Bank letter of credit template

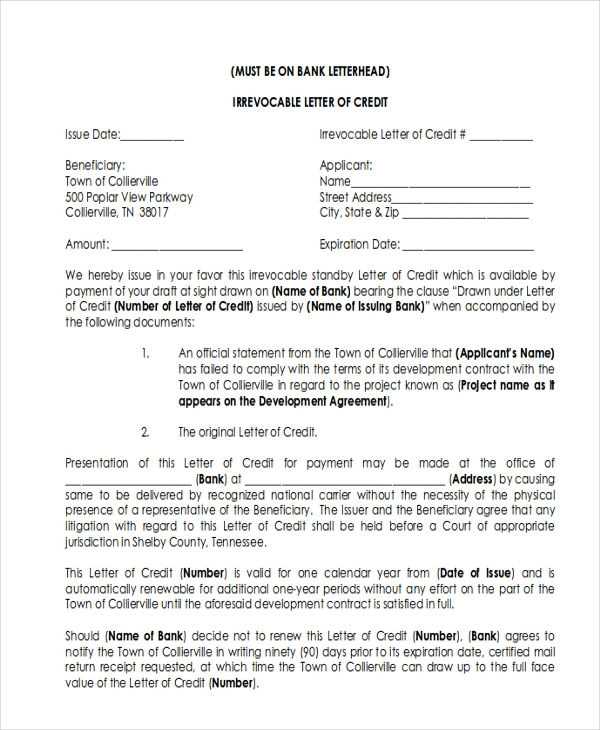

A well-structured letter of credit can make international trade transactions smoother and more secure. To get it right, follow a clear template that includes all necessary components. These typically consist of identification of the buyer and seller, the type of credit, and specific terms regarding payment, shipment, and other conditions.

Start with a heading stating the letter’s purpose. Include key details like the opening and expiry dates, and be sure to specify the payment method and currency. List any conditions that need to be met before the credit is activated, such as specific documents like invoices, shipping confirmations, or certificates of origin. Make the terms precise to avoid misunderstandings.

It’s also advisable to outline the obligations of both parties in separate sections. Specify the goods, services, or conditions tied to the payment, and outline any required action if disputes arise. By keeping the language clear and straightforward, both the buyer and seller can move forward with confidence.

Sure! Here’s the revised version:

Begin by clearly stating the details of the transaction, including the parties involved and the amount covered by the credit. Specify the currency, the terms of payment, and any conditions tied to the transaction. This ensures clarity and prevents misunderstandings.

Payment Terms

Outline the payment methods, such as whether it will be a sight payment or a time draft. Define the timeframe for payment after documents are presented. Mention the acceptable documents, like bills of lading, invoices, or certificates of origin, to facilitate smooth processing.

Documentary Requirements

Be specific about the required documents and their format. If the letter of credit involves shipping goods, provide clear guidelines on the acceptable forms of shipping documents like tracking numbers or shipping company names. This helps the beneficiary to prepare everything on time.

Lastly, ensure the letter of credit includes a clear expiration date and an indication of the location where the documents must be presented. This provides both parties with a clear deadline for fulfilling their obligations and ensures the process moves forward without unnecessary delays.

Bank Letter of Credit Template

Key Components of a Bank Letter of Credit

How to Draft a Credit Letter for International Trade

Common Terms in a Letter of Credit Agreement

Customizing a Template for Particular Transactions

Steps to Verify the Correctness of a Letter of Credit

Understanding Discrepancies and Ways to Resolve Them

Start by including the correct title, “Letter of Credit,” at the top of your template, along with the date of issuance. Clearly identify the applicant (buyer) and the beneficiary (seller), along with the issuing bank’s details. State the credit amount, the currency, and any terms of payment such as sight or deferred payment.

Key Components of a Bank Letter of Credit

The credit amount should be clearly stated, along with the applicable currency and the terms of payment (e.g., at sight or with a certain delay). A description of the goods or services being purchased should follow, with specifications like quantity, delivery location, and method. Include the expiration date and location of the letter of credit, as well as the required documents (e.g., bill of lading, invoice) the beneficiary needs to provide in order to claim payment.

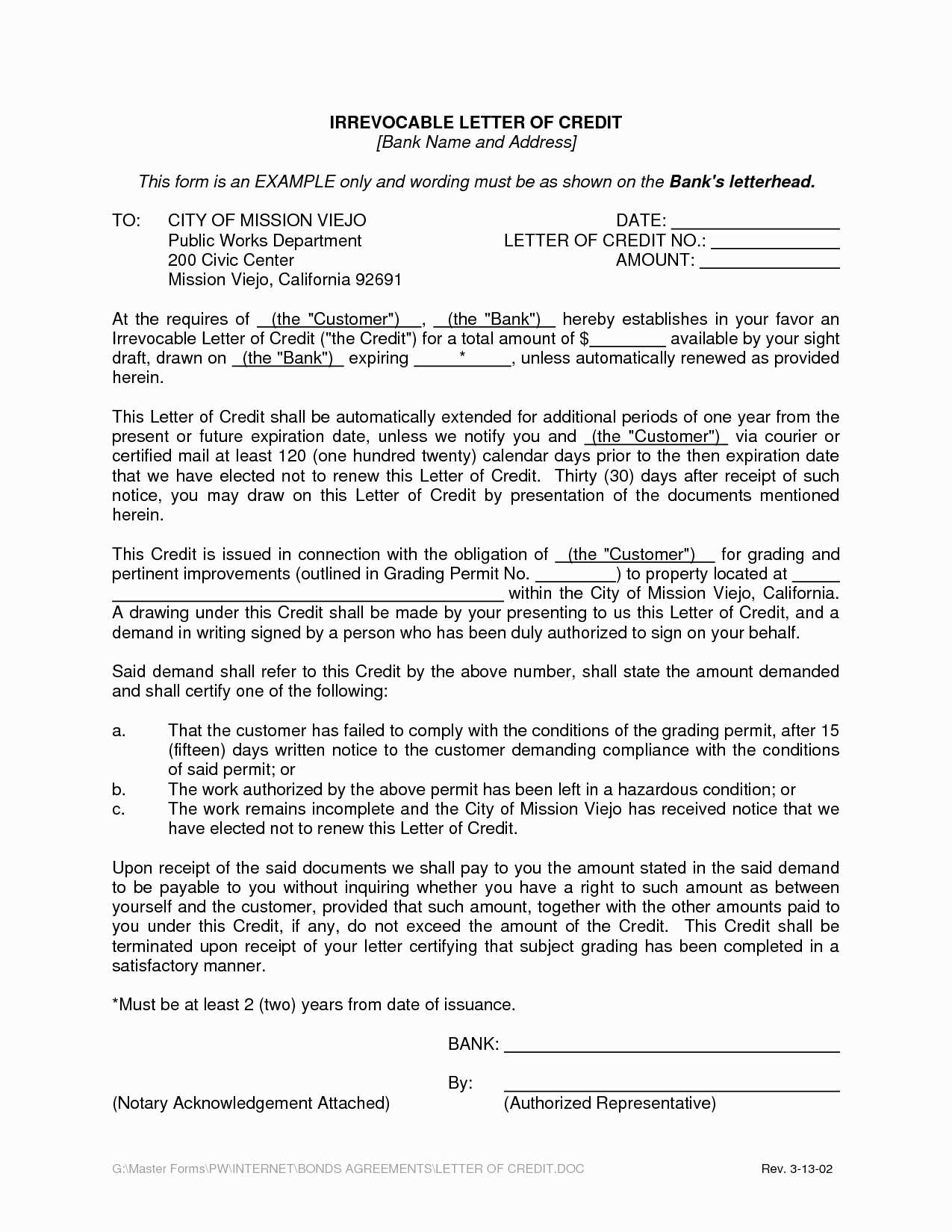

How to Draft a Credit Letter for International Trade

Ensure that all terms and conditions meet both parties’ expectations. Include specific details such as shipment terms, payment methods, and delivery deadlines. Customization depends on the nature of the trade, so carefully adapt the template to reflect accurate and appropriate details for each transaction. Mention any required inspections, certifications, and documents that need to be presented for the payment to be processed.

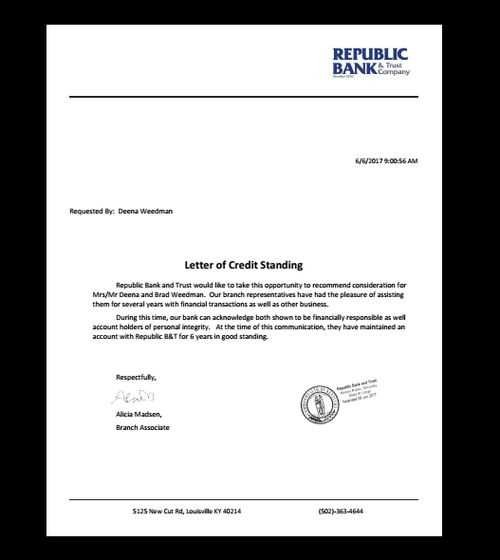

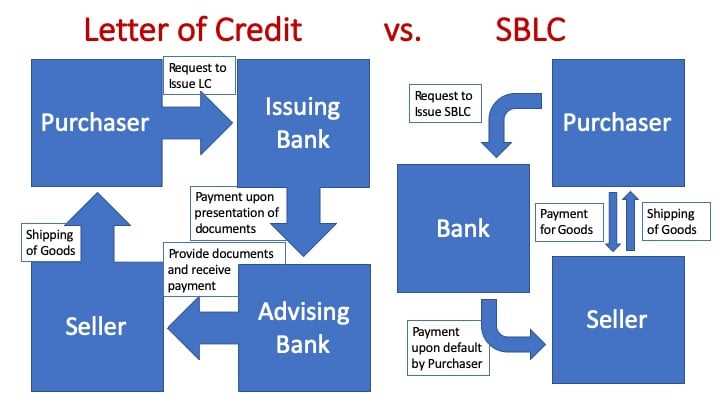

Review common terms in letters of credit, such as “documentary credit,” “advising bank,” “negotiation,” and “confirmation.” Each term should be used correctly to avoid confusion and legal issues.

Common Terms in a Letter of Credit Agreement

Familiarize yourself with terms like “sight payment,” which refers to payment upon presentation of required documents, and “negotiable documents,” which refer to documents that allow the transfer of goods. It’s essential to define these terms to ensure all parties understand the expectations clearly.

When customizing your letter, take into account the specifics of the transaction–whether it’s a one-time purchase or a recurring arrangement. Modify the template to suit different payment terms or shipment methods depending on what’s agreed upon between buyer and seller.

Customizing a Template for Particular Transactions

For transactions with different risk levels, consider including additional clauses, such as terms regarding insurance or security for the payment. Adapt the letter according to each unique trade agreement, adjusting payment and shipping details as necessary.

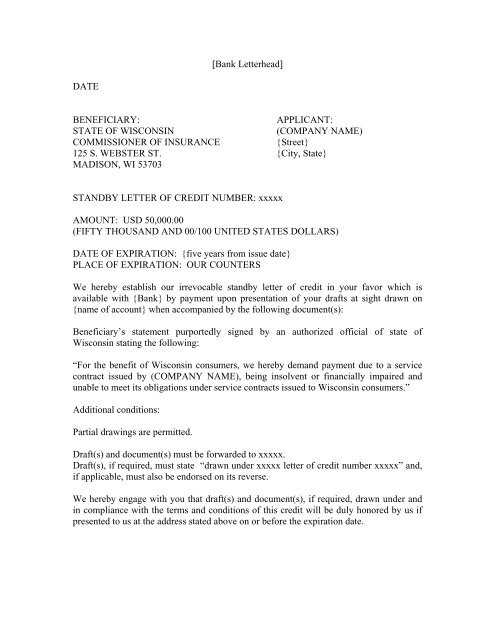

To ensure the letter’s correctness, thoroughly verify the details with all involved parties before issuance. Check the applicant’s and beneficiary’s names, the amount of the credit, and the required documents. A small discrepancy can result in delays or complications in payment processing.

Steps to Verify the Correctness of a Letter of Credit

Verify all information carefully: the currency, credit limit, expiration date, and delivery terms. Compare the terms against the agreed contract to ensure they align with the parties’ expectations. Double-check the accuracy of the supporting documents, such as the commercial invoice, bill of lading, and insurance certificates.

Finally, address any discrepancies immediately by reviewing the specific terms that may conflict. A common issue could be a mismatch between the documents presented and the requirements set in the letter of credit. In such cases, work with the issuing bank and the beneficiary to resolve the discrepancies promptly.

Understanding Discrepancies and Ways to Resolve Them

Discrepancies often arise from misinterpretations of document terms or missing signatures. When these occur, it’s important to communicate with both the applicant and beneficiary to clarify the issues. Use a straightforward approach to revise and correct the documents as needed before resubmission. If there’s any ambiguity, involve the issuing bank to offer guidance on proper document handling.