Credit Inquiry Letter Template for Easy and Professional Requests

When you need to gather important financial details or verify your personal data with a company, sending a formal request is often the best approach. Such requests help ensure that the necessary information is shared accurately and promptly. Knowing how to phrase your request clearly can make a significant difference in receiving the response you need.

Properly drafting a formal request requires careful attention to detail. Your communication should be straightforward and professional to avoid misunderstandings. A well-constructed message not only helps in achieving your goal but also reflects your seriousness and organizational skills.

In this guide, we’ll walk you through the process of crafting a compelling request, ensuring you include all essential components. Understanding the structure of such correspondence can streamline the process, allowing you to focus on the next steps once you have the required information in hand.

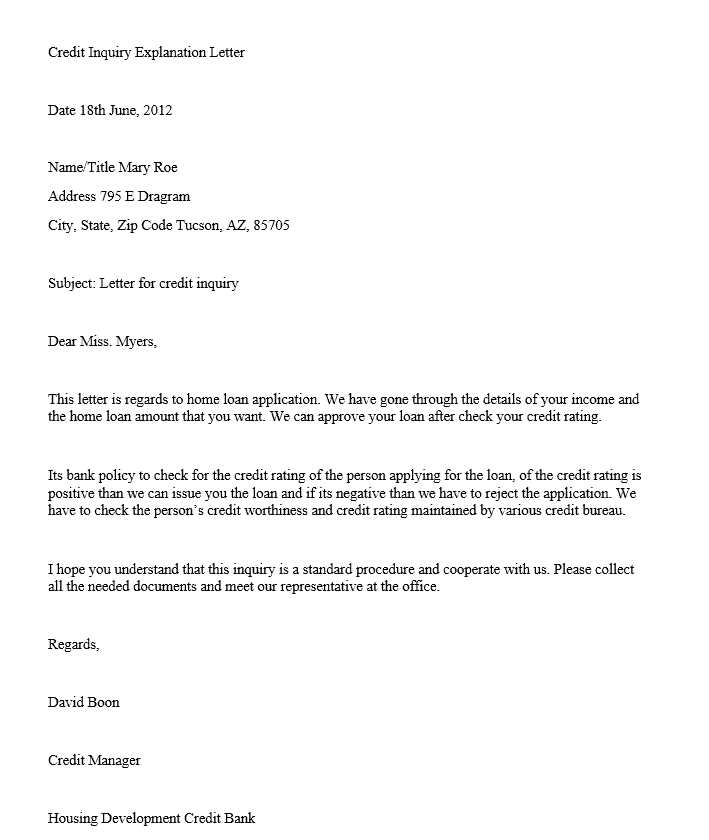

What is a Request for Financial Information

A formal request for personal financial details is a professional communication sent to an organization or financial institution. It is commonly used when individuals need access to their financial records, such as reports or account statuses. These requests are essential for monitoring one’s financial history, ensuring accuracy, or making informed decisions.

This type of communication serves as an official means of gathering necessary data. The recipient typically processes the request by reviewing the individual’s information and providing the requested details. Understanding how to properly compose such a message is crucial in achieving a prompt and efficient response.

| Purpose | Examples |

|---|---|

| Verify Financial Data | Accessing detailed financial records |

| Correct Inaccuracies | Requesting corrections to personal details |

| Request Information | Obtaining necessary data for decisions |

Reasons for Sending a Request for Financial Details

There are several important situations where an individual may need to reach out to a financial institution or other organizations for personal information. Understanding the reasons behind these requests helps ensure they are made appropriately and efficiently. Here are some common scenarios where such a request is essential:

- Verifying Personal Information: Sometimes, you may need to confirm that the details listed in your financial records are correct, especially if you suspect errors.

- Monitoring Financial History: Regular checks on your personal records help you stay informed about your financial standing and identify any unusual activity.

- Resolving Discrepancies: If you notice discrepancies in your data, requesting clarification or adjustments is necessary to maintain accuracy.

- Preparing for a Major Decision: When making decisions like applying for a loan or mortgage, having up-to-date information helps you understand your financial options.

Each of these reasons emphasizes the importance of reaching out and obtaining the necessary documents to make informed decisions and maintain control over one’s financial information.

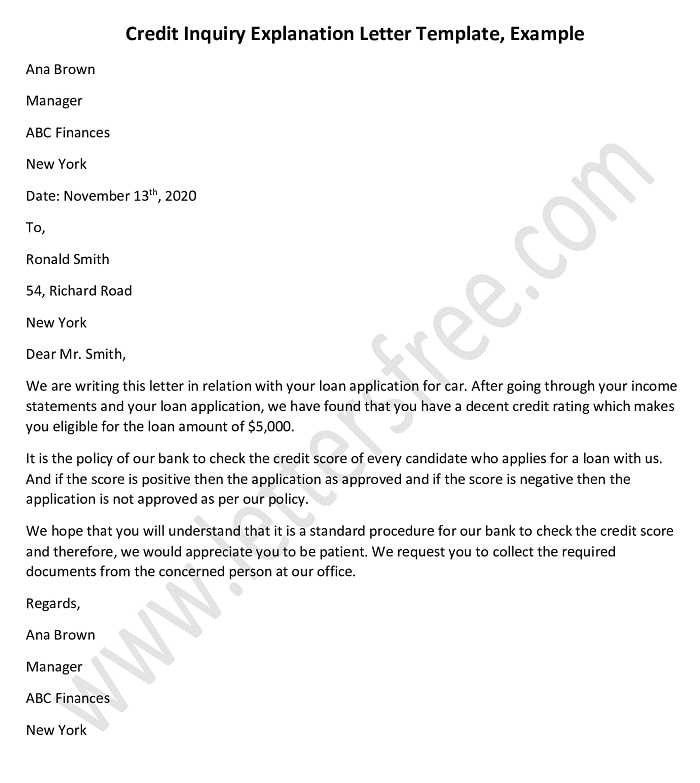

Steps to Write an Effective Request

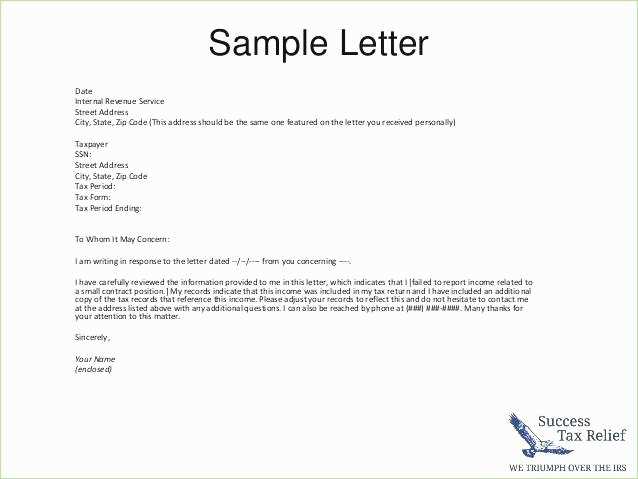

Writing a clear and concise request is essential to ensure that the recipient understands your needs and can respond promptly. Following a structured approach not only improves the likelihood of a timely response but also conveys professionalism. Here are the key steps to crafting an effective message:

1. Begin with a Formal Greeting: Start your message with a polite and professional salutation, addressing the recipient by name if possible.

2. Clearly State Your Purpose: Be direct and specific about the information you are requesting. Make it clear why you need the details and how they will be used.

3. Provide Relevant Details: Include any necessary information that will help the recipient locate your records, such as account numbers or personal identification data.

4. Use a Polite and Respectful Tone: Ensure your language is courteous and respectful throughout the message, as this promotes a positive response.

5. Request a Timely Response: Politely ask for a specific timeframe in which you would like to receive the information, without being demanding.

6. Close Professionally: End with a polite closing statement, thanking the recipient in advance for their assistance and expressing your willingness to provide any further information if needed.

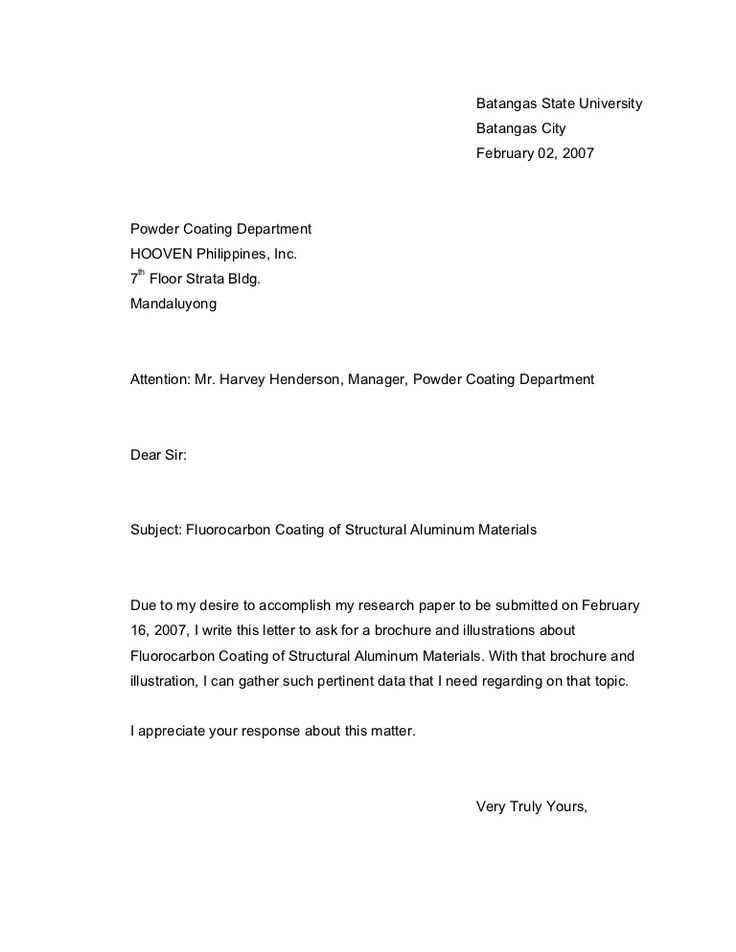

Essential Details to Include in Your Request

When composing a formal request for personal financial information, it is important to provide all necessary details that will allow the recipient to process your request efficiently. Including the right information ensures that the response is accurate and timely. Below are some key elements that should be part of your communication:

Personal Identification Information

To help the recipient locate your records, make sure to include your full name, address, and any other identifying details, such as your date of birth or account number. This ensures that the request is linked to the correct individual and processed without delay.

Specific Information Requested

Be clear about what information you need. Whether it’s a detailed financial report or a correction to an existing record, specifying the exact data required will help avoid confusion. This clarity can speed up the response process and reduce the need for follow-up communications.

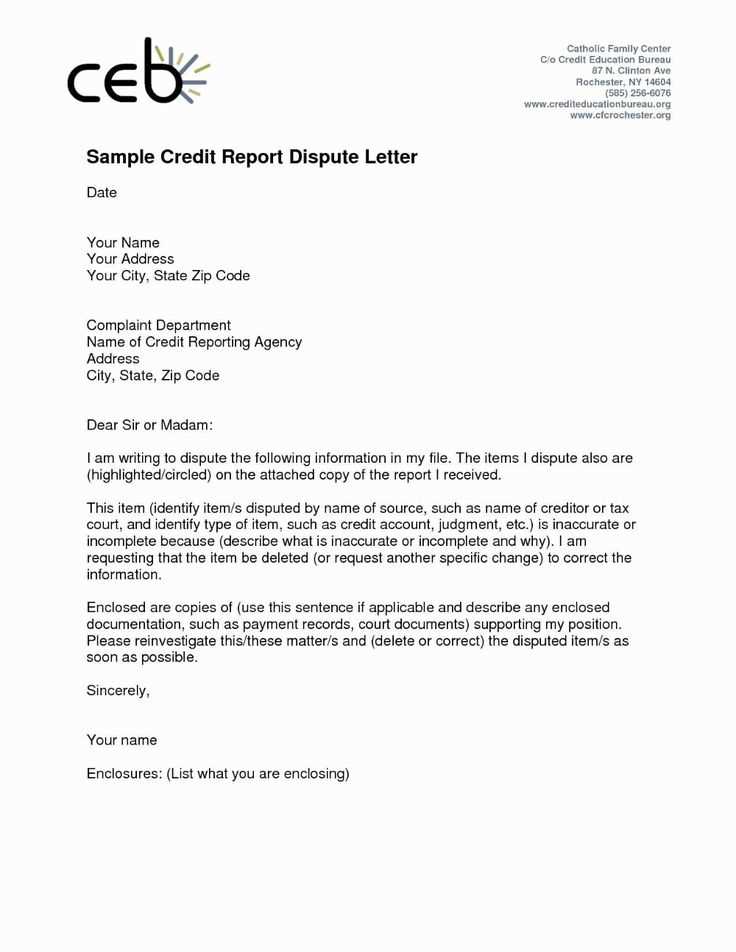

Avoiding Common Mistakes in Requests

When sending a formal request for personal financial data, avoiding mistakes is crucial to ensure that the process goes smoothly and that you receive the information you need in a timely manner. Simple errors in your message can cause delays or misunderstandings. Here are some common pitfalls to watch out for:

Not Being Specific Enough

Vague requests can lead to confusion. Always be clear and precise about the information you’re requesting. Instead of simply asking for “information about my account,” specify whether you need a detailed transaction history, a current balance, or any corrections to your personal data. The more specific you are, the faster the response.

Failing to Include Essential Information

Omitting important details, such as your full name, account number, or identification number, can slow down the process. Always ensure that you provide all the necessary personal details to help the recipient find your records quickly and accurately.

When to Follow Up on Your Request

After sending a formal request for personal data, it is important to know when to follow up if you haven’t received a response. Waiting too long without action can delay important decisions, while following up too soon may appear impatient. Understanding the right time to check on the progress of your request ensures that the process remains efficient and professional.

Typically, if you haven’t received a response within the specified timeframe in your initial message, it is appropriate to follow up. If no timeframe was mentioned, waiting about 7-10 business days before sending a polite reminder is generally a good practice. This gives the recipient enough time to process your request while also keeping the matter on their radar.