Credit Inquiry Letter of Explanation Template

When managing your financial reputation, there are times when errors or unfamiliar entries appear in your report. This can be concerning, especially if you believe the details to be incorrect. Addressing these discrepancies is essential to maintain an accurate reflection of your financial situation.

In many cases, a well-crafted response to these issues can help clarify misunderstandings and potentially lead to corrections. Understanding how to communicate your concerns clearly and professionally is key to ensuring a positive outcome.

By following a structured approach and presenting relevant information in an organized way, you can effectively resolve any issues and restore confidence in your financial profile. With the right guidance, the process becomes straightforward and manageable.

Understanding Credit Inquiry Letters

When reviewing your financial documents, you may come across instances where unfamiliar or questionable activities are noted. These situations often require formal clarification to ensure the accuracy of your records. A well-prepared response can help address these issues and prevent misunderstandings.

In this context, it’s important to understand the nature of such documents and how they serve as a tool for communication between you and the relevant institutions. These communications typically aim to provide additional context or clarification on specific items in your financial history.

By responding appropriately, you can help ensure that your records are corrected if necessary. Having a clear understanding of how to approach this process is crucial for resolving any discrepancies efficiently.

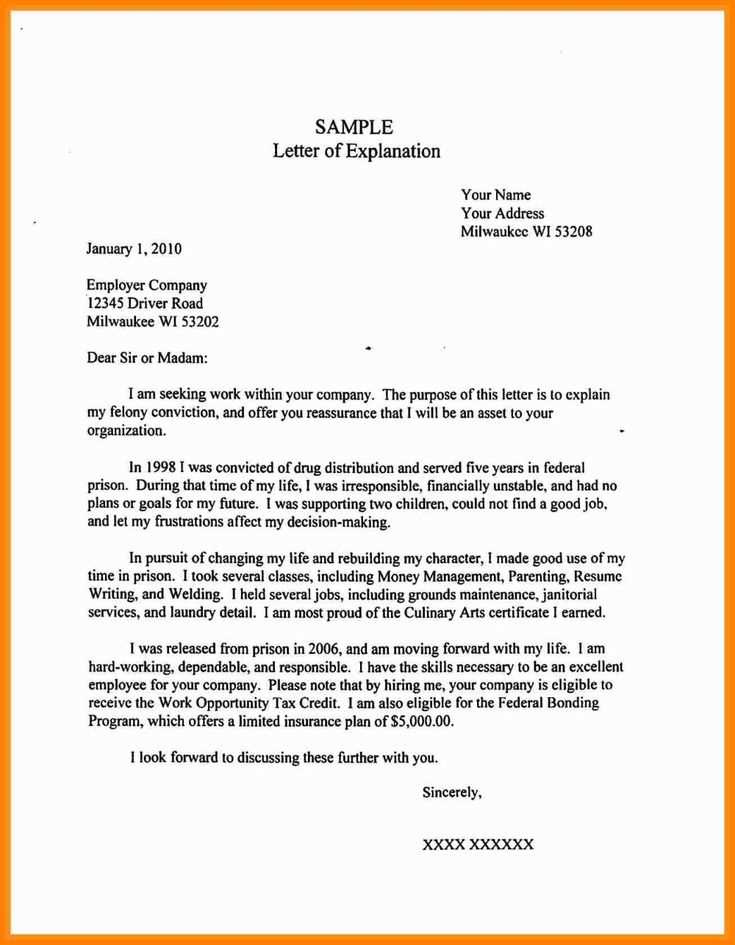

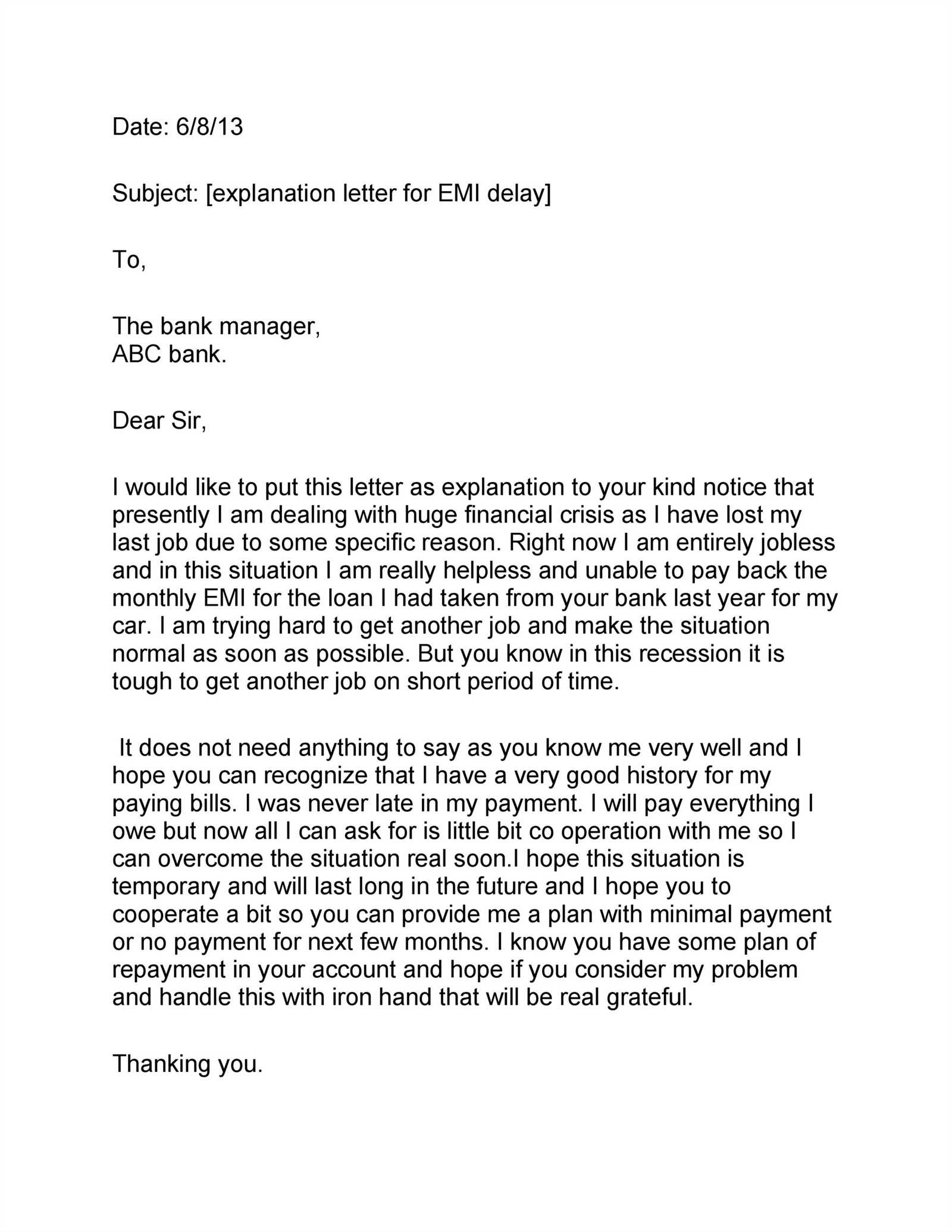

Why You Need an Explanation Letter

Addressing inaccuracies or unexpected entries in your financial records is essential for maintaining a clear and accurate profile. When certain items in your report are unclear or disputed, providing a detailed response can help clarify the situation.

Such a response not only demonstrates your attention to detail but also offers insight into circumstances that may have led to the discrepancy. This can be especially helpful when you’re seeking to improve your financial standing or resolve misunderstandings with lenders and institutions.

By submitting a well-crafted communication, you are taking a proactive step toward ensuring that your records accurately reflect your financial activities, which can ultimately improve your reputation and facilitate smoother transactions in the future.

Key Components of a Credit Inquiry Letter

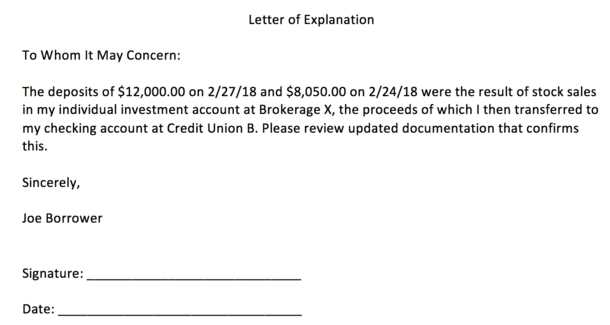

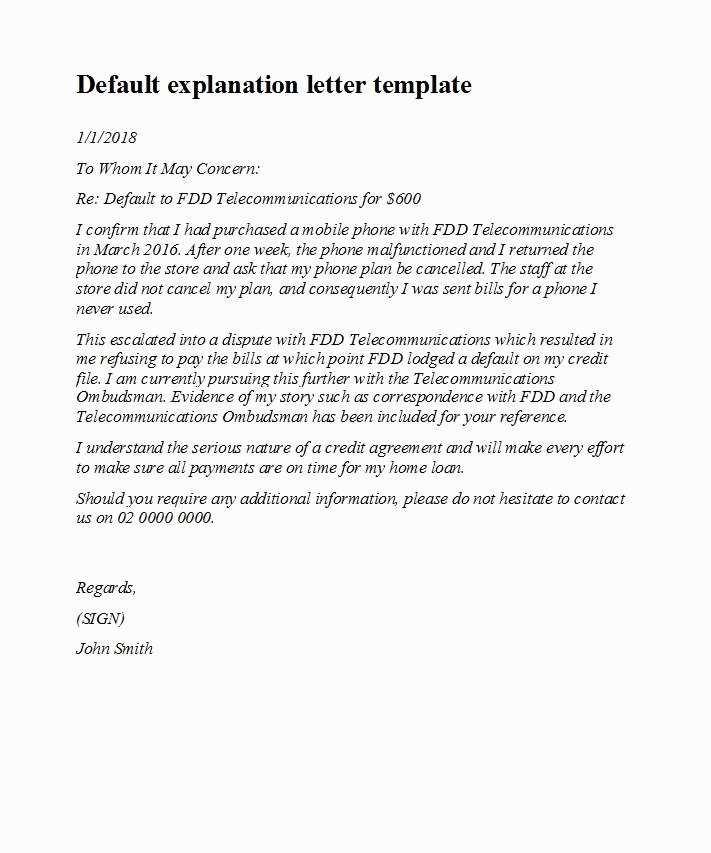

When addressing issues in your financial record, it’s important to include specific elements in your communication to ensure clarity and provide the necessary context. A well-organized response allows the recipient to fully understand the circumstances surrounding the disputed entry.

One key component is providing detailed information about the item in question, including dates and any supporting documentation. Accuracy is essential, as this will help avoid any further confusion or delays in resolving the matter.

Another important aspect is being concise while also offering enough background information. A direct approach with clear explanations can help convey your intent and minimize misunderstandings. Lastly, including your contact information allows for easier follow-up if additional details are required.

How to Write a Strong Explanation

Crafting a convincing and effective response requires a clear structure and careful attention to detail. A strong communication provides all the necessary context and information while remaining professional and concise.

Here are some essential steps to follow when writing your response:

- Be Clear and Specific: Clearly identify the issue at hand, specifying dates, amounts, and any other relevant details to avoid ambiguity.

- Stay Concise: Keep your explanation to the point, focusing on the most important facts without unnecessary elaboration.

- Provide Supporting Documents: If available, include evidence to back up your statements, such as account statements, transaction records, or any communication related to the matter.

- Stay Professional: Maintain a polite and respectful tone throughout, even if you disagree with the information in question.

By following these steps, you ensure that your response is clear, effective, and likely to lead to a positive resolution.

Common Mistakes to Avoid

When addressing discrepancies in your financial records, it’s crucial to avoid certain missteps that could delay the resolution process or lead to misunderstandings. By being aware of these common errors, you can improve the effectiveness of your communication and ensure your response is well-received.

1. Lack of Clarity

Vague or unclear statements can create confusion and hinder the review process. To prevent this, ensure that every point you make is direct and supported by clear details.

- Provide exact dates and amounts involved in the issue.

- Avoid using ambiguous language; be specific and to the point.

2. Failure to Provide Supporting Evidence

Without proper documentation, it can be difficult for the recipient to verify your claims. Always include relevant documents that back up your statement.

- Attach supporting documents, such as transaction records or communications, where applicable.

- Ensure all files are legible and properly formatted for easy review.

By avoiding these common mistakes, you increase the likelihood of a timely and favorable resolution.

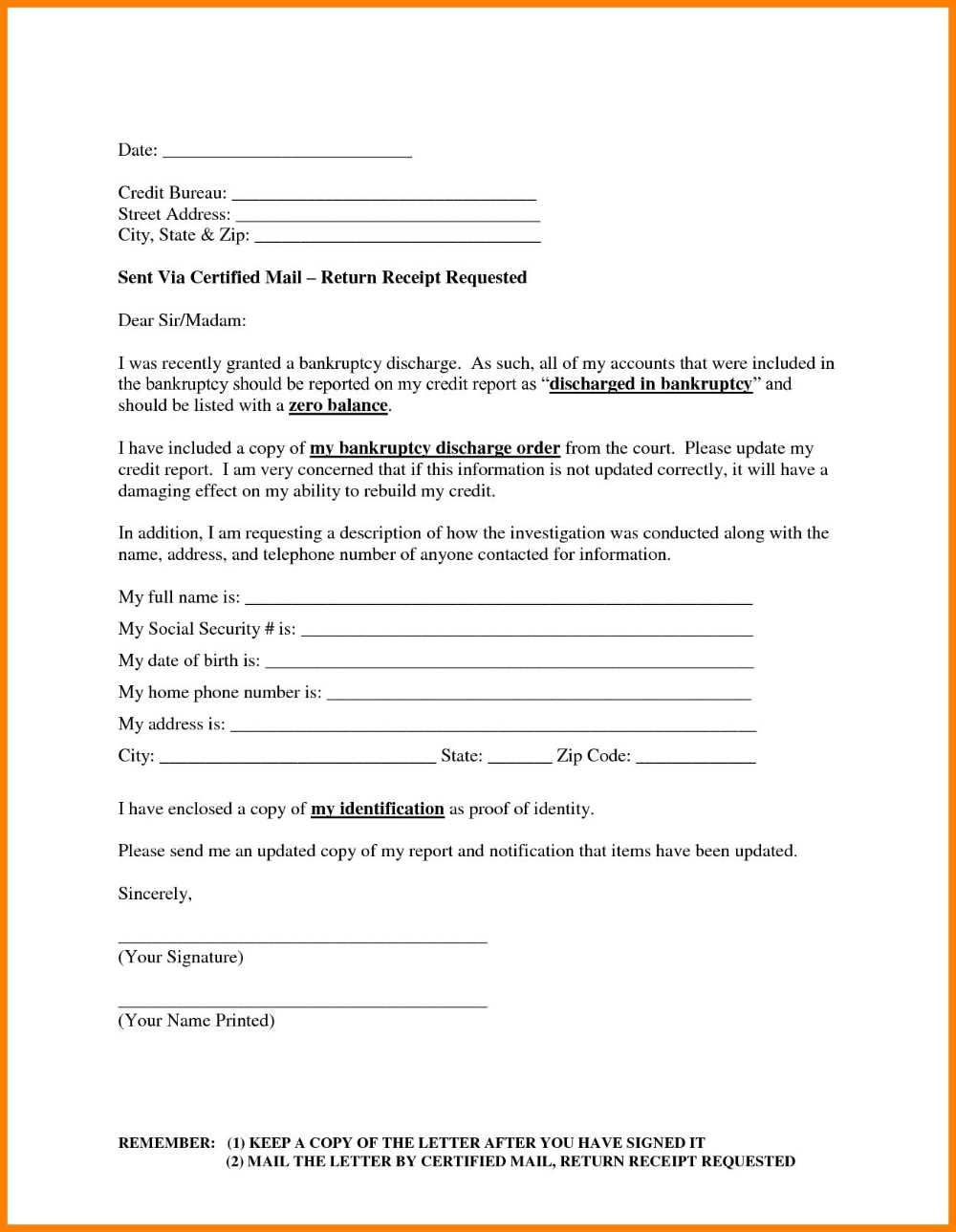

How to Submit Your Letter Effectively

Once you’ve crafted a detailed and clear response to address discrepancies in your financial records, it’s important to submit it properly to ensure it reaches the right person and is processed in a timely manner. The method of submission plays a crucial role in the efficiency and outcome of your request.

1. Choose the Right Submission Method

Select the most appropriate channel for submission to ensure your response is received and reviewed without delay. Common options include:

- Email: This is a fast and reliable option, but ensure that all attachments are properly formatted and easy to read.

- Postal Mail: If submitting by mail, use certified or registered mail to track the delivery and ensure receipt.

2. Confirm Receipt

After submitting your response, it’s important to confirm that it has been received and is being processed. This can help avoid unnecessary delays and ensure that your issue is being addressed.

- Follow-up: Send a polite follow-up inquiry if you haven’t received confirmation within a reasonable timeframe.

- Keep Records: Retain copies of all communications and receipts for future reference.

By following these steps, you improve the chances that your communication will be handled swiftly and effectively, bringing you closer to a resolution.

Tips for Improving Your Credit Score

Enhancing your financial standing is crucial for securing better loan terms and lower interest rates. By focusing on key habits and strategies, you can gradually improve your profile, making it more attractive to potential lenders and service providers.

1. Maintain a Low Balance on Your Accounts

Keeping your balances low relative to your available credit is one of the most important factors in improving your profile. It signals to lenders that you are managing your finances responsibly.

| Account Type | Recommended Balance |

|---|---|

| Credit Cards | Below 30% of credit limit |

| Personal Loans | On-time payments, full repayment |

| Installment Loans | Low remaining balance |

2. Ensure Timely Payments

Making payments on time is one of the most effective ways to build a positive financial history. Avoiding late fees and penalties keeps your record clean and demonstrates reliability to lenders.

By adopting these practices, you can steadily improve your financial profile and unlock better opportunities in the future.