Credit Limit Increase Letter Template

When seeking a larger borrowing capacity, it is important to present a well-structured request. This approach can help persuade your lender to consider your application favorably. Knowing the right way to frame your appeal is essential for achieving the desired outcome.

In this guide, we will explore how to write an effective request that highlights your financial reliability. A clear and concise approach is key, and including relevant details will increase your chances of success. With the right structure, your request can stand out to those reviewing it.

Understanding the key elements of a successful request is crucial, and we will outline these aspects to ensure your appeal is both professional and impactful. Clarity and organization play a major role in how your submission is perceived.

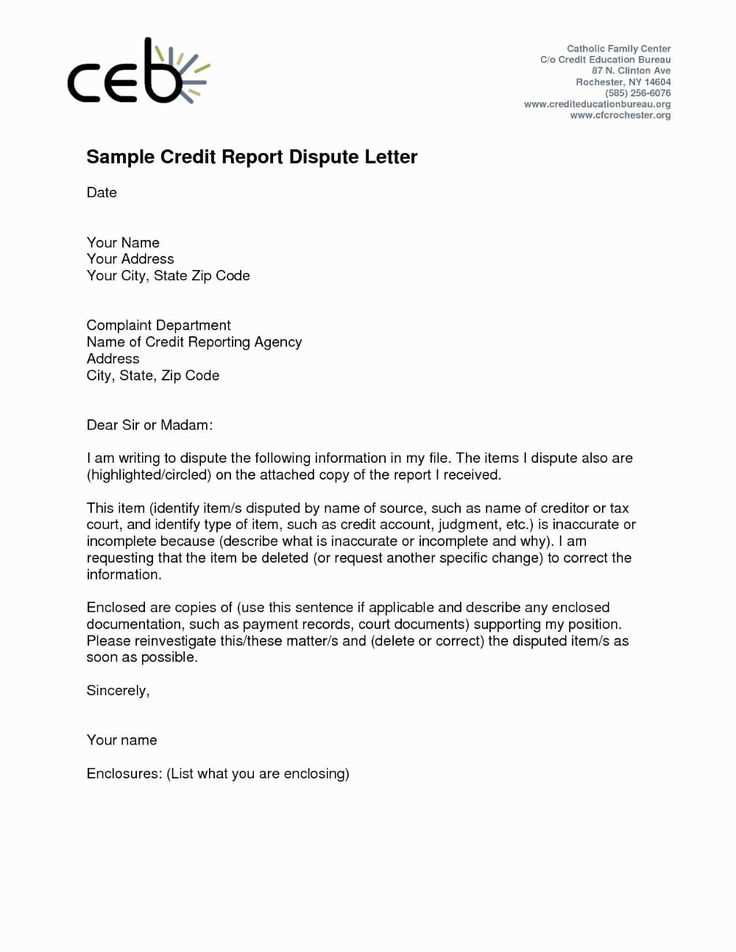

How to Write a Credit Limit Request

To formally ask for a higher borrowing capacity, it’s essential to craft a request that clearly communicates your intention while demonstrating financial responsibility. The way you present your case can significantly influence the decision-making process. A well-written message will highlight your trustworthiness and increase the likelihood of approval.

Key Steps to Follow

- Start with a polite greeting: Address the right person or department to ensure your request is directed appropriately.

- State your purpose clearly: Clearly mention why you are requesting the adjustment and any specific goals you wish to achieve.

- Provide relevant details: Include any information that supports your case, such as your payment history or improvements in your financial situation.

- End with gratitude: Thank the recipient for considering your request and express appreciation for their time.

Additional Tips for Crafting an Effective Request

- Keep it concise: Avoid unnecessary details and stay focused on the key points.

- Maintain a professional tone: Even if you have a long-standing relationship with the lender, always use formal language.

- Double-check for errors: Review your request before submitting to ensure clarity and professionalism.

Steps to Craft an Effective Letter

Creating a strong request involves more than just stating your desire for a higher financial threshold. It’s about presenting your case in a way that is both clear and compelling. A well-structured message ensures that your request is taken seriously and that all relevant information is communicated effectively.

1. Begin with a Professional Greeting

The first impression matters, so start your communication with a polite and respectful salutation. Address the recipient by name or the appropriate department to ensure your request reaches the right hands.

2. State Your Intentions Clearly

In the opening paragraph, make sure to state the purpose of your request directly. Explain why you’re seeking an adjustment, providing a concise and honest explanation of your financial goals or needs. This helps the recipient understand the reasoning behind your request right away.

3. Provide Supporting Details

- Payment history: Mention your timely payments and responsible use of your current resources.

- Financial stability: If applicable, highlight any improvements in your financial situation.

- Future plans: Explain how the adjustment will help you achieve specific goals.

4. Close Professionally

End your request by expressing appreciation for their time and consideration. A polite closing ensures you leave a positive impression, reinforcing the professionalism of your approach.

Key Information to Include in Your Letter

When crafting a request, it is essential to include the right details that will strengthen your case and show your financial reliability. Including relevant information ensures that the recipient understands your situation and the reasons behind your request. A well-rounded message will provide the context needed for a favorable review.

Start by sharing your current financial standing. Mention any positive changes or milestones that demonstrate your ability to manage your resources effectively. This helps build trust and shows that you are capable of handling a higher threshold.

Another important point is your payment history. Provide a summary of your timely payments and how you have maintained a responsible relationship with your current provider. This can serve as evidence of your reliability and commitment.

Finally, include any specific goals or reasons for requesting an adjustment. Whether you need additional flexibility for personal or business purposes, outlining these reasons will help the recipient understand how the change will benefit both parties.

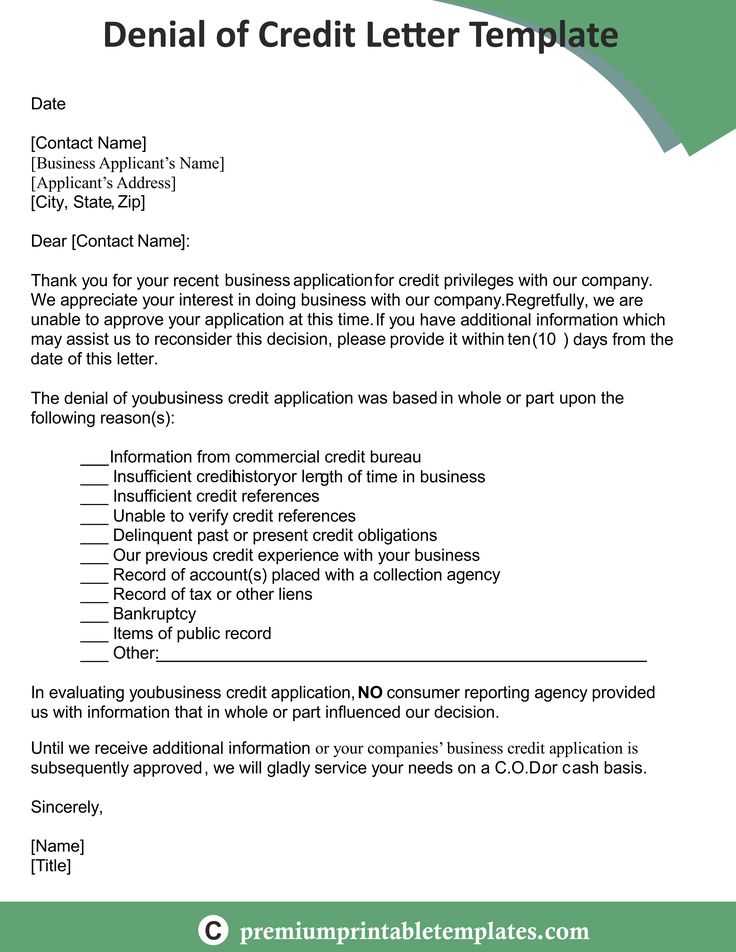

Common Mistakes to Avoid When Requesting

When submitting a request for a higher financial allowance, it’s important to avoid common errors that could harm your chances of approval. Small mistakes in your communication can lead to misunderstandings or make your request seem less professional. Knowing what to avoid can make a significant difference in the outcome.

1. Being Too Vague

One of the biggest mistakes is not being clear about the purpose of your request. It’s essential to be specific about why you are asking for a higher threshold and how it will benefit both you and the lender. Lack of clarity can lead to confusion and delay your request.

2. Ignoring Important Details

Another mistake is failing to provide supporting details that demonstrate your financial responsibility. Without relevant information such as payment history or financial improvements, your request may not be taken seriously. Always include key facts that strengthen your case.

3. Using an Unprofessional Tone

Even if you have an established relationship with the lender, always maintain a formal and respectful tone in your request. Being too casual or overly familiar can diminish the professionalism of your message and negatively impact the review process.

| Mistake | Impact | How to Avoid |

|---|---|---|

| Being too vague | Leads to confusion and delay | State your intentions clearly and provide reasons for the request |

| Ignoring important details | Weakens your case | Include relevant information like payment history and financial updates |

| Using an unprofessional tone | Reduces credibility | Always use formal language and respect in your request |

How to Increase Your Chances of Approval

Securing approval for a higher financial threshold requires more than just submitting a request. To improve the likelihood of a positive response, it’s essential to approach the situation with the right strategy. By presenting yourself as a reliable and responsible borrower, you can significantly boost your chances.

Start by ensuring your financial standing is strong. This includes having a good history of managing current obligations and maintaining a stable income. Lenders are more likely to approve adjustments when they can see that you are capable of managing additional resources responsibly.

Additionally, it’s important to be transparent and honest in your communication. Clearly outline why you are requesting an adjustment and how it will benefit both you and the provider. A well-explained reason backed by facts, such as your payment history or financial improvements, can make your case more compelling.

Finally, timing matters. Consider requesting an adjustment at a time when your financial situation is favorable, such as after a period of consistent payments or a salary increase. This can give your request a better chance of being favorably considered.

What to Do After Sending the Request

Once you’ve submitted your request, it’s important to remain proactive and follow up appropriately. The process does not end with the submission; there are several actions you can take to ensure that your request is being reviewed and to prepare for the next steps.

1. Monitor for Responses

Keep an eye out for any communication from the lender or provider regarding your request. Responses can come through email, phone, or official mail, depending on the company’s preferred method of contact. Make sure you check all communication channels regularly.

2. Be Patient but Prepared

Approval processes may take some time. While waiting, ensure that you have all necessary documents ready should the lender need additional information. Respond promptly to any follow-up questions to show your cooperation and commitment.

3. Follow Up If Necessary

- If you haven’t heard back within the expected timeframe, consider following up with a polite inquiry about the status of your request.

- Ensure your follow-up is respectful and professional to maintain a positive relationship with the provider.

- Be prepared to provide any further details or clarification that may be requested.

4. Consider Other Options

If your request is declined, don’t be discouraged. Consider other avenues for financial flexibility, such as alternative providers or adjusting your current arrangements. Learning from the feedback you receive can help improve future requests.

When to Follow Up on Your Request

After sending a request for a higher financial allowance, waiting for a response can be a time-consuming process. However, knowing when and how to follow up is crucial for ensuring that your request is being properly considered and not overlooked. It’s important to strike a balance between giving enough time for review and showing initiative in a respectful manner.

Timing is key when it comes to following up. It’s essential to allow the provider sufficient time to process your request. Generally, waiting at least a week or two is advisable unless the company specifies a response time in their communication. This shows patience while still remaining engaged in the process.

If the response time has passed and you haven’t heard back, it’s appropriate to send a courteous follow-up. This should be a gentle reminder to check on the status of your request, not a demand. Refrain from excessive inquiries, as this may come across as impatience.

Professionalism in your follow-up is vital. Ensure that your tone remains polite and respectful, and express gratitude for their consideration. This helps maintain a positive relationship and can improve your chances of a favorable response.