Credit bureau letter of removal templates

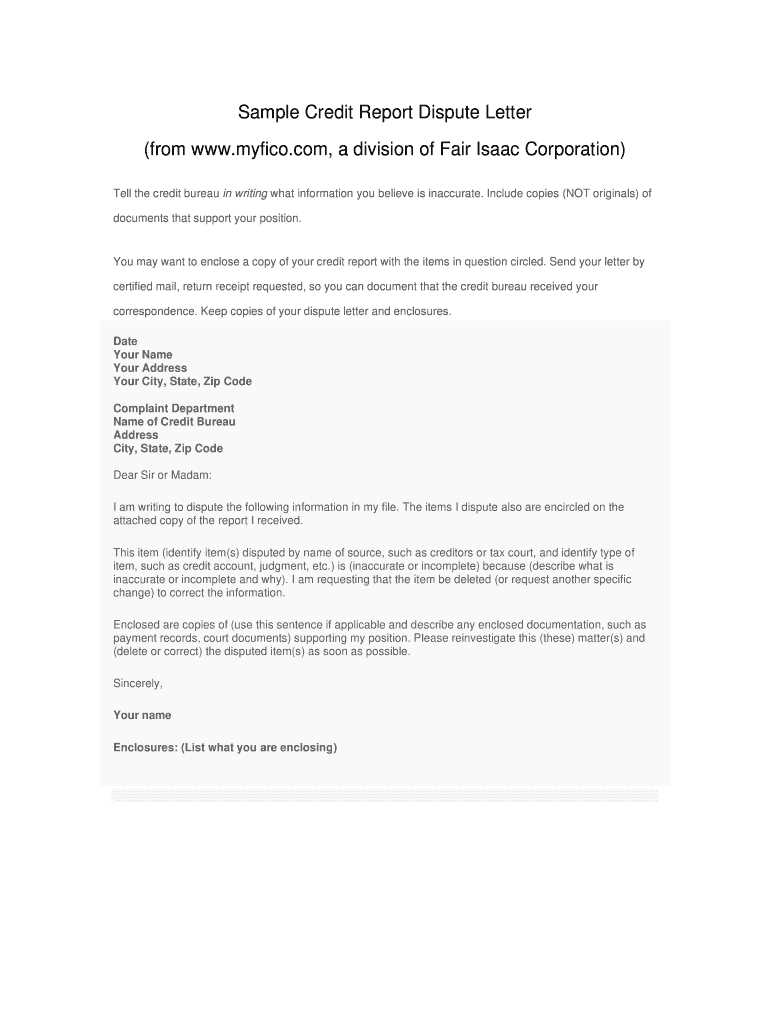

To request the removal of an inaccurate or outdated entry from your credit report, use a clear and concise credit bureau letter. Begin by identifying the specific item you want removed and state why it is inaccurate. Provide supporting documentation, such as payment records or proof of error, to strengthen your case.

Start your letter with a formal introduction, including your full name, address, and the details of the credit entry in question. This will help the credit bureau easily locate the item on your report. Be direct in your request, specifying the action you want them to take, whether it’s correcting the error or removing the entry entirely.

Keep the tone professional throughout your letter. Avoid emotional language or complaints about the error. Instead, focus on the facts, and make it easy for the bureau to understand your request. Attach any relevant documents to support your claim and request confirmation once the correction has been made.

Close your letter with a polite request for a follow-up and your contact details for any further correspondence. A well-crafted, factual letter can speed up the process and help you clear your credit report effectively.

Here are the revised lines where word repetition is minimized:

When crafting a letter to a credit bureau requesting removal of incorrect information, precision is key. A clear and concise message will improve your chances of a successful request. Here’s an example of how to adjust your wording:

-

Original: “I am writing to request the removal of inaccurate information that is harming my credit score.”

-

Revised: “Please remove the incorrect information affecting my credit score.”

-

Original: “The information provided is not accurate, and I would like it removed immediately to correct my credit file.”

-

Revised: “Kindly remove the inaccurate details from my credit file to ensure its accuracy.”

-

Original: “I have provided proof that the information is incorrect, and I request that it be taken off my credit report.”

-

Revised: “Attached are the documents proving the inaccuracy; please remove the entry from my credit report.”

By eliminating redundant phrases, your request becomes more direct and impactful. Keep the tone respectful and professional while maintaining clarity throughout your letter. Avoid unnecessary elaboration to ensure your message is not lost in overly complex language.

- Credit Bureau Removal Letter Templates

To write an effective credit bureau removal letter, focus on clarity and directness. Begin by clearly stating the request for the removal of specific items from your credit report. Mention the date when the item was first reported and provide any evidence that supports your claim, such as payment records or settlement letters.

Template Example:

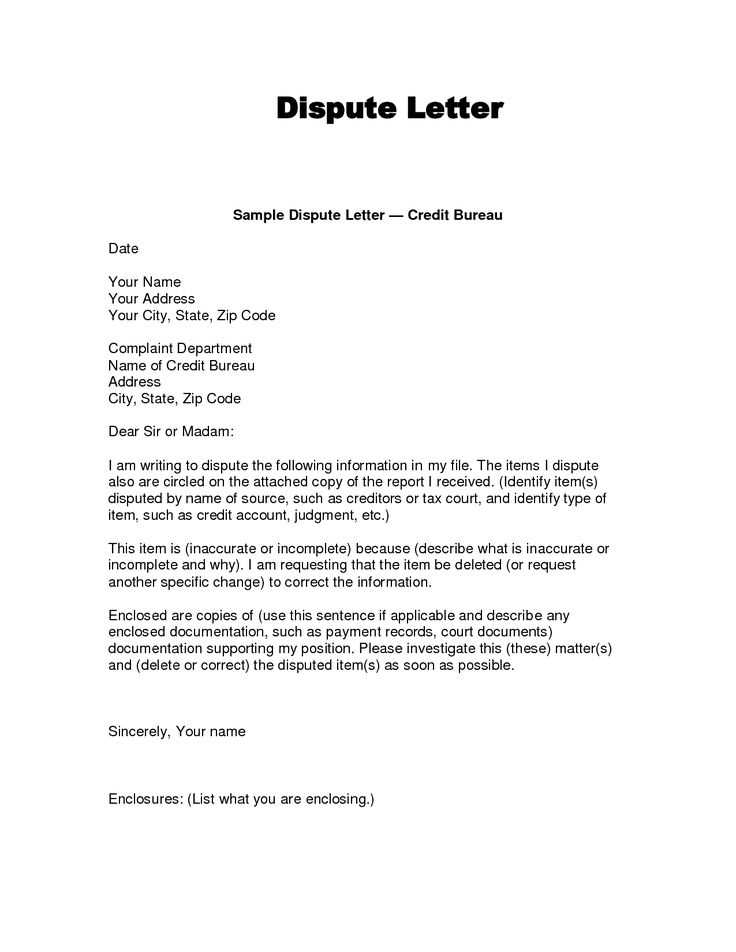

Dear [Credit Bureau Name],

My name is [Your Name], and I am writing to formally request the removal of the following item from my credit report. The item in question was reported on [Date] and is associated with [Creditor Name]. After careful review, I believe that the item was reported in error or has been resolved, and I would like it removed from my report.

I have enclosed supporting documentation that confirms this. Please review the attached records and update my credit file accordingly. If additional information is needed, feel free to contact me at [Your Phone Number] or via email at [Your Email Address].

Thank you for your prompt attention to this matter. I look forward to receiving confirmation of the removal of this item from my credit report.

Sincerely,

[Your Name]

This simple and direct approach increases the likelihood of your request being processed smoothly. Ensure that you send your letter via certified mail and keep a copy of all correspondence for your records.

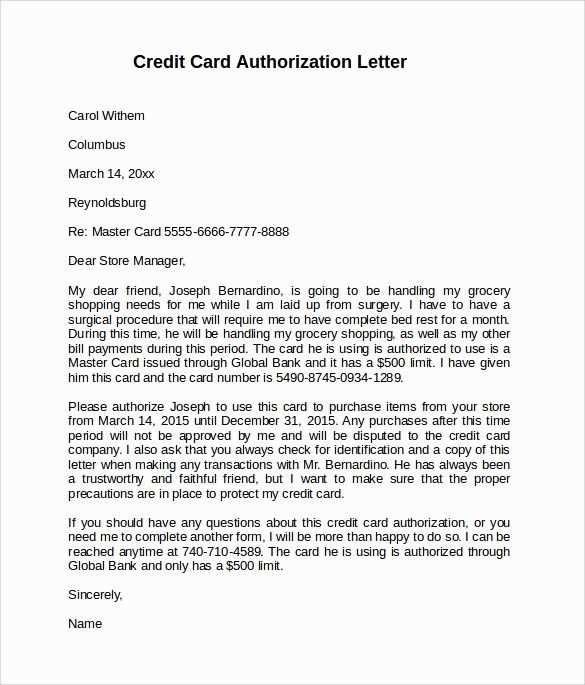

A credit report removal letter serves as a formal request to a credit bureau or lender to remove inaccurate, outdated, or erroneous information from a credit report. The primary objective is to correct any mistakes that may negatively affect your credit score. It’s important to address inaccuracies quickly, as they can impact loan approvals, interest rates, and overall financial health.

When drafting this letter, it’s crucial to provide clear and specific details about the information in question. Include any supporting documentation, such as payment records or court orders, to substantiate your claim. The letter should maintain a professional tone and outline the reasons for the requested removal, referencing relevant laws or credit reporting guidelines where applicable.

By sending a well-crafted credit report removal letter, you can ensure your credit history accurately reflects your financial behavior, improving your chances of securing favorable lending terms in the future.

Make your removal request clear and direct by including the following information:

1. Full Name and Contact Information

Always begin with your full name, address, phone number, and email address. This helps the credit bureau easily identify you and address your request accurately. It’s essential to verify your identity in case they need further details to process your request.

2. Account Information and Disputed Entry

Specify the account number related to the disputed entry. If you are requesting removal for a particular issue, mention the exact entry or error on your report that you believe should be corrected. Clearly describe the nature of the dispute (e.g., inaccurate late payments or incorrect account status). Providing specific details strengthens your case.

3. Request for Action

State clearly that you are requesting the removal of the disputed item. Use direct language, such as, “Please remove the inaccurate information related to my account from my credit report.” A clear request helps avoid confusion and ensures a prompt response.

4. Supporting Documentation

Attach any documents that support your claim, such as payment receipts, bank statements, or letters from creditors. This shows the credit bureau you have valid reasons for your request, making it more likely that your dispute will be resolved in your favor.

5. Signature and Date

Sign the letter and include the date you’re submitting it. This gives your request legitimacy and ensures they know when the request was made, establishing a timeline for resolution.

6. Follow-Up Information

If necessary, include a line requesting confirmation of receipt or a follow-up contact, like, “Please confirm receipt of this letter and provide an estimated date for resolution.” It helps you stay on top of your request and track progress.

7. Politeness and Professional Tone

Maintain a courteous tone throughout your letter. A professional and respectful approach increases the chances of receiving a favorable response and helps in building a good rapport with the credit bureau.

| Detail | Description |

|---|---|

| Full Name and Contact Info | Provide your full name, address, phone number, and email for identification. |

| Account and Disputed Entry | Specify the account number and describe the entry in question. |

| Request for Action | Clearly state that you want the disputed entry removed. |

| Supporting Documentation | Attach any proof that supports your claim, such as receipts or statements. |

| Signature and Date | Sign the letter and include the date of submission. |

| Follow-Up | Request a confirmation of receipt or follow-up date. |

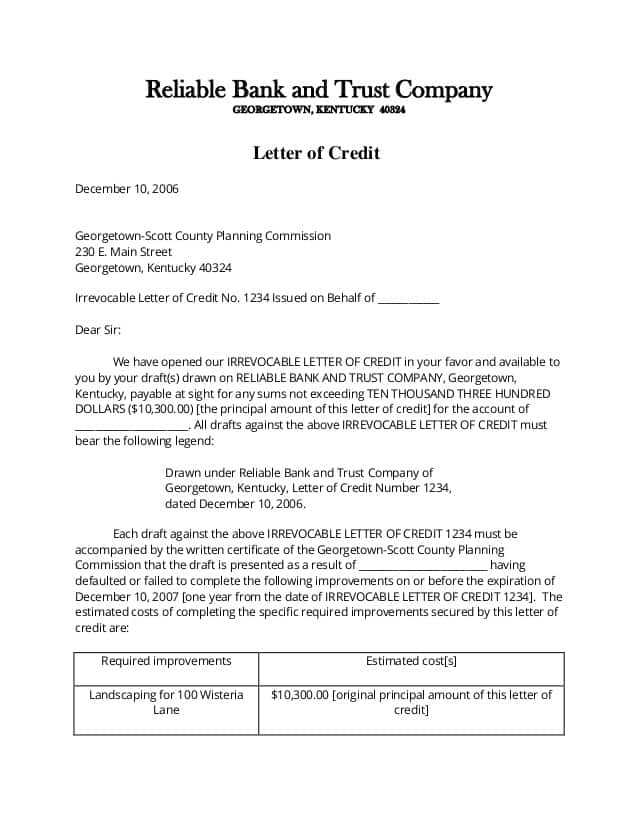

Begin by obtaining a copy of your credit report from each of the major credit bureaus: Equifax, Experian, and TransUnion. Review the report carefully for any discrepancies or mistakes. If you spot any inaccuracies, gather supporting documents such as bank statements or receipts to validate your claim.

Next, contact the credit bureau reporting the error. Provide them with a clear explanation of the issue and include the supporting documentation. Be concise in your communication, ensuring that all facts are presented clearly. You can typically dispute the error online, via mail, or by phone, depending on the bureau’s preferences.

Once your dispute is submitted, the credit bureau will investigate the issue. The process usually takes about 30 days. During this time, they will verify the information with the creditor and, if necessary, update your credit report accordingly.

If the credit bureau resolves the dispute in your favor, the error will be corrected, and your credit score may improve. However, if they deny your claim, you have the right to appeal the decision. Ensure that you have a solid case before re-submitting the dispute, and consider escalating the matter to the creditor directly if needed.

It’s also wise to monitor your credit report regularly to catch errors before they impact your financial standing. This proactive approach will help you maintain an accurate credit history and avoid surprises in the future.

Using the right template can help resolve common credit report problems quickly and clearly. Below are templates for addressing different credit-related concerns:

Dispute for Inaccurate Information

If you find inaccurate details on your credit report, use this template to request a correction:

Dear [Credit Bureau Name], I am writing to dispute an item on my credit report. The information I believe is inaccurate is listed as follows: - Account Name: [Name of the Creditor] - Account Number: [Account Number] - Inaccurate Detail: [Describe the inaccuracy] I request that this information be reviewed and corrected. Please notify me of any updates to my credit report. Thank you for your attention to this matter. Sincerely, [Your Full Name] [Your Address] [Your Contact Information]

Request for Removal of Negative Marks

To remove a negative mark, send a request like the one below:

Dear [Credit Bureau Name], I am requesting the removal of the following negative entry from my credit report: - Account Name: [Name of the Creditor] - Account Number: [Account Number] - Negative Entry: [Description of the negative item] This entry is inaccurate due to [reason for removal request]. I kindly ask that you investigate and remove this entry if it does not reflect the correct status of my account. Thank you for your assistance. Sincerely, [Your Full Name] [Your Address] [Your Contact Information]

Goodwill Removal Request

If you have a late payment but your overall credit history is positive, you can request a goodwill removal:

Dear [Creditor's Name], I hope you are doing well. I am writing to request that you consider removing the late payment recorded on my account: - Account Name: [Your Account Name] - Account Number: [Your Account Number] - Date of Late Payment: [Date of Payment] I fully acknowledge my mistake in missing the payment; however, this incident does not reflect my usual payment history. I kindly ask for your understanding and request that this late payment be removed from my credit report as a goodwill gesture. Thank you for considering my request. Sincerely, [Your Full Name] [Your Address] [Your Contact Information]

Reinvestigation Request

If you’ve already disputed an error and it hasn’t been resolved, submit a reinvestigation request:

Dear [Credit Bureau Name], I am requesting that you reopen my dispute regarding the following item on my credit report: - Account Name: [Creditor's Name] - Account Number: [Account Number] - Disputed Detail: [Describe the disputed item] I previously submitted a dispute on [date], but the issue has not been resolved. I would appreciate it if you could reinvestigate the situation and update my credit report accordingly. Thank you for your prompt attention. Sincerely, [Your Full Name] [Your Address] [Your Contact Information]

Debt Verification Request

If you’re unsure about a debt listed on your report, request verification with this template:

Dear [Creditor or Collection Agency Name], I am writing to request verification of the debt listed on my credit report: - Account Name: [Your Account Name] - Account Number: [Account Number] - Amount Due: [Debt Amount] Please provide me with the necessary documentation to verify this debt, as I do not recognize this information. I ask that this debt be confirmed in writing before any further action is taken. Thank you for your attention to this matter. Sincerely, [Your Full Name] [Your Address] [Your Contact Information]

| Issue Type | Template Purpose |

|---|---|

| Dispute for Inaccurate Information | Request for correction of inaccurate details on credit report |

| Request for Removal of Negative Marks | Request to remove negative information from credit report |

| Goodwill Removal Request | Request to remove late payment as a goodwill gesture |

| Reinvestigation Request | Request for a second review of a disputed item |

| Debt Verification Request | Request to verify a debt listed on the credit report |

Ensure that you are clear and concise in your request. Avoid making vague statements, as they may delay the removal process. A specific reason for the request is crucial, whether it’s due to inaccurate information or reporting errors. Avoid including unnecessary personal details that do not directly relate to the issue. Stay focused on the removal request itself and present your case logically.

Incorrect Contact Information

Using incorrect or outdated contact details can cause your request to be delayed or ignored. Double-check that your contact information is accurate and up-to-date to ensure smooth communication between you and the credit bureau.

Failure to Provide Supporting Documents

Omitting essential documents, such as proof of the error or previous communication, weakens your case. Always attach relevant evidence to support your claim. Whether it’s a court order, bank statement, or other official records, this documentation will help expedite the process.

After sending your credit bureau removal letter, take the following steps to monitor and ensure the removal is processed correctly:

1. Track the Response

- Keep an eye on your mail or email for a confirmation from the credit bureau. Most bureaus will provide an acknowledgment of receipt within 30 days.

- If no response is received within the specified time, consider following up with the credit bureau to check on the status of your request.

2. Review Your Credit Report

- Once you receive a response, obtain an updated copy of your credit report to verify that the item has been removed.

- Look for any discrepancies, such as the removal not being reflected, and take immediate action to address them.

3. Dispute Any Remaining Errors

- If the removal was not completed correctly, file a dispute with the credit bureau. Attach any supporting documents to strengthen your case.

- Ensure that all negative information that was addressed in your removal letter is gone from your credit report.

4. Monitor Your Credit Regularly

- Check your credit report periodically to ensure no new inaccuracies or unwanted items appear.

- Use a credit monitoring service to stay updated and catch potential issues before they impact your credit score.

Letter Templates for Credit Bureau Removal

To request the removal of an inaccurate entry from your credit report, use a clear and concise letter. Start by addressing the credit bureau directly, providing your full name, address, and any relevant account numbers. The goal is to keep the communication professional and focused on your request for correction.

Here’s a simple template you can follow:

- Begin with your contact details:

- Full name

- Address

- Phone number

- Email address (optional)

- State the reason for your letter:

Clearly explain which entry you are disputing and why it should be removed. Mention specific inaccuracies or mistakes and reference any supporting documentation.

- Provide proof of correction:

If you have any documentation or proof that the entry is inaccurate (such as a court ruling or a paid-off balance), include this with your letter. This will help strengthen your case.

- Request for removal:

Be direct in asking for the removal of the entry. For example, you can write, “I request that this entry be removed from my credit report immediately.” Avoid using vague language, as this can delay the process.

- Close professionally:

- Thank them for their attention to the matter.

- Sign the letter at the end.

Use this template for faster and more organized communication with the credit bureau. Keep a copy of the letter for your records, as well as any responses you receive.