609 credit letter template

If you need to create a 609 credit letter, focus on crafting a clear and concise message. A well-structured letter can help dispute inaccurate or outdated information on your credit report. Start by addressing the credit reporting agency directly and provide all necessary details for easy reference. Use specific language to point out any discrepancies, and include supporting documents as evidence. Make sure your tone is polite but firm.

Begin with your full name, address, and contact details at the top of the letter. Specify the item(s) on your credit report that are being disputed, including any account numbers or dates. Be precise about why these entries are incorrect or outdated. The credit agency should be able to identify and investigate the issue quickly based on your information.

Highlight key facts and be sure to mention the specific action you expect from them–such as removing the incorrect information or updating their records. You may also reference the Fair Credit Reporting Act (FCRA) to remind them of their legal obligations. Lastly, end the letter by requesting written confirmation of their receipt of your dispute, as well as any outcomes or updates regarding the issue.

Keep the tone professional throughout and avoid unnecessary details. Make sure you keep copies of all communication for your records. A well-written 609 letter can be an effective tool in maintaining an accurate credit report and addressing errors directly.

Here’s the revised version with word repetitions reduced, while preserving the original meaning and structure:

To begin with, the credit letter should maintain a clear and concise tone. Avoid using unnecessary phrases or redundant terms. Ensure the content is straight to the point, focusing on the key elements such as the credit amount, terms, and any relevant conditions.

Make sure to clearly state the applicant’s information, including their full name, contact details, and the purpose for which the credit is being requested. This helps set a professional and organized tone right from the start.

Follow with a brief mention of the reason for the credit request. Ensure the information provided is factual and avoids repetition. The more specific the details, the better the impression it creates. Next, outline the repayment terms, including the duration and any other important stipulations related to the credit. These should be clear and non-ambiguous.

Conclude the letter with a call to action, directing the recipient on the next steps. This might include contact information or further instructions related to the approval process.

By keeping the language direct and streamlined, the letter becomes more effective and maintains professionalism throughout.

HTML Outline for “609 Credit Letter Template”

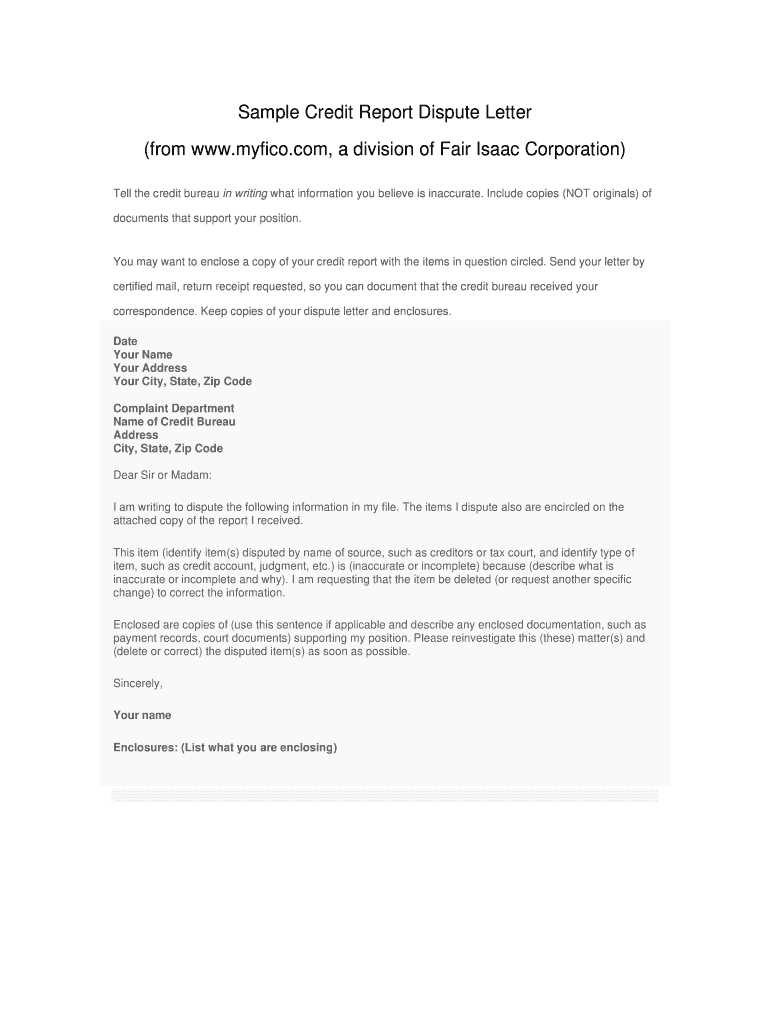

Creating an organized structure for a 609 credit letter template simplifies the process of drafting the letter while ensuring all necessary components are included. Below is an outline that helps in crafting a clear and actionable credit dispute letter under section 609 of the Fair Credit Reporting Act (FCRA).

- Letter Header

- Include your name, address, and contact details at the top left corner.

- Below, add the recipient’s name, address, and relevant department (e.g., credit bureau or lender).

- Subject Line

- State the purpose of the letter clearly, such as “Disputing Inaccurate Credit Report Entries” or “609 Dispute Letter.”

- Salutation

- Use a formal greeting, such as “Dear Sir/Madam” or “To Whom It May Concern.”

- Opening Paragraph

- State your intent to dispute specific information on your credit report under section 609 of the FCRA.

- Provide your full name, address, date of birth, and Social Security Number to help identify your file.

- Detailed Dispute Information

- List each item you are disputing, including account numbers and specific inaccuracies.

- Provide supporting evidence, such as copies of documents or statements, proving the error or inaccuracy.

- Request for Action

- Clearly request the correction or removal of inaccurate information from your credit report.

- Refer to your rights under section 609, specifying that the credit bureau must investigate the dispute.

- Closing Paragraph

- Reiterate your request for a prompt resolution and mention that you look forward to receiving the corrected credit report.

- Thank the recipient for their attention to this matter.

- Signature

- Include your signature (if sending by mail) and your printed name below.

- If submitting electronically, provide a typed name with an option to digitally sign the letter.

By following this outline, you can create a professional and direct 609 credit letter that addresses inaccuracies effectively and clearly communicates your dispute.

Featuring 6 concise, practical headings focusing on key areas:

1. Clear Structure and Formatting

Start with a concise introduction that outlines the purpose of the letter. Use bullet points or numbered lists to highlight key details such as amounts, dates, and terms. Keep your sentences short and direct, ensuring readability for all parties involved.

2. Legal Language and Terms

Incorporate standard legal terminology. Terms like “debtor,” “creditor,” and “guarantor” should be used clearly. Avoid ambiguity to reduce misunderstandings and ensure the letter stands up in case of disputes.

3. Clear Payment Terms

Specify the repayment schedule and conditions. Mention exact due dates, installment amounts, and any interest charges or penalties for late payments. This avoids confusion and sets clear expectations for both parties.

4. Risk and Liability Clauses

Include terms that define the lender’s rights if the debtor defaults. Clarify any steps the creditor may take, such as pursuing legal action or claiming collateral. Make sure both parties fully understand the risks.

5. Professional Tone and Language

Maintain a formal, professional tone throughout the letter. Avoid using overly complex language, but ensure the tone remains serious to emphasize the legal significance of the letter.

6. Signature and Acknowledgement

End the letter with space for both parties’ signatures. Include a statement confirming that both parties acknowledge the terms and agree to abide by them. This serves as a clear, binding agreement.

- Overview of a 609 Credit Letter

A 609 credit letter is a formal request aimed at removing inaccurate or unverifiable information from your credit report. It refers to Section 609 of the Fair Credit Reporting Act (FCRA), which provides the consumer the right to dispute any credit report entries that cannot be substantiated with proper documentation. The letter is often used to challenge negative marks, such as late payments or defaults, that may not be accurate or substantiated by the creditor.

Key Components of a 609 Credit Letter

The letter should clearly identify the disputed information, specifying which items on the credit report are being contested. Include a request for the creditor or credit reporting agency to provide proof of the validity of the disputed items. If no such proof exists, the entry should be removed from your report. Ensure you provide all necessary personal information, including your full name, address, and social security number, to help identify your file accurately.

Best Practices for Writing a 609 Credit Letter

Be concise and professional. Avoid including unnecessary personal details or emotional language. Attach copies of any relevant documents that support your claim, such as payment receipts or correspondence with creditors. It is also advisable to send the letter via certified mail with return receipt requested to ensure you have a record of communication. Keep copies of everything you send and receive during the dispute process.

Begin with a clear and concise request for the removal of inaccurate or unverifiable information from your credit report. Make sure to specify the items you want investigated and include a timeline for when you expect a response.

Key Details to Include:

Provide your full name, address, date of birth, and the last four digits of your Social Security Number. This will help the credit bureaus locate your records and verify your identity efficiently.

Sample Table of Information

| Component | Description |

|---|---|

| Request for Removal | Specify the inaccurate items and request their removal. |

| Personal Information | Include your name, address, DOB, and last four digits of SSN for verification. |

| Supporting Documentation | Attach proof of your claims, such as receipts, statements, or court documents. |

Incorporate any supporting documents that validate your claims, such as statements from creditors, legal notices, or proof of payment. These documents help strengthen your case and provide clear evidence to support your dispute.

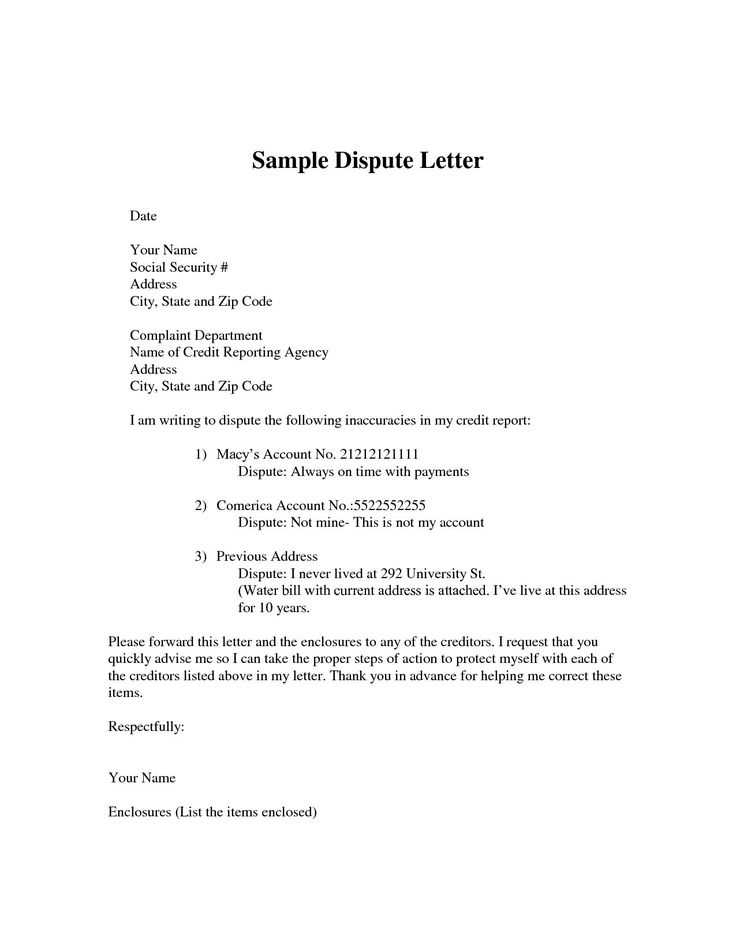

Begin your 609 credit letter by clearly stating your request. Specify that you are exercising your rights under the Fair Credit Reporting Act (FCRA) to dispute inaccurate or outdated information on your credit report. Address your letter to the credit bureau or creditor directly, using their correct contact details.

Step 1: Include Your Personal Information

At the top of the letter, include your full name, address, date of birth, and social security number (or the last four digits) for identification. This will help the credit bureau quickly locate your file.

Step 2: Identify the Discrepancy

List the specific item(s) on your credit report that you are disputing. Include the account number, the name of the creditor, and the nature of the error. Be concise and precise in pointing out the discrepancy, referencing the exact information from your credit report.

Step 3: State Your Dispute

Clearly explain why the information is incorrect. For example, if you have paid a debt that still appears as unpaid, state the date of the payment and include any supporting documentation, like a receipt or bank statement. If the information is outdated, mention the date it should have been removed according to the reporting guidelines.

Step 4: Request for Action

Request that the credit bureau or creditor investigates and removes or corrects the inaccurate information. Be direct about your expectations and the importance of resolving the issue promptly.

Step 5: Close with Your Contact Information

Finish by thanking the recipient for their attention to the matter. Provide your phone number or email address in case they need additional information to process your dispute.

End the letter with a polite closing, and remember to keep a copy of the letter for your records.

Do not use vague or generalized language. Be clear about the inaccuracies you are disputing. Avoid stating things like “I think this is wrong,” and instead, specify the exact entries that are inaccurate and why they should be removed.

Failing to Include Documentation

Always attach supporting evidence. Whether it’s a bank statement, a court order, or other relevant documents, failure to provide proof weakens your case. Ensure that the evidence aligns with the information you’re disputing.

Ignoring the Debt’s Status

Be mindful of the status of the debt you’re addressing. If the debt is already paid off or settled, mention that clearly. Don’t dispute information that has been resolved or clarified already.

Do not send multiple letters for the same issue. Sending more than one 609 letter for the same dispute can confuse the credit bureau and delay the process. Stick to a single submission per issue.

Check the status of your dispute regularly through the credit bureau or the entity you’re dealing with. Most organizations offer online tracking, so make sure to log in to your account to view any updates. If you’re using a credit letter template for dispute resolution, keep track of the response dates and any correspondence related to your claim.

Set reminders to follow up if you haven’t received a response within the expected timeframe. If you’re not getting updates, consider reaching out to customer service directly. Be concise when explaining your issue to get a quicker response.

Document all interactions regarding your dispute. Keep a record of emails, letters, and phone calls to refer to in case of any discrepancies. This will help you stay organized and ready to escalate the issue if necessary.

Check for any changes on your credit report once the dispute is resolved. If the issue hasn’t been addressed as agreed, consider submitting a follow-up dispute or seeking legal advice.

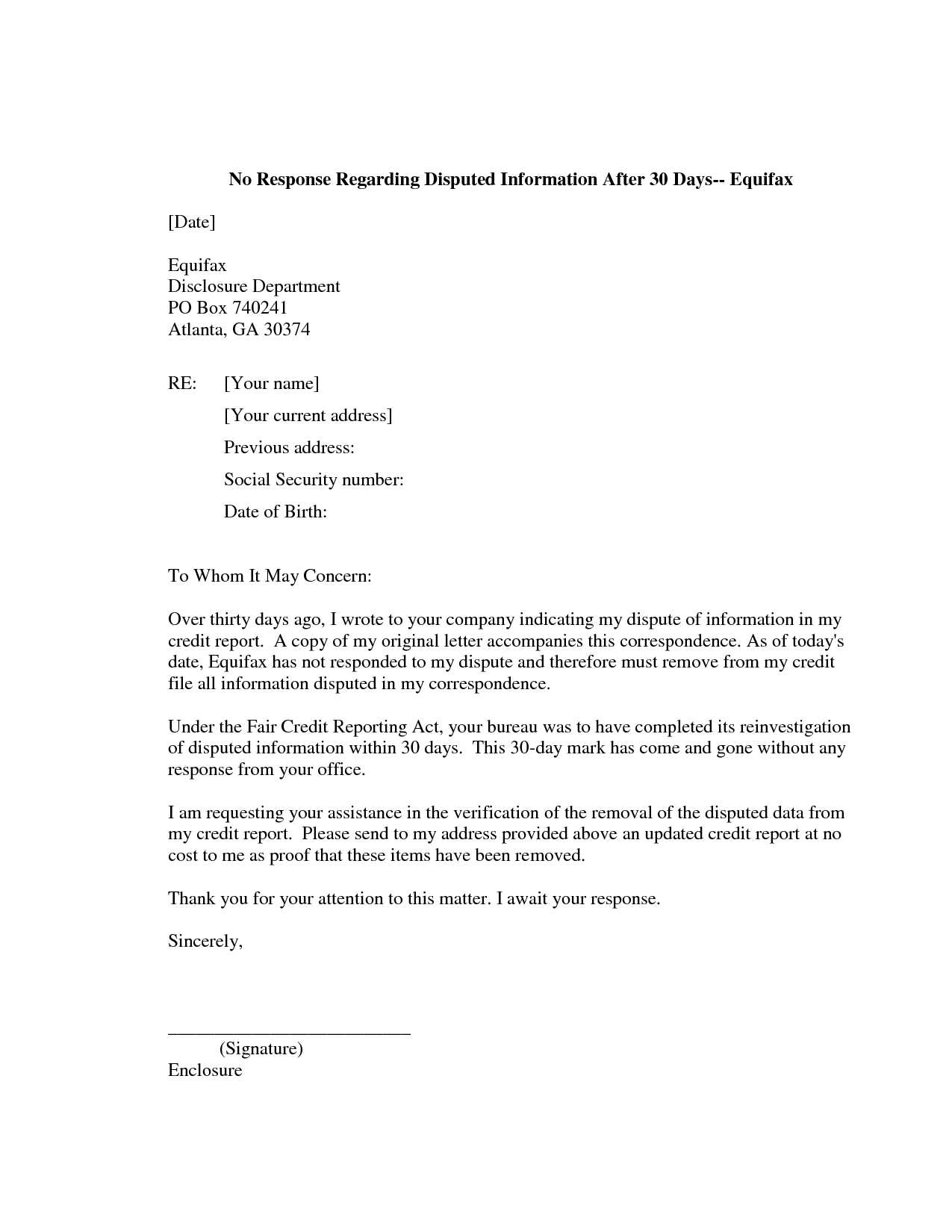

If your 609 letter receives no response, it’s important to take proactive steps. Begin by checking your timeline. The credit bureaus typically have 30 days to respond, so if it’s been longer than that, consider following up. You can send a second letter or make a phone call to ensure your request was received. Keep records of all communication to track the process.

Contact the Credit Bureau Directly

Reach out to the credit bureau via their customer service or dispute resolution channels. Confirm whether they received your 609 letter and inquire about the status of your request. Be clear and assertive about your rights to receive a timely response.

File a Complaint with Regulatory Authorities

If you still receive no response after following up, consider filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general. These agencies can help enforce consumer rights and push for a resolution.

- Keep a detailed record of all your communications.

- Provide proof that you sent the original letter (such as certified mail receipts).

- Highlight the failure to comply with federal regulations in your complaint.

Taking these steps helps ensure that your rights are protected and increases the likelihood of receiving a timely resolution to your credit dispute. Be persistent and stay informed about your options.

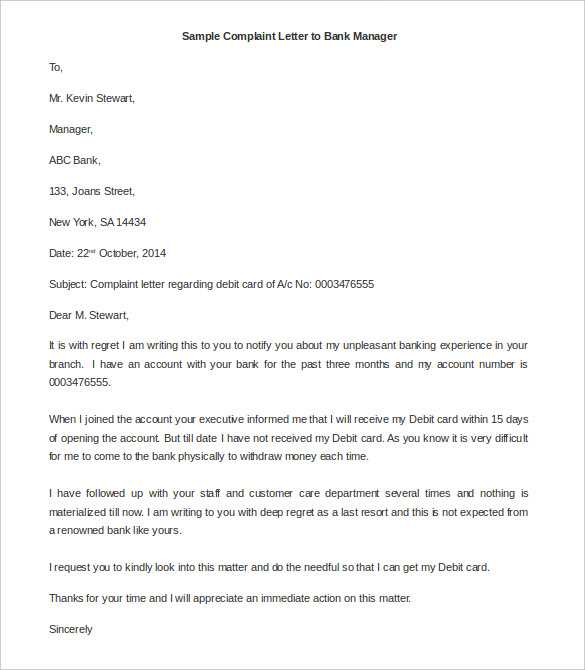

Start by organizing your credit letter content clearly. Focus on the recipient’s name, the amount of credit being offered, and the terms associated with it. Use simple language and clear headings to avoid confusion.

Define the Terms of the Credit

Outline the credit amount and any payment deadlines or interest rates. If applicable, mention any collateral or guarantees required. Be specific about the repayment schedule and any potential fees for late payments.

Provide Contact Information

Include your contact details, such as phone number or email address, in case the recipient has questions. Also, indicate the preferred method of communication for any further discussions.

Keep your language polite and professional throughout. Avoid unnecessary jargon, and ensure that the letter is easy to follow from beginning to end.