How to Use a Credit Forgiveness Letter Template

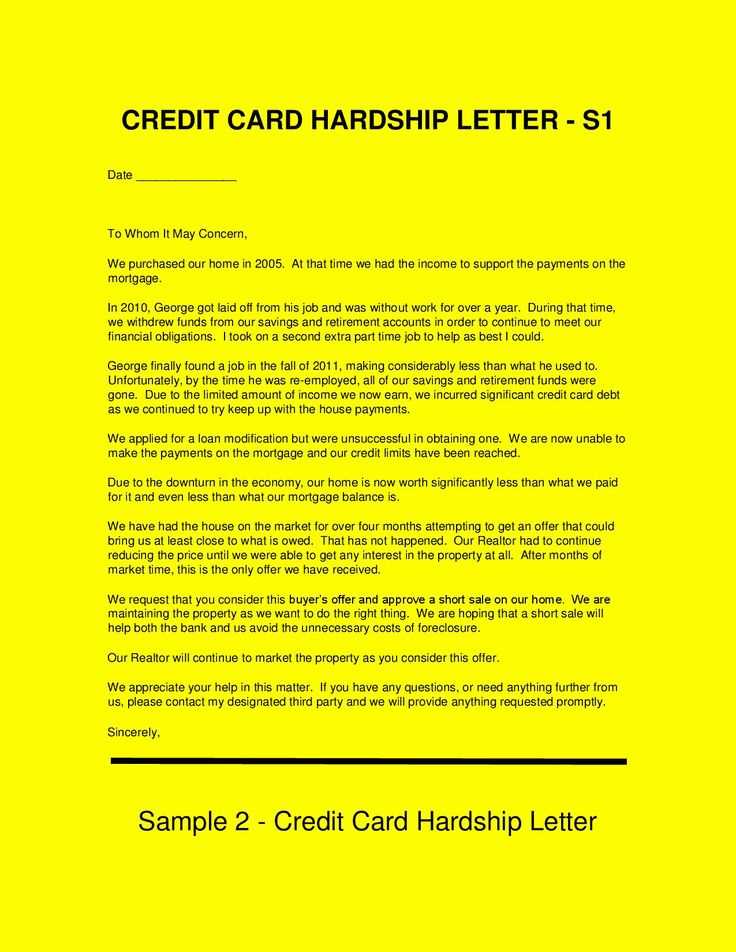

When facing financial hardship, requesting assistance from creditors may be the solution to regain control of your financial situation. Many people find themselves in need of some form of relief to manage overwhelming debts, and reaching out to lenders in a professional manner can increase the likelihood of success. A formal request outlining your situation can serve as a powerful tool in securing the support you need.

Crafting a well-organized appeal is essential for conveying your message clearly and effectively. Whether it’s for postponing payments or reducing the amount owed, presenting your case in the right way can make a significant difference. It’s important to be precise and polite while explaining your circumstances to ensure that your request is taken seriously.

In this guide, we’ll explore the steps for creating a strong, convincing appeal that can help you achieve favorable terms with your lenders. From the key components to include, to strategies for improving your chances, this article will provide all the necessary insights to help you through the process.

Understanding Credit Relief Requests

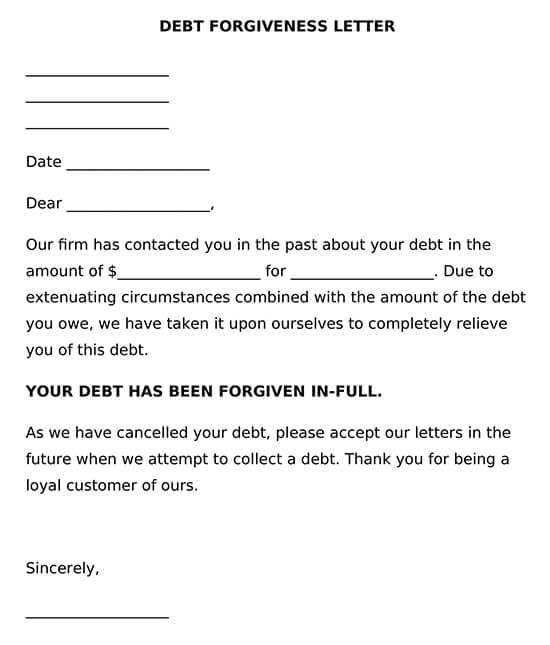

When facing financial difficulties, individuals may seek a way to alleviate their burden by formally approaching lenders for assistance. These formal requests are meant to outline the reasons for the hardship and ask for a reduction in debt, extended payment terms, or other forms of relief. The main objective is to present a case that justifies the need for a change in the terms of repayment based on the borrower’s current financial standing.

Such requests are essential for borrowers who want to negotiate better conditions, whether it’s for lowering monthly payments or delaying deadlines. By presenting a clear and thoughtful appeal, individuals can demonstrate their willingness to resolve the situation while highlighting the challenges they are facing. Lenders often consider these appeals on a case-by-case basis, evaluating the financial circumstances and the potential for future repayment.

It’s crucial to understand that the success of these requests depends largely on how well the case is presented. Being transparent, respectful, and organized when making the appeal is key to gaining the lender’s cooperation and securing a favorable outcome.

Importance of a Well-Written Request

When seeking assistance from a lender or creditor, how you present your situation plays a crucial role in the likelihood of a positive outcome. A carefully crafted appeal can make a significant difference in how your request is received and evaluated. It’s not only about explaining your financial troubles, but also about demonstrating that you are proactive and serious about finding a solution.

Clarity and Professionalism

A well-written request clearly outlines the specifics of your situation, including the reasons for the financial difficulty and the assistance you are seeking. The more transparent and concise you are, the easier it will be for the recipient to understand your needs and consider your case. A polished, professional tone conveys that you respect the process and are committed to resolving your issues responsibly.

Building Trust and Credibility

By providing a structured and respectful appeal, you also build credibility with the recipient. A well-organized request showcases your willingness to address your responsibilities, making it more likely that the lender will view your appeal favorably. It’s an opportunity to show your commitment to improving your financial situation, which can lead to a more favorable decision.

How to Start Your Debt Relief Request

Beginning your formal request for financial assistance can seem like a daunting task, but taking the first step is essential in gaining the support you need. The key is to approach the situation with a clear plan and a structured format. This initial stage sets the tone for the entire process, making it important to start with the right approach to ensure that your appeal is taken seriously.

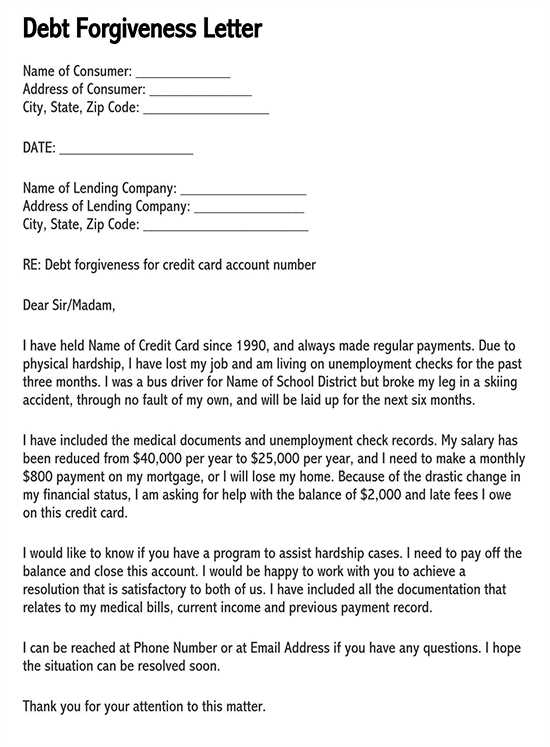

Start by addressing your communication to the appropriate person or department. Make sure you have the correct contact details and include any relevant account or reference numbers to help the recipient easily identify your case. A personalized approach shows that you’ve taken the time to research and understand the process, which can increase your chances of a favorable response.

Next, briefly explain the purpose of your request, highlighting the specific relief you’re seeking. Keep this section concise but informative, as it’s important to immediately communicate the nature of your appeal without overwhelming the reader. Being direct and polite will demonstrate respect for the recipient’s time and decision-making process.

How to Start Your Request for Debt Relief

The first step in approaching your lender for assistance is to begin by clearly stating the purpose of your request. Start by acknowledging your financial challenges and providing a concise explanation of your current situation. The goal is to ensure that the recipient understands the reason behind your appeal while setting a tone of transparency and honesty.

It’s essential to introduce yourself and include relevant account details early in the communication. By being upfront, you demonstrate your commitment to resolving the issue and allow the creditor to easily identify your file. Make sure to express your willingness to work together toward a mutually beneficial outcome, as this helps foster a sense of cooperation.

Be mindful of the tone you use; it should be respectful and professional. Opening your appeal with a clear statement of intent helps set the right framework for the rest of your request, making it easier for the recipient to understand and respond favorably.

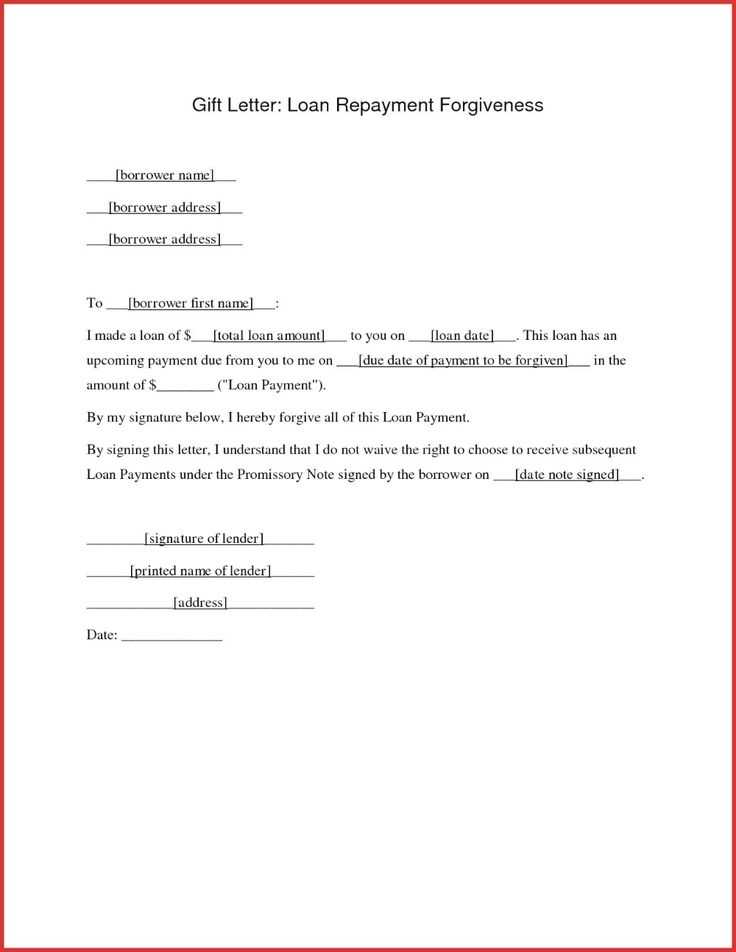

Key Elements to Include in Your Request

When drafting your formal request, it’s crucial to ensure that you cover all the necessary points that will help your case stand out. A well-organized appeal should not only provide context about your financial situation but also make it clear what kind of assistance you are seeking. Including the right details in a structured manner will increase the likelihood of your request being considered favorably.

Below are the essential components to include in your appeal:

| Element | Description |

|---|---|

| Personal Information | Your full name, contact details, and account or reference number. This ensures the recipient can quickly identify your file. |

| Reason for Request | Clearly explain why you are unable to meet the current terms, detailing any financial hardships or circumstances. |

| Requested Assistance | Specify the relief you are asking for, such as reduced payments, deferred deadlines, or a change in terms. |

| Supporting Documents | Include any necessary documents that can substantiate your claims, such as income statements or medical bills. |

| Commitment to Resolve | Reassure the lender that you are committed to resolving the situation and outline any plans you have for future payments. |

By including these critical elements, your request will not only be thorough but also more likely to receive the attention it deserves. A clear and direct approach helps to build trust and demonstrates your seriousness about resolving the issue.

Enhancing Your Request’s Success Rate

Crafting a compelling appeal is only part of the equation. To increase the likelihood that your request will be favorably considered, it’s important to take additional steps that can enhance the strength of your message. Proper preparation and thoughtful presentation can significantly improve your chances of success.

Here are some strategies that can help strengthen your appeal:

- Be Honest and Transparent – Always be truthful about your financial situation. Providing accurate details builds trust and ensures that your request is taken seriously.

- Maintain a Professional Tone – Approach the matter respectfully and avoid sounding demanding. A polite and professional tone increases your credibility and the likelihood of a positive outcome.

- Offer a Realistic Solution – Propose a feasible plan for repayment or assistance. Presenting a practical solution shows that you are committed to resolving the issue.

- Include Relevant Documentation – Attach any supporting evidence, such as income statements or medical bills, to back up your claims and provide a clearer picture of your situation.

- Follow Up – After sending your appeal, follow up to ensure it has been received and is being reviewed. This demonstrates your commitment and interest in resolving the issue.

By applying these techniques, you can significantly enhance the effectiveness of your appeal and improve the chances of receiving the relief you need. Properly presenting your case will not only help you stand out but also make it more likely that your request will be granted.

htmlEdit

Choosing the Right Time for Maximum Impact

Timing plays a crucial role when making a request that could significantly alter your financial obligations. The right moment can influence how your appeal is received and increase the chances of a favorable outcome. Identifying the most strategic period involves understanding your financial circumstances and any relevant external factors that may affect decision-making.

Evaluating Personal and External Factors

Before submitting your request, consider both your personal situation and any broader economic conditions. External events, such as changes in legislation or company policies, may create a window of opportunity. Additionally, assessing your financial standing and ensuring that you can clearly communicate your need for relief at this specific time can strengthen your position.

Optimizing Your Appeal for a Positive Response

Understanding the organization’s review cycle or peak decision-making periods can help you align your request with their priorities. By timing your submission to coincide with moments when the review process is most active, you can maximize the likelihood of a thorough and timely evaluation. It’s also important to be prepared for follow-up actions, as prompt and effective communication may further boost your chances of success.