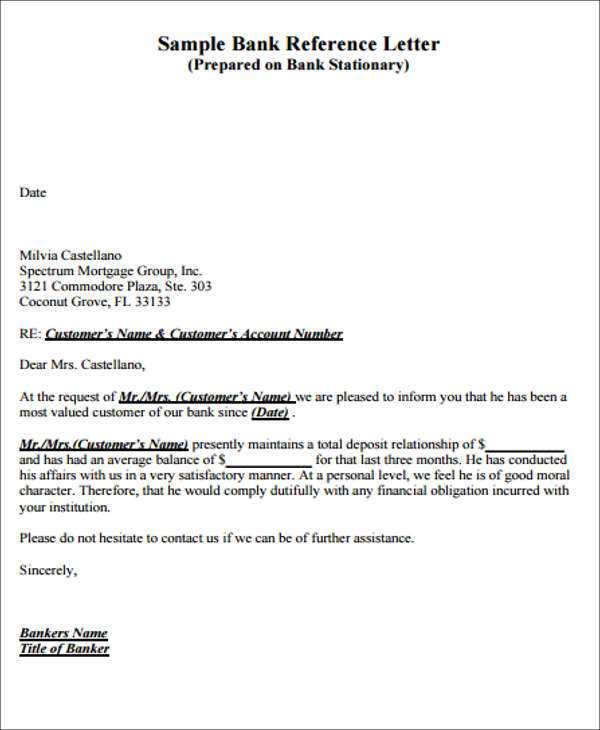

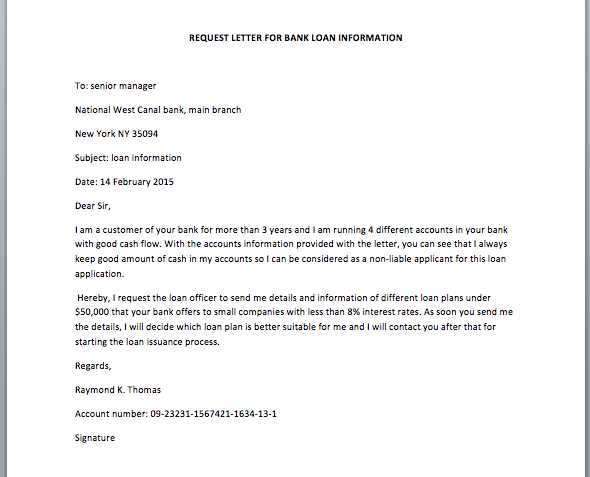

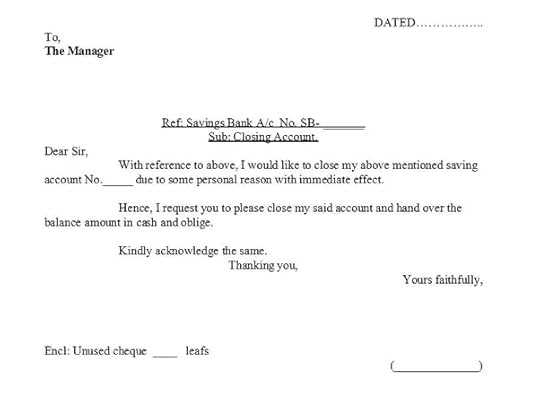

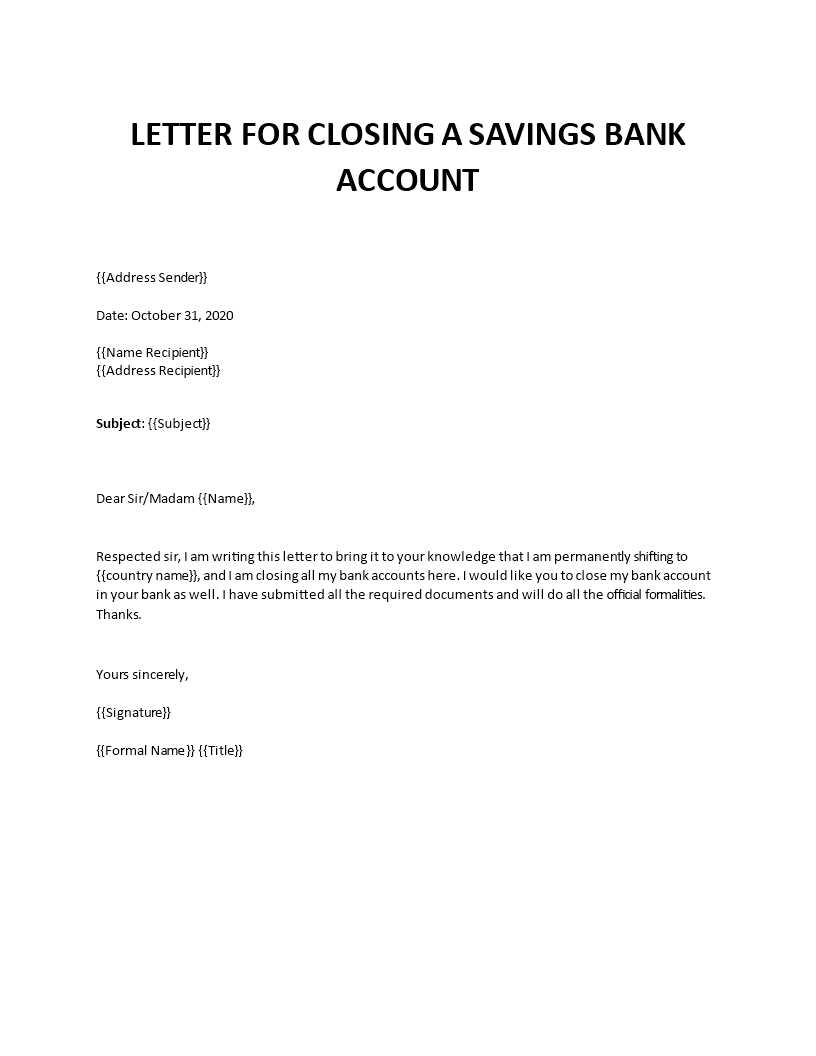

When it comes to formally ending your relationship with a financial institution, it is essential to compose a document that is clear, respectful, and precise. A well-written message ensures that all necessary details are addressed, and the process is executed smoothly without any misunderstandings.

Key Points to Include

- Account Details: Mention relevant information like account numbers or identification numbers to avoid any confusion.

- Reason for Termination: State the reason for your request, though this is optional and can be brief.

- Request for Confirmation: Ask the institution to provide written confirmation once the process is complete.

- Outstanding Transactions: Ensure all pending transactions are resolved before requesting the termination.

Maintaining Professional Tone

Even if you are terminating services, it is crucial to keep your message polite and professional. Maintain a respectful tone throughout the correspondence, as it can have an impact on the institution’s willingness to assist you promptly. A courteous closing, such as “Thank you for your attention to this matter,” will leave a positive impression.

Understanding Bank Account Termination Procedures

Ending a financial service requires careful attention to various steps to ensure a smooth and effective transition. Financial institutions typically have specific procedures that must be followed to officially complete the termination. Being aware of these steps can help avoid unnecessary delays or complications.

Key Steps to Follow

- Check for Pending Transactions: Make sure no payments or deposits are pending before making a formal request to end the service.

- Settle Any Fees or Balances: Ensure all outstanding fees or balances are cleared to avoid any issues once the relationship is terminated.

- Provide Necessary Documentation: The institution may require you to fill out specific forms or submit additional documentation to finalize the process.

Confirming the Termination

After initiating the termination request, it is essential to obtain confirmation from the institution that all procedures have been completed. This ensures that the service has been officially ended and prevents future confusion or charges. Keep a copy of this confirmation for your records as proof of the action taken.

Key Elements to Include in Your Letter

When composing a formal request to terminate your relationship with a financial institution, certain elements must be included to ensure that your request is processed efficiently. Providing the correct information allows the institution to handle your request promptly and accurately.

| Element | Description |

|---|---|

| Account Identification | Include any reference numbers or account IDs associated with your service. |

| Reason for Request | While optional, stating why you are ending the service can help clarify your intentions. |

| Outstanding Transactions | Note if there are any pending transactions that need to be resolved before the termination. |

| Request for Confirmation | Ask for written confirmation once the process has been completed. |

| Contact Information | Ensure your contact details are up-to-date so the institution can reach you if needed. |

Including these essential components will help you maintain clarity and ensure that the institution can efficiently process your request to end the service without unnecessary delays.

Common Mistakes When Closing a Business Account

While ending a financial relationship can seem like a straightforward task, many people overlook important details that can lead to complications. These mistakes can delay the process, incur additional fees, or result in unresolved issues. Being aware of these common pitfalls can help ensure the process goes smoothly and without surprises.

Neglecting Outstanding Transactions

One of the most common mistakes is not checking for pending transactions. If there are payments, deposits, or transfers that are not yet processed, they could complicate the termination process. Always ensure that all transactions are completed or canceled before moving forward with the request.

Forgetting to Request Confirmation

Another frequent error is failing to request formal confirmation of the termination. Without this confirmation, you might be unaware if there were any issues or if the service has been fully ended. Always request a written statement to ensure everything is finalized and to avoid future discrepancies.