Credit Report Dispute Letter Template for Effective Resolution

When reviewing your financial history, you may notice inaccuracies that affect your overall standing. These discrepancies can hinder your ability to secure loans, affect your trustworthiness with lenders, and even impact your financial opportunities. It’s crucial to address these issues promptly to ensure that they don’t create unnecessary obstacles for your financial future.

One effective method of resolving these issues is to communicate directly with the agencies responsible for managing your financial details. By doing so, you can request corrections and have the errors rectified, allowing for a more accurate portrayal of your financial history.

In this guide, we’ll walk you through the process of drafting a formal communication to address such mistakes, providing you with the necessary steps to ensure that your message is clear and effective. Following this approach will improve your chances of having the inaccuracies corrected in a timely manner.

Why You Should Address Errors in Your Financial History

Having incorrect information on your financial records can lead to significant setbacks. Whether it’s an inaccurate balance, a missed payment that was paid on time, or outdated personal information, these errors can affect your reputation with lenders, impact your ability to borrow, and even influence interest rates. Correcting these inaccuracies ensures that your financial profile truly reflects your behavior and reliability.

Inaccurate data on your financial background can also negatively affect your creditworthiness, which is used by financial institutions to assess your loan applications. By promptly addressing mistakes, you can prevent potential financial difficulties and maintain a healthier financial standing. It’s essential to ensure that all entries on your profile are up-to-date and accurate, allowing for better opportunities when seeking loans or other financial services.

Additionally, correcting these errors helps in improving the overall trustworthiness of your financial history. By taking the necessary steps to fix discrepancies, you are safeguarding your financial future and ensuring that no misinformation limits your potential for growth and success.

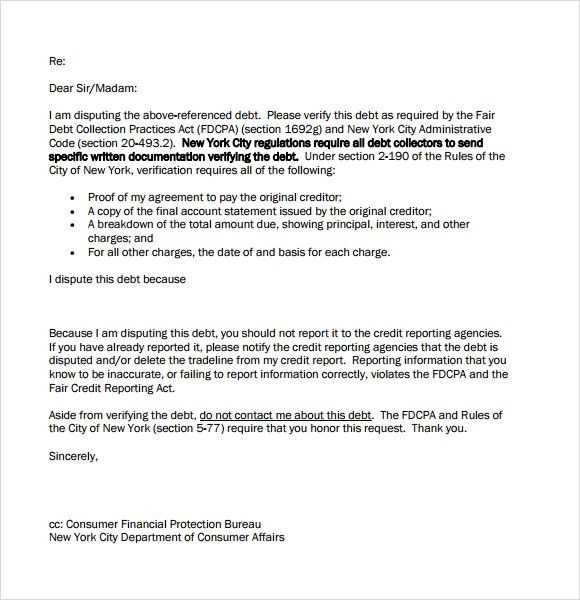

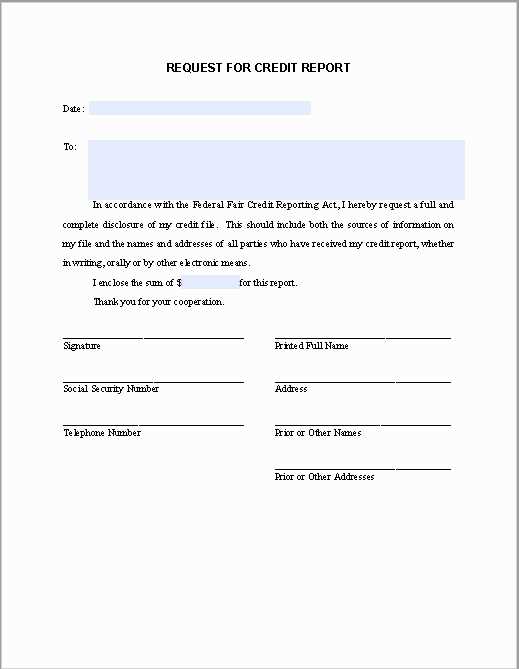

Steps to Write a Formal Request for Correction

When addressing inaccuracies in your financial history, it’s crucial to follow a clear and organized approach. By presenting your case in a formal and precise manner, you increase the chances of the issue being resolved efficiently. Here’s a guide to help you navigate the process of drafting a request for corrections to ensure all necessary details are included and your communication is effective.

Gather Relevant Information

Before composing your formal communication, make sure you have all the necessary documents. This includes any records that support your claim, such as receipts, bank statements, or previous correspondence. Collecting this evidence will help strengthen your case and make it easier to identify where the mistakes occurred.

Write a Clear and Concise Message

Start by addressing the organization in a professional tone. Clearly explain the error you’re identifying, and provide relevant details such as the date of the mistake or the incorrect figure. Make sure to remain polite and focused on the facts to increase the likelihood of a positive outcome. Be sure to request the correction and offer any supporting documentation to back up your statement.

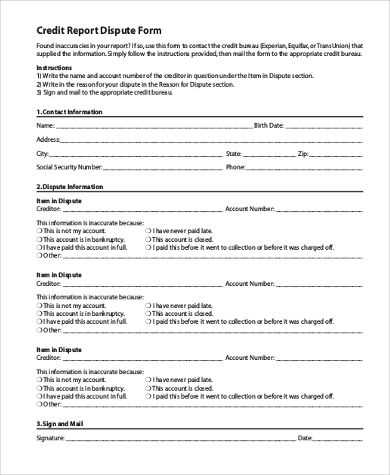

Key Information to Include in Your Request

To ensure your formal communication is clear and effective, it’s important to include all necessary details that help the recipient understand the issue and take prompt action. A well-organized request will outline the problem, provide supporting evidence, and specify the resolution you are seeking. Here’s a list of key elements to include:

- Your Full Name and Contact Information: Provide your full name, address, and any other relevant contact details, such as an email address or phone number, so the recipient can easily reach you.

- Identification Number or Account Details: Include any relevant account numbers or identification details that help the organization locate your file quickly.

- Description of the Error: Clearly explain the mistake, specifying what is wrong and providing the date or transaction details that highlight the issue.

- Supporting Documentation: Attach copies of any documents that support your claim, such as receipts, bank statements, or emails that demonstrate the error.

- Your Requested Action: Clearly state what you want the organization to do, such as correcting the error or removing incorrect information.

By including all these key details, you can create a strong case that ensures your request is processed accurately and efficiently. A complete and organized communication will help save time and increase the likelihood of a successful resolution.

Common Mistakes to Avoid When Disputing

When addressing inaccuracies in your financial history, it’s important to approach the process carefully to avoid common errors that could delay the resolution. By being aware of these pitfalls, you can ensure that your efforts are effective and that your issue is addressed as quickly as possible. Below are some of the most frequent mistakes and how to avoid them.

Incomplete or Vague Information

One of the most common mistakes is failing to provide all the necessary details in your request. Without clear and accurate information, the recipient may not be able to locate the issue or take appropriate action. Always be specific about what is wrong and include relevant supporting documentation.

Failing to Follow the Proper Process

Another mistake is not following the correct steps when submitting your request. Make sure to follow the required guidelines and ensure you are contacting the right department. This will help avoid unnecessary delays and increase the likelihood of your issue being resolved correctly.

| Mistake | How to Avoid |

|---|---|

| Inaccurate or Missing Information | Double-check all details and include relevant documents to support your claim. |

| Being Too Vague | Be clear and concise in your explanation of the issue, providing dates and specific errors. |

| Not Following the Correct Process | Research the correct procedures for submitting your request and follow them closely. |

Avoiding these common mistakes will help streamline the process and ensure your request is taken seriously. Be thorough, specific, and patient, and you are more likely to achieve a successful resolution.

How Addressing Errors Can Impact Your Score

Taking action to correct inaccuracies in your financial records can have a significant effect on your overall standing with lenders. While it’s crucial to fix mistakes, it’s also important to understand how challenging discrepancies can affect your rating. Addressing these errors, when done properly, can improve your chances for better financial opportunities.

Positive Impact on Your Score

If the corrections result in removing negative or incorrect entries, your financial standing may improve. For example, if a late payment was wrongly recorded or a balance was inaccurately reported, rectifying these errors can boost your overall rating. In some cases, a corrected record can even increase your chances of qualifying for loans with more favorable terms.

Potential Negative Impact

On the other hand, improperly handled corrections or unresolved errors may lead to a temporary dip in your standing. If the agency doesn’t remove the incorrect information as expected, it may cause frustration and could negatively influence future decisions. Additionally, if too many incorrect entries are unresolved for an extended period, it may signal to lenders that your financial history requires further scrutiny.

Understanding how addressing inaccuracies can impact your standing will help you navigate the process with better insight and expectations. It’s important to stay patient and proactive, ensuring that all errors are fixed properly to see positive long-term results.

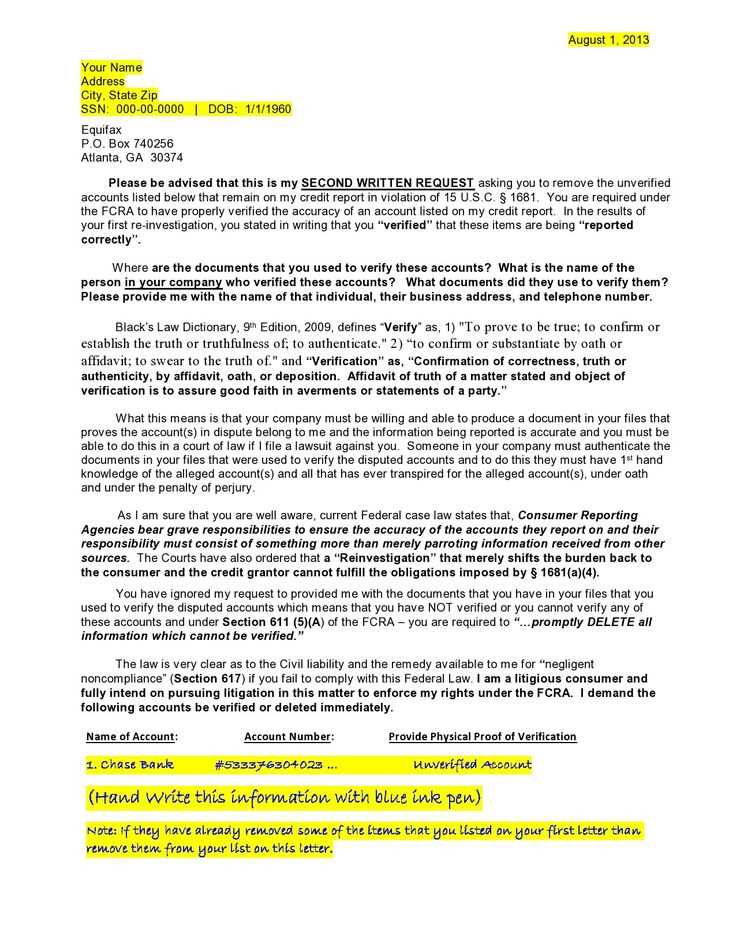

What to Do After Sending Your Request

Once you’ve submitted your formal communication regarding the error, the next step is to remain proactive and monitor the progress. While waiting for a resolution, there are a few important actions you can take to ensure your request is handled properly and that you are prepared for any follow-up actions.

Firstly, keep a record of your submission, including any confirmation of receipt from the organization. This will serve as proof that your request was received and is being processed. Additionally, be prepared to follow up if you don’t hear back within the specified time frame, as some agencies may take longer to resolve the issue.

Next, monitor your financial status or account for any changes. Once the correction is made, check that the incorrect information is updated or removed as necessary. If the issue isn’t addressed as expected, be ready to escalate the matter or contact the relevant authorities for further assistance.

By staying organized and vigilant, you can ensure that your concerns are addressed promptly and accurately. Take the necessary steps to follow through and ensure that your request leads to a positive outcome.