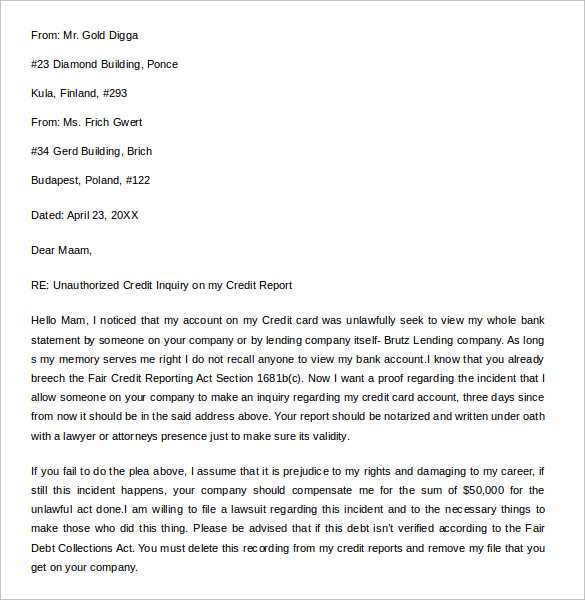

Credit removal letter template

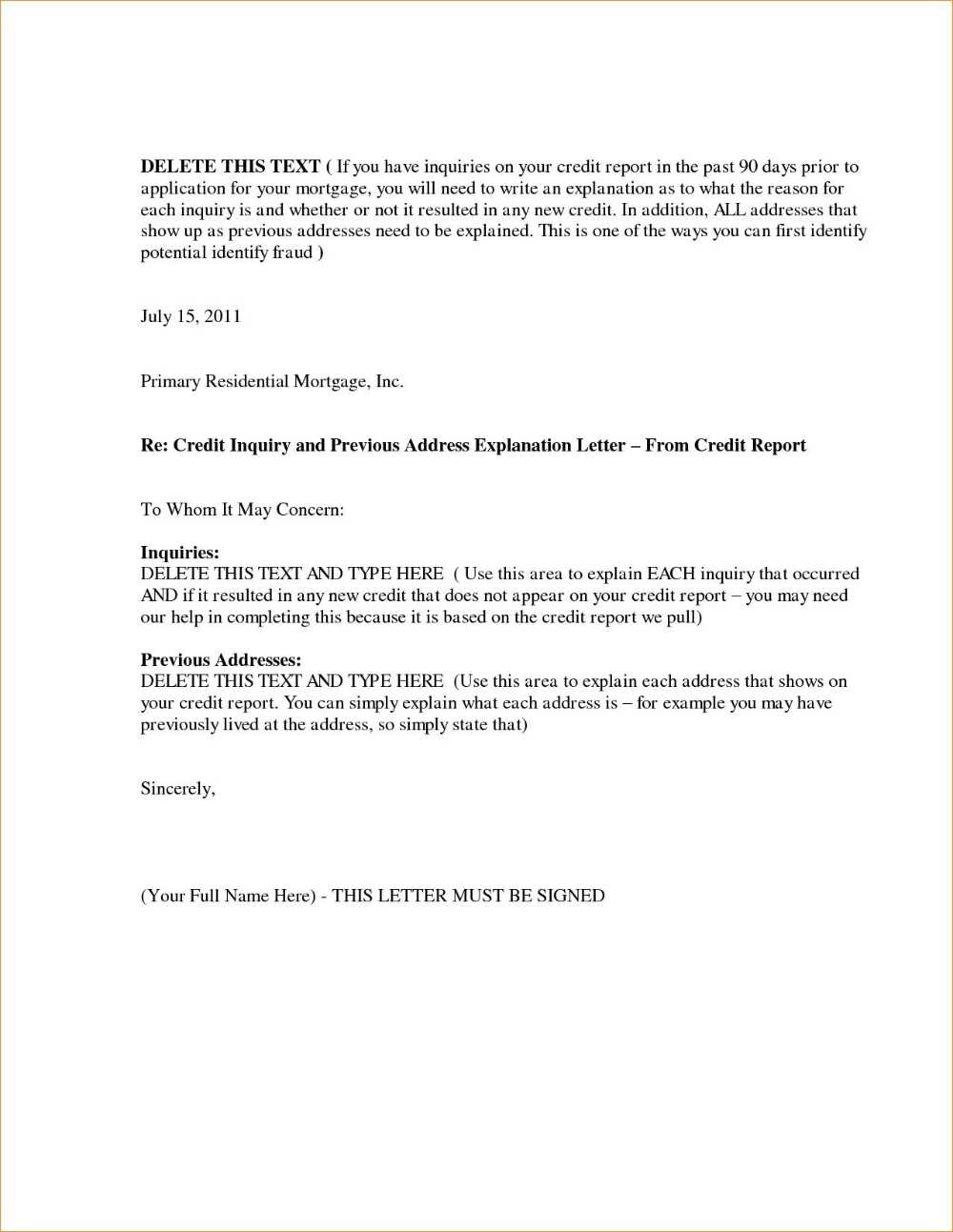

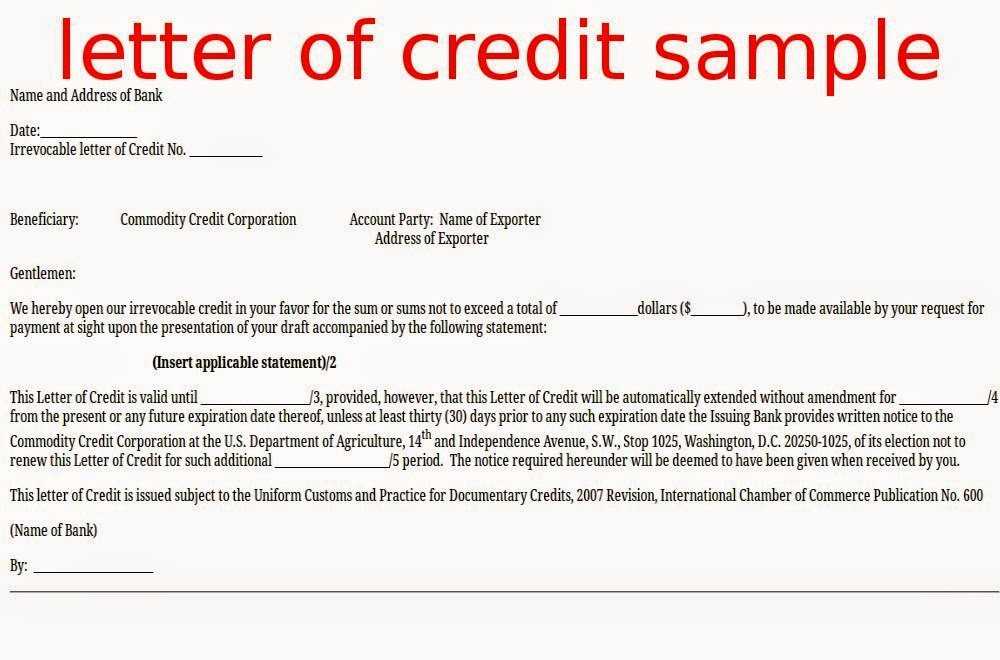

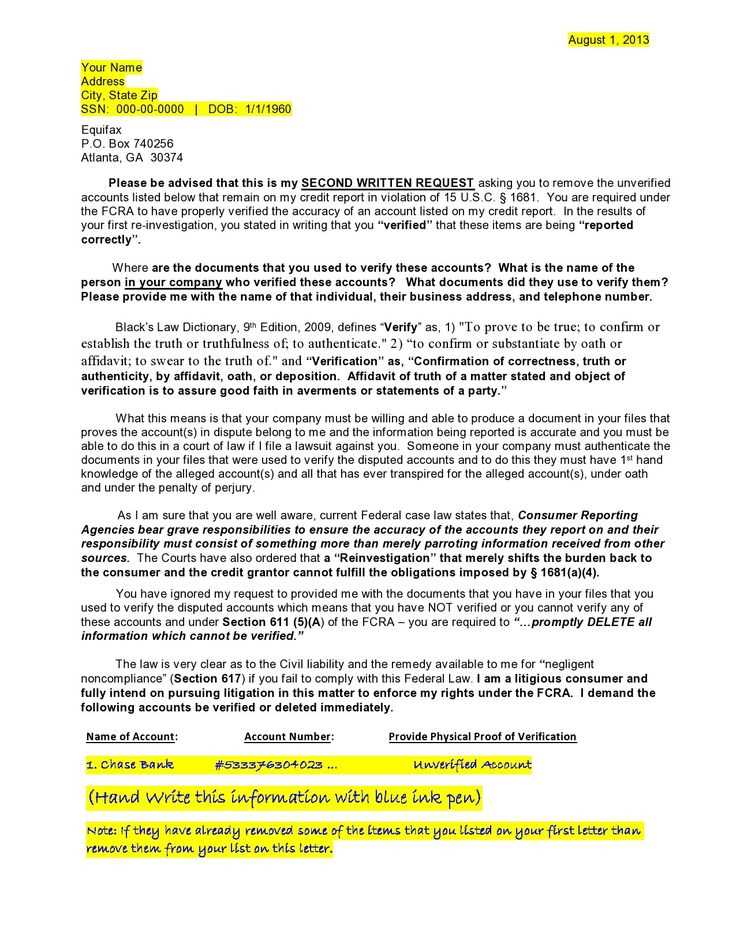

To initiate the process of removing inaccurate or outdated information from your credit report, start by writing a clear and concise credit removal letter. This letter should outline your request and provide evidence supporting the claim that the credit entry should be removed. Always keep the tone professional and factual to ensure a smooth process.

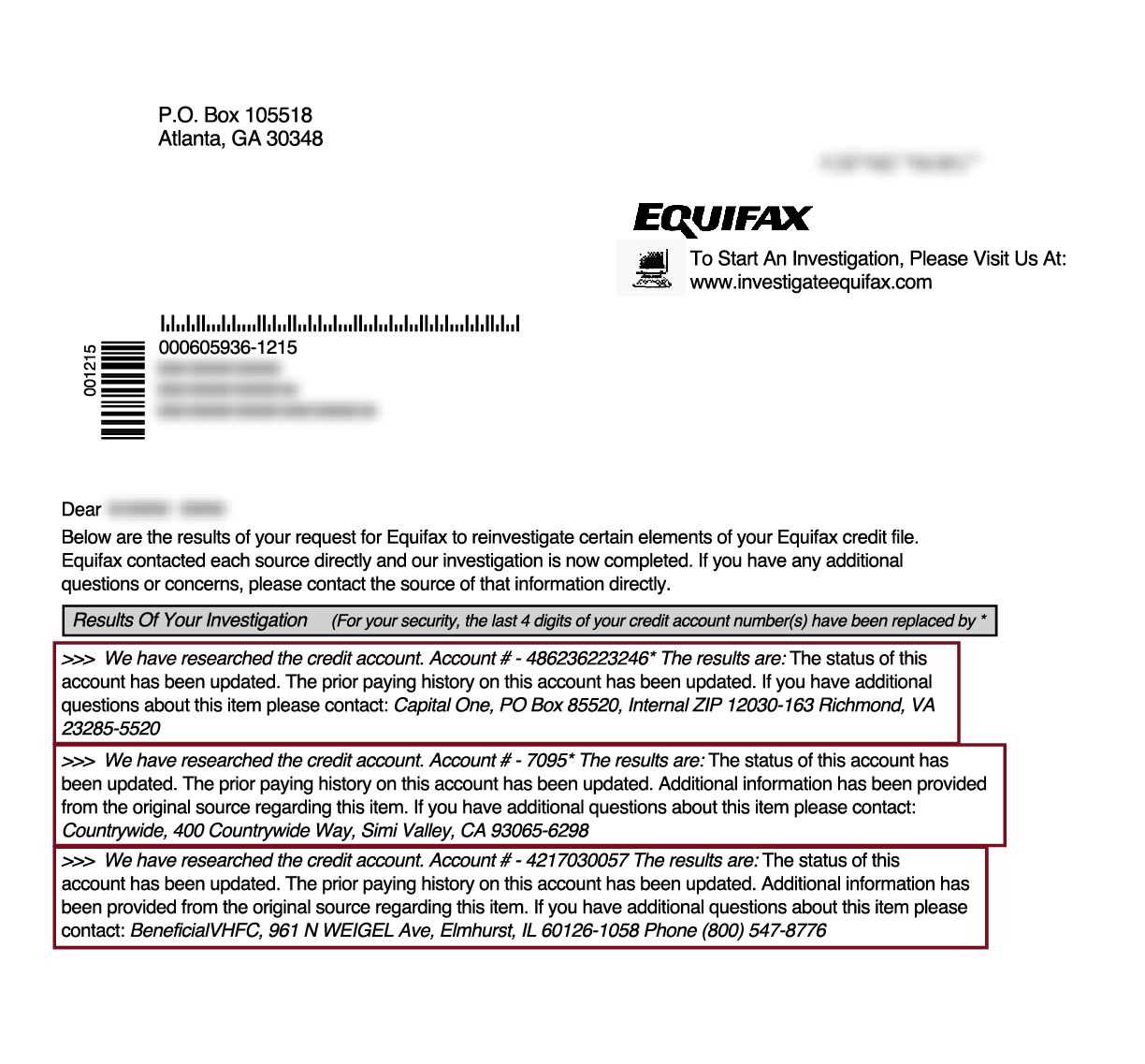

Begin your letter by identifying the specific item(s) you wish to dispute. Include the account number, the reporting agency, and any other relevant details. If you have supporting documentation, such as payment receipts or court documents, mention them in the letter to back up your case.

Address the recipient directly–whether it’s the credit bureau or creditor responsible for reporting the error. Be sure to use the correct contact information and maintain a polite yet assertive tone. Avoid using unnecessary jargon or emotional language; instead, focus on the facts and your intention to resolve the matter quickly.

Finally, request a response within a reasonable time frame to confirm that the necessary corrections will be made. If the issue is not addressed, be prepared to follow up or escalate the situation. A well-written letter is a key step toward cleaning up your credit history and improving your financial standing.

Here is the updated version of the text with minimized repetitions:

Begin by addressing the credit bureau directly. Clearly state your request to remove the inaccurate information. Be specific about the item in question and reference the relevant dates, account numbers, or other identifying details to avoid confusion.

Ensure your tone remains professional and polite. While being firm in your request, acknowledge the possibility of a clerical error or misunderstanding. Provide supporting documentation to back your claim, such as payment records, settlement letters, or court decisions if applicable. The more evidence you can provide, the stronger your case will be.

Keep your letter concise and to the point. Avoid including irrelevant details or personal stories. Focus only on the facts that directly pertain to your credit history. This will help the recipient process your request more efficiently and reduce any chances of unnecessary back-and-forth communication.

Finally, conclude the letter by requesting confirmation of the removal in writing. Give the credit bureau a reasonable time frame to respond, typically 30 days, and include your contact information for any follow-up.

Credit Removal Letter Template Guide

How to Start Your Credit Removal Request

Key Information to Include in the Letter

Common Mistakes to Avoid in Writing

When and How to Send Your Request

Follow-Up Actions After Submission

What to Do if Your Request Is Rejected

Begin by addressing the letter to the appropriate credit bureau or lender, and clearly state your request for the removal of an inaccurate credit entry. Be polite but firm, providing specific details about the error you are disputing, such as the account number, date of the entry, and the reason why it is incorrect.

Include key information like your full name, address, and any relevant account information that will help the recipient identify your records. Always attach any supporting documents that prove the error, such as bank statements, payment confirmations, or communication records. This helps strengthen your case and adds credibility to your request.

Avoid vague statements or emotional language. Stick to facts and clearly explain why the entry is inaccurate. Ensure there are no spelling or grammatical errors, as these can undermine the professionalism of your letter. Double-check that the information is accurate before submission, including your contact details and any referenced dates.

Send your letter via certified mail or another trackable method to ensure it is received and you have proof of delivery. Include a return receipt request to confirm the recipient received your letter. Avoid sending it through regular mail as this could result in delays or issues in case of dispute.

If you don’t hear back within a reasonable time frame, follow up with another letter or phone call. If your request is rejected, carefully review the response and consider escalating the matter, either by providing additional evidence or seeking legal assistance if necessary.