Advanced Credit Dispute Letter Template for Resolving Errors

Inaccuracies in your financial history can have significant effects on your ability to secure loans or favorable terms. When mistakes appear, it’s important to address them quickly and professionally. The best way to resolve such discrepancies is through a formal written approach that outlines the issues clearly and demands prompt resolution.

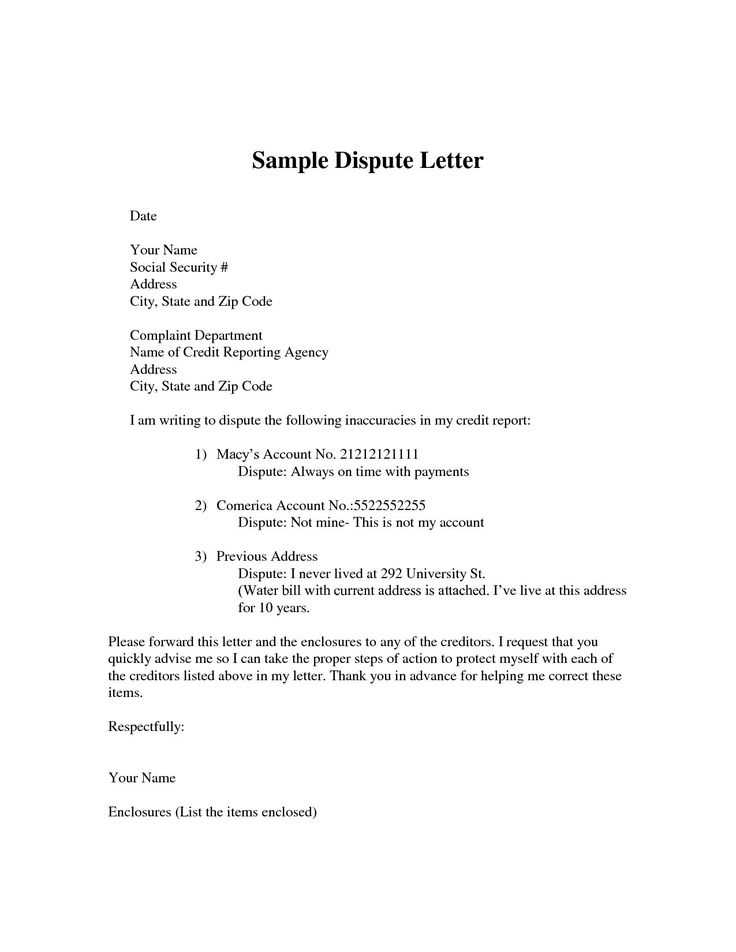

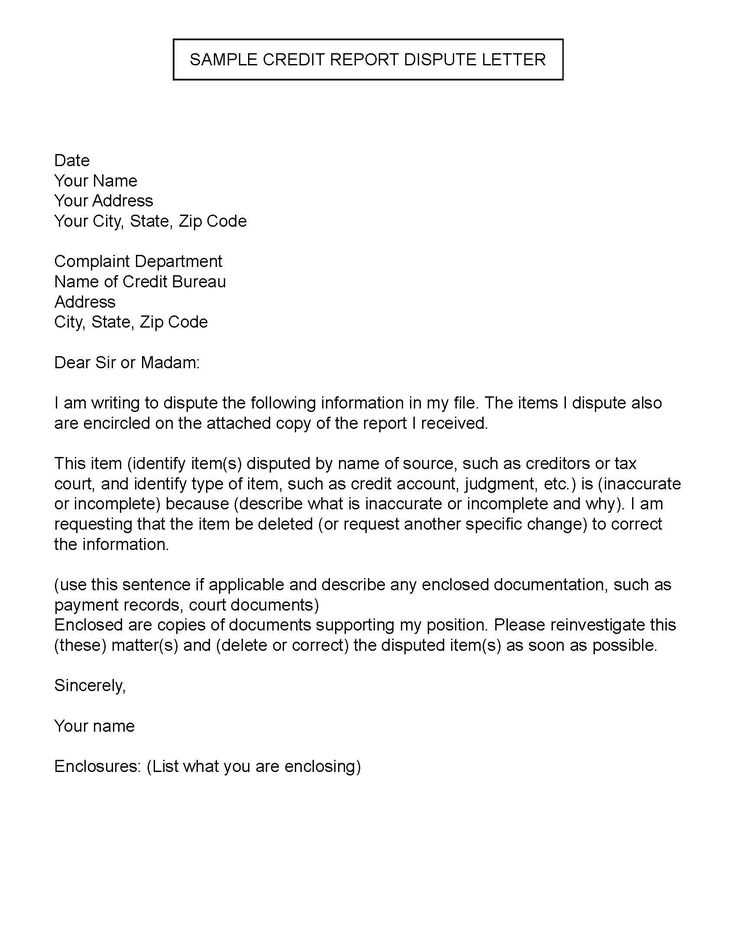

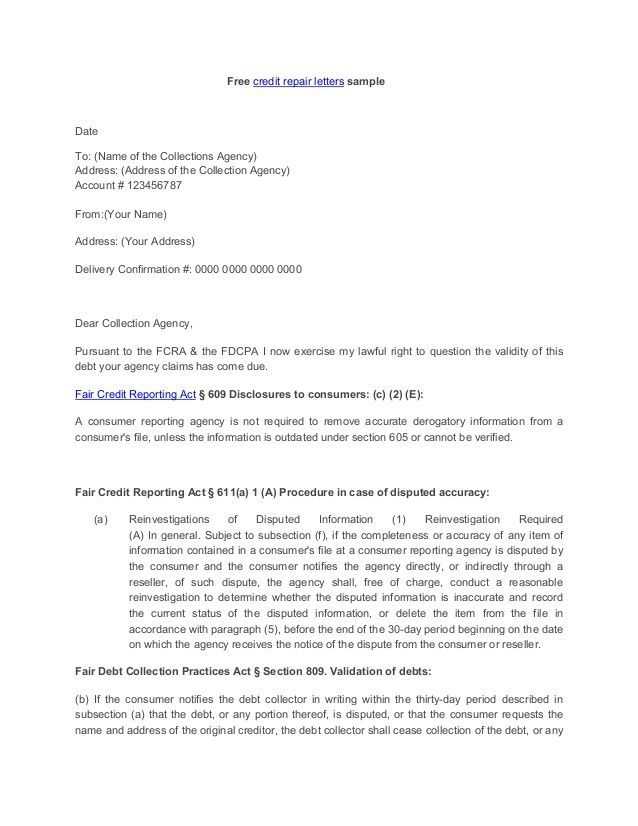

Structure of a Formal Correction Request

Writing a formal correction request requires a strategic approach. It should be concise, clear, and free of unnecessary information. Start by providing all relevant personal details, followed by a clear description of the error. Make sure to reference any supporting documents that validate your claim.

Key Points to Include

- Identification Information: Full name, address, and relevant account numbers.

- Description of the Mistake: A brief but specific explanation of what is incorrect.

- Supporting Documents: Attach copies of any evidence that supports your case.

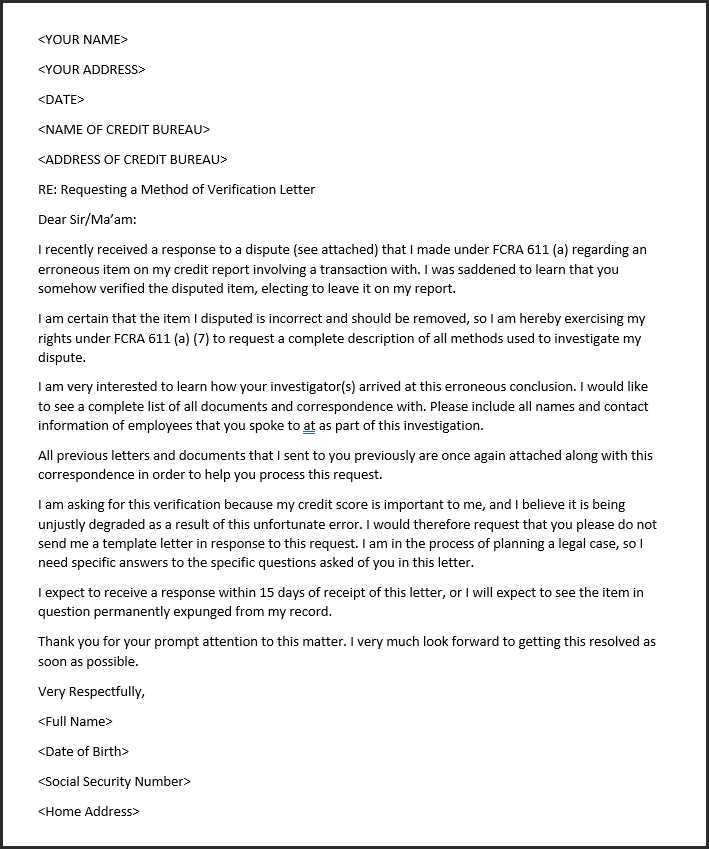

Steps to Take After Submission

Once the request is sent, it’s essential to follow up regularly. Keep a record of all correspondence and be ready to escalate the matter if it’s not resolved within the required timeframe. Depending on the response, you may need to refine your approach or provide additional information.

What to Expect During the Process

The correction process typically takes a few weeks, but this can vary. You should receive notification from the relevant party acknowledging your request, followed by an update on the outcome. If the issue is not resolved in your favor, there are further actions available, such as contacting regulatory bodies or seeking legal assistance.

Why Correcting Financial Record Issues is Crucial

Addressing mistakes in your financial history is vital to maintaining a solid financial reputation. These errors can affect your ability to secure loans, credit, and favorable terms from financial institutions. A swift and effective response is essential to prevent long-term consequences that may arise from incorrect information.

Understanding the Proper Format for a Formal Request

The structure of your formal request plays a key role in its success. A well-organized document ensures that the recipient understands your concerns clearly and can address them efficiently. Your approach should be formal, precise, and focused on the facts.

Common Mistakes Found in Financial Reports

It’s common to find a variety of inaccuracies, such as incorrect account details, outdated information, or false claims of missed payments. These types of errors can significantly impact your financial standing and need to be addressed as soon as possible.

How to Craft an Effective Request for Correction

When preparing your request, be direct and to the point. Clearly state the error, provide supporting documents, and ask for a specific resolution. A concise and focused approach will improve your chances of a prompt and accurate response.

Key Elements to Include in Your Request

Make sure to provide all necessary identification details, including your name, address, and account number. Be specific about the issue, and include any relevant documents or evidence that support your claim. This will make it easier for the recipient to verify and resolve the issue.

Next Steps After Submitting Your Formal Request

After submitting your request, it’s important to follow up. Keep track of all communication and be prepared to escalate the issue if no response is received within the designated time frame. In some cases, additional action may be required to ensure the correction is made.