Effective Credit Repair Letter Templates for Disputing Errors

When managing your financial records, disputes over incorrect information can cause significant issues. To resolve these problems, having a set of carefully crafted communication formats is essential. These documents help address discrepancies and initiate the process of reviewing and correcting financial statements, improving your overall standing.

Why Accurate Documentation Matters

Accurate and well-structured communication plays a key role in correcting mistakes on your records. Without proper documentation, resolving errors may take much longer, affecting your ability to secure favorable financial terms. A well-organized request can speed up the review process and increase the likelihood of a positive outcome.

Key Elements to Include

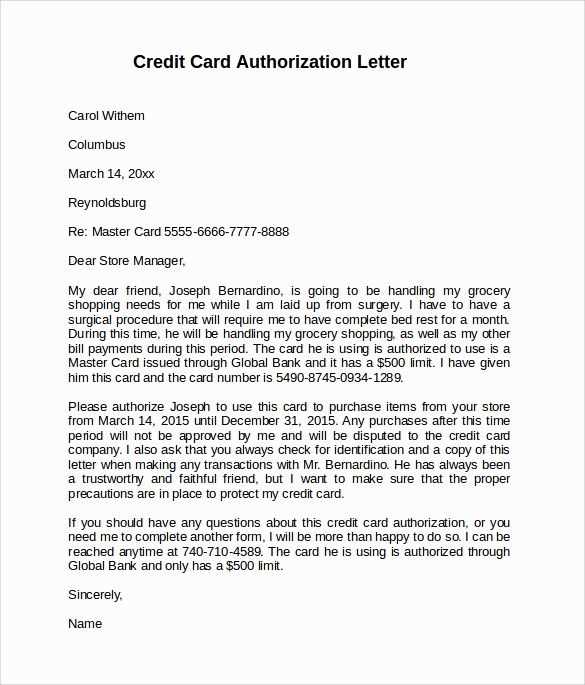

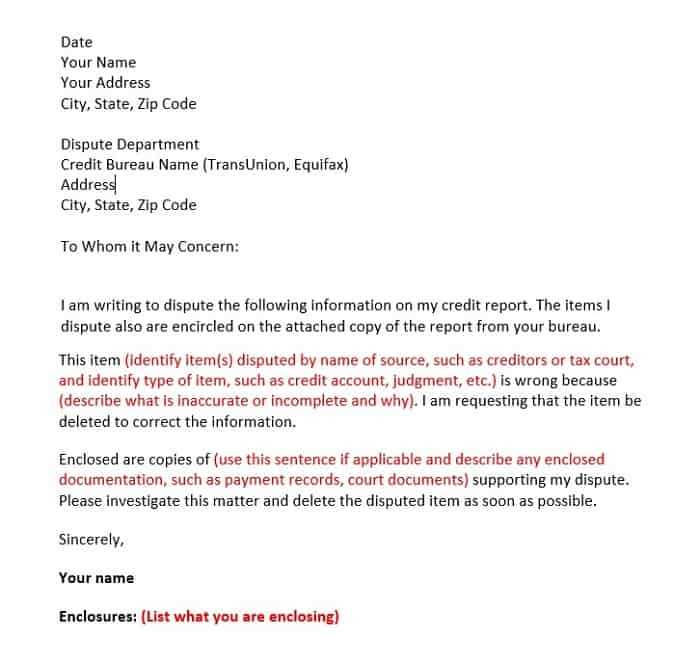

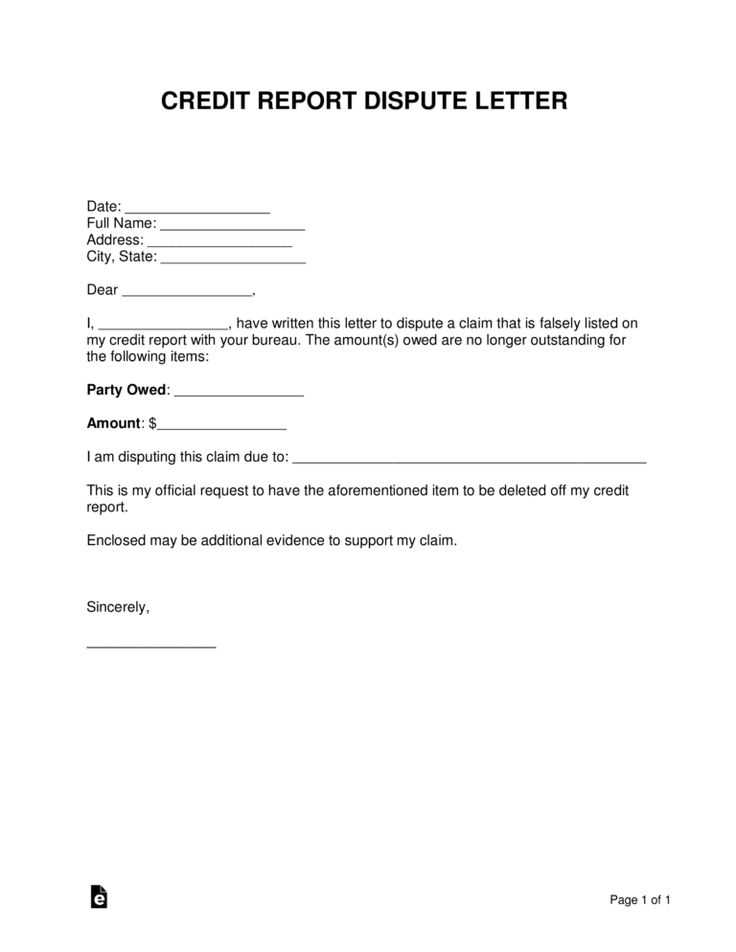

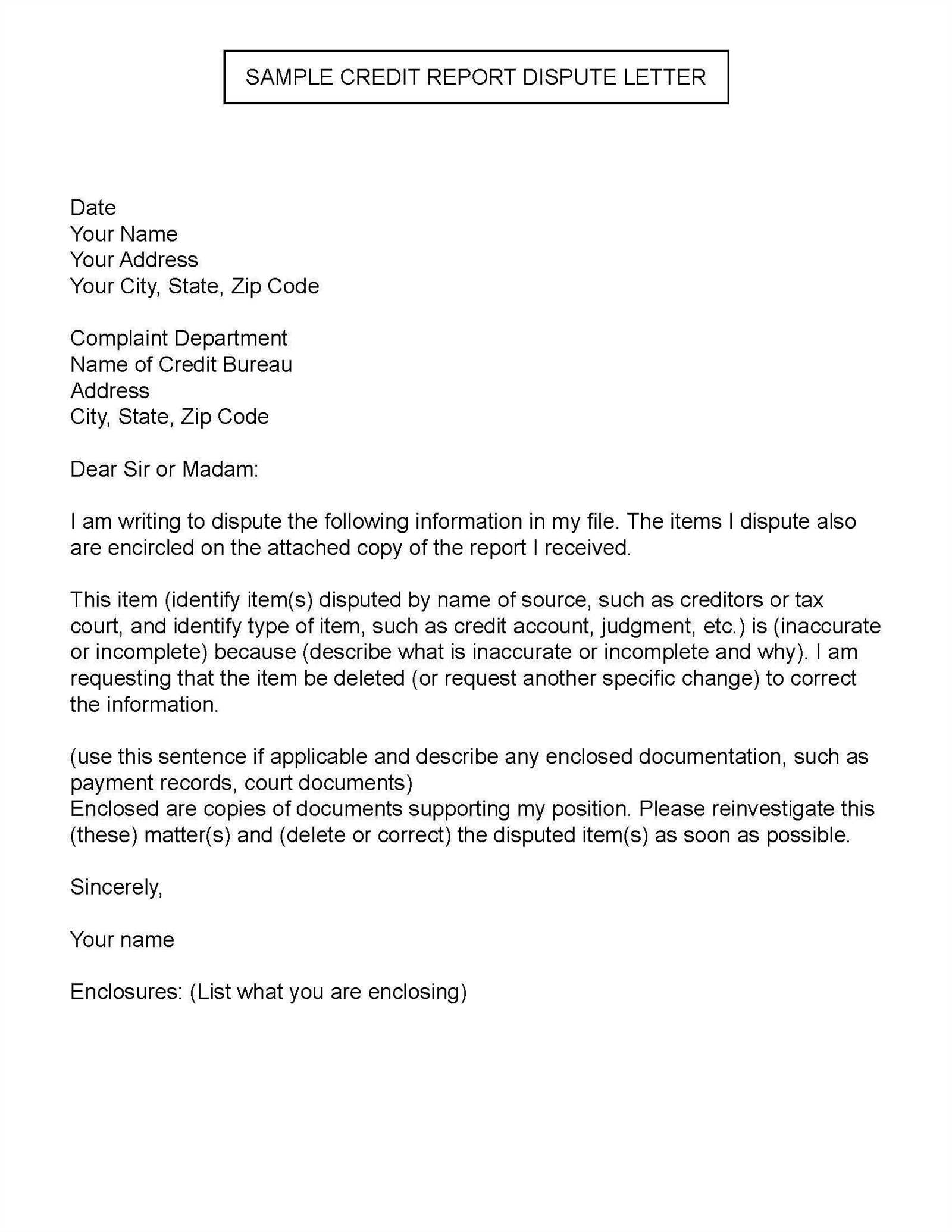

- Personal Information: Clearly provide identifying details, such as name, address, and account numbers.

- Description of the Issue: Describe the specific mistake and provide supporting evidence.

- Desired Resolution: Be clear about what you are asking for–whether it is a correction, removal, or update.

Common Mistakes to Avoid

- Vague Requests: Avoid unclear or overly general statements. Be specific about what needs to be fixed.

- Lack of Supporting Documents: Ensure that you include any evidence, such as statements or receipts, to back up your claims.

- Overly Aggressive Tone: Maintaining a polite and professional tone will often lead to a faster resolution than an adversarial one.

Choosing the Right Format for Your Situation

While there are various options available, selecting the appropriate format for your specific circumstances can make a big difference. Whether you’re dealing with a credit agency, financial institution, or another entity, tailoring your approach can help streamline the process.

In summary, having the right documentation and approach can significantly improve your chances of resolving financial issues quickly and efficiently. Always ensure your communication is clear, polite, and backed by evidence to enhance the chances of success.

Effective Communication Strategies for Financial Disputes

When errors appear on your financial statements, addressing them promptly and clearly is crucial. Having the right structure for your requests can significantly impact the speed and success of the review process. Whether you’re disputing inaccurate data or seeking corrections, knowing how to craft an effective appeal is essential.

How to Draft a Dispute Request

Begin by identifying the specific mistake and providing any necessary details that clearly describe the issue. Make sure your request includes the relevant information, such as account numbers, dates, and amounts. A well-detailed submission ensures that your claim is processed accurately and quickly. Always state your goal, whether it’s an update, deletion, or clarification of the information in question.

Key Tips for Effective Communication

- Be Clear and Concise: Avoid unnecessary details that may confuse the process. Stick to the facts.

- Remain Professional: A respectful tone increases the chances of your request being taken seriously.

- Provide Documentation: Attach all necessary supporting documents, such as statements, receipts, or contracts, to validate your claim.

Effective communication not only resolves issues faster but also strengthens your case. Avoiding common errors can prevent delays and improve your chances of a successful outcome.

Avoiding Common Mistakes

- Being Vague: Ensure you clearly specify what needs to be corrected.

- Omitting Proof: Failing to provide supporting evidence can delay the process.

- Using Aggressive Language: A courteous and professional tone is more likely to yield positive results.

Choosing the right structure for your communication makes a substantial difference. The more tailored your approach is to your unique case, the faster and more efficiently your concerns will be addressed.

By using a well-crafted request, you not only have the opportunity to correct errors but can also improve your overall financial health. A well-structured approach can have a significant impact on your ability to achieve more favorable financial terms in the future.