Cancel Credit Card Letter Template

When you decide to discontinue using a financial service, it’s important to communicate your decision clearly and professionally. Knowing the proper format and language to use can make the process smoother and ensure that your request is processed quickly.

In this guide, we will walk you through the necessary steps to formally request the closure of your financial agreement. We’ll provide tips on what information should be included, common errors to avoid, and how to follow up to make sure your request is handled properly.

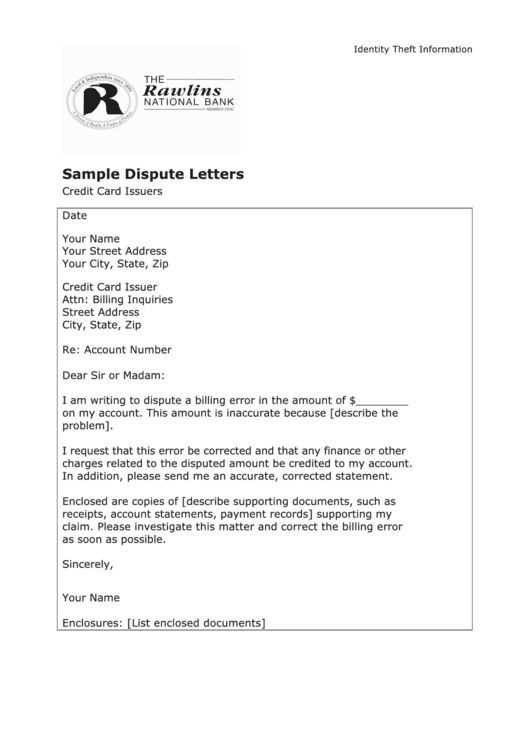

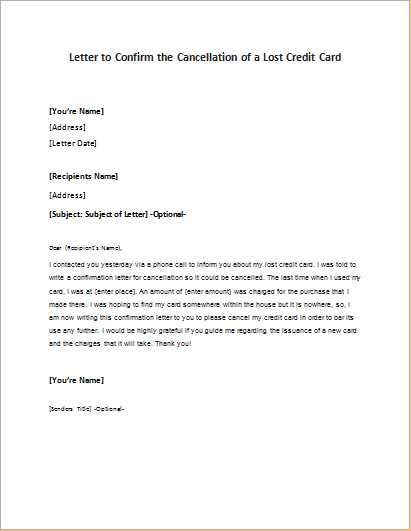

How to Write a Credit Card Cancellation Letter

When deciding to end a financial service, it is essential to express your intention clearly and in an organized manner. A well-written request ensures that your account is closed smoothly and that all necessary steps are taken without confusion.

Key Information to Include

To ensure your request is properly processed, make sure to include the following details:

- Your Full Name: This ensures that the service provider can identify you correctly.

- Your Account Number: Including this information helps speed up the process and avoid any confusion.

- Request for Closure: Clearly state your wish to end the service.

- Date of Request: This is crucial for keeping track of the timeline.

What to Avoid

To ensure your request is not delayed or misunderstood, avoid the following:

- Ambiguity: Be direct and concise about your intentions.

- Irrelevant Information: Stick to what’s necessary for your request.

- Negative Language: Keep the tone professional and polite.

Essential Information to Include in the Letter

When requesting the termination of a financial service, it is crucial to provide specific details to ensure that your request is understood and processed without delay. Clear and precise information will help both you and the service provider to avoid any confusion and ensure a smooth process.

Key Details to Include

Make sure to include the following vital information in your communication:

- Your Full Name: This ensures that the provider can correctly identify your account.

- Account Number: Including this detail will help in quickly locating your account information.

- Request Statement: Clearly state that you wish to discontinue the service and close your account.

- Date of Request: Indicate the date on which you are making the request to establish a timeline for processing.

Additional Considerations

It’s also important to consider adding the following elements to your request:

- Contact Information: Ensure your phone number or email is included in case the provider needs to reach you.

- Outstanding Balance: If applicable, mention any remaining balance and ask about the final payment process.

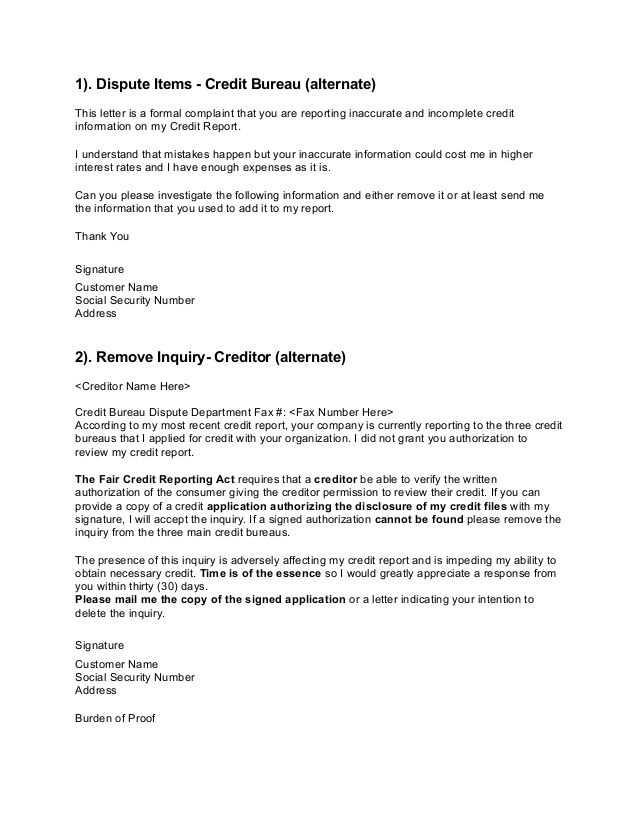

Common Mistakes to Avoid When Cancelling

When ending a financial agreement, it’s important to be mindful of the details in order to avoid unnecessary delays or complications. Small oversights can result in confusion or prolonged processing times. Here are some common mistakes to watch out for.

One of the biggest errors is failing to provide enough identifying information. Without clear details, such as your account number or full name, your request might not be processed correctly. Additionally, it’s essential to make sure the request is clear and direct. Vague language or unclear intentions can lead to misunderstandings or delays.

Another frequent mistake is neglecting to confirm any outstanding obligations. Before submitting your request, ensure that all balances are cleared, and inquire about any final steps needed to fully close the account. Ignoring this may result in unresolved financial matters even after your request is processed.

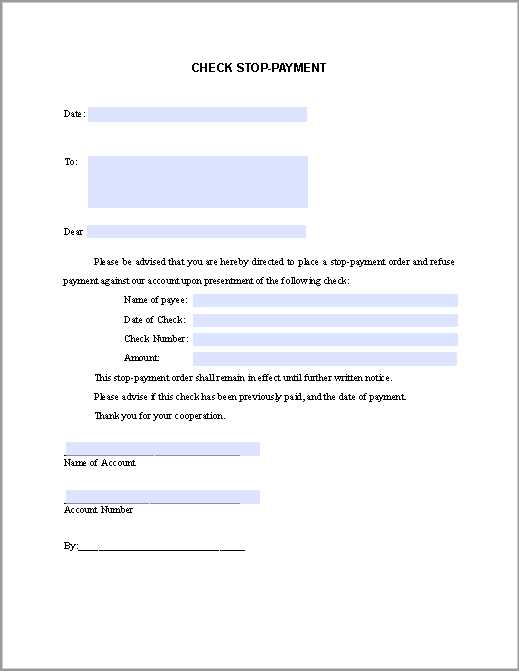

Steps to Send Your Cancellation Request

Once you’ve prepared your formal request to end a financial service, it’s time to send it in a manner that ensures it is received and processed promptly. The following steps outline how to effectively submit your request.

First, make sure your document is properly addressed to the right department. This can usually be found on the provider’s website or in the terms of agreement. If you’re unsure, contacting customer support to confirm the correct recipient is a good idea.

Next, choose the method of delivery that guarantees receipt. Sending your request by certified mail or using a secure email system provides confirmation that your communication has been delivered. Avoid using regular postal services if you want a receipt for proof.

Once sent, ensure that you follow up within a reasonable period. Contacting the company to verify the status of your request helps ensure that no issues arise and that your account is closed as requested.

What to Expect After Sending the Letter

After you have submitted your formal request to terminate a financial service, it’s important to know what steps follow and how to track the progress. Understanding the process can help set clear expectations and ensure everything is completed smoothly.

Once your request has been received, the company will typically review the details and verify the information you provided. This may include checking for any outstanding balances or final steps necessary to close your account. You may receive a confirmation of your request either by mail or email, indicating that the process has been initiated.

If there are any issues or further actions required, such as settling an unpaid balance, the provider may contact you. In some cases, a follow-up may be necessary on your part to ensure everything is on track. Be prepared to respond promptly to avoid delays in the finalization of your request.

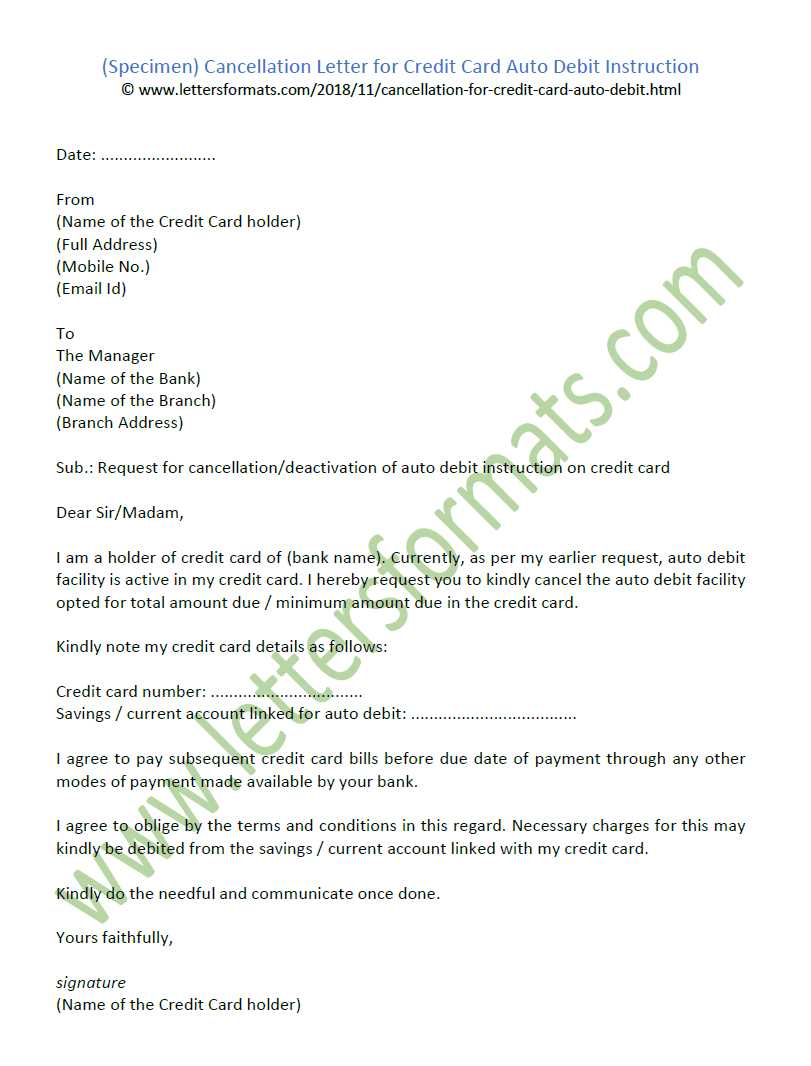

Alternative Methods to Close Your Credit Card

If you prefer not to submit a formal written request, there are alternative methods available to end your financial service. These options provide flexibility and may suit your situation better depending on your preferences or urgency.

Methods to Consider

Below are some other ways to close your account effectively:

| Method | Description |

|---|---|

| Phone Request | Contact customer service directly to request account closure. Be sure to ask for a confirmation number and follow up if needed. |

| Online Portal | Some providers allow you to close accounts through their website or app. This is usually a fast and convenient option. |

| In-Person Request | If the provider has a physical branch, visiting in person can ensure that your request is immediately processed. |

Considerations for Alternative Methods

While these methods may offer convenience, be sure to ask for written confirmation of the closure. Whether via email, mail, or a receipt, this serves as proof that the request has been processed. Always follow up if you do not receive confirmation within a reasonable time frame.

How to Follow Up on Your Request

After submitting your request to close an account, it’s important to follow up to ensure the process is completed correctly and in a timely manner. Taking the right steps to check on your request can help avoid delays or any issues that may arise.

Steps to Take When Following Up

Here are some important actions to consider when following up:

- Contact customer service by phone or email to confirm that your request has been received and is being processed.

- Ask for a specific time frame for the completion of your request. This will help you know when to expect confirmation.

- If no confirmation is received within the expected time, reach out again for an update and inquire about any potential delays.

- Ensure that all necessary steps have been completed, such as settling any outstanding balances or resolving final details.

What to Do if You Encounter Issues

If you experience delays or complications, don’t hesitate to escalate the matter. You can ask to speak with a supervisor or request additional documentation to verify the closure of your account. Keeping a record of all communications will be helpful in case further follow-up is required.