Credit Repair Letter Template to Boost Your Credit Score

Managing your financial reputation can be a challenging task, especially when mistakes or inaccuracies appear on your reports. Disputing these issues in an organized and formal manner can significantly improve your chances of having them corrected. Knowing how to approach this process is essential for anyone looking to restore their standing with financial institutions.

Understanding the process of addressing discrepancies is the first step in achieving positive results. With the right approach, individuals can communicate effectively with the agencies responsible for maintaining their records, helping to ensure fairness and accuracy in their reports.

Taking the time to craft a clear and professional request is key to moving forward. A well-written communication can make a world of difference when it comes to having negative items reviewed and potentially removed, ultimately leading to better opportunities for financial growth.

Why You Need a Credit Repair Letter

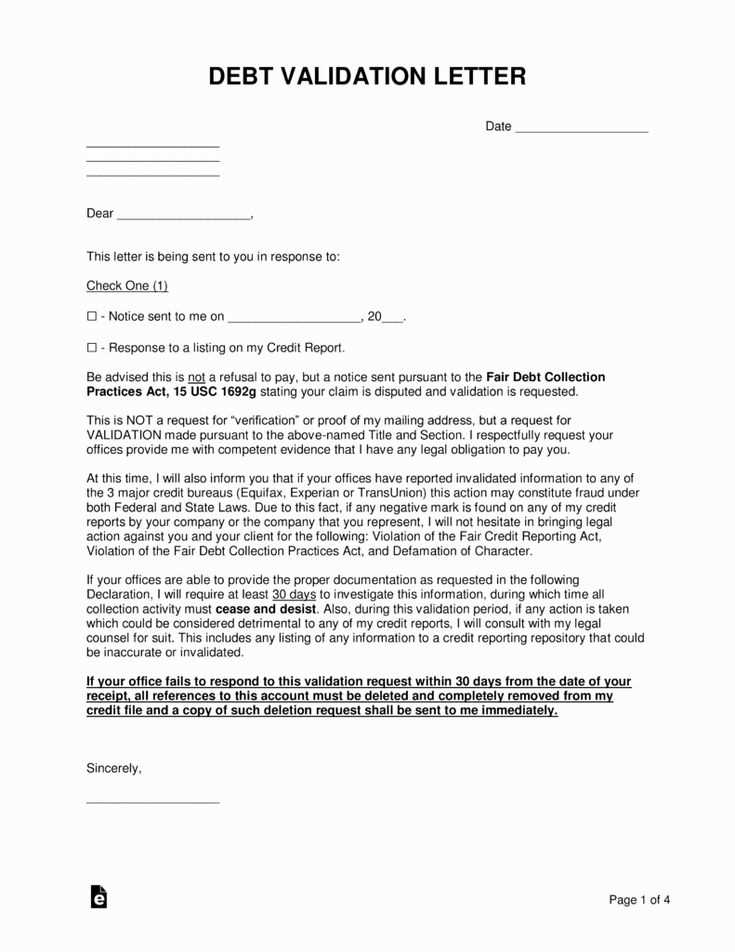

Addressing inaccuracies on your financial record is crucial for maintaining a healthy relationship with lenders and financial institutions. When mistakes or outdated information appear, it can have a significant impact on your ability to secure loans, obtain favorable interest rates, or even get approved for basic services. The need to communicate effectively with the agencies responsible for these records is essential for correcting such discrepancies.

Taking the initiative to formally dispute incorrect entries ensures that your financial history accurately reflects your situation. A well-structured request can prompt the necessary parties to review and amend erroneous data, leading to a more accurate representation of your financial reliability. This step is often necessary to take control of your financial future and improve your overall standing in the eyes of creditors.

Steps to Write an Effective Letter

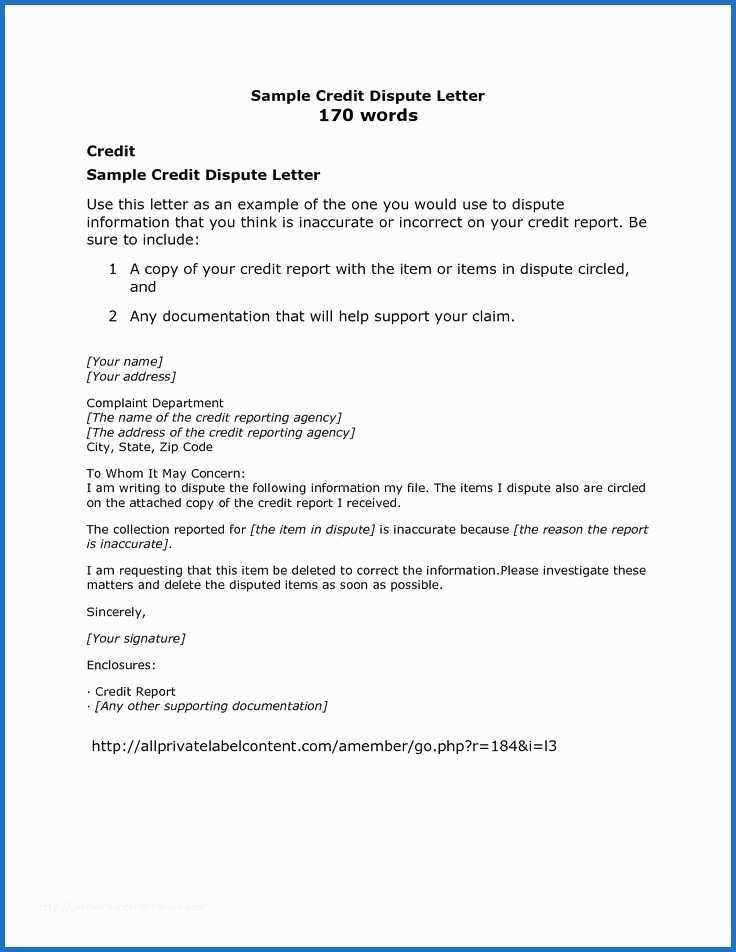

When addressing inaccuracies on your financial records, presenting a clear, organized, and compelling request is crucial for success. The goal is to make sure your message is understood, factual, and persuasive enough to prompt the necessary corrections. A well-structured approach can significantly increase the likelihood of a positive outcome.

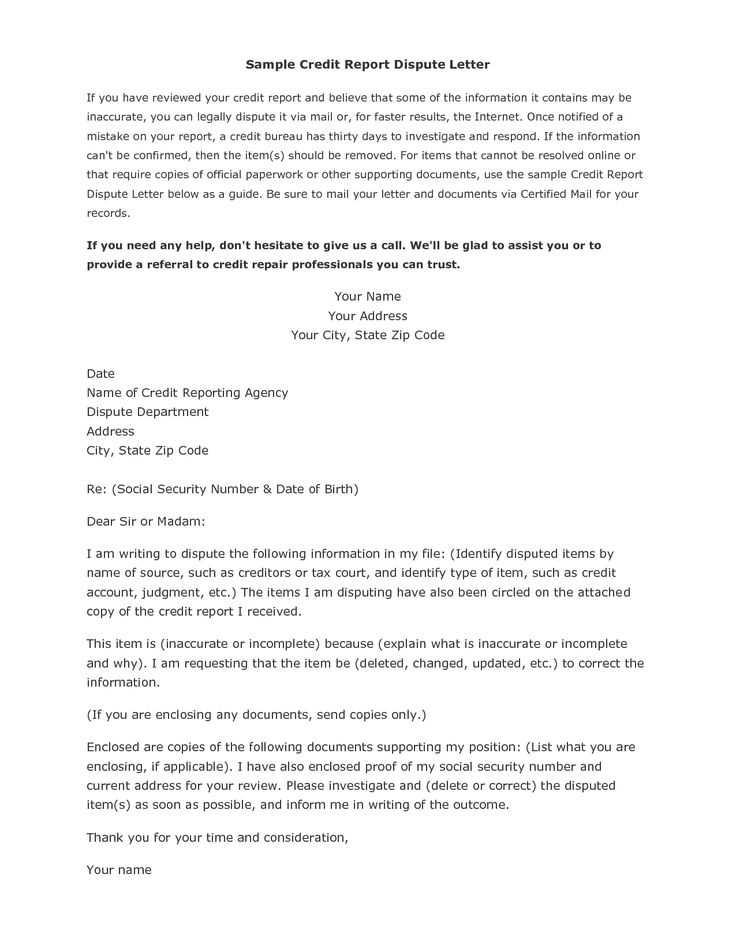

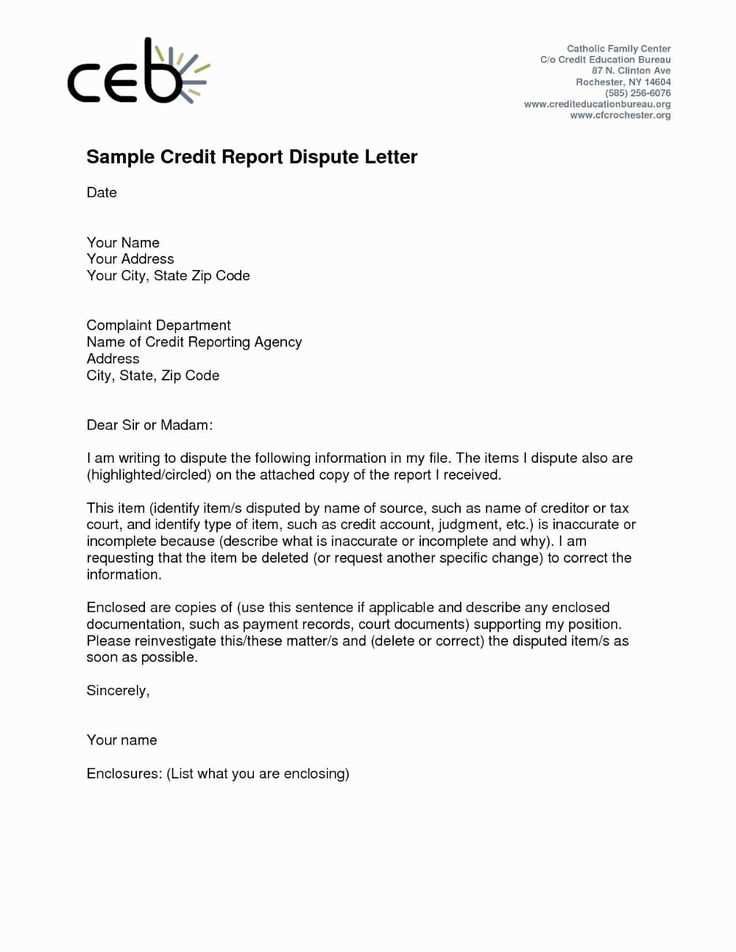

Follow these key steps to write a professional and effective communication:

- Start with your contact details: Include your full name, address, and account number at the beginning of the document for easy identification.

- Clearly state the issue: Describe the discrepancy or error in detail. Be specific about what information is incorrect and why it needs to be addressed.

- Provide supporting evidence: Attach any relevant documents, such as bank statements or previous communications, that validate your claim.

- Request a specific action: Clearly explain what you want the agency or institution to do, such as updating or removing inaccurate data.

- Be concise and respectful: Use polite language and avoid emotional or confrontational tones. A professional and calm approach increases your chances of being taken seriously.

- Close with a call to action: Include a statement encouraging a timely response and indicate that you look forward to resolving the matter.

By following these steps, you can create a document that is clear, professional, and more likely to yield positive results. The key is to be precise and respectful in your communication, ensuring that your request is understood and acted upon efficiently.

Common Mistakes to Avoid in Letters

When submitting a formal request to address errors in your financial records, avoiding common mistakes is essential to ensure your message is taken seriously and processed efficiently. Even small errors in phrasing or structure can weaken your argument or lead to delays in resolution. Being mindful of these pitfalls will help you craft a more effective and professional communication.

Being Too Vague or General

One of the most frequent mistakes is not providing enough specific information about the issue. A vague description of the problem can cause confusion and delay the process. Always be clear about what is wrong and where the error appears. Provide detailed examples, such as dates or amounts, to help the recipient quickly understand the situation.

Using an Aggressive or Emotional Tone

While it’s understandable to feel frustrated, using an angry or aggressive tone can harm your case. A professional, calm, and respectful approach is more likely to result in a positive outcome. Keep the tone polite and factual, focusing on the issue at hand without making personal attacks or displaying impatience.

By avoiding these and other common mistakes, you can present a stronger, more convincing argument and increase the likelihood of a swift resolution. Remember, professionalism and clarity are key to ensuring your communication is effective and well-received.

How Credit Repair Letters Help Improve Scores

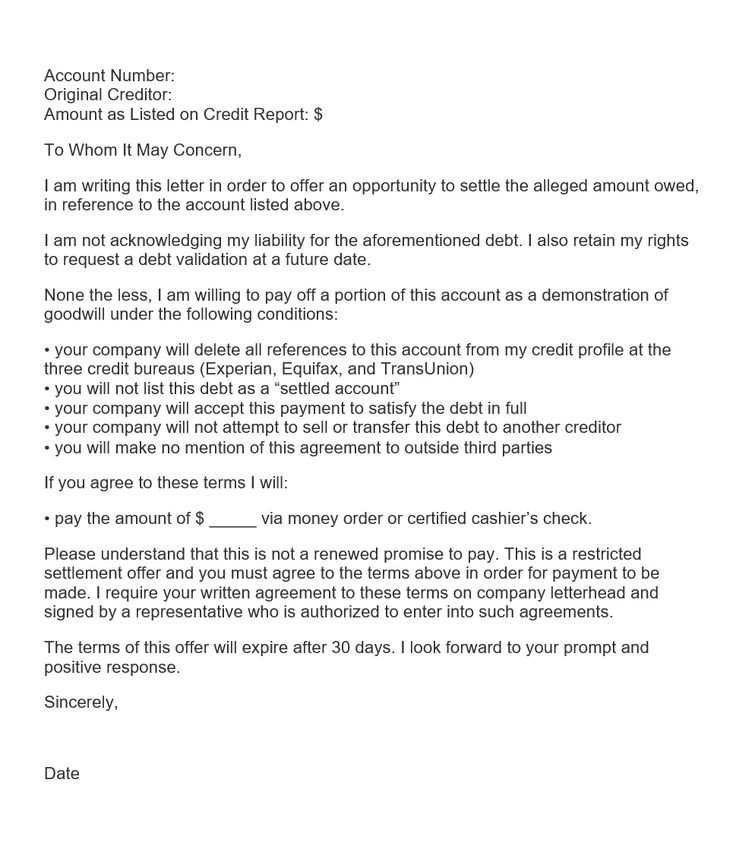

Taking steps to correct inaccuracies in your financial history can have a significant impact on your overall financial standing. By addressing mistakes directly with the organizations responsible for maintaining your records, you create an opportunity to improve how you’re perceived by lenders and other financial institutions. This process is crucial in the effort to raise your rating and gain access to better terms on loans, mortgages, and other financial products.

When errors are corrected, it can lead to an immediate positive change in your financial evaluation. The removal of outdated, incorrect, or disputed information helps to create a more accurate picture of your financial behavior, which in turn enhances your score. Even minor adjustments can lead to noticeable improvements, especially if the discrepancies are significant enough to influence the overall calculation.

In essence, taking proactive steps to challenge and correct inaccuracies on your file ensures that you’re not being unfairly penalized. The result can be a stronger financial profile and a better chance of obtaining the credit or financing you need in the future.

Best Practices for Sending Your Letter

Once you’ve crafted your formal request to address inaccuracies, sending it properly is just as important as the content itself. The way you submit your communication can affect its effectiveness and how quickly it is processed. Following best practices ensures that your message is received, reviewed, and acted upon without unnecessary delays.

First, always send your document through a method that provides confirmation of receipt, such as certified mail or a courier service that tracks deliveries. This provides proof that your communication was delivered and can protect you in case of disputes. Additionally, be sure to keep a copy of the letter and any supporting documents for your own records.

It’s also a good idea to address the communication to the correct department or individual responsible for handling such requests. A bit of research or inquiry can help ensure that your message goes directly to the right place, avoiding unnecessary routing or delays.

Finally, be mindful of the timing when sending your correspondence. Choose a time when you can follow up appropriately, and allow enough time for the recipient to review and act on your request. Patience, combined with clear documentation and tracking, will help ensure that the process moves smoothly.

Real-Life Examples of Successful Letters

Seeing how others have successfully addressed discrepancies in their financial history can offer valuable insights and inspiration. By examining real-life examples, you can better understand how to structure your own communication for maximum impact. Here are a few instances where individuals effectively used formal requests to correct errors and improve their financial standings.

| Case | Issue | Outcome |

|---|---|---|

| John D. | Incorrect late payment listed on report | Payment removed after providing bank statement showing on-time payment |

| Alice M. | Dispute over incorrect balance reported | Balance corrected after showing proof of payment and settlement agreement |

| Mark T. | Wrongly reported defaulted loan | Account marked as paid in full after submitting settlement agreement |

These examples highlight the importance of providing solid evidence and maintaining a clear, professional tone. Each individual was able to improve their situation by effectively communicating with the right organizations, ultimately leading to more accurate records and an improved financial profile.