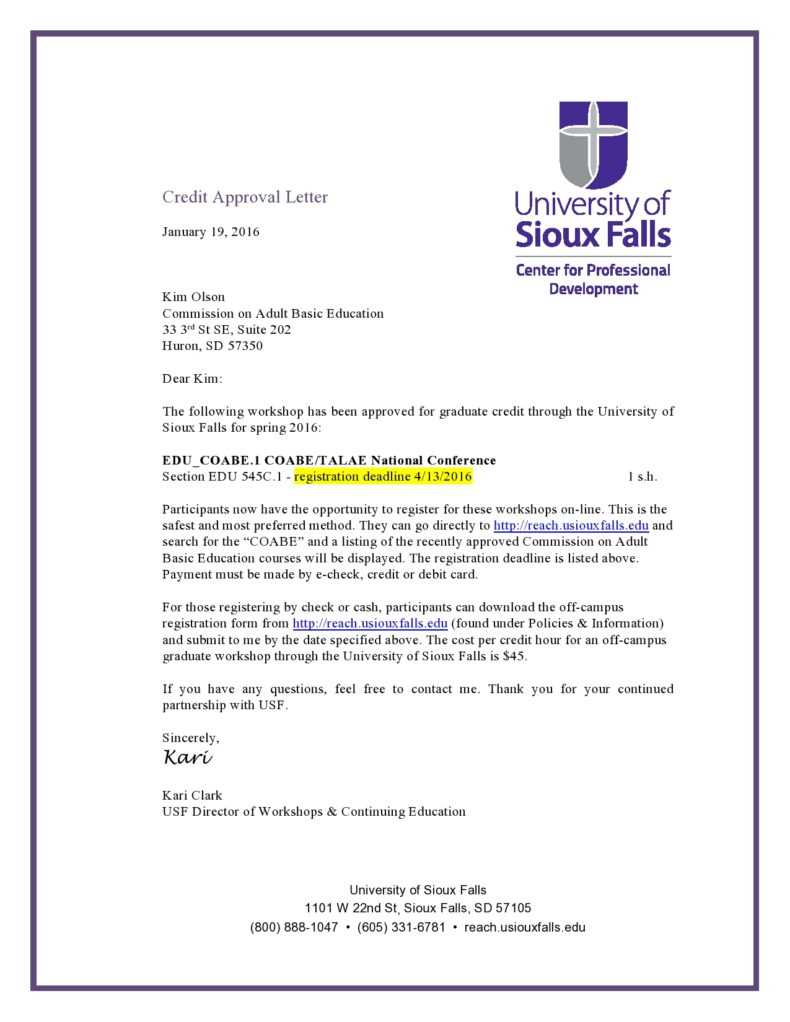

Credit approval letter template

When you’re preparing a credit approval letter, it’s important to be clear and direct. The letter should outline the key details of the credit being approved and offer a professional tone throughout. Start with a formal greeting, then state the approval of the credit, followed by the terms and conditions under which it is granted. Specify the loan amount, interest rate, repayment schedule, and any other relevant information the recipient needs to know.

Be concise and avoid unnecessary fluff. The purpose is to confirm approval in an unambiguous manner, giving the recipient everything they need to understand the agreement. Include any deadlines for signatures or documents required to finalize the approval. This helps keep everything on track and ensures that both parties are on the same page.

End with a call to action, encouraging the recipient to contact you if they have any questions or need additional details. A friendly yet professional closing will reinforce your commitment to the relationship, while also ensuring the process moves smoothly. By following these steps, you can create a straightforward, effective credit approval letter every time.

Here’s the revised version based on your request:

To create a professional credit approval letter, make sure to include all necessary details such as the applicant’s name, loan amount, terms, and approval date. Clearly state the conditions under which the loan is granted and mention any documentation required for the applicant to complete the process.

Specific Points to Address:

Ensure the loan amount and repayment terms are outlined with precision. For example, you might say, “We have approved your loan of $10,000, payable in monthly installments of $500 over 24 months.” Include the start date and any interest rates or fees applied to the loan. Be transparent about what’s expected from both parties to avoid confusion later.

Next Steps After Approval:

Conclude the letter by outlining the next steps clearly. Mention any additional documents or steps the applicant must follow to complete the process. An example could be, “Please submit the signed agreement and any supporting documents by [Date] to finalize the approval.” This keeps everything organized and ensures the applicant knows exactly what to do next.

- Credit Approval Letter Template

When drafting a credit approval letter, it’s crucial to keep the tone clear, positive, and straightforward. The letter should outline the terms of the credit approval while ensuring that all necessary details are included for the recipient’s understanding.

Key Elements to Include

The letter should begin with a formal greeting, followed by a statement confirming the approval of the credit application. Specify the credit amount approved, along with any conditions or terms that apply, such as repayment schedule or interest rates. If applicable, mention any additional documentation required before funds are disbursed.

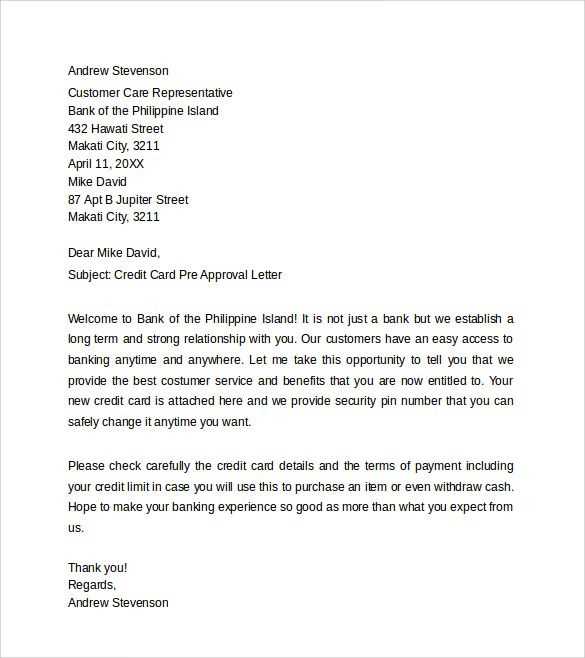

Example Template

Subject: Credit Approval Notification

Dear [Applicant’s Name],

We are pleased to inform you that your credit application with [Company Name] has been approved. The approved amount is [Credit Amount]. Below are the key details of the credit terms:

- Credit Amount: [Amount]

- Interest Rate: [Interest Rate]

- Repayment Schedule: [Monthly/Quarterly] payments, due on [due date].

- Additional Requirements: [list any conditions or documents].

Please review the terms and reach out if you have any questions. Once you have confirmed your understanding, we will proceed with the disbursement of the funds. We look forward to continuing our partnership.

Sincerely,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

A credit approval letter serves as an official confirmation from a lender that a borrower is eligible for credit. It outlines the terms and conditions of the credit offer, including the approved loan amount, interest rate, and repayment period. This letter gives both the lender and the borrower clarity on the expectations and commitments involved.

What It Represents

The letter signifies the lender’s willingness to extend credit based on the borrower’s financial situation and creditworthiness. It acts as a legal agreement that binds both parties to the terms outlined, ensuring transparency and reducing misunderstandings. For the borrower, it provides assurance that the requested amount of credit has been granted under the specified conditions.

Why It Matters

A credit approval letter is important for both the borrower and the lender. It offers security and certainty for the borrower, knowing that financing is in place. For the lender, it documents the conditions of the credit arrangement, providing a reference point in case of disputes. It also signals that the borrower has met the necessary criteria for credit approval, allowing the process to move forward.

Clear and specific information is critical when drafting a credit approval letter. The document should outline key details that confirm the terms of the approval, as well as any conditions attached to it. These components ensure that both the lender and borrower have a shared understanding of the agreement.

1. Borrower’s Information

Begin with the borrower’s full name, address, and contact details. This personal data helps identify the recipient and avoids confusion. Double-check for accuracy to ensure the letter reaches the correct party.

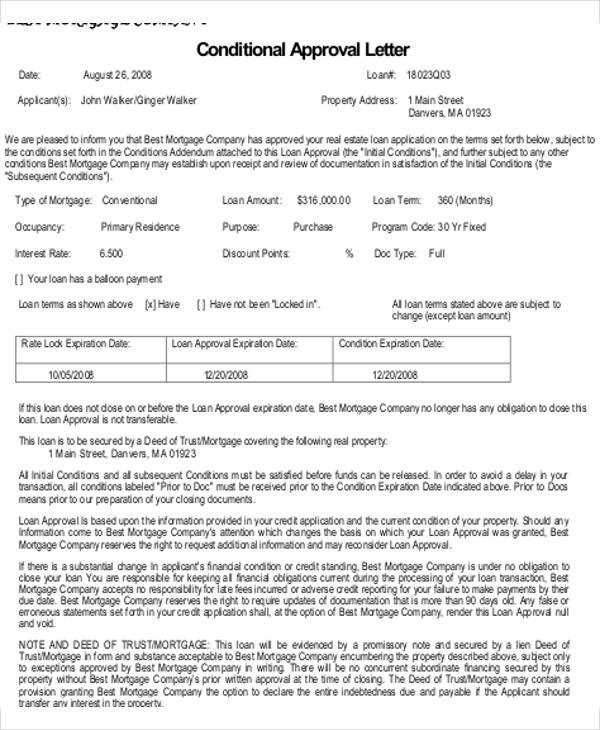

2. Credit Limit and Terms

State the exact credit amount approved and any conditions, including interest rates, repayment schedule, and the duration of the credit agreement. If applicable, include the type of credit (e.g., personal loan, line of credit). Ensure that all terms are clearly laid out to avoid any ambiguity.

3. Approval Date and Expiration

Clearly mention the date when the approval is issued, along with any expiration date for the approval. This provides a reference point for both parties regarding when the terms are valid.

4. Conditions or Requirements

List any conditions tied to the approval, such as additional documentation or specific actions the borrower needs to take before funds are disbursed. This ensures that all parties understand the obligations tied to the approval.

5. Signature and Contact Information

Ensure the letter includes a space for the authorized lender’s signature and contact information for follow-up. This establishes legitimacy and provides a point of contact for the borrower should they have questions.

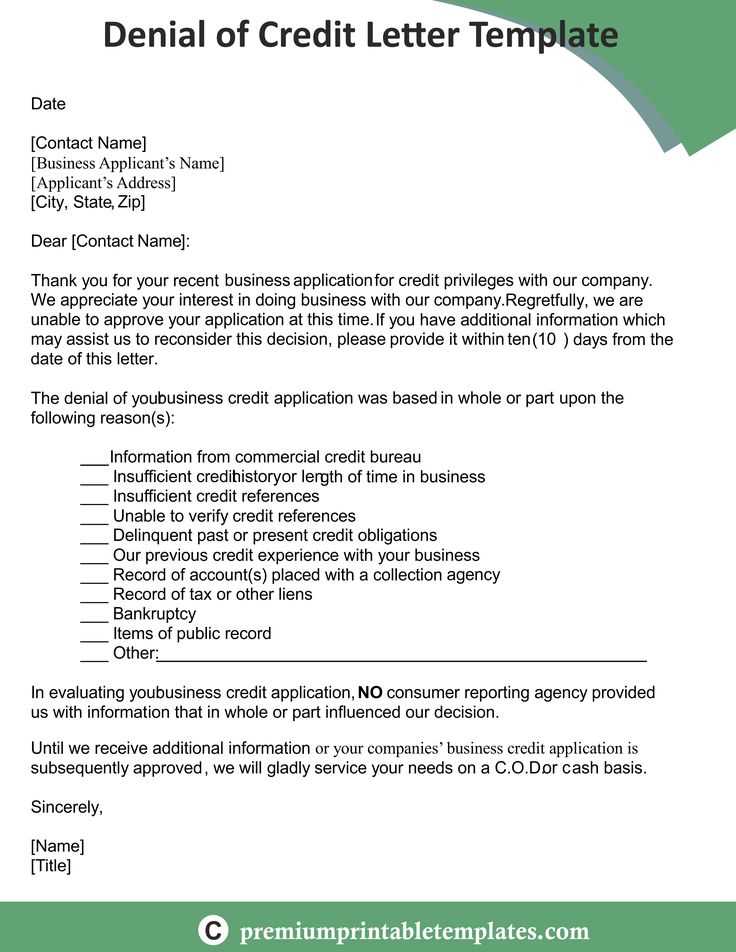

Organize the credit approval letter into clear, distinct sections to enhance readability. Begin with a professional header, including your company name, contact information, and the date. This sets the tone for the letter and provides quick reference details.

1. Introduction

The opening paragraph should immediately convey the purpose of the letter. State whether the credit request is approved or denied and outline the specific terms or conditions. Avoid unnecessary details and keep the message direct.

2. Body of the Letter

Use this section to explain the decision. If approval is granted, list the terms, such as the credit limit, repayment schedule, and interest rates. For a denial, provide the reasons in a straightforward, concise manner. Organize the body into short paragraphs for clarity and readability.

Close the letter with a professional conclusion. If the request is approved, encourage the recipient to contact you with questions. If denied, suggest alternative options or offer guidance on how they might reapply in the future.

Approval letters must adhere to specific legal standards to avoid disputes and ensure they are enforceable. Ensure that the language used is clear, unambiguous, and complies with applicable financial regulations. The letter should outline all terms in a way that is easily understood and legally binding.

Ensure compliance with privacy laws, such as the General Data Protection Regulation (GDPR) in the EU, or similar regulations elsewhere, by avoiding the inclusion of personal information that isn’t required for the approval process. Always secure the recipient’s consent before collecting or using their personal data.

Make sure the letter specifies the exact terms of the approval, including the amount, duration, and conditions. Clearly state any contingencies or obligations that must be met by the recipient to avoid confusion or legal challenges down the road.

Additionally, the approval letter should comply with all relevant lending laws in your jurisdiction. This includes adherence to usury laws, fair lending practices, and providing proper disclosures. Not including necessary disclaimers can result in fines or legal actions.

| Key Legal Element | Recommendation |

|---|---|

| Clear Terms | Specify loan amount, repayment period, and any conditions in clear, simple terms. |

| Privacy Compliance | Ensure adherence to GDPR or other relevant data protection laws. Avoid sharing unnecessary personal information. |

| Disclaimers | Include necessary disclaimers about approval conditions and potential legal obligations. |

| Regulatory Adherence | Ensure compliance with local lending laws, such as interest rates and repayment terms. |

Common Mistakes to Avoid When Crafting a Credit Approval Letter

Be clear and precise in your wording. Ambiguities can lead to misunderstandings that create delays or disputes. Avoid vague terms like “likely” or “probably.” State the approval in definite terms, specifying the loan amount and conditions directly.

1. Incorrect or Missing Details

Double-check all the personal information and loan terms. Incorrect names, addresses, or loan amounts can delay processing. Always confirm details with the applicant before finalizing the letter.

2. Failing to Specify Terms and Conditions

Outline all terms clearly. This includes the interest rate, repayment schedule, and any other relevant clauses. Failing to mention specific terms can lead to confusion or disputes later on.

3. Overcomplicating the Language

Use simple and straightforward language. Overly complex sentences or legal jargon can alienate the applicant. Aim for clarity and ease of understanding to prevent miscommunication.

4. Not Providing a Timeline

It’s important to specify the timeline for when the credit will be disbursed or when further actions are needed from the applicant. A lack of clear deadlines can cause unnecessary delays in the process.

5. Forgetting to Mention Contingencies

Clearly state any conditions under which the approval might be revoked, such as changes in creditworthiness or failure to meet specific deadlines. Omitting these can lead to confusion if issues arise.

6. Not Offering Contact Information

Provide clear contact information for any follow-up questions. Make it easy for the applicant to reach out if they need clarification or have concerns about the approval letter.

Tips for Customizing the Letter Based on Loan Type

Tailoring the credit approval letter to the specific loan type makes it more relevant and clear for the recipient. Here’s how you can adjust the letter for different loan categories:

1. Personal Loans

- Highlight the loan amount and repayment terms in clear, simple terms.

- Ensure the letter specifies the purpose of the loan if relevant (e.g., home improvements, debt consolidation).

- Include any applicable interest rates or fees that may apply to personal loans.

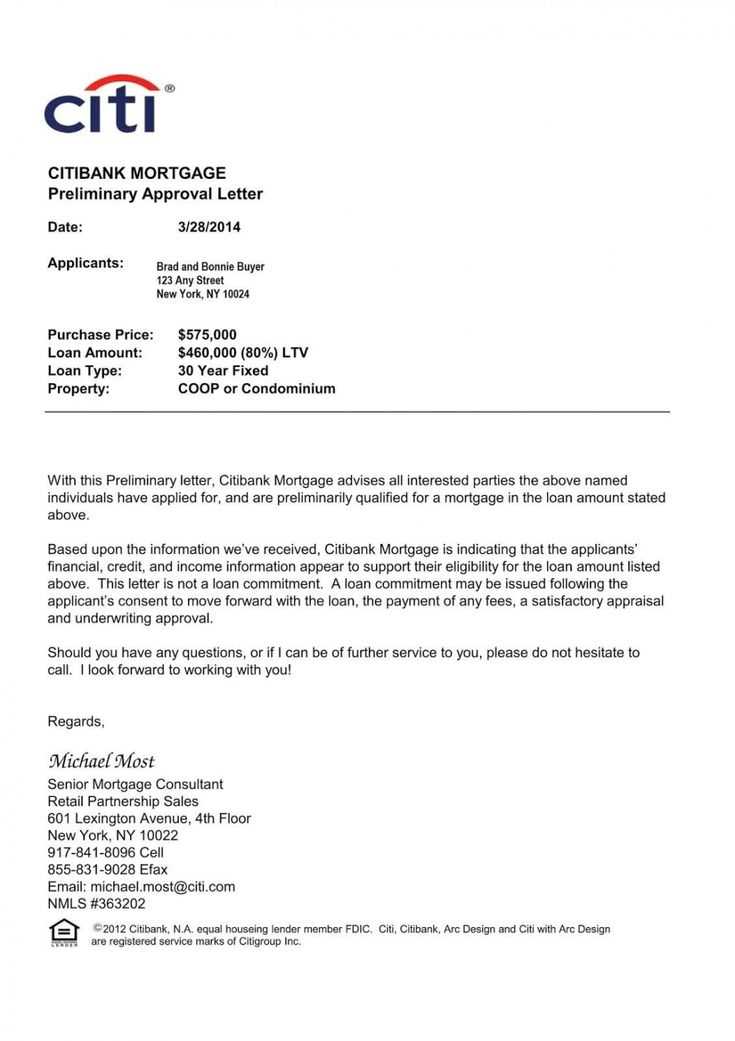

2. Mortgage Loans

- Be explicit about the loan term (e.g., 15 years, 30 years) and the fixed or adjustable interest rate.

- List the down payment requirements, if any, along with any contingencies (e.g., approval based on appraisal).

- Mention the expected closing date or timeline to set clear expectations.

3. Auto Loans

- Clearly state the loan amount and the vehicle details (e.g., make, model, year) for clarity.

- Include the loan term and interest rate, and whether the loan is secured against the vehicle.

- Highlight any down payment or trade-in information if applicable.

4. Business Loans

- Focus on the loan amount and any terms related to business use, such as equipment or expansion.

- Outline the repayment schedule and any collateral or guarantees required.

- Emphasize the financial standing of the business, as lenders will often want to see proof of income and stability.

Reducing Word Repetition While Maintaining Clarity and Accuracy

Use varied language to keep your credit approval letter engaging and concise. Avoid repeating the same words unnecessarily, which can lead to a cluttered and repetitive tone. For example, instead of using “approve” multiple times, consider synonyms like “authorize” or “grant.” You can also rephrase sentences to convey the same idea more fluidly without redundancy.

When reviewing your letter, check for areas where repetition might occur. Often, you can replace repetitive terms with pronouns or restructure sentences to create more variety. This will keep the content fresh and help convey your message clearly.

Another tip is to focus on different sentence structures. Use a combination of short and long sentences to keep the reader engaged while avoiding overuse of particular words. Additionally, consider using active voice where possible to create a direct and engaging tone without repetitive phrasing.

By making these adjustments, you ensure that the approval process is communicated effectively and with clarity, making the letter more professional and easier to read.