Credit letter template

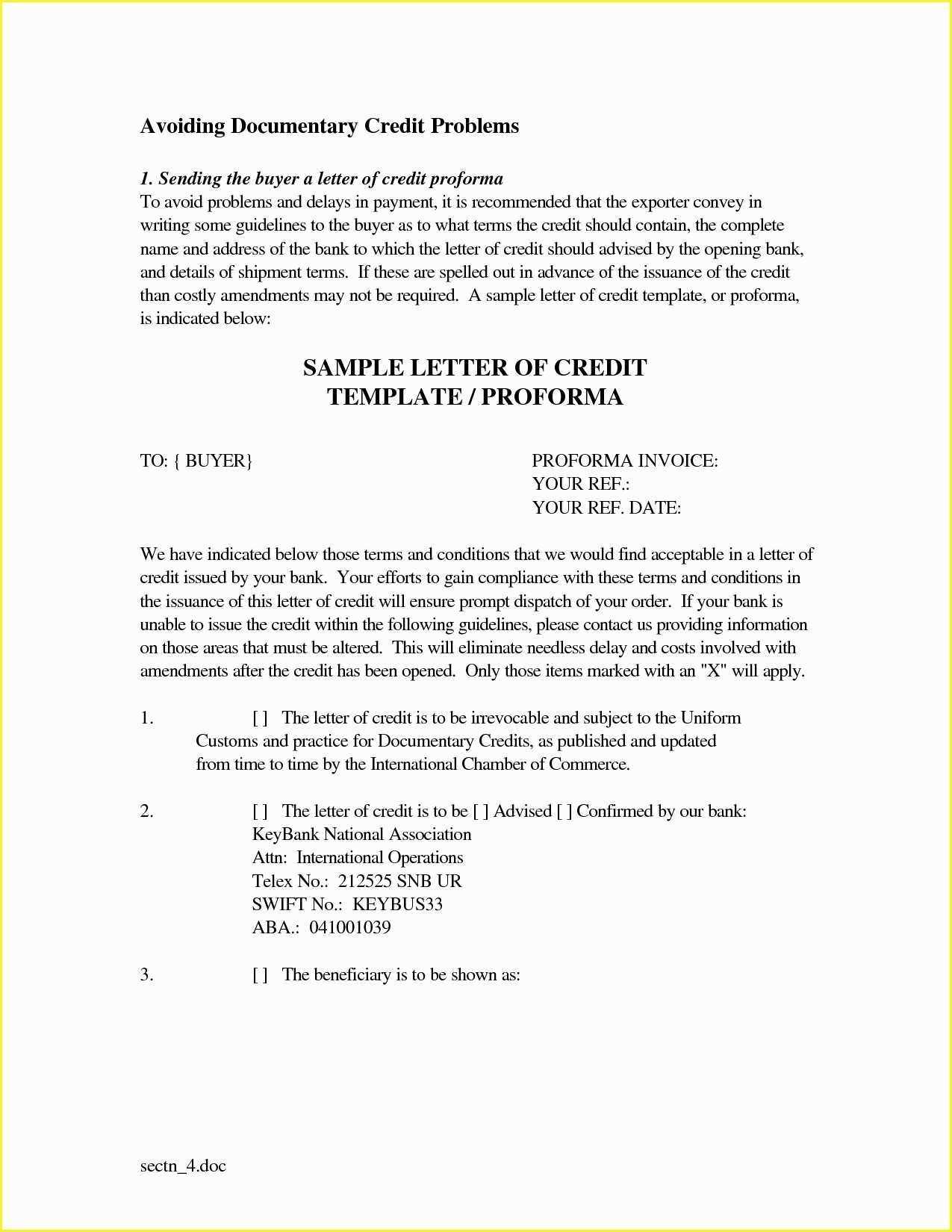

Start by structuring your credit letter with a clear and direct approach. Address the recipient with their full name or company, followed by a concise statement of your intention to issue or request credit. It’s important to maintain a formal tone while being respectful and to the point. State the specific terms of the credit, including the amount, duration, and any conditions that apply. This clarity avoids misunderstandings and sets expectations upfront.

Next, outline the reason for the credit, whether it’s based on a prior agreement or a new arrangement. If necessary, refer to any related documents or agreements that support your decision. Be specific about payment terms and deadlines, and if applicable, include details on how the credit can be used or accessed. This keeps the letter transparent and straightforward for both parties.

Finally, offer any necessary contact information for further clarification or queries. Sign off with a polite closing, reaffirming the credit agreement. Make sure the letter looks professional and adheres to any legal requirements relevant to the credit transaction. A well-organized and precise credit letter not only serves its functional purpose but also establishes trust between the parties involved.

Here are the corrected lines:

Begin by addressing the recipient clearly at the top of the letter. Ensure their full name and company details are correct, as well as the proper salutation. An example could be, “Dear Mr. Smith,” or “To whom it may concern,” if the specific person is unknown.

Correct Statement of Credit

State the specific amount being credited and the reason for the credit. This could look like: “We are pleased to inform you that a credit of $500 has been applied to your account as a result of an overpayment on invoice #12345.” This makes the purpose of the letter clear.

Clarifying Terms and Conditions

It’s vital to include any terms regarding the credit, such as its expiration or how it can be used. For example: “This credit is valid for 90 days and can be applied to any future invoices with our company.” This provides transparency for the recipient.

Conclude the letter with a courteous closing. For example, “If you have any questions or need further assistance, feel free to contact us at [contact information].”

- Credit Letter Template

A well-crafted credit letter can help establish trust and facilitate smooth financial transactions. Here’s a simple template you can follow:

- Header: Include your company name, address, and contact information at the top.

- Subject Line: Mention the purpose of the letter, e.g., “Credit Approval for [Customer Name].”

- Introduction: Begin by addressing the recipient by name or title. State the reason for the letter clearly–approval or denial of credit.

- Body:

- Start by acknowledging any previous communication or agreements regarding credit terms.

- If granting credit, specify the approved amount, interest rate, repayment terms, and any conditions that apply.

- If denying credit, provide a brief, polite explanation without going into unnecessary detail.

- Conclusion: Reaffirm the decision and express your willingness to work with the recipient in the future. If applicable, offer options for alternative solutions.

- Closing: Use a professional closing like “Sincerely” or “Best regards,” followed by your name and title.

This format ensures clarity and professionalism in your credit letters, making it easy for both parties to understand the terms and expectations.

Begin with a clear subject line to specify the purpose of the credit letter. This helps the recipient understand the nature of the request or offer right away.

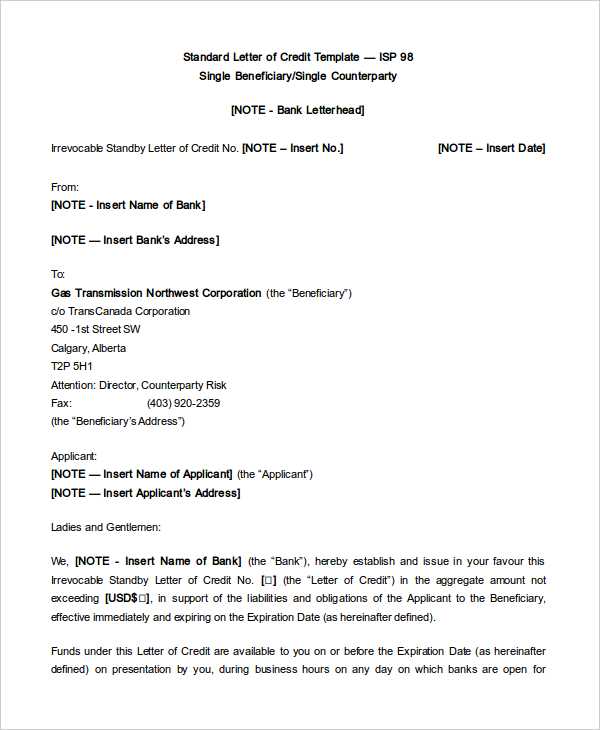

- Sender Information: Include your business name, address, phone number, and email at the top of the letter. This ensures the recipient knows who is making the request.

- Recipient Information: Address the letter to the appropriate individual or department. Use their full name and title to maintain professionalism.

- Introduction: Start with a brief statement explaining the reason for the letter, such as requesting credit or offering credit terms for a business deal.

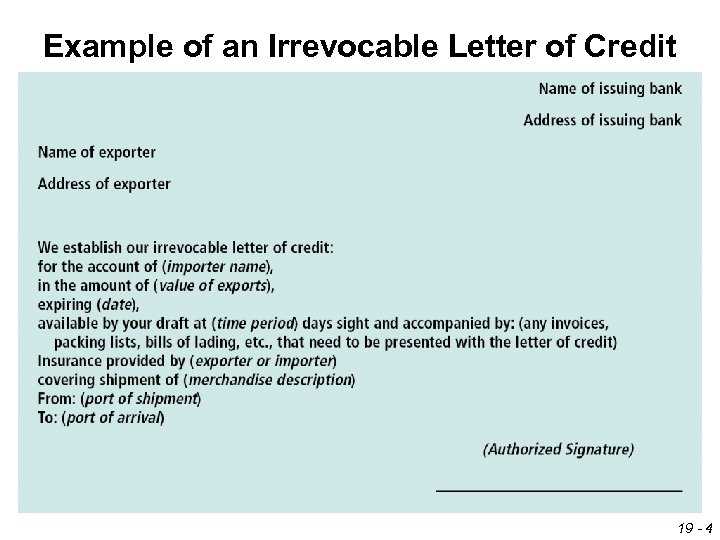

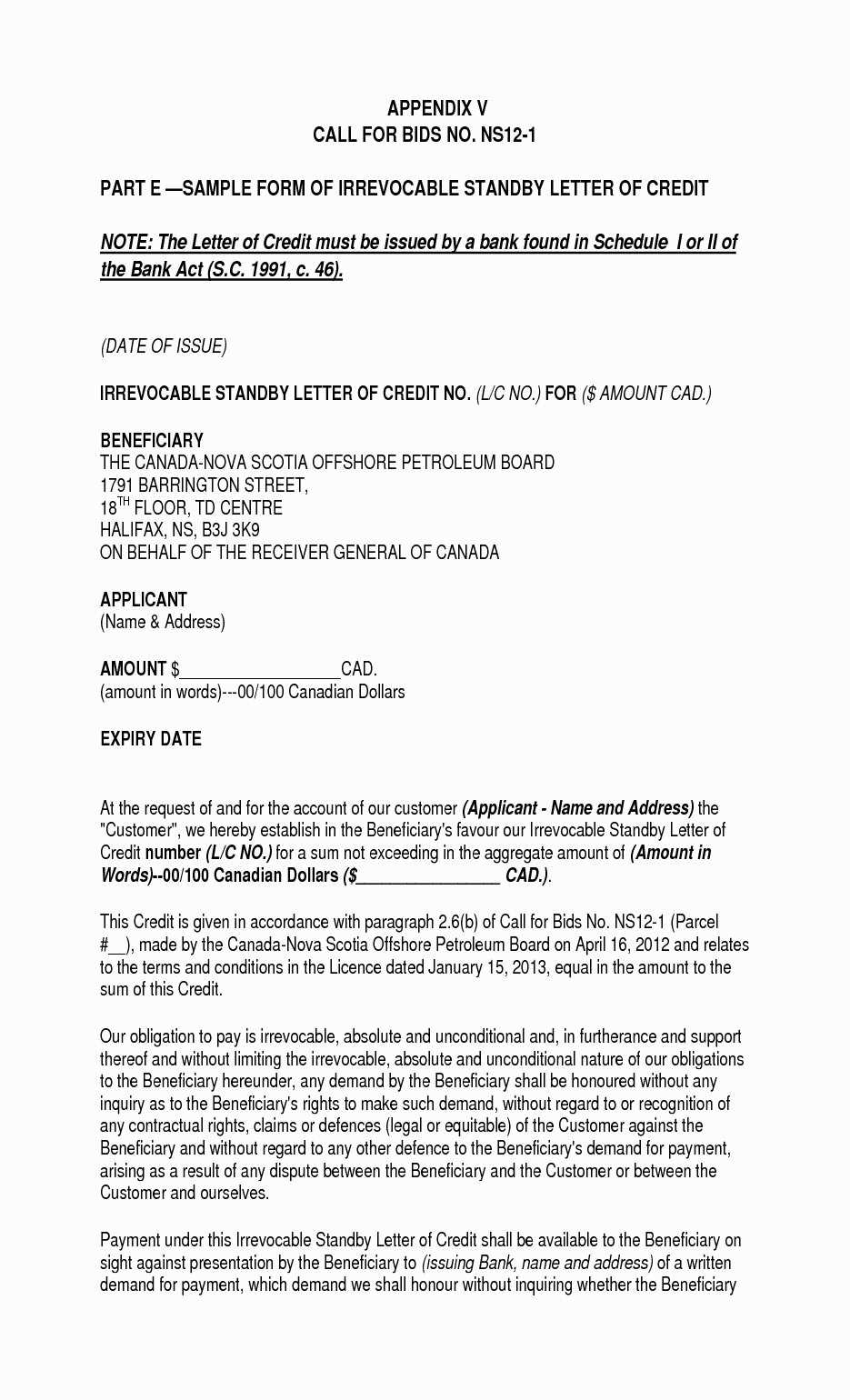

- Details of the Agreement: Outline the terms of the credit being offered or requested. Specify the amount, repayment terms, and any other relevant details such as interest rates, timelines, or collateral if applicable.

- Payment Terms: Clearly state the expected payment schedule. Include the date by which payment is due, any penalties for late payment, and other payment-related conditions.

- Guarantee or Collateral (if applicable): If the credit offer involves collateral or a guarantee, detail these terms so both parties are aware of the conditions securing the agreement.

- Closing: Reiterate the agreement terms and invite the recipient to reach out with any questions. Express your willingness to discuss the terms further if necessary.

- Signature: End with a professional closing and your signature, along with your title and contact details.

Ensure the tone remains professional and direct throughout the letter. Double-check for accuracy in all financial details before sending the letter.

A credit letter should be clear and precise to establish trust and ensure smooth communication between the parties involved. The following elements are critical to include:

1. Contact Information

Start with your contact details–name, address, phone number, and email. Include the recipient’s information as well, ensuring that it is accurate and up-to-date. This avoids any confusion or delays in communication.

2. Introduction and Purpose

Clearly state the reason for the credit letter. If it’s a letter of credit or a credit reference, mention it early on so the reader knows exactly what to expect.

3. Amount and Terms

Outline the specific amount of credit being extended, along with the terms of repayment or any conditions attached. This helps prevent misunderstandings about the credit agreement.

4. Payment and Interest Terms

Specify payment due dates, interest rates (if any), and penalties for late payments. Providing these details upfront protects both parties and establishes clear expectations.

5. Authorization

Make sure to include a statement of authorization, indicating that the credit extended is official and sanctioned by the relevant parties.

6. Closing Remarks

End with a professional closing, offering to provide further details if necessary, and express your willingness to cooperate. A polite and professional tone strengthens the relationship.

Adopt a tone that reflects the purpose of your credit letter. If you’re requesting a credit extension, a polite and respectful tone builds trust. On the other hand, if you’re addressing a delay or dispute, use a firm but courteous approach to assert your position without sounding aggressive.

Keep It Professional, Yet Approachable

Your letter should maintain professionalism at all times, avoiding overly casual language or excessive formality. Address the recipient by their correct title, and ensure the language is clear and respectful. This helps convey that you’re serious while also being considerate of their position.

Adjust Your Tone Based on Your Relationship

If you have an established relationship with the recipient, a slightly more familiar tone is acceptable. However, if you’re writing to a new contact or a company, stick to a more formal and neutral tone. This approach minimizes misunderstandings and shows respect for the professional relationship you’re building.

A credit letter is commonly used to establish or confirm a financial arrangement between a lender and borrower. You may need it when you want to provide a guarantee or assurance for a transaction. Below are key instances where a credit letter plays a critical role:

1. Guaranteeing Payment for a Transaction

If a company or individual is unsure about their ability to pay for a service or product upfront, a credit letter can be issued to reassure the seller of payment. This is often seen in international trade or high-value purchases.

2. Confirming Credit Terms with Suppliers

Businesses often use credit letters to confirm terms of credit or deferred payments with suppliers. This provides a clear written record of the agreement and can help in case of disputes regarding the payment schedule or amount.

3. Supporting Loan or Lease Agreements

When a borrower needs financial backing for a loan or lease, a credit letter from a trusted institution or third party can be used to provide confidence to the lender about the borrower’s financial stability.

4. Assuring Refunds or Reimbursements

In cases where customers or business partners are unsure about the possibility of receiving a refund, a credit letter assures them that any necessary reimbursements will be provided according to the terms of the agreement.

Each of these scenarios highlights the importance of a credit letter in offering security, establishing trust, and ensuring that financial transactions proceed smoothly.

Clarity is key. Avoid using vague terms or leaving important details unstated. Specify the exact terms of credit, such as the amount, interest rate, repayment schedule, and any collateral involved. Ambiguous language may lead to misunderstandings or disputes later on.

Not Addressing the Purpose Clearly

Clearly state the reason for the credit letter. Whether it is to request a line of credit, offer a loan, or confirm existing terms, make sure the purpose is immediately apparent. Failing to do so might cause confusion or delay in processing the request.

Overcomplicating the Terms

Avoid using overly technical or legal language. Keep the letter straightforward, with simple terms anyone can understand. Complex jargon or excessive legalese can create unnecessary barriers and frustrate the recipient.

Another mistake is neglecting the tone. While a credit letter should be professional, it should not be cold or rigid. Ensure your language remains courteous and respectful, even if the letter involves a dispute or rejection.

Lastly, always proofread for accuracy. Small errors in names, dates, or figures can severely affect the credit terms and harm your credibility. Double-check all details before sending the letter to prevent costly mistakes.

Adjust the tone and content of your credit letter based on the credit type you are addressing. For a personal loan, highlight the borrower’s history of reliable repayments and stable income. Focus on reassuring the lender about the applicant’s ability to meet monthly obligations. Mention employment stability, savings, or other financial assets that contribute to the borrower’s trustworthiness.

For a business credit letter, emphasize the company’s financial health, including revenue growth, market stability, and long-term strategies. Share key financial metrics, such as net profit margins, cash flow, and any positive industry recognition. Tailor the letter to convey your confidence in the business’s ability to repay the debt while fostering a mutually beneficial relationship.

If applying for a mortgage, underline the applicant’s history of responsible homeownership or solid rental track record. Ensure to include any long-term savings or investments that demonstrate financial discipline. Stress the stability of their income and ability to cover larger payments consistently, especially if this is their first home purchase.

For student credit, emphasize the individual’s academic achievements, the potential for future career growth, and how they plan to manage their debt after graduation. Lenders typically appreciate a well-organized budget or a plan to repay loans once employed. Keep the tone professional but understanding of their current situation.

Each credit type requires tailored information to suit the expectations of the lender. By aligning the focus of your letter with the specific requirements of the credit product, you enhance your chances of approval and build a clear, persuasive case for the applicant’s reliability.

Ensure you create a clear and concise structure when drafting a credit letter. Begin with a polite greeting, addressing the recipient by name if possible. Keep your tone formal but approachable, and clearly state the purpose of your letter in the opening sentence.

Key Elements of a Credit Letter

The following table highlights the important sections of a credit letter that you should include for clarity and professionalism:

| Section | Description |

|---|---|

| Header | Include your name, address, and the recipient’s information at the top of the letter. |

| Subject Line | Provide a clear subject to indicate the purpose of the letter, such as “Credit Approval Request” or “Credit Limit Increase.” |

| Body | Detail the credit request, including any necessary background information, financial history, or justifications for your request. |

| Conclusion | Summarize the key points and include any required next steps. Express appreciation for consideration and mention how to contact you for follow-up. |

After drafting the letter, review it for clarity and professionalism. Double-check any financial figures or terms included, ensuring they are correct. A well-organized credit letter increases the likelihood of a successful outcome.