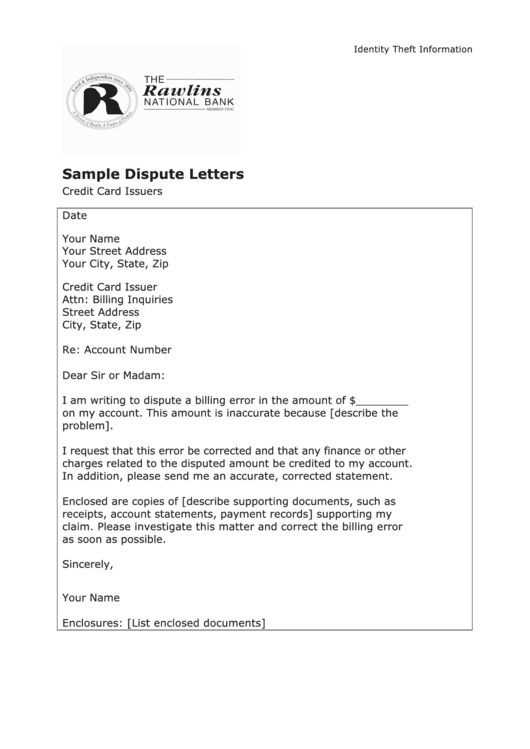

Credit dispute letter templates

If you’ve found an error on your credit report, a credit dispute letter can help resolve the issue. Use a template to ensure that you cover all necessary details and make your case clearly to the credit bureaus or creditors. Start by addressing the specific error and including any supporting documentation that can help clarify the situation. Keep the tone professional and concise to increase your chances of a timely resolution.

Template structure: Your letter should begin with a clear statement of the dispute, referencing the specific entry that needs correction. Include personal details like your name, address, and account number to ensure the recipient can easily identify your file. Attach any relevant documentation that supports your claim, such as receipts, statements, or proof of payment.

Be specific: Avoid vague statements. Clearly state what the error is and how it affects your credit report. Provide evidence of your claim and explain how the error can be corrected. If you’re disputing a late payment, for example, include bank statements showing timely payments or an explanation of why a payment was delayed.

End the letter with a polite request for the error to be investigated and corrected. Provide a timeline for follow-up and ask for a written response confirming the resolution. Using a dispute letter template ensures that you are thorough and efficient in addressing credit report mistakes.

Here’s the revised version with reduced repetition:

When disputing a credit report entry, clarity and precision are key. Begin by clearly identifying the item in question, referencing the date and amount if applicable. Use direct language to state that the information is inaccurate or incomplete, and explain why it does not reflect your actual financial status. Include supporting evidence, such as bank statements or receipts, to substantiate your claim.

Focus on Specifics

Rather than providing a general explanation, outline specific inaccuracies. For instance, if the balance is wrong, mention the exact discrepancy. This helps to avoid unnecessary back-and-forth with the credit bureau or creditor.

Keep it Professional

Although it can be frustrating, always maintain a professional tone. Politeness can encourage quicker resolution. Remember, the goal is to resolve the issue efficiently, so being respectful increases the chances of a positive outcome.

- Credit Dispute Letter Templates

To effectively resolve discrepancies on your credit report, using a well-crafted credit dispute letter is key. Below are several templates designed for different types of disputes, ensuring clear communication and proper documentation for quick resolution.

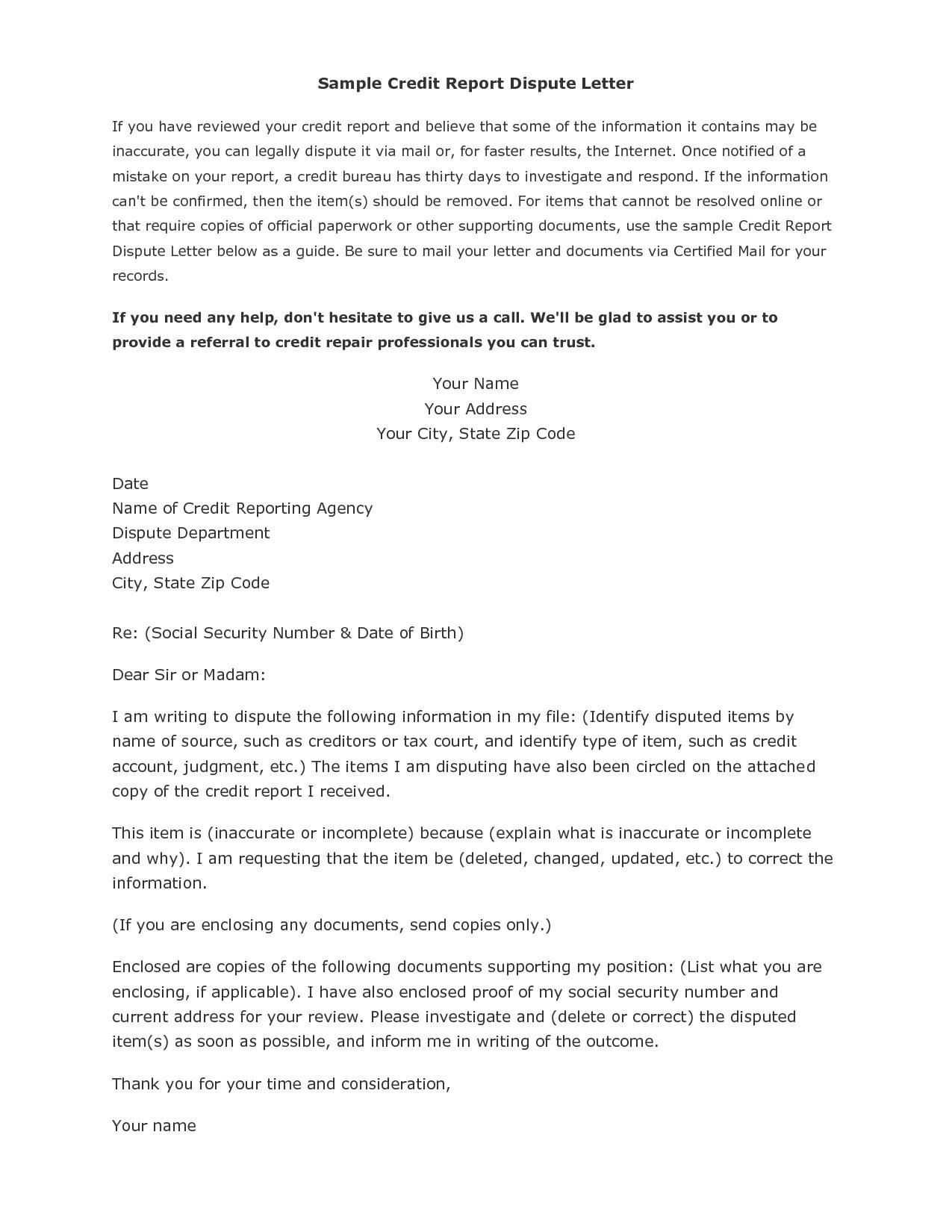

Template 1: Disputing Incorrect Information

Use this template when you find inaccurate information on your credit report that you believe is incorrect.

Your Name Your Address City, State, ZIP Code Date Credit Bureau Name Credit Bureau Address City, State, ZIP Code Subject: Dispute of Incorrect Information on My Credit Report Dear Sir/Madam, I am writing to dispute the following information on my credit report. The item(s) listed below are inaccurate, and I request an immediate investigation to correct or remove them. [Insert detailed information about the incorrect item(s) such as account number, date, and nature of the error.] Attached are supporting documents that prove the error. Please investigate this matter and correct my credit report accordingly. Thank you for your attention to this matter. Sincerely, Your Name

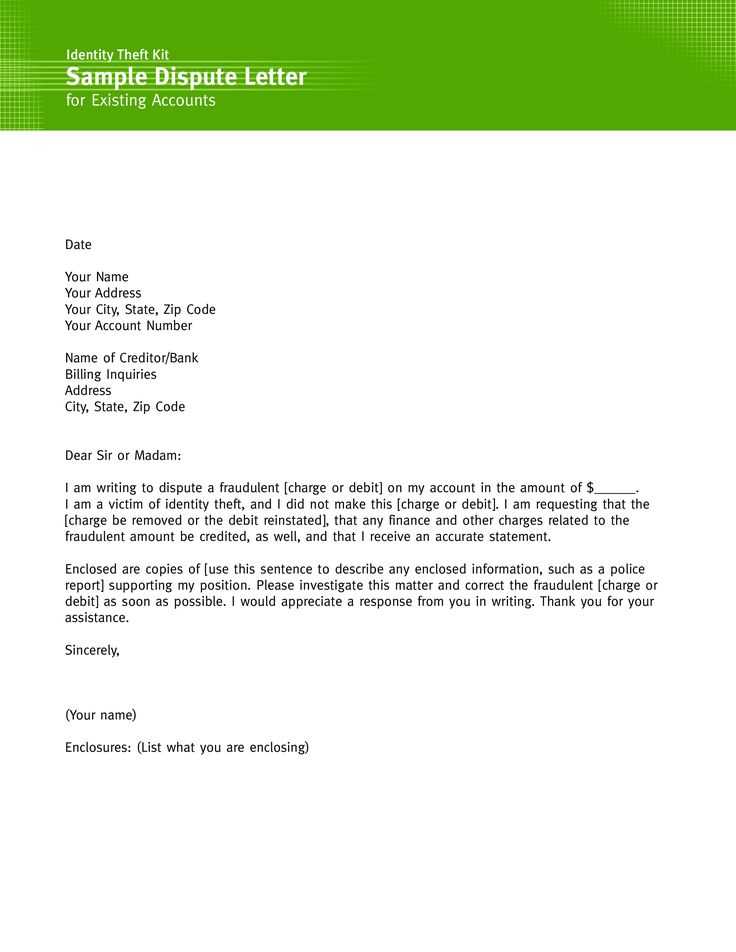

Template 2: Disputing Negative Items Due to Fraud

If you have experienced fraudulent activity, this template helps you notify credit bureaus to remove the fraudulent entries.

Your Name Your Address City, State, ZIP Code Date Credit Bureau Name Credit Bureau Address City, State, ZIP Code Subject: Fraudulent Activity on My Credit Report Dear Sir/Madam, I am writing to dispute several entries on my credit report that I believe are the result of fraud. The following accounts were opened without my consent: [Insert fraudulent account details here.] Attached are copies of my police report and other supporting documents to verify the fraudulent nature of these accounts. I request immediate investigation and removal of these items from my credit report. Thank you for your assistance in resolving this matter. Sincerely, Your Name

Template 3: Disputing an Account with Incorrect Payment History

Use this template if you believe your payment history has been inaccurately reported, potentially affecting your credit score.

Your Name Your Address City, State, ZIP Code Date Credit Bureau Name Credit Bureau Address City, State, ZIP Code Subject: Dispute of Payment History on My Credit Report Dear Sir/Madam, I am writing to dispute the payment history on the following account. The payment records appear to be incorrect, and I believe there is an error in reporting. [Insert account details and a description of the dispute.] Enclosed are my bank statements or other documents showing the correct payment history. Kindly review the matter and update my report as necessary. Thank you for your prompt attention to this issue. Sincerely, Your Name

Ensure all relevant documents and evidence are included when sending your dispute letter. This increases the chances of a swift and accurate resolution.

Clearly identify the error in your account information. Begin your letter by stating that you have reviewed your credit report and found incorrect data. Mention the specific account or transaction that needs correction, including any relevant dates, amounts, and account numbers. Provide a concise explanation of why the information is inaccurate, referencing any supporting documents you may have, such as receipts, bank statements, or previous correspondence.

Request a clear and specific correction. Ask the recipient to remove or update the incorrect details on your account. State that you expect the matter to be resolved within a reasonable timeframe. If applicable, indicate that you will be monitoring the situation to ensure the accuracy of your account.

Include your contact information and any relevant identifiers, such as your full name, address, date of birth, and social security number (if needed). This will help the recipient locate your account quickly and prevent delays in addressing the issue.

Close your letter professionally, thanking the recipient for their attention to the matter. Provide your signature at the end of the letter to confirm that the request is coming from you.

Disputing late payments or missed transactions on your credit report requires a structured approach. Follow these clear steps to challenge inaccuracies effectively:

1. Review Your Credit Report Thoroughly

Start by obtaining a copy of your credit report from all three major bureaus: Equifax, Experian, and TransUnion. Review the entire report, paying close attention to any late payments or missed transactions. Ensure you identify the correct accounts and time periods related to the dispute.

2. Gather Supporting Documentation

Collect all relevant documentation that can back up your claim. This may include bank statements, receipts, payment confirmations, or any correspondence with the creditor that shows you made timely payments. The more evidence you have, the stronger your case will be.

3. Contact the Creditor Directly

Before filing a formal dispute with the credit bureaus, reach out to the creditor listed on your report. Clarify the situation and provide any supporting evidence. In some cases, the creditor may resolve the issue directly without the need for further action.

4. Dispute with the Credit Bureau

If contacting the creditor doesn’t yield results, file a formal dispute with the credit bureaus. You can usually do this online through their websites. Include all the evidence you’ve gathered to support your claim, and be clear about what is inaccurate.

5. Wait for the Bureau’s Response

The credit bureau will typically investigate the dispute within 30 days. They will contact the creditor and review the provided evidence. Once the investigation is complete, you will receive a response detailing whether the dispute was resolved in your favor.

6. Review the Outcome

If the dispute is resolved in your favor, the late payment or missed transaction will be corrected or removed from your report. If the dispute is unsuccessful, you may request further clarification from the bureau or reattempt the process with additional evidence.

7. Keep Detailed Records

Throughout the dispute process, maintain detailed records of all communications, documents, and responses. This will help you track progress and provide evidence for future actions if necessary.

| Step | Action |

|---|---|

| 1 | Review your credit report |

| 2 | Gather supporting documentation |

| 3 | Contact the creditor directly |

| 4 | Dispute with the credit bureau |

| 5 | Wait for the bureau’s response |

| 6 | Review the outcome |

| 7 | Keep detailed records |

Focus on specific details when addressing errors in credit inquiries. Begin by identifying the incorrect inquiry on your credit report and gather the necessary documentation to support your claim. This includes a copy of the credit report showing the dispute and any communication or records that clarify the mistake. Make sure to include the inquiry date, the company involved, and any reference numbers. Address the recipient by name, using the exact name listed on your credit report.

Clarify the Error

In your letter, clearly explain the nature of the error. State that you believe an inquiry was made without your consent or was incorrectly reported. If the inquiry was unauthorized, mention that you did not apply for credit with the specific company and request that it be removed from your report. Provide any supporting evidence, such as a copy of your application or bank statements showing no record of the inquiry.

Request Action

Be direct about your desired outcome. Ask the credit bureau or lender to investigate the error and correct your report. Include a request for confirmation once the dispute is resolved. Keep the tone polite but assertive, emphasizing the importance of accuracy in your credit report for your financial well-being.

End your letter by thanking the recipient for their attention to the matter and provide your contact details for follow-up.

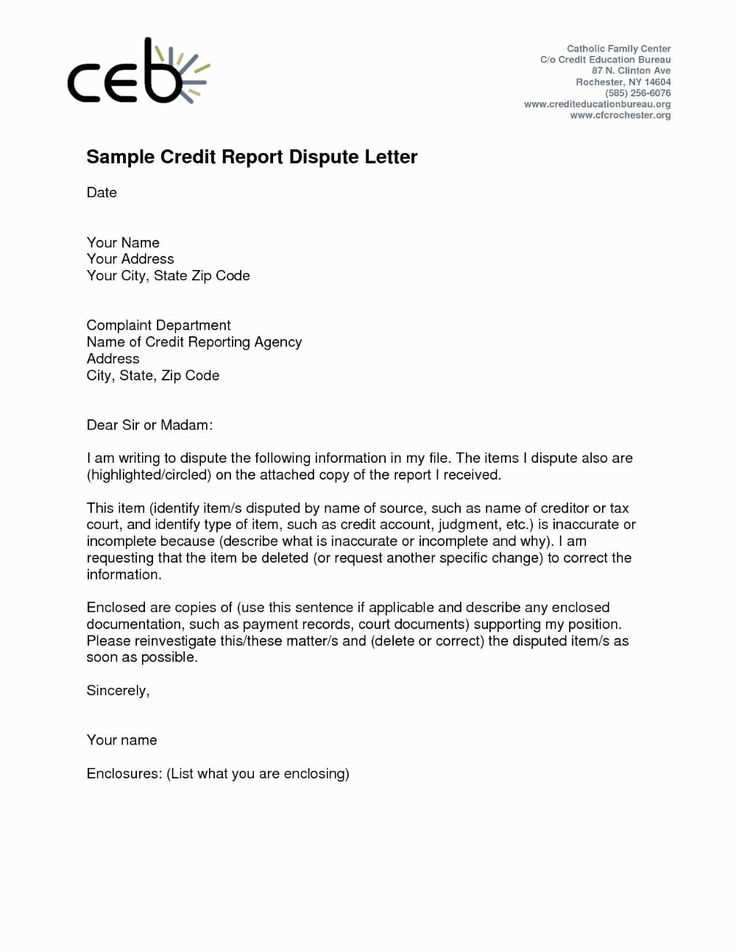

If you find errors on your credit report, it’s important to dispute them with all three credit bureaus–Equifax, Experian, and TransUnion. Each bureau may have different information, so addressing each report individually ensures all errors are corrected. Gather documents that support your claim, such as receipts or account statements, to back up your dispute.

Submitting Disputes to Each Bureau

Create a separate dispute letter for each bureau. In your letter, clearly outline the specific error, provide evidence, and request that the mistake be removed or corrected. Use the official dispute process for each bureau, whether it’s online, by mail, or over the phone. Be sure to keep records of your communication for future reference.

Following Up

If you suspect identity theft, include clear and specific details in your dispute letter. Start by stating that you believe the account or transaction is a result of fraudulent activity. Specify the date and details of the fraudulent event, including any relevant documents such as a police report or identity theft affidavit.

- Begin with a direct statement: “I believe this account reflects fraudulent activity due to identity theft.”

- Provide any evidence supporting your claim, such as a police report number or identity theft affidavit.

- Request the creditor to investigate the dispute thoroughly and remove any fraudulent charges or accounts from your credit report.

- Ensure that you clearly state the steps you have already taken, such as reporting the theft to the authorities or placing fraud alerts on your credit file.

- Ask for a specific resolution: “Please remove this fraudulent account from my credit report as soon as possible.”

By presenting clear evidence and taking a direct approach, your dispute letter will provide a strong foundation for addressing identity theft effectively.

Start with clear identification of the disputed item. Include the account number, the name of the creditor, and the specific entry you believe is incorrect. This helps direct attention to the issue promptly.

Provide a detailed explanation of why the information is inaccurate. Point out any discrepancies, such as incorrect dates, amounts, or reporting errors. If applicable, reference any documentation that supports your case, like payment records or bank statements.

Ensure that your dispute is concise and to the point. Avoid unnecessary details that might detract from the main issue. Stick to the facts and keep your tone neutral and professional.

Clearly state what you want to be done. Whether it’s a request for removal, correction, or further investigation, make sure your expectation is clear.

Lastly, include your contact information for follow-up. Provide a phone number or email address where the credit bureau or creditor can reach you easily.

Credit Dispute Letter Templates

Begin your dispute letter by addressing the credit bureau or lender directly. Clearly state the reason for your dispute, mentioning specific errors or discrepancies in your credit report. Use concise, straightforward language to explain why the information is incorrect and include supporting evidence, such as bank statements or transaction receipts, to substantiate your claim.

Ensure that all personal details, including your full name, address, and account numbers, are accurate and up-to-date. This will help the recipient process your request without delays. Always include a request for a timely investigation and resolution of the matter.

Close your letter with a polite but firm statement requesting an update on the dispute’s status within a set timeframe. Include your contact information so that the recipient can reach you if needed. Finally, sign the letter and send it via certified mail to ensure you have proof of delivery.