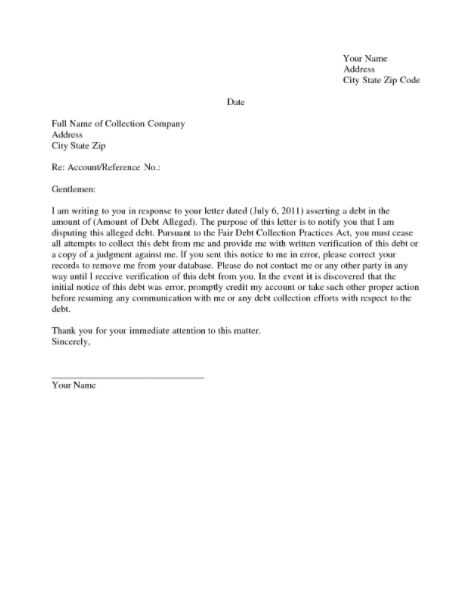

Best credit dispute letter template

Clear and Concise Template for Credit Disputes

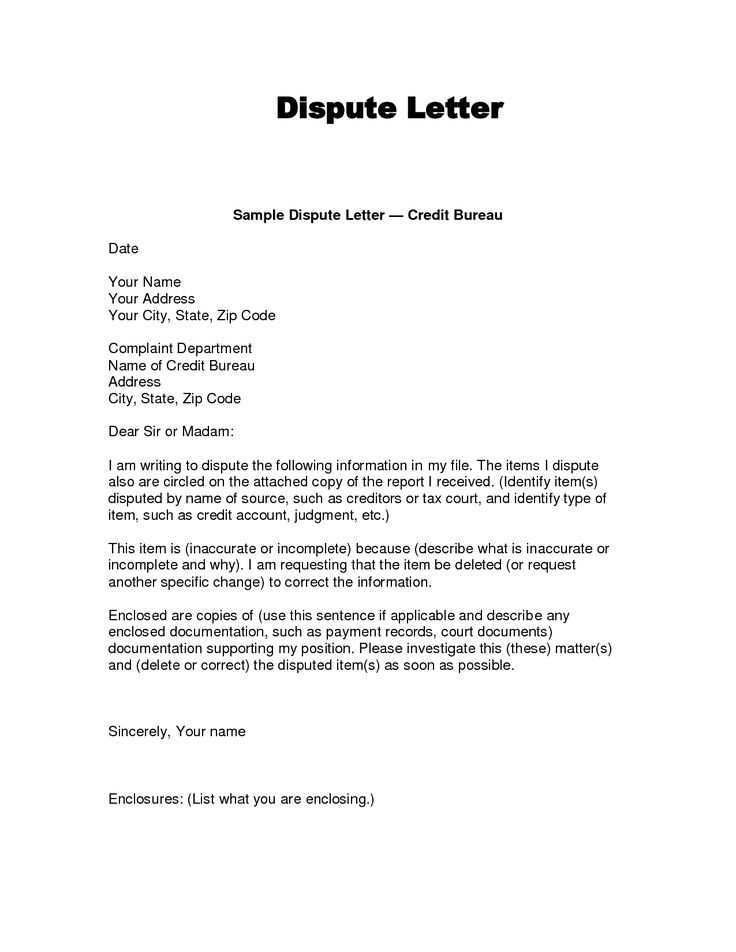

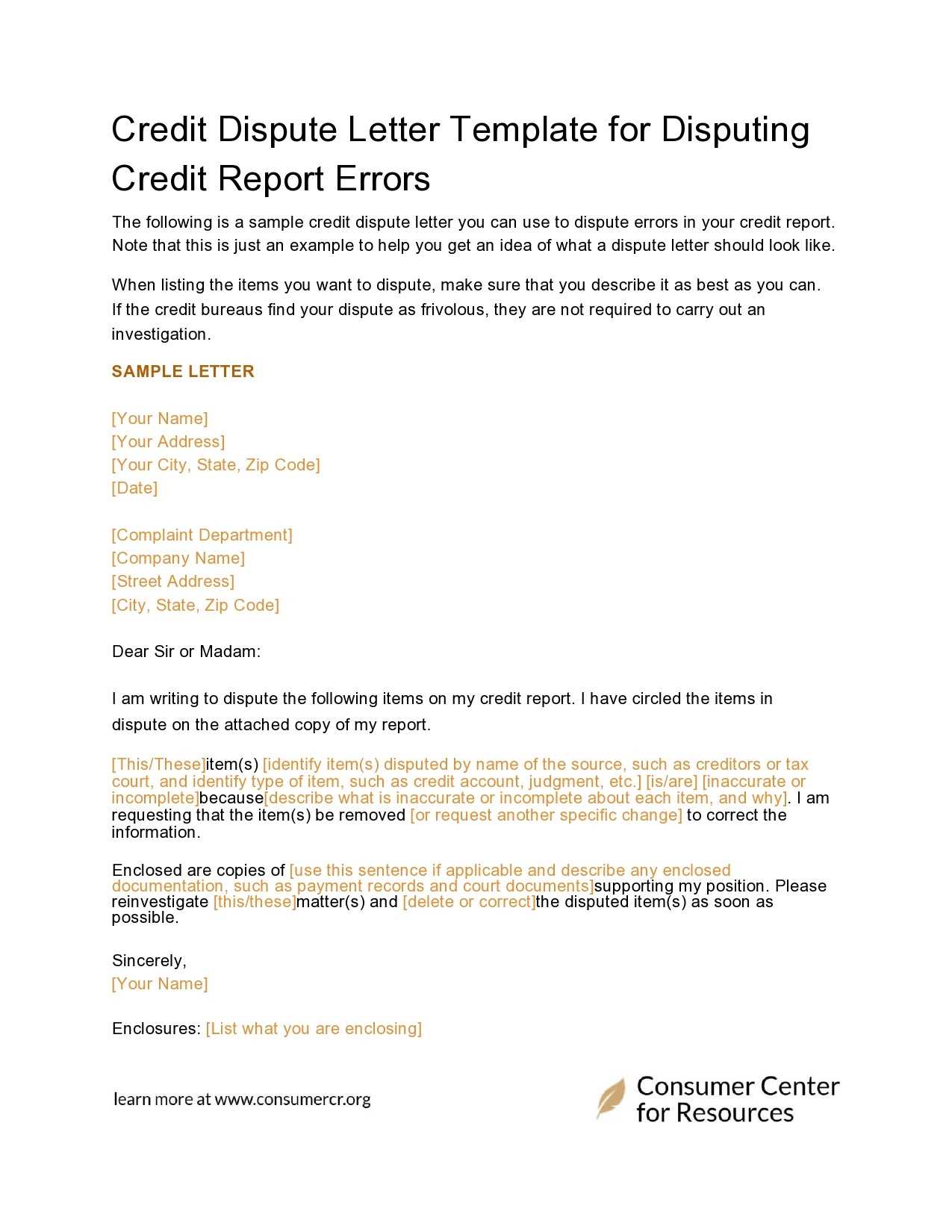

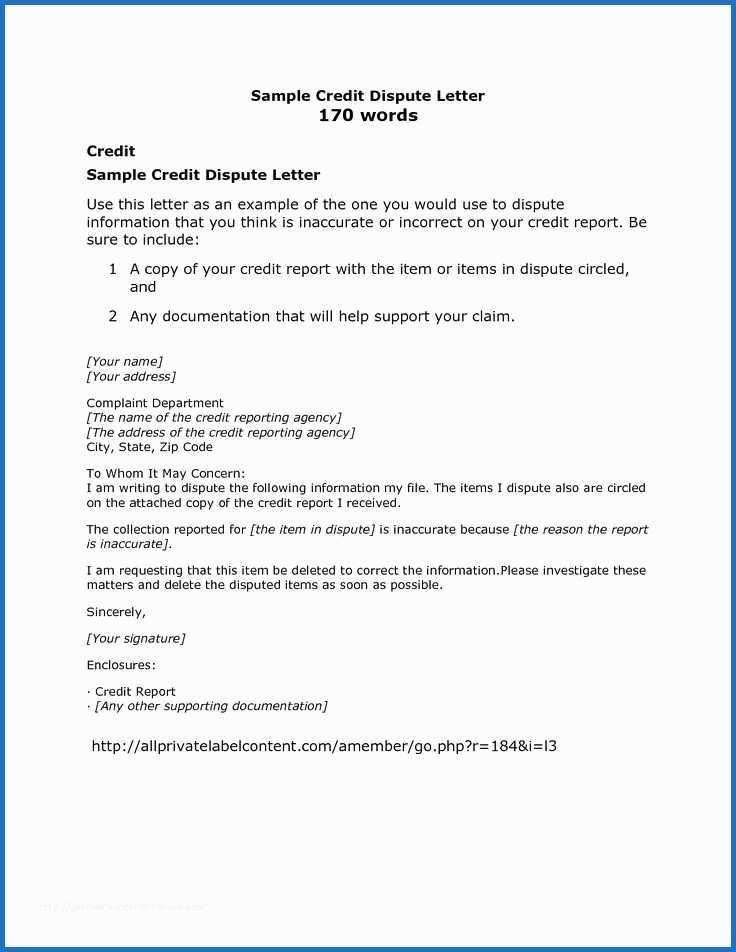

To address any inaccuracies in your credit report, use a credit dispute letter template that is direct and precise. This template helps you highlight the errors in your report and formally request corrections. Follow the structure below to ensure that your dispute is clear and organized.

Credit Dispute Letter Template

Below is a proven template that will guide you in writing an effective dispute letter:

- Your Name

Include your full name as it appears on your credit report. - Your Address

Provide your current address, making sure it matches the one listed on your report. - City, State, ZIP Code

Include your city, state, and ZIP code for proper identification. - Date

Use the date you’re sending the letter. - Credit Bureau Information

Include the full name and address of the credit bureau receiving your letter.

Subject: Credit Report Dispute

Dear [Credit Bureau Name],

I am writing to dispute the following information in my credit report. The items listed below are inaccurate and I request that they be corrected or removed from my credit file. Please investigate this matter and update my credit report accordingly.

Disputed Item(s):

- Account Name: [Name of the creditor or institution]

- Account Number: [Account number]

- Reason for Dispute: [Specific issue with the item, such as “incorrect balance,” “account not mine,” or “duplicate account”]

Please find attached documents supporting my dispute. This includes [copies of receipts, statements, or relevant communications]. If additional documentation is needed, kindly let me know.

Thank you for your attention to this matter. I look forward to your prompt response and the correction of this error on my credit report.

Sincerely,

[Your Full Name]

Why This Template Works

This format allows you to focus on the key elements needed to dispute incorrect information. By clearly identifying the errors, attaching supporting documents, and making a direct request, you help expedite the process of reviewing and resolving the issue. Always keep a copy of the letter for your records and consider sending it via certified mail for tracking purposes.

Best Credit Dispute Letter Template

Understanding Key Components of a Dispute Letter

How to Spot Errors on Your Credit Report

Crafting a Clear and Concise Dispute Request

Common Mistakes to Avoid When Writing a Dispute Letter

Best Practices for Sending Your Letter to Credit Bureaus

What to Do After Sending a Dispute Letter

To ensure your dispute letter is effective, start by including your personal information, including your full name, address, and contact details. Also, clearly state the account number associated with the dispute. This helps the credit bureau quickly locate your file. Reference the specific error, whether it’s a wrong balance, outdated information, or identity theft. Be precise in describing the mistake.

Review your credit report thoroughly. Errors often involve accounts that don’t belong to you or inaccurate balances. It’s easy to overlook these mistakes, but they can negatively impact your credit score. Focus on discrepancies in account numbers, dates, or outstanding balances. If there’s a discrepancy, highlight it clearly in your dispute letter.

Your dispute letter should be direct. Avoid unnecessary details and stay focused on the issue at hand. Request that the credit bureau investigate and remove or correct the error. Keep the tone polite but firm. Attach any supporting documentation, such as bank statements, letters, or records, to reinforce your case. Provide only relevant documents to avoid confusion.

Common mistakes in dispute letters include not clearly identifying the error, sending vague or incomplete information, and missing required documentation. Avoid submitting your letter without verifying that you’ve addressed all points of contention. Ensure your letter is neatly formatted and free from spelling or grammatical errors. Double-check your contact details before sending.

Send your letter via certified mail to ensure it’s received and to have proof of delivery. This step prevents the possibility of your letter being lost or overlooked. Always keep copies of your dispute letter and any documents you send. Note the credit bureau’s response time, typically 30 days, and keep track of their investigation.

After sending your dispute letter, follow up if you don’t receive a response within the allotted time frame. If the dispute is resolved in your favor, confirm that the credit report has been updated accordingly. In case the error isn’t corrected, you have the option to appeal or contact the creditor directly. Stay organized and keep all correspondence for future reference.