Credit explanation letter template

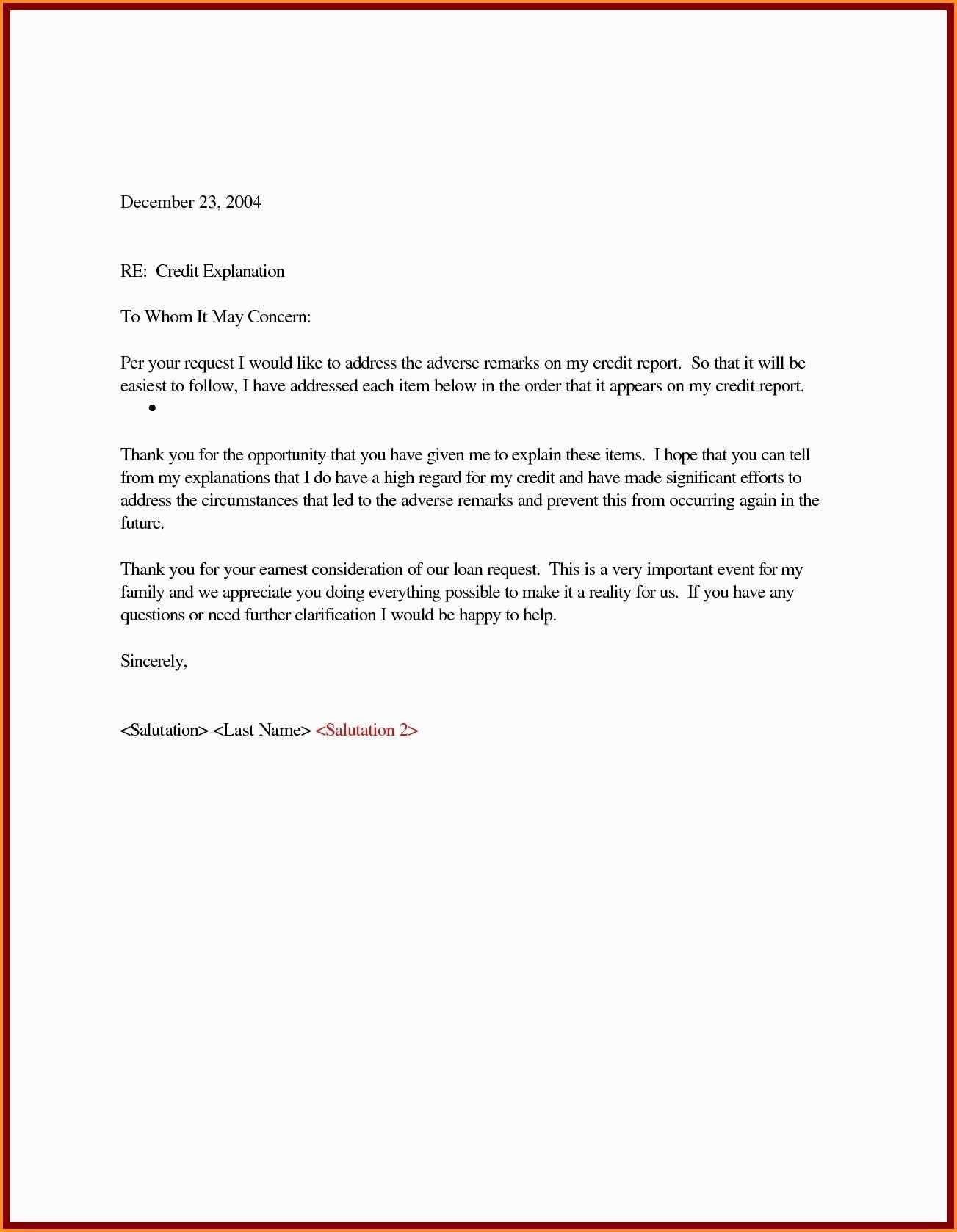

Start by addressing the recipient with a formal greeting, using their name if possible. This sets a respectful tone from the beginning.

Next, clearly state the purpose of your letter. Be direct and specific, such as “I am writing to explain the circumstances surrounding the recent credit issue on my account.” Mention the date and any reference number related to the matter for clarity.

Provide a brief explanation of what caused the issue. Whether it was due to an oversight, a delay, or an unexpected financial situation, keep the details concise. Avoid unnecessary embellishments. Focus on what happened and how you have addressed or plan to address it.

Reassure the recipient that you are actively working to resolve the situation. If applicable, mention any steps you’ve already taken or a specific timeline for resolution. Offering proof of any actions you’ve undertaken, like a payment confirmation, can strengthen your case.

Close by expressing your willingness to cooperate and provide any additional information if needed. Thank the recipient for their time and attention, and ensure your contact details are easily visible in case further clarification is required.

Here’s the corrected version:

Begin by clearly stating the purpose of the letter. Make sure to include the necessary details, such as the credit issue being addressed, the reason behind it, and any actions taken to resolve the matter. Use simple and direct language to avoid confusion.

Provide accurate dates and amounts when referencing specific credit events. If relevant, mention any supporting documentation, such as payment receipts or correspondence with creditors, that demonstrate your effort to resolve the issue.

Include a clear request or next step at the end of the letter. Specify what you expect from the recipient, whether it’s a reconsideration of the credit decision or an update to the credit report.

Ensure the tone remains respectful and professional throughout. Avoid placing blame on external factors and focus on what steps you’ve taken to correct the situation.

- Credit Explanation Letter Template

When writing a credit explanation letter, clarity and conciseness are key. Focus on addressing the specific issue, providing factual details, and offering a solution. Use a professional tone while maintaining transparency about the situation.

The letter should start with a clear statement about the purpose of the letter. For example, you can say, “I am writing to explain the circumstances that led to the recent credit issue.” Follow this with a brief, straightforward explanation of the event that caused the credit problem, ensuring you include dates, amounts, and any other relevant details.

Next, offer an explanation of any misunderstandings or mistakes that may have contributed to the situation. If the issue was due to an error or oversight, take responsibility and outline the steps taken to correct it.

Conclude with a commitment to resolve the matter. If possible, mention any actions you have already taken, or propose a plan for how you intend to rectify the situation. Be specific about what you are offering, whether it’s a payment plan, adjustments, or other solutions.

Here’s a sample template for your letter:

| Section | Content |

|---|---|

| Opening | State the purpose of the letter. Example: “I am writing to explain the circumstances regarding the late payment on my account.” |

| Explanation | Describe the reason for the credit issue. Provide clear details such as dates, amounts, and any external factors. |

| Resolution | State the actions taken or proposed to fix the situation. Example: “I have arranged for the overdue balance to be paid in full by the end of this month.” |

| Closing | End with a polite but confident request for understanding. Example: “I appreciate your consideration and look forward to resolving this matter promptly.” |

By staying concise and to the point, you can present a well-structured explanation while showing that you are actively working to resolve the credit issue.

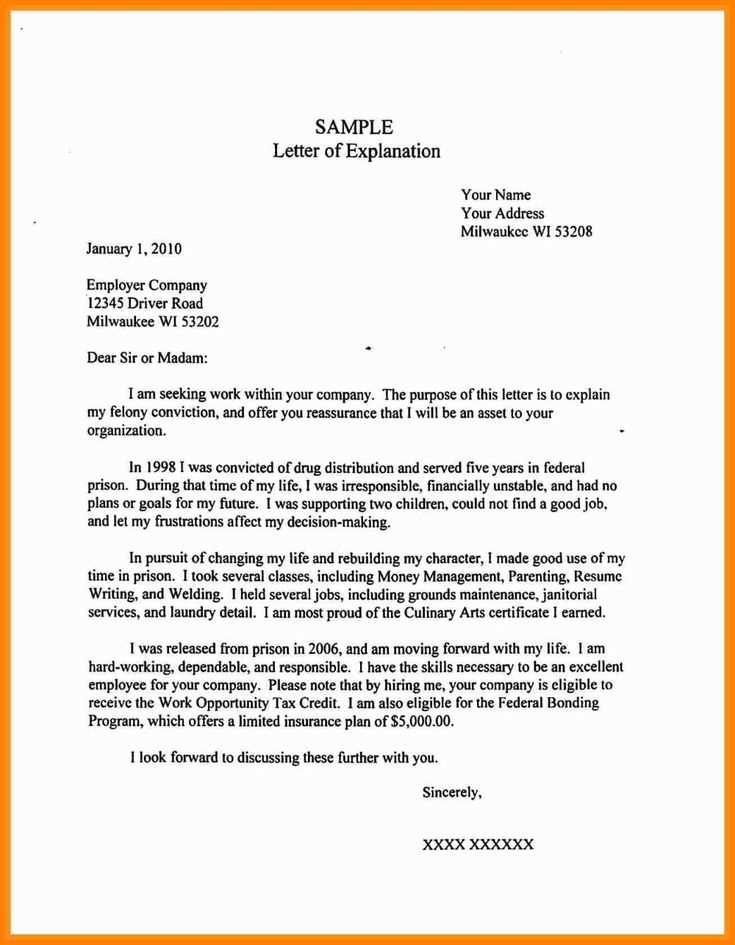

Begin your letter with a clear and concise subject line. State the reason for writing the letter in the first sentence, so the reader immediately understands its purpose.

In the opening paragraph, briefly introduce yourself and your request. Be straightforward and specify the credit issue you’re addressing. Mention the specific loan or account involved, including any relevant dates or reference numbers.

Next, provide a detailed explanation of the circumstances surrounding the credit issue. Clearly outline any events that contributed to the problem, such as financial hardship, health issues, or unforeseen emergencies. Use factual, objective language and avoid making excuses.

If applicable, show how you have taken steps to resolve the issue, such as paying off the debt, setting up a payment plan, or making any other relevant efforts. Include any supporting documentation, such as payment records or agreements, to strengthen your case.

In the final paragraph, state your desired outcome clearly. Whether you’re requesting a reconsideration of a denied credit application, asking for a reduction in interest rates, or seeking to resolve a dispute, make your request specific and reasonable.

End the letter by thanking the reader for their time and consideration. Sign off with a professional closing statement, such as “Sincerely” or “Best regards,” followed by your name and contact information.

Start with a clear statement of the purpose of the letter. Mention the specific credit issue being addressed and explain the reason for the explanation. Be direct and avoid ambiguity.

Include a detailed description of the circumstances that led to the negative credit event. Whether it’s a missed payment, late fee, or any other issue, be transparent and provide specific dates and events that caused the situation.

Clarify the steps you’ve taken to resolve the issue. If you’ve paid off debts or set up payment plans, mention those actions. This shows a commitment to managing your finances responsibly.

Offer a plan for preventing similar issues in the future. Whether it’s setting up automatic payments, budgeting, or working with a financial advisor, provide assurance that you’re taking steps to avoid repeating the problem.

End with a polite request for reconsideration of your credit application, or ask for the credit issue to be reviewed and amended. Express appreciation for the reader’s time and consideration.

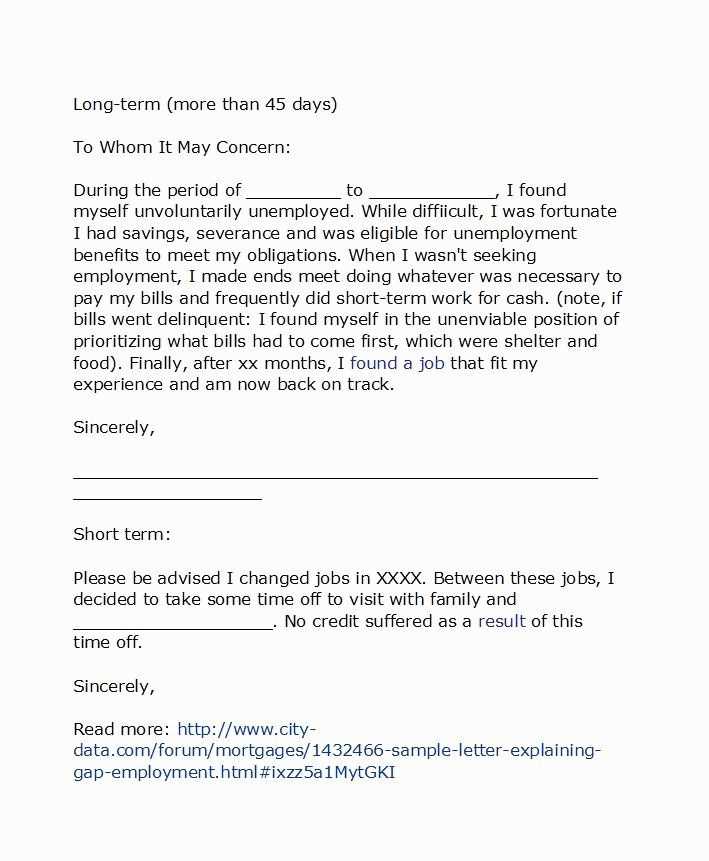

One of the most common reasons to write a credit letter of explanation is to clarify late payments. If you missed a payment due to financial hardship, medical emergencies, or other legitimate reasons, a letter helps demonstrate that the situation was temporary and not indicative of your overall financial behavior.

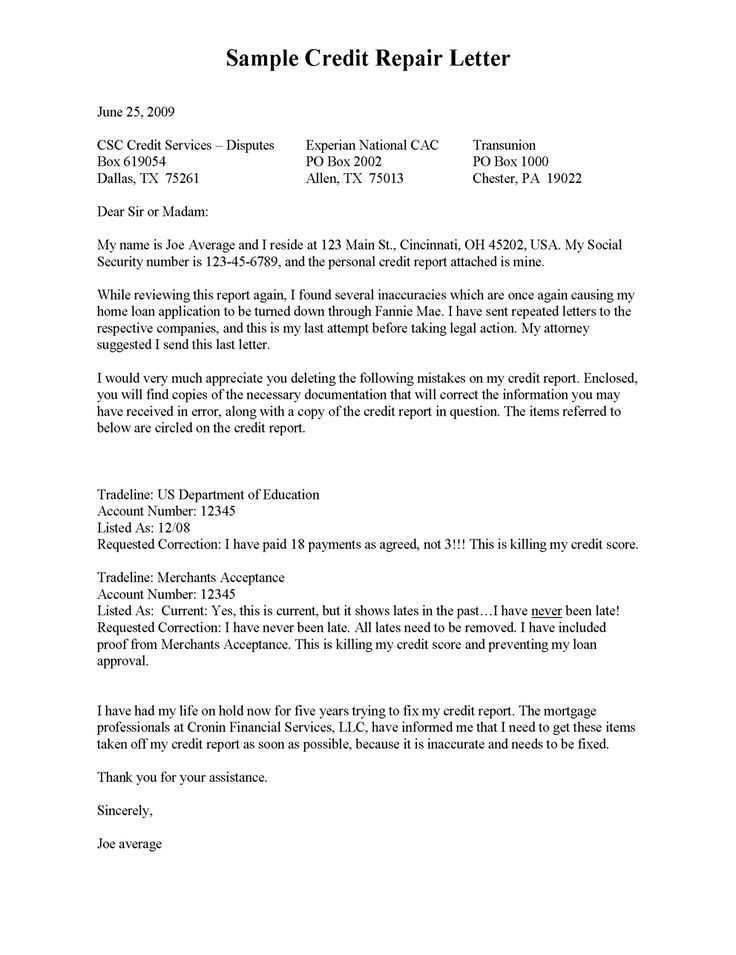

Another reason is to explain discrepancies in your credit report. If your report contains errors, such as incorrect account information or fraudulent activity, the letter can outline the steps you’ve taken to resolve these issues and your current credit status.

Changes in your income or employment status often require an explanation. If your income was inconsistent for a period but has since stabilized, explaining this in a letter can reassure lenders or creditors of your current financial stability.

Unforeseen events like divorce or job loss may also be valid reasons for writing a credit letter of explanation. Providing context helps clarify why these events impacted your credit history and emphasizes that these events are behind you.

Additionally, if you have a history of bankruptcy or foreclosure, the letter provides an opportunity to explain how you have since managed your finances and what steps you’ve taken to rebuild your credit score.

Address negative credit history directly and professionally. Acknowledge any past mistakes without oversharing personal details. Be honest about the situation, but also show that you’ve taken steps to improve your credit. This builds credibility and trust.

Start by briefly explaining the reason behind the negative marks. For example, if medical bills or unexpected job loss caused financial difficulty, mention this clearly, but avoid making excuses. If applicable, state that the negative marks were out of your control.

Then, highlight the positive actions you’ve taken since the incident. Whether it’s paying off outstanding debts, maintaining current payments, or using credit responsibly, explain what you’ve done to regain control. Providing concrete examples, such as “I have successfully made on-time payments for the last 12 months,” can help demonstrate your commitment to improving your financial health.

End by expressing your willingness to provide any additional information or documentation that may be needed. Reaffirm your goal to build a positive credit history moving forward, showing your commitment to financial responsibility.

Maintain clarity and conciseness in your letter. Avoid lengthy sentences that may confuse the reader. Stick to direct language, focusing on the key points you need to address.

- Use polite but direct language. Avoid slang or overly casual phrases.

- Keep your sentences structured and easy to follow. Break up long paragraphs to improve readability.

- Stay neutral and avoid emotional language. Keep your tone calm and respectful, even when explaining negative circumstances.

- Address the recipient by their proper title and full name. If you don’t know the name, use a general but respectful salutation such as “To Whom It May Concern.”

- Maintain professionalism by avoiding humor, especially if it might be misinterpreted or irrelevant to the subject matter.

- Avoid excessive use of exclamation points or overly enthusiastic language, which can detract from the professionalism of your tone.

- Use correct grammar and punctuation. A letter with errors may appear rushed or careless.

By focusing on clear, respectful, and error-free communication, you can ensure your letter is professional and well-received.

After sending your credit explanation letter, take immediate steps to follow up and monitor the progress of your request. First, keep a record of the date and time you sent the letter. This ensures you have proof of submission if any questions arise later.

Next, wait for the creditor or financial institution to process the letter. Allow them a reasonable timeframe to review your explanation, usually 7-10 business days. If you haven’t heard back by then, send a polite follow-up email or call to confirm receipt and inquire about the next steps.

Stay Organized

Maintain all correspondence related to the letter, including any replies you receive. If they request additional documentation or clarification, respond quickly to avoid further delays.

Be Ready for Possible Outcomes

While waiting for a response, prepare for any possible decision. The creditor might agree to adjust your credit report or deny the request. If your explanation is accepted, check that the necessary corrections are made. If denied, you can ask for specific reasons and appeal the decision if necessary.

Lastly, keep your credit report updated and regularly monitor it for accuracy. If new errors arise, be proactive in addressing them promptly to maintain a healthy credit profile.

Credit Explanation Letter Template: How to Write it Right

To make sure your Credit Explanation Letter conveys the right message, stick to a clear structure and use only relevant details. The main goal is to explain any discrepancies or late payments in a concise way, addressing the reason behind them without over-explaining. Avoid excessive use of the phrase “Credit Explanation Letter,” but ensure it is included within context where necessary.

What to Include in a Credit Explanation Letter

- Introduction: Briefly state the purpose of the letter and your intention to clarify the credit issue.

- Details of the Issue: Clearly explain the situation, such as late payments or inaccuracies, and the factors that led to it.

- Action Taken: Highlight the steps you’ve taken to resolve the issue, such as paying off the balance or working out a new payment plan.

- Request for Consideration: Politely ask the recipient to consider the context when reviewing your credit history, if relevant.

Keep It Short and Direct

Limit your explanation to one or two paragraphs. Avoid repeating the same information, and focus on the most crucial details. A well-written Credit Explanation Letter is straightforward and doesn’t include unnecessary backstory. Keep the tone respectful and professional.