Credit deletion letter template

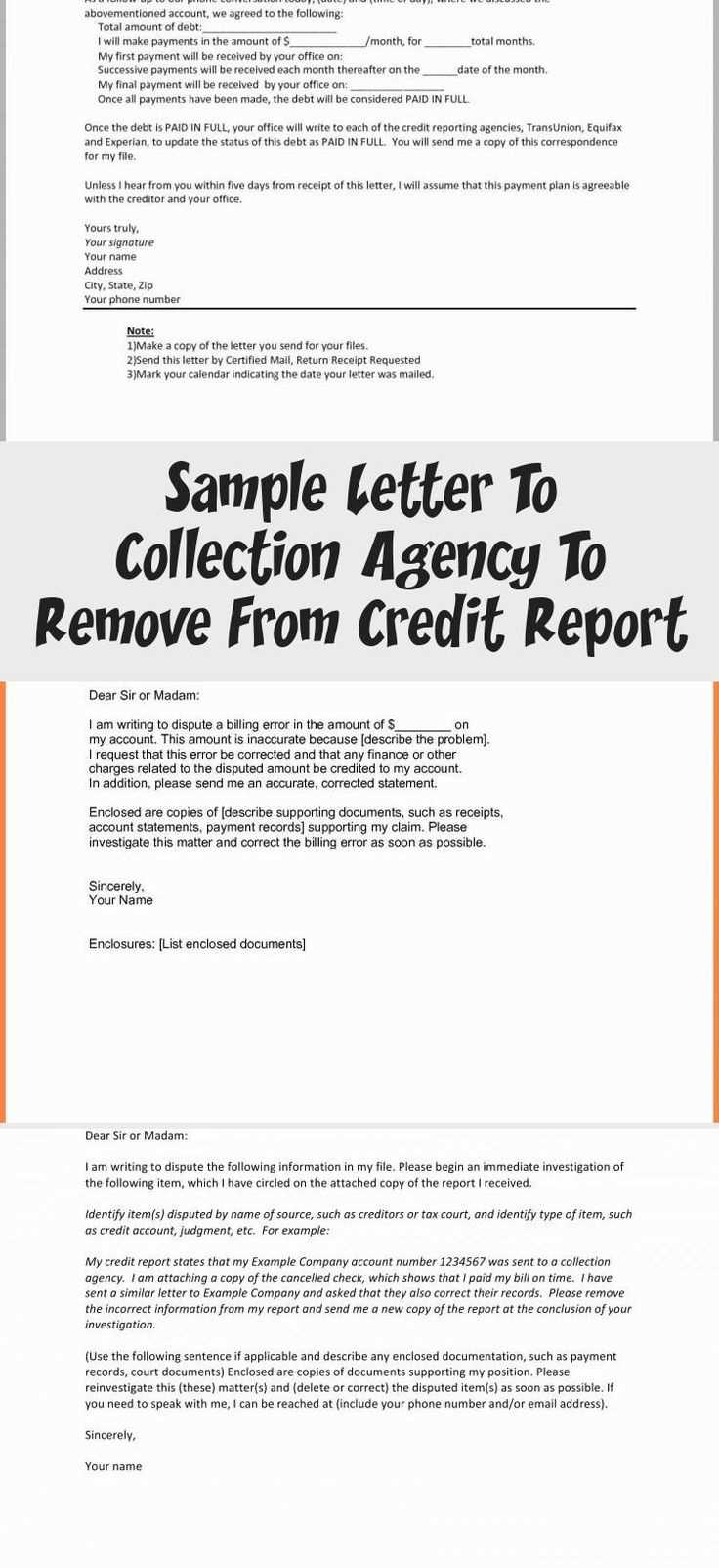

To request the removal of incorrect or outdated information from your credit report, you can use a credit deletion letter. This formal letter allows you to clearly present your case to credit bureaus or creditors, helping to improve your credit score by removing inaccuracies. Below is a simple, effective template that can be customized based on your situation.

Start with a clear subject line. Clearly state your intent to dispute the information and request its removal. This helps to ensure your letter is processed correctly without unnecessary delays.

Provide your personal details. Include your full name, address, date of birth, and the last four digits of your social security number. These details help the credit bureaus verify your identity and locate your file efficiently.

Explain the issue. In the letter, be specific about the error or outdated information that you are requesting to be deleted. Provide relevant details, such as account numbers and dates, so that the credit bureau or creditor can easily identify the issue.

State your request. Politely but firmly request the removal of the inaccurate information from your credit report. Be concise and professional in your wording. Attach any supporting documentation that proves the information is incorrect, such as receipts or court judgments.

End with a call to action. Ask for a written response, and request a confirmation once the information has been removed. Make sure to include your contact details for easy follow-up.

This template ensures your request is clear, direct, and professional, which is key in achieving a successful outcome.

Sure! Here’s a revised version with minimal repetition of words:

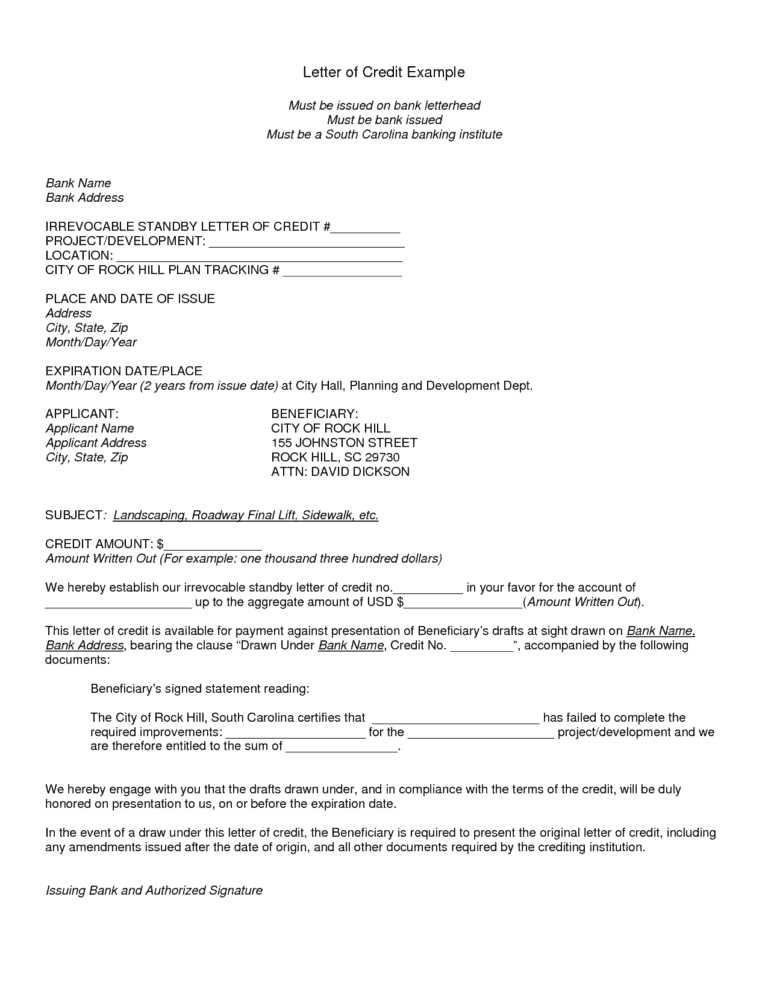

When requesting credit deletion, clearly state your goal of removing inaccurate or outdated information from your credit report. Specify the item or items in question and provide the relevant details, such as account numbers and dates. Attach supporting evidence to validate your request, whether it’s proof of payment or confirmation of the error. Ensure the tone remains polite but firm, stressing your intent for resolution. Conclude by requesting a timely response, indicating your willingness to follow up if necessary.

Example Request:

“I am writing to request the removal of the following inaccurate entry on my credit report. The account listed under [Account Number] was settled in full on [Date], and I have attached proof of payment. Please update my report accordingly. Thank you for your attention to this matter.”

Credit Deletion Letter Template

Understanding the Significance of a Credit Deletion Request

Step-by-Step Guide for Writing a Credit Deletion Letter

Essential Components to Include in the Credit Deletion Request

Common Errors to Avoid When Requesting Deletion of Credit

How to Address Credit Reporting Agencies in Your Request

What to Do If Your Deletion Request Is Denied

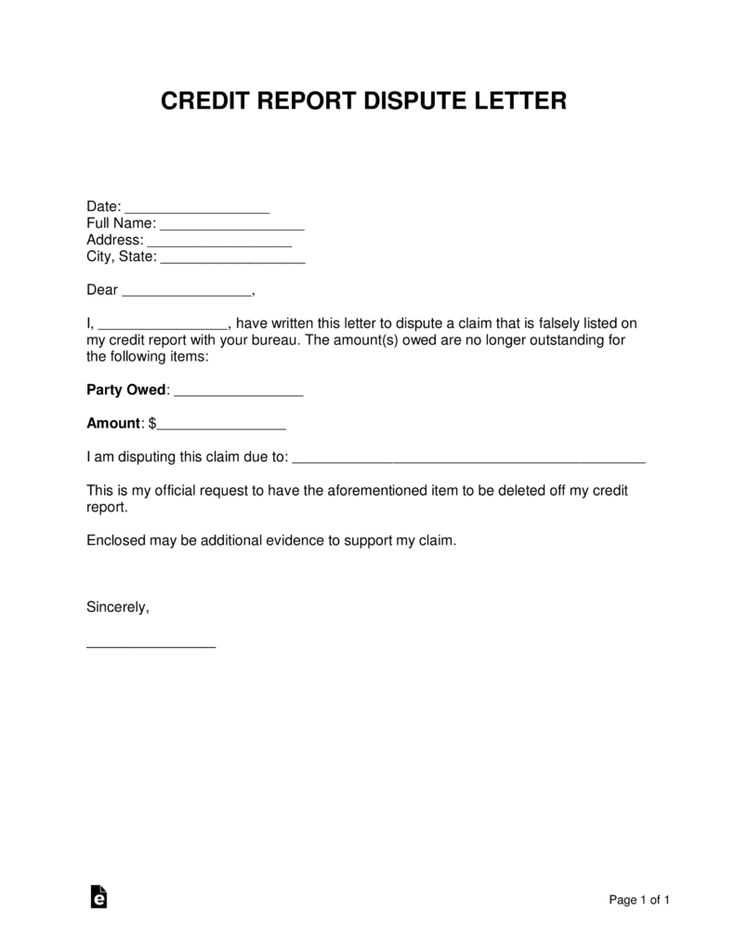

When submitting a credit deletion request, focus on providing clear and concise details. The objective is to make your request straightforward and understandable for the credit reporting agency. Start by addressing the letter to the appropriate agency, referencing the specific account or credit item you wish to remove.

Begin your letter with a formal salutation, such as “Dear [Agency Name],”. Clearly state the reason for your deletion request. If you’re disputing an error, provide any relevant supporting documentation such as receipts or records that prove the inaccuracy. Be factual and avoid any emotional language to keep the tone professional.

Include all necessary details such as your full name, address, date of birth, and Social Security number (if required) for identification. Specify the account number and the details of the credit item you want to be deleted. It’s also helpful to include any references to the dispute or resolution if applicable.

Ensure that your letter contains a direct and clear request for deletion. Avoid vague statements and focus on the action you want the credit reporting agency to take. Provide supporting evidence to strengthen your case, such as court rulings or statements from creditors confirming the debt was settled or incorrect.

Avoid using overly complex language or irrelevant information. Stick to the facts and the details that directly support your case. Mistakes often occur when requests lack clarity or sufficient documentation, so ensure that you provide all the required information in a well-organized manner.

Address the credit reporting agency properly, using its official name and correct contact details. Use formal language and avoid informal greetings or tones. If you are addressing multiple agencies, tailor your request to each one individually, ensuring the letter matches the specific requirements of each agency.

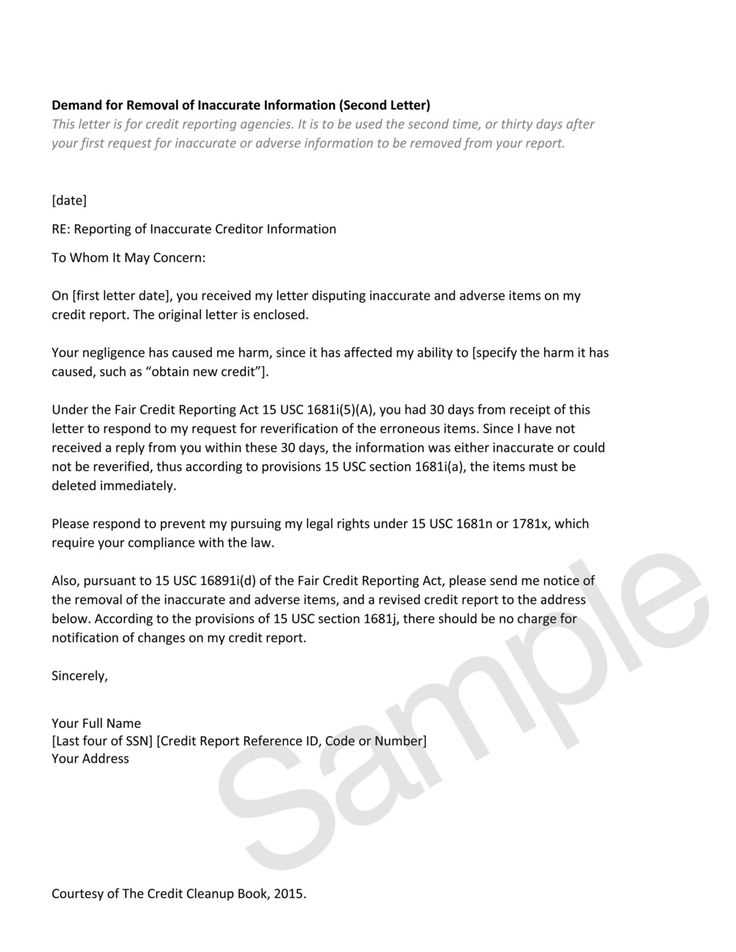

If your deletion request is denied, review the reason for the rejection. If the credit reporting agency provides an explanation, check if additional information or documents are needed. In some cases, you may need to follow up with further evidence or contact the creditor directly for confirmation before resubmitting your request.