Credit Card Hardship Letter Template for Debt Relief

When facing financial difficulties, reaching out to your creditors with a formal request can help alleviate some of the strain. A well-crafted request can lead to more manageable payment terms, offering temporary relief from overwhelming financial obligations. Knowing how to structure this communication is crucial for maximizing its effectiveness.

Key Components of an Effective Request

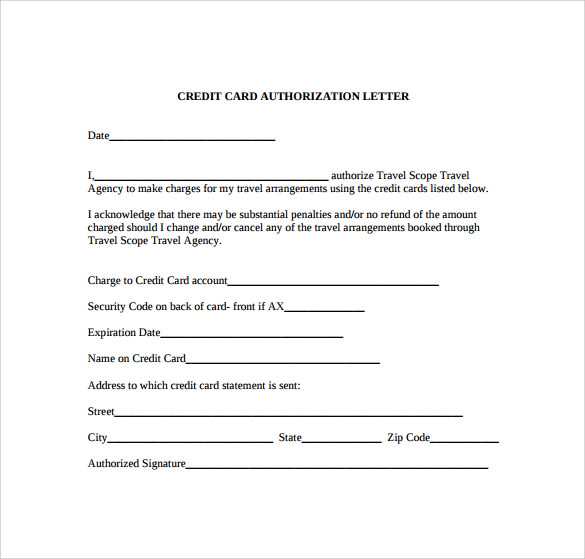

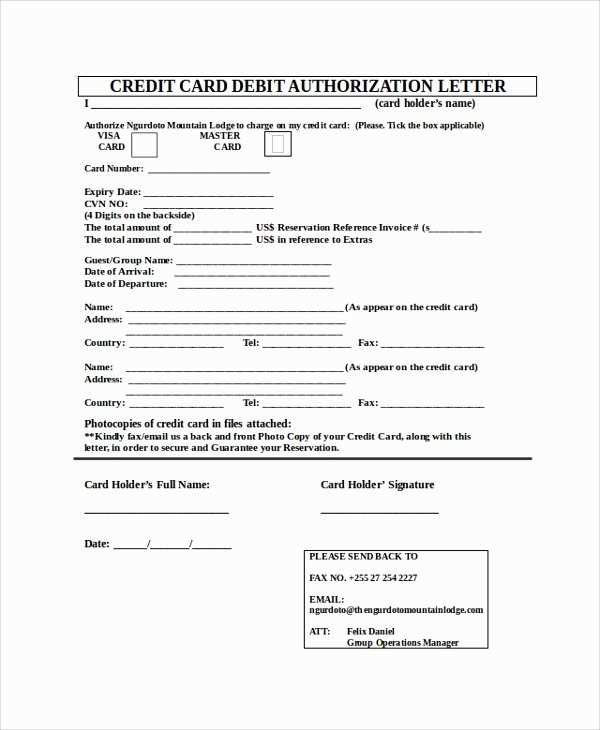

To ensure your appeal is taken seriously, include the following essential elements:

- Personal Information: Clearly state your identity and account details to ensure the creditor can easily locate your information.

- Reason for Difficulty: Be honest and specific about the circumstances that are causing your financial struggles.

- Requested Relief: Specify the adjustments you are seeking, such as reduced payments, deferred payments, or temporary forbearance.

- Commitment to Pay: Assure the creditor of your intention to repay the debt, outlining how you plan to manage payments once the relief period ends.

When to Send Your Request

Timing is critical when submitting a financial relief appeal. Aim to send it as soon as you recognize that your financial situation is changing. Early communication shows initiative and may result in more favorable terms.

Common Mistakes to Avoid

- Vagueness: Avoid being unclear about your needs or circumstances. The more specific you are, the better the chances of a positive response.

- Neglecting Documentation: If applicable, provide supporting documents that validate your financial difficulties, such as medical bills or unemployment verification.

- Failure to Follow Up: If you don’t receive a response within a reasonable timeframe, follow up with a polite reminder.

What to Expect After Submission

Once your request has been submitted, creditors may take a few weeks to review your situation. They will assess your financial standing and determine if your proposed terms are viable. Be prepared to discuss alternative solutions if your initial proposal is not accepted. While responses can vary, the process can lead to a more manageable repayment structure tailored to your current financial condition.

Financial Relief Request Guide

In times of financial difficulty, reaching out to your lender with a formal request for support can help ease the burden. Crafting a clear and effective appeal is essential to getting the necessary assistance. This section will guide you through understanding the process and offer tips for success.

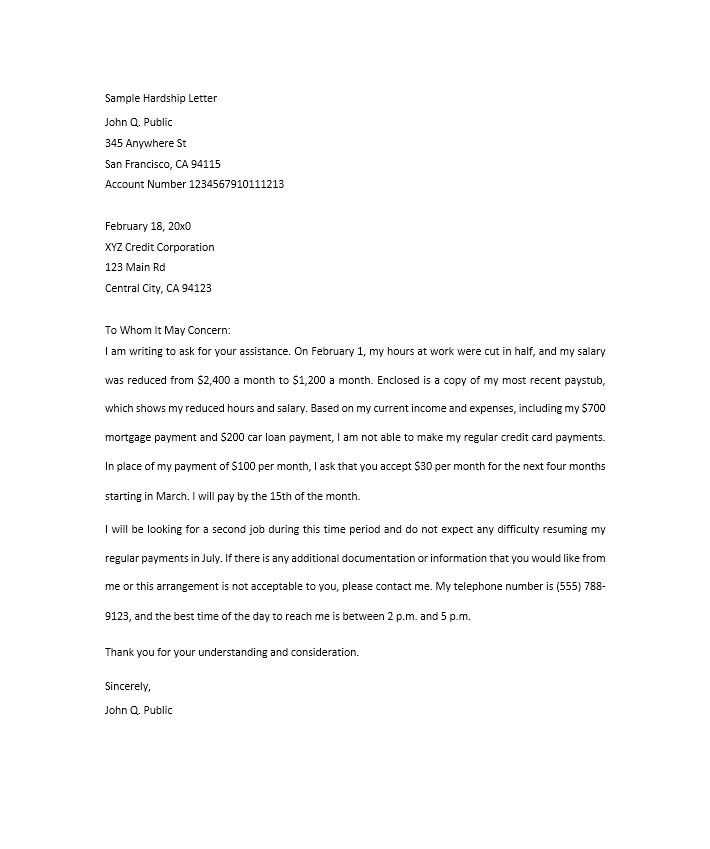

How to Write a Financial Appeal

When drafting your request, it’s important to focus on clarity and honesty. Start by explaining your current financial situation and the challenges you’re facing. Be specific about the type of relief you’re seeking and outline how this assistance will help you manage your obligations more effectively. A well-structured appeal is both respectful and direct, ensuring that your lender understands your needs.

Key Elements to Include in Your Request

There are several vital components to include in your appeal to make it as effective as possible:

- Personal Identification: Make sure to include your account number and any other relevant details to help the lender identify your case.

- Explanation of Circumstances: Clearly explain the reasons why you’re struggling, whether it’s due to illness, job loss, or other unforeseen events.

- Requested Relief: Specify what type of assistance you need–whether that’s reduced payments, a temporary pause, or a different repayment structure.

- Future Commitment: Emphasize your willingness and plan to fulfill your obligations once the relief period ends, showing your dedication to repaying the debt.

When to Send Your Request

It’s crucial to send your appeal as soon as you realize that you’re facing financial difficulties. Early communication shows your proactive approach, which can positively influence the lender’s decision. Don’t wait until you’ve missed multiple payments; addressing the situation sooner can increase your chances of receiving assistance.

Tips for Successful Negotiation

To improve your chances of success, approach the negotiation process with patience and flexibility. Understand that lenders may offer different solutions, and be open to discussing alternatives. Showing your willingness to find a mutual solution can create a more positive outcome. Additionally, keep your communication professional and courteous throughout the process.

Avoiding Common Pitfalls

- Lack of Detail: Be thorough in your explanation and avoid vague statements. The more specific you are, the better.

- Failure to Provide Supporting Documents: If possible, include proof of your financial hardship, such as medical bills or unemployment documentation.

- Not Following Up: If you don’t receive a timely response, follow up respectfully to ensure your request is being considered.

What to Expect After Submission

Once your request has been submitted, expect to wait for a response, which may take a few weeks. The lender will review your financial situation and determine whether your proposed solution is feasible. Be prepared for further discussions or negotiations, and remain flexible if alternative terms are suggested.