Credit Card Letter of Authorization Template for Easy Use

When handling transactions on behalf of another person or organization, clear permission is often required to ensure that the payment process runs smoothly. A formal document serves as a safeguard, confirming that one party is authorized to use someone else’s financial details for a specific transaction. Such a document is crucial for security, preventing misunderstandings and potential disputes.

Having a well-structured form can simplify this process. With the right format, it becomes easier to grant approval for various financial transactions without complications. Whether for personal or business purposes, this tool helps to streamline the approval procedure and ensures both parties are on the same page.

Understanding the key components of this form is essential to create a functional and legally sound agreement. In this article, we will explore how to draft such a document, highlighting its importance and practical applications in everyday transactions.

What is a Payment Consent Document

A payment consent document is a formal agreement that grants permission for one individual or organization to use another party’s financial information for a specific transaction. This type of agreement ensures that both sides are clear on the terms and that the transaction is legitimate. It serves as a way to confirm that the individual whose details are being used has given explicit consent, which helps to avoid any confusion or potential fraud.

Typically, this document includes key information such as the names of both parties, the payment amount, and the purpose of the transaction. It acts as an official record that can be referred to in case any issues arise during or after the payment process. This ensures both parties are protected and that the process is fully transparent.

The purpose of such a document is to streamline financial exchanges while ensuring that the person whose account is being charged is aware of and approves the transaction. Without such documentation, there is a risk of unauthorized transactions and potential legal complications.

Why You Need an Authorization Template

Having a well-structured consent form is crucial when managing financial transactions on behalf of another person. Without a standardized format, you may encounter confusion, delays, or even legal complications. A consistent document ensures that all required details are included and that the process runs smoothly. It also provides both parties with a clear, written record of the agreement.

Benefits of Using a Standardized Document

- Clarity and Transparency: A structured form makes the terms of the transaction clear, ensuring both parties understand their roles and responsibilities.

- Security: Proper documentation reduces the risk of fraud by ensuring that consent is granted in writing, preventing unauthorized transactions.

- Time-Saving: With a pre-designed format, you can quickly fill out and submit the form without having to draft a new agreement every time.

- Legal Protection: A formal document can serve as evidence in case of a dispute, providing legal support if necessary.

When to Use an Authorization Form

- When someone else is making a purchase or payment on your behalf.

- If you are handling another person’s financial account or details for a specific transaction.

- When a service provider requires proof of consent for processing payments or charges.

By using a predefined format, you ensure that each transaction is documented and authorized properly, which safeguards both the payer and the payee.

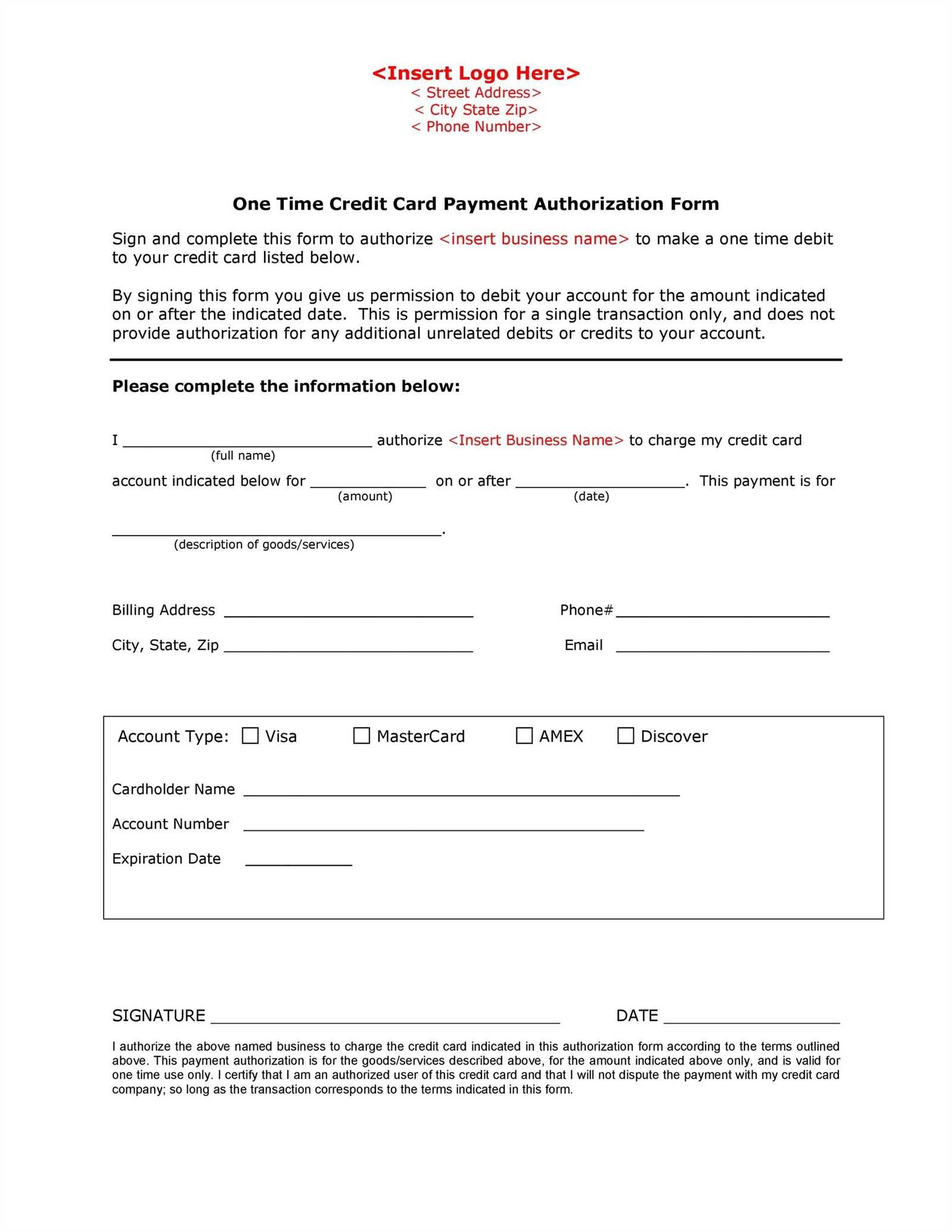

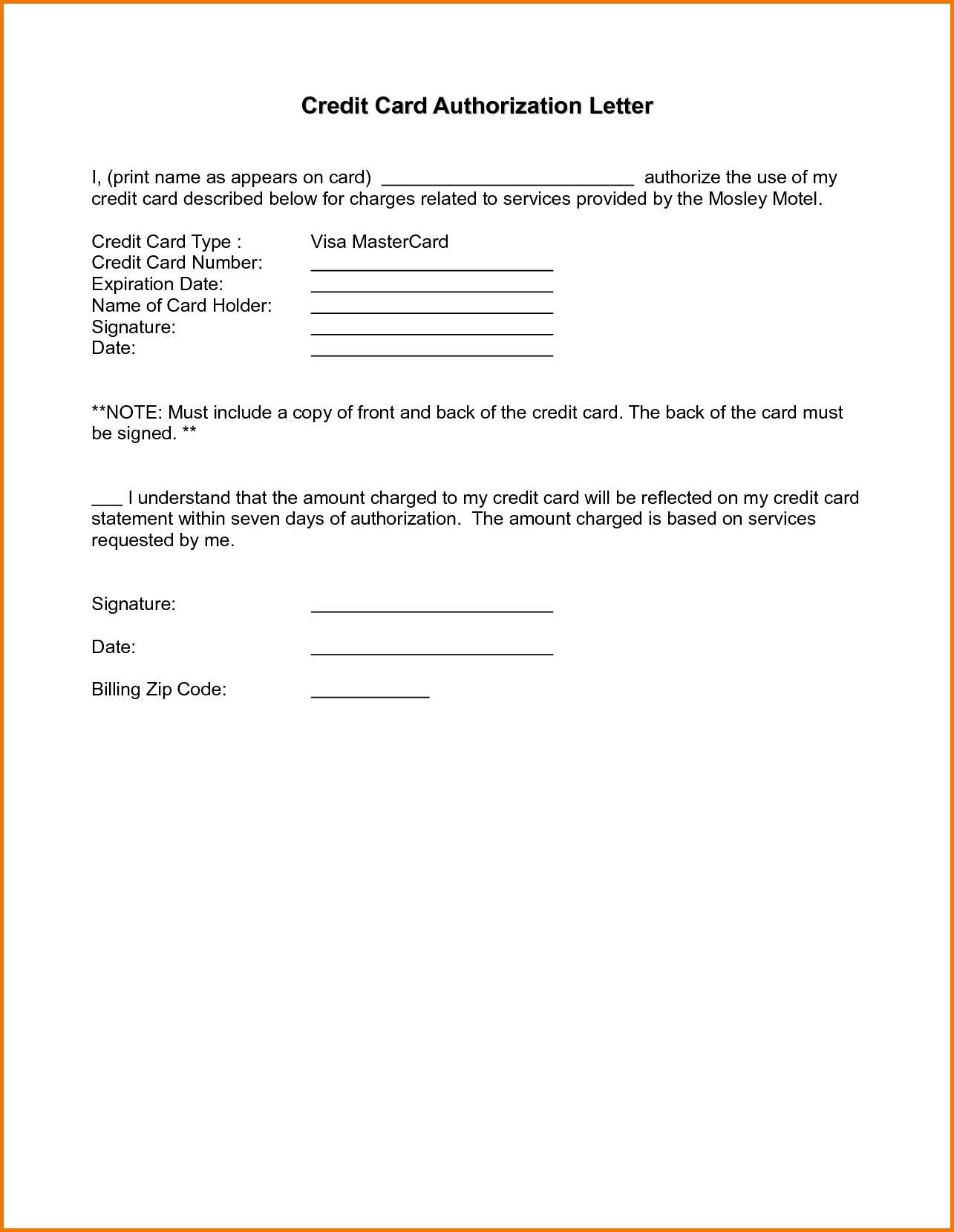

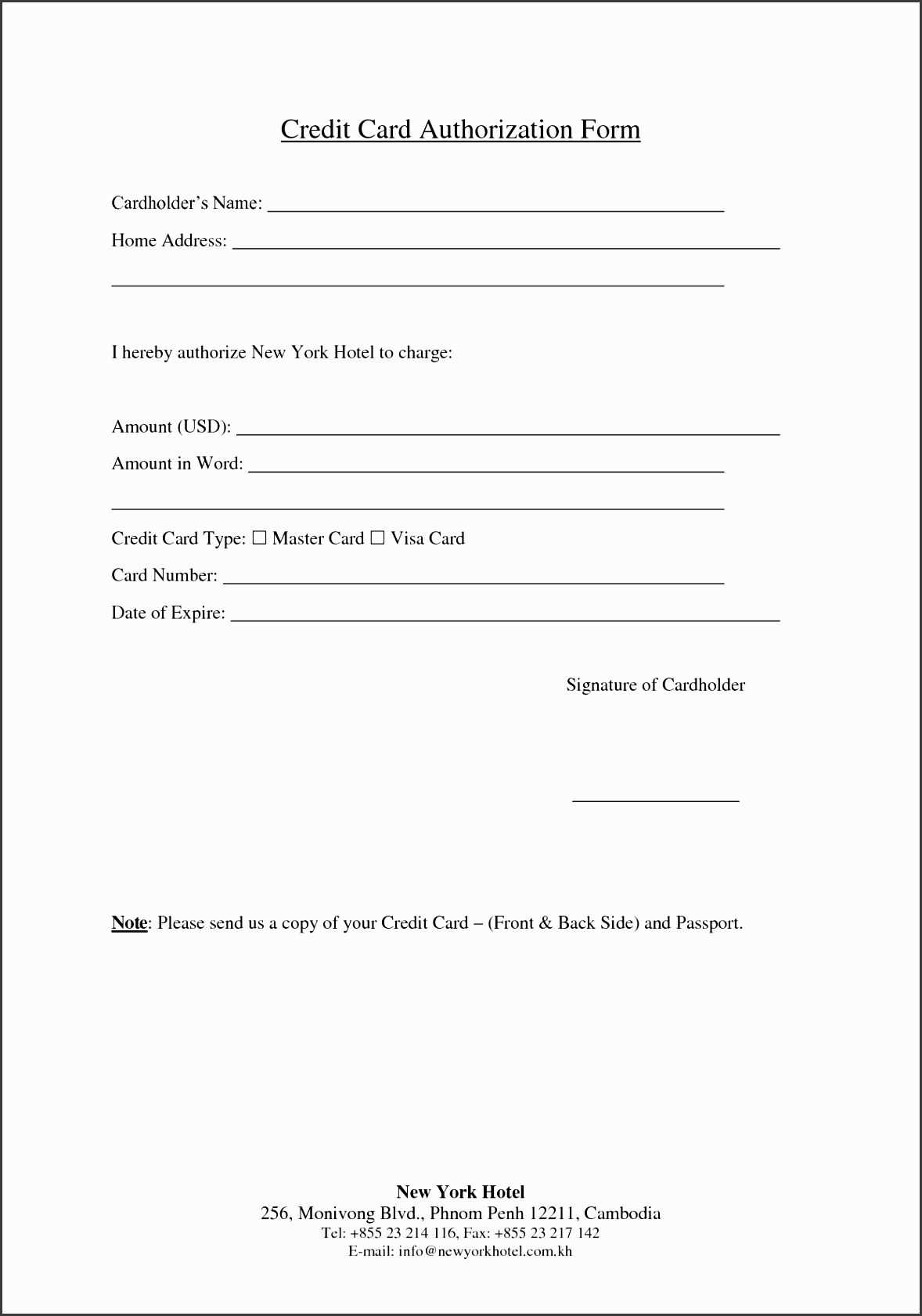

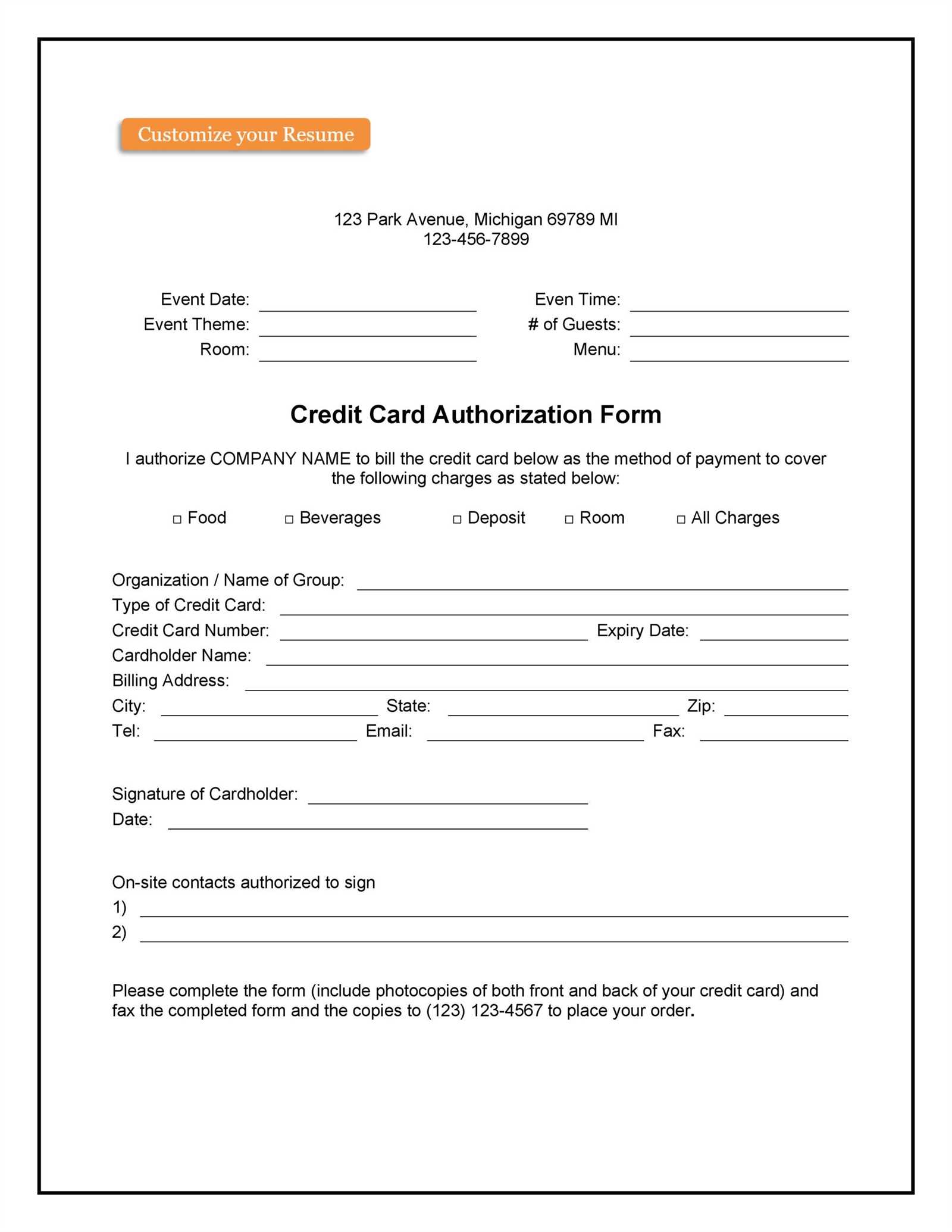

Key Elements of an Authorization Document

To ensure that a financial transaction is carried out correctly and securely, it is essential that the consent form includes all necessary details. A comprehensive document should contain specific information that clearly defines the relationship between the parties involved, the purpose of the transaction, and the terms under which consent is granted. Missing any of these elements can lead to confusion or disputes.

Some of the key components of a proper document include:

- Names of the Parties: The full names of both the individual granting permission and the one receiving the authorization must be clearly stated.

- Transaction Details: The document should specify the nature of the payment, including the amount, date, and reason for the transaction.

- Signature: A signature from the individual giving consent is crucial to validate the document and confirm their agreement.

- Timeframe: If the authorization is limited to a certain period or specific transaction, the timeframe should be explicitly mentioned.

- Contact Information: Both parties’ contact details are essential for easy communication, especially if further clarification is needed.

Including these key elements ensures that both parties are fully informed and protected throughout the transaction process, minimizing the risk of misunderstandings.

How to Create a Simple Consent Form

Creating an effective consent form is a straightforward process when you know the key elements that must be included. By focusing on the essential information and maintaining clarity, you can quickly put together a document that serves its purpose. The goal is to ensure that both parties understand the terms of the transaction and agree to them in writing.

Follow these simple steps to create your form:

- Start with a clear heading: Include a title that clearly states the purpose of the document, such as “Payment Consent Form” or “Transaction Approval Agreement.”

- Include the parties’ details: Write the full names and contact information of both the person granting approval and the individual handling the payment.

- Specify the transaction details: Clearly state the amount, date, and reason for the payment. This helps to ensure that both parties are on the same page.

- Provide a space for signatures: Ensure that there is a designated area for the signature of the individual giving consent, confirming the legitimacy of the transaction.

- Set a timeframe: If the authorization is time-limited, specify the exact duration for which consent is valid.

Once these elements are included, the document will serve its intended purpose and ensure the transaction is legitimate and secure.

Common Uses for Payment Consent Forms

There are various situations where a formal document granting permission for a transaction is essential. Whether for personal or business reasons, these documents help ensure that payments are processed securely and that both parties are protected. They can be used in a range of scenarios to facilitate transactions without confusion or complications.

Some of the most common uses for these forms include:

- Third-Party Payments: When someone needs to make a payment on behalf of another individual, a consent form is required to confirm that approval has been granted.

- Subscription Services: For recurring payments, these forms are often used to authorize ongoing charges for services or memberships.

- Online Transactions: When making online purchases or bookings, some merchants may require written consent to charge an individual’s account.

- Emergency Purchases: If an emergency occurs and someone needs to use another person’s financial information to make an urgent purchase, a consent form is necessary.

- Business Transactions: Companies often require this type of document when processing payments on behalf of clients or handling financial details for their employees.

Using these forms in these scenarios ensures that all parties are aware of and agree to the terms, minimizing the risk of disputes or misunderstandings.

Tips for Ensuring Security and Validity

When creating and using a formal consent document for financial transactions, it is crucial to ensure that it is both secure and legally valid. A well-constructed form can protect all parties involved and minimize the risk of fraud or disputes. Following certain best practices can help guarantee that the document meets legal standards and safeguards sensitive information.

Here are some key tips to follow:

- Verify the Identity: Always confirm the identity of the individual granting permission, especially in online or remote transactions, to avoid unauthorized use.

- Use Clear and Specific Language: Be precise in describing the transaction details, including the amount, date, and purpose, to avoid any misunderstandings.

- Include a Signature: The document should always be signed by the individual providing consent. This ensures that the transaction is authorized and legally binding.

- Limit the Authorization: Clearly state any time limits or restrictions on the scope of the transaction to prevent misuse of the granted consent.

- Store the Document Securely: Keep a copy of the form in a safe place, either digitally or physically, to ensure it is easily accessible if needed for reference or legal purposes.

By following these simple precautions, you can ensure that the consent form is not only secure but also legally valid, helping to avoid any potential issues down the line.