Credit card dispute letter template

When you notice a mistake on your credit card statement, it’s crucial to act quickly and write a formal letter to dispute the charge. The first step is to make sure you have all the necessary details about the transaction–such as the date, amount, and the merchant name. Once you’ve confirmed the discrepancy, you can craft a clear and direct letter that outlines the issue.

Be concise in your explanation, focusing on the specific transaction you are disputing. Mention why you believe the charge is incorrect, whether it’s an unauthorized transaction, duplicate charge, or a billing error. Provide any supporting evidence such as receipts, emails, or communication with the merchant.

Make sure your letter is polite but firm. Address it to the correct department, usually the customer service or billing disputes team, and include your full account details so they can easily locate the transaction in question. Keep your tone professional to ensure a smooth process.

By using a credit card dispute letter template, you can ensure your letter includes all the necessary components, such as your contact information, account number, details of the disputed charge, and a clear request for resolution. This will help you communicate your issue efficiently and improve your chances of a prompt response.

Here is the corrected text with reduced repetition of words:

When writing a credit card dispute letter, keep your points clear and to the point. Focus on providing details of the charge, your reason for disputing it, and any supporting evidence. Avoid excessive elaboration or redundant phrasing.

Key Points to Include

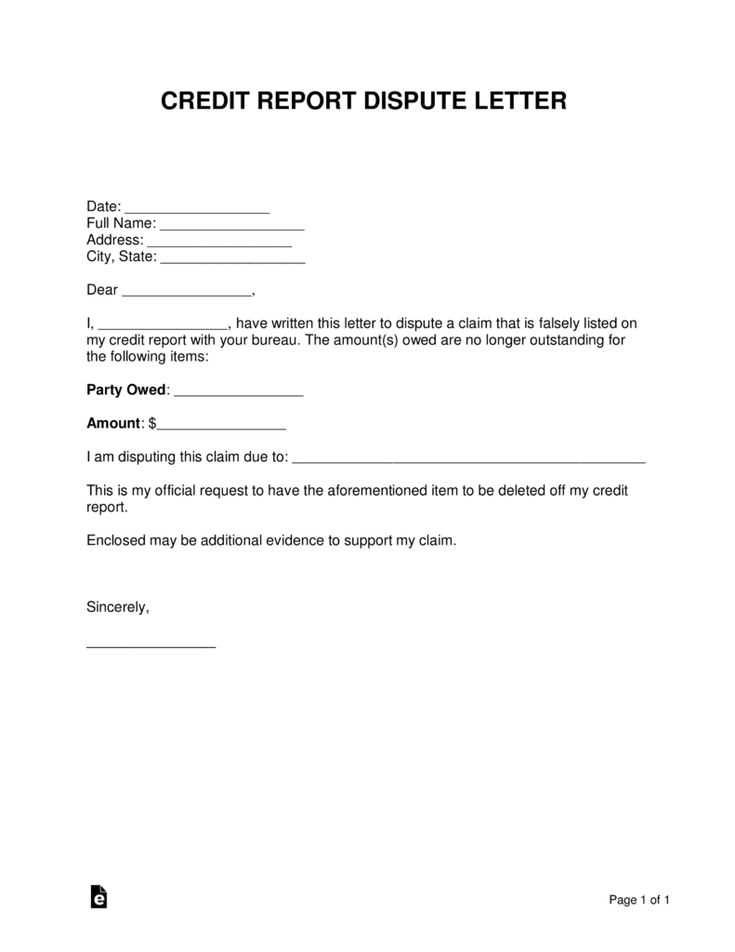

Include the following details in your letter:

- Your account number

- The disputed transaction date and amount

- A brief description of why the charge is incorrect

- Any supporting documents (e.g., receipts, communication records)

Recommended Structure

| Section | Content |

|---|---|

| Opening | State your intent to dispute a charge with specific details. |

| Details | Clearly explain why the charge is incorrect. Be precise. |

| Evidence | Attach relevant documentation or references that support your claim. |

| Closing | Request a prompt resolution and provide contact information for further communication. |

Write in a professional tone, avoid unnecessary jargon, and keep the letter concise to ensure clarity. A well-organized letter will help expedite the process of resolving your dispute.

- Credit Card Dispute Letter Template

Begin your letter with a clear identification of the disputed charge. Include the date, the amount, and the merchant’s name. Make sure to specify your account number and the transaction reference number if available.

Account Information and Disputed Charge Details

Provide your full name, address, and contact information. Then, outline the charge you are disputing. Specify the transaction date, the amount, and why you believe it is incorrect. For instance, you might mention that you never made the purchase or that the goods/services were not received as expected.

Request for Resolution

Clearly state what you want to happen. You might request a refund, a charge reversal, or a credit to your account. Include a polite but firm closing, such as, “I expect a resolution to this matter within the time frame specified by your policy.”

Lastly, include any supporting documents like receipts, communication records, or evidence of the disputed charge to strengthen your case. Ensure your contact details are easy to find for follow-up.

Begin your dispute letter with clear, direct information to avoid any confusion. Start by addressing the credit card company with their correct name and include your account number for easy identification.

- Include your personal details: Name, address, and any relevant contact information. This will ensure the credit card company can quickly locate your account.

- Provide the dispute reason: Clearly state why you are disputing the charge. Be specific–whether it’s an incorrect amount, fraudulent charge, or an error in processing.

- Include relevant dates and amounts: Specify the date of the transaction and the amount you’re disputing. Attach any supporting documents, such as receipts or statements, to back your claim.

By following this structure, you’ll make it easier for the company to address your concern quickly and accurately.

Begin with your full name, address, and contact details. This ensures the recipient can easily identify and reach you. Include your credit card number, but be careful to only provide the last four digits for security reasons. Clearly state the date of the transaction in question, along with the merchant’s name and any relevant reference numbers or invoices.

Next, describe the issue you are disputing. Be concise but specific about the problem. If it’s a charge you didn’t authorize, mention this directly. If the item or service was not as described, explain how it failed to meet expectations. Include any supporting evidence, like receipts or correspondence with the merchant, to strengthen your case.

If possible, mention the steps you’ve already taken to resolve the issue with the merchant. This shows that you’ve made an effort before reaching out to the credit card company. Finally, clearly state the resolution you are seeking, whether it’s a refund, a charge reversal, or a correction to the transaction.

Don’t miss the deadline. Each credit card issuer has a specific time frame for submitting a dispute, usually between 30 to 60 days. Missing this window can result in the automatic rejection of your claim.

Avoid submitting incomplete information. Provide all necessary details, including transaction dates, amounts, and any supporting documents. Lack of clarity or missing proof can delay the process or cause your dispute to be dismissed.

Don’t overlook the terms and conditions. Ensure the charge is genuinely disputable. Sometimes, charges are within your agreement, and disputing them might not be valid. Double-check the contract or service terms before proceeding.

Don’t assume the bank will resolve everything. Although your card issuer may assist, it’s your responsibility to follow up regularly and stay involved throughout the dispute process. Keep track of communication and make sure they’re handling your case.

Avoid making emotional statements. Stay factual and professional in your communication. Emotional language or accusations can weaken your case and cause unnecessary complications.

Don’t forget to keep copies. Always keep a record of any correspondence or documents sent. If something goes wrong, having a paper trail will make it easier to escalate the issue if necessary.

Don’t dispute minor charges. Small, low-value disputes might not warrant the time and effort. Assess whether it’s worth your energy before initiating the process.

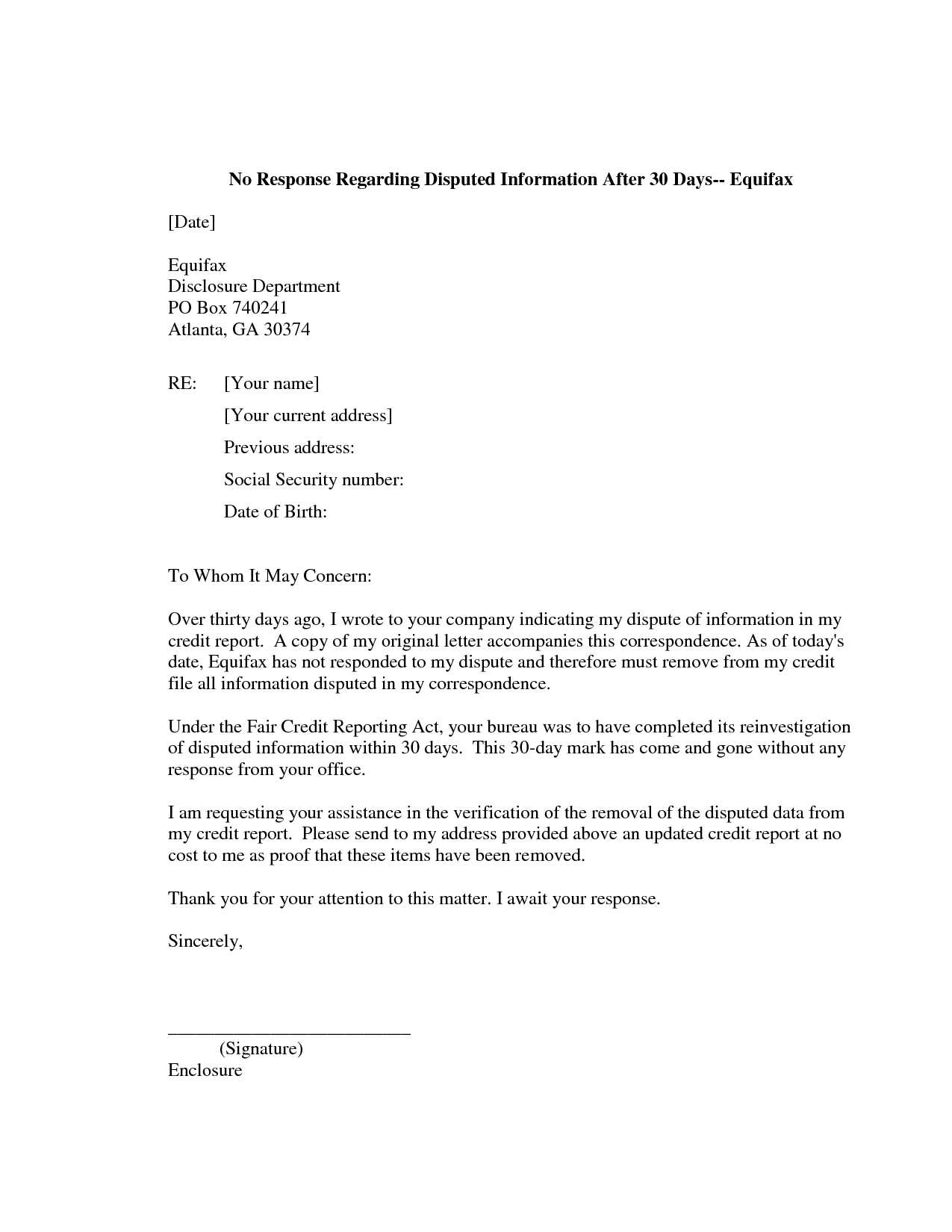

Use the correct name of the issuer as it appears on official documents, such as your billing statement or cardholder agreement. Avoid using informal or generic terms. Double-check the contact details, including the specific department or office handling disputes, if mentioned on the letter or website. If unsure, call customer service to confirm the correct contact details before sending your letter.

Addressing the Letter

Begin by addressing the issuer directly. Use formal language, such as “Dear [Issuer’s Name]” or “To Whom It May Concern” if the specific department or representative isn’t listed. Include the account number in the subject line or at the start of the letter for easy identification of your case.

Use of Account and Dispute Details

Be clear and concise when referencing the transaction in question. State the date, amount, and reason for your dispute. This will help the issuer process your request promptly without requiring further clarifications.

Attach clear copies of your bank statement showing the disputed transaction. Highlight the specific charge in question to make it easy for the reviewer to locate. If possible, include any receipts or invoices related to the purchase, as they can serve as direct evidence to support your claim. A screenshot of the transaction from the merchant’s website or your online account can also strengthen your case, especially if there is a discrepancy between the billed amount and the one you authorized.

If the charge is due to a fraudulent activity, include a copy of the police report or any other official documents related to the investigation. This documentation confirms the legitimacy of your dispute. Also, provide communication records such as emails or letters exchanged with the merchant, as they may offer valuable context to your claim.

Lastly, if you’ve attempted a chargeback or previous dispute process, include any case reference numbers, tracking details, or responses received from the merchant or your credit card issuer. This helps establish the timeline and your efforts to resolve the issue directly.

Once you’ve mailed your dispute letter, the next steps will guide you through the resolution process. Keep these actions in mind:

- Track the delivery: Confirm that your letter was received. Use a service that provides delivery confirmation or tracking.

- Monitor your account: Check your credit card statement regularly for updates or changes in the disputed charge status.

- Prepare for communication: Be ready for any follow-up from the issuer. They may contact you for additional information or clarification.

- Document responses: Keep copies of any communication you receive from the credit card company, including emails or letters.

- Follow up if needed: If you don’t hear back within the specified time (usually 30 days), reach out to inquire about the status of your dispute.

Stay organized and proactive to ensure that your dispute is addressed efficiently.

Begin your dispute letter with a clear and concise statement of the issue. Mention the date and transaction details that you are disputing. Provide the charge amount and a brief description of why the transaction is incorrect. Attach any supporting evidence, such as receipts or communication with the merchant, to back up your claim.

Explain your desired outcome–whether it’s a refund, credit, or cancellation of the charge. Be specific and direct about your expectations. Keep the tone professional but firm. Clearly state your contact information and ask the issuer to resolve the issue promptly.

Finish by thanking the recipient for their attention to the matter. Include any deadlines or follow-up steps to emphasize the urgency. Sign the letter at the bottom with your full name and account information for reference.